This is the product tanker investment hypothesis in its entirety -- replacing Russian gasoil from further sources, sending utilisations to 99% and earnings to $250k/day. By now, it has become an unquestioned mantra in the market. One small problem… #tankers $ASC $HAFNI $STNG

When we constructed our European recession scenario a few months ago, with a 3% decline in 2023 real GDP, we felt a bit extreme. We later trimmed it to -2.6%, but now feeling this might be too sanguine. Weak Case sees an extended downturn à la BoE.

This chart is the same in every country, with road diesel showing strong income elasticity. In Europe's case, diesel shortages & high prices may be limiting industrial production and pressuring GDP, as well as the traditional mechanism.

Other clean product grades exhibit some income elasticity, and a sharp, V-shaped recession should see a 0.5-0.6 mbpd decline in clean prod demand in early-2023, before rebounding in 2h23. Note rise in "other gasoil" this winter and next...

…since the forecasts do include the impact of gas-to-oil switching, roughly in line with IEA estimates, and support gasoil imports to some degree. Note that not all switching gains are clean products, with fuel oil & LPG also contributing.

Much of the clean product tanker market excitement stems from the French refinery strikes, as well as general gasoil hoarding globally. The strikes trimmed 1 mbpd of crude intake, severely cutting mid-distillate output, sending France scrambling in the gasoil export market.

The mass balances for each grade in each country determine these future imports, for a given level of inventories. Declining demand and recovering crude runs would prompt a 0.7 mbpd drop in clean imports, from a France-exaggerated 4q22.

As for record-low inventories, nothing cures that condition like a recession. (cc: @JKempEnergy). Note that rebounding product imports in 2h23 and 2024 do include flows to maintain days of inventories.

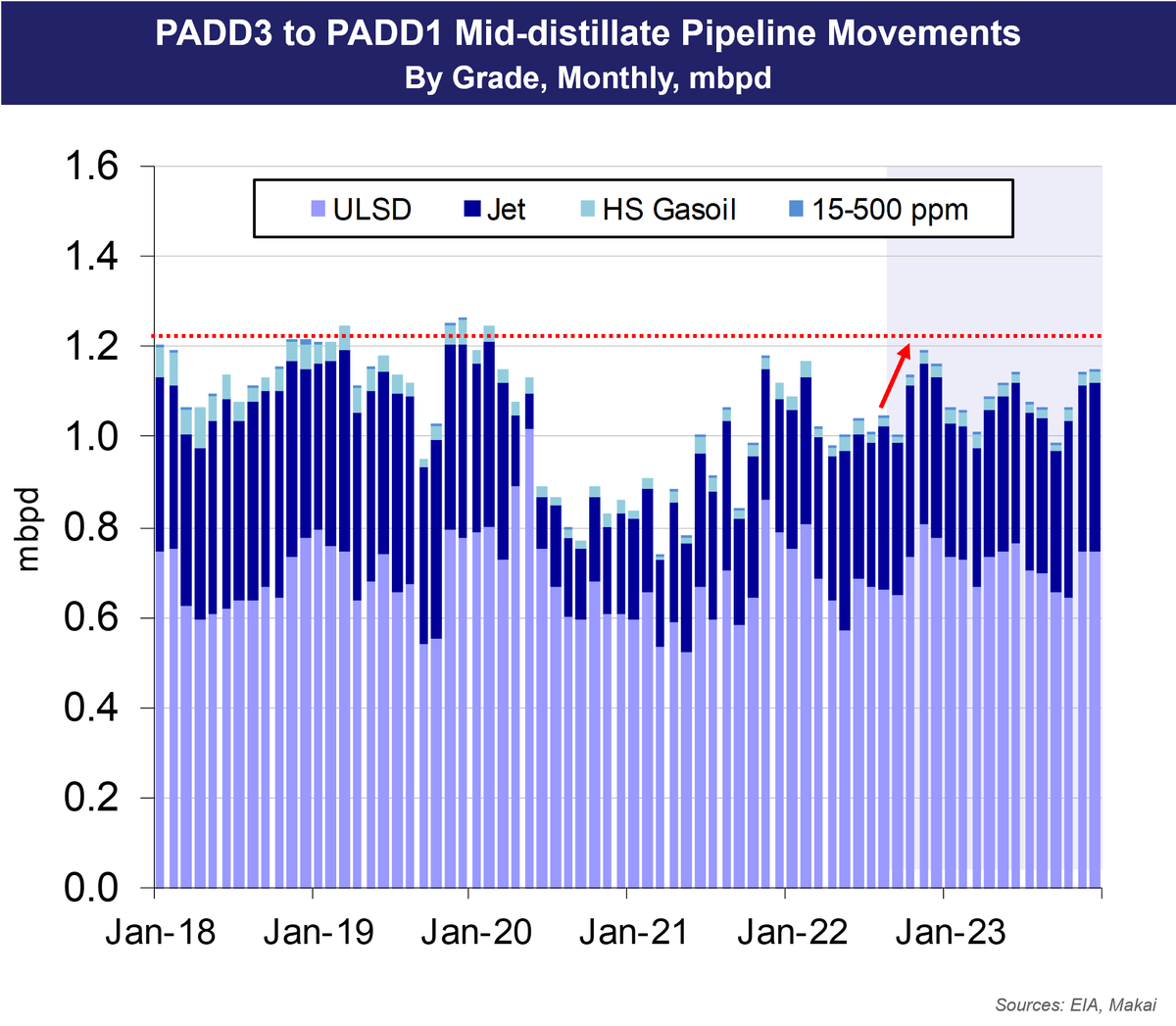

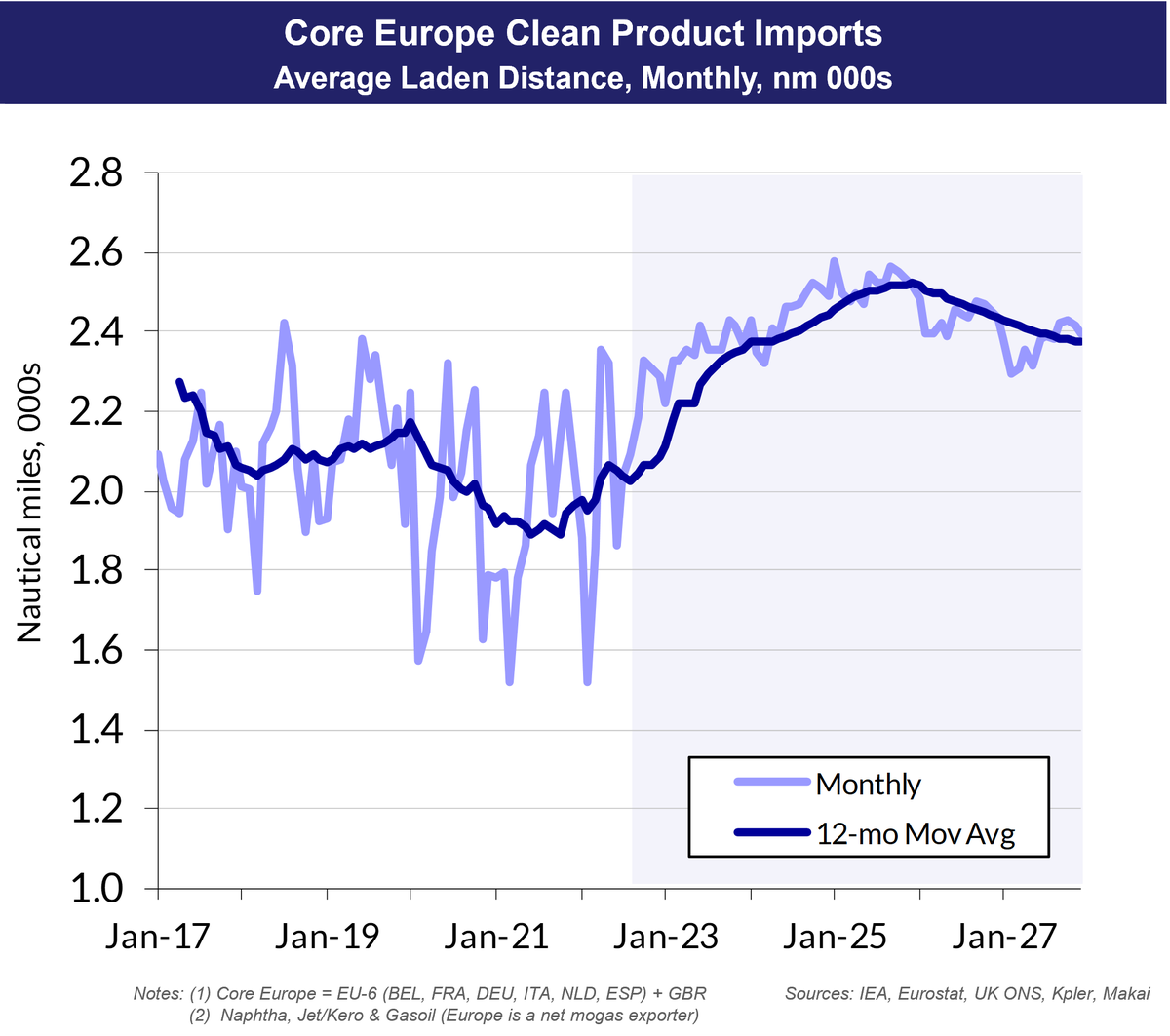

Still, the shift from Russian gasoil is obvious, with an increase in AG and Asian sources. Note that much of the intra-Europe flow ultimately drives external sourcing through key entrepot countries BEL & NLD. We model this intra-Europe trade in our mass balances.

The tonne-mile impact from these imports shifts is predictable, but note the sharp drop in 1q23, from French crude run recovery and declining import demand. Also note the vigorous recovery in 4q23, which should trigger a furious rate recovery (we are super bullish on this).

Looking at destination tonne-miles, easy to spot France as the driver of the current tonne-mile frenzy, which should subside as runs resume. Rather than an amuse bouche preceding even higher earnings, this looks to be something more ephemeral, in a recessionary environment.

We expect clean tanker longs to reject this analysis, preferring to listen to the dulcet tones of brokers assuring them that recessions do not matter and that tonne-miles will save all. Redirected Russian exports are similarly over-hyped (more later). #tankers $ASC $HAFNI $STNG

• • •

Missing some Tweet in this thread? You can try to

force a refresh