🧵on Twitter conduct. This is an epic forum for finance, market enthusiasts and we have to cultivate and grow it. We have a culture and etiquette, and I am sharing a priceless lesson from last week how you can get more here.

2/Whether you realize it or not there are several people, most widely followed, running money for a living, and are consummate professionals. They are often happy to help.

3/Last week I needed to reach out to two of the best and both were most generous with their time. They are the finest of gentleman, but it takes a while to grow relationships to ask the questions I did.

3/I've run money for clients, myself (still), and now at a family office. I've traded rates futures from STIR to Ultra's, and now focus on STIR, #ZB_F, and 2Yr when I trade rates.

4/I've not traded UST futures in size in spreads. Additionally, I've only been a Bloomberg user for 18 months which means I've used about 15% of its capability, maybe.

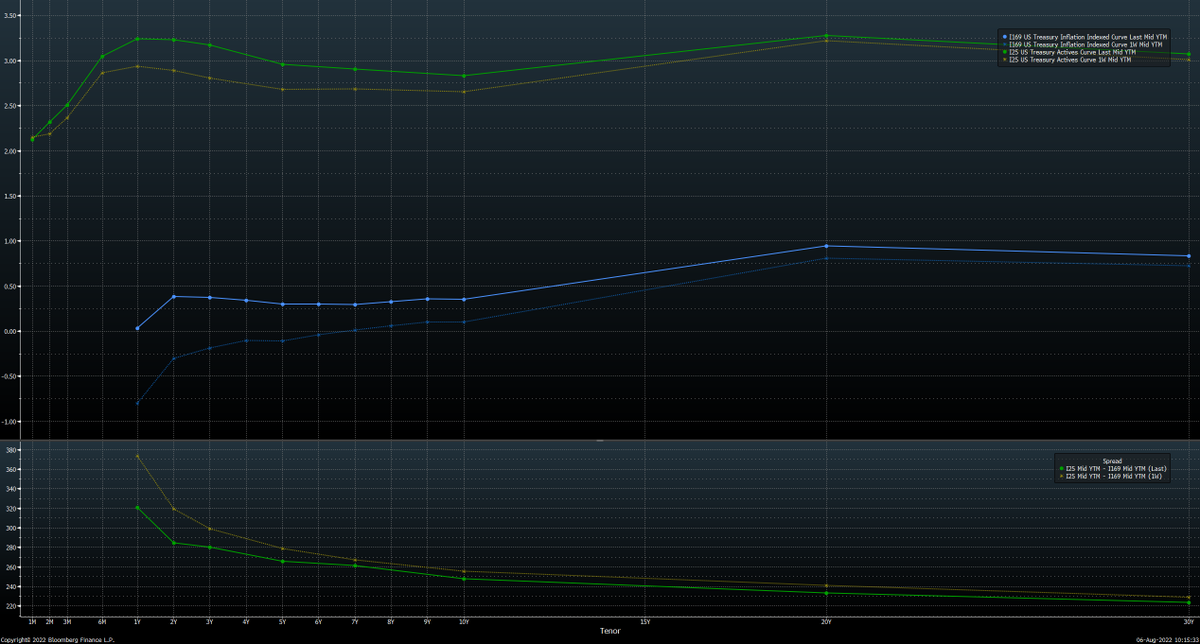

5/We've been talking about curve steepeners with the 2M/10Y at century deep inversion. I've done the math on spreadsheets, but not in size or in Bloomberg. After days grinding in Bloomberg, I got the nerve to ask @EffMktHype and @JorgeCalderonMx for help.

6/EMH and Jorge were both willing to help timely for me to interpret Bloomberg. I cannot say enough about how gracious and generous both were. I learned a great deal in little time.

7/I've received questions from others and thankful for the opportunity, so I get it. Here are some things to consider about how we conduct ourselves on #fintwit, learn, and grow the community.

8/

•If you disagree with someone, try asking a question instead of "Yeah, fuck off bro, have fun being poor..."

•Always consider and respect time frame. Your timeframe is likely not aligned with your audience or the original tweet.

•If you disagree with someone, try asking a question instead of "Yeah, fuck off bro, have fun being poor..."

•Always consider and respect time frame. Your timeframe is likely not aligned with your audience or the original tweet.

9/

•For those in the back: mismatched timeframe is the root of 90% of disagreement on #fintwit.

•Try thanking someone for their content or comment how it helped you. Good posts get 100 likes, the 101st like isn't getting noticed.

•Disagree? Back it up with some data, a chart.

•For those in the back: mismatched timeframe is the root of 90% of disagreement on #fintwit.

•Try thanking someone for their content or comment how it helped you. Good posts get 100 likes, the 101st like isn't getting noticed.

•Disagree? Back it up with some data, a chart.

10/For those who are doing this for a living some thoughts:

•75% of the pushback comes from anon accounts with less than 100 followers. Is it really worth your time to argue with them?

•Timeframe

•When someone does reach out it makes a big difference to respond.

•75% of the pushback comes from anon accounts with less than 100 followers. Is it really worth your time to argue with them?

•Timeframe

•When someone does reach out it makes a big difference to respond.

11/If you are curious about how relationships grow and mature here. Check out @bennpeifert He runs a master class on sharing and responding to high quality content.

This may be Elon's business, but it's our community and what we make it.

This may be Elon's business, but it's our community and what we make it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh