Christian, Macro, Family Office Derivatives, Recovering USN Aviator (A4, F14), USAF PEP F16, 2A, Energy, Fedwatch, Pure Blood, C02 isn't pollution. not advice

7 subscribers

How to get URL link on X (Twitter) App

2/Throw $2 w/the $5 or $10 at the valet stand and usually get "Wow, haven't seen this in years". Shake their hand, say Thank You, remember the 2nd Amendment. They ALWAYS remember me next time.

2/Throw $2 w/the $5 or $10 at the valet stand and usually get "Wow, haven't seen this in years". Shake their hand, say Thank You, remember the 2nd Amendment. They ALWAYS remember me next time.

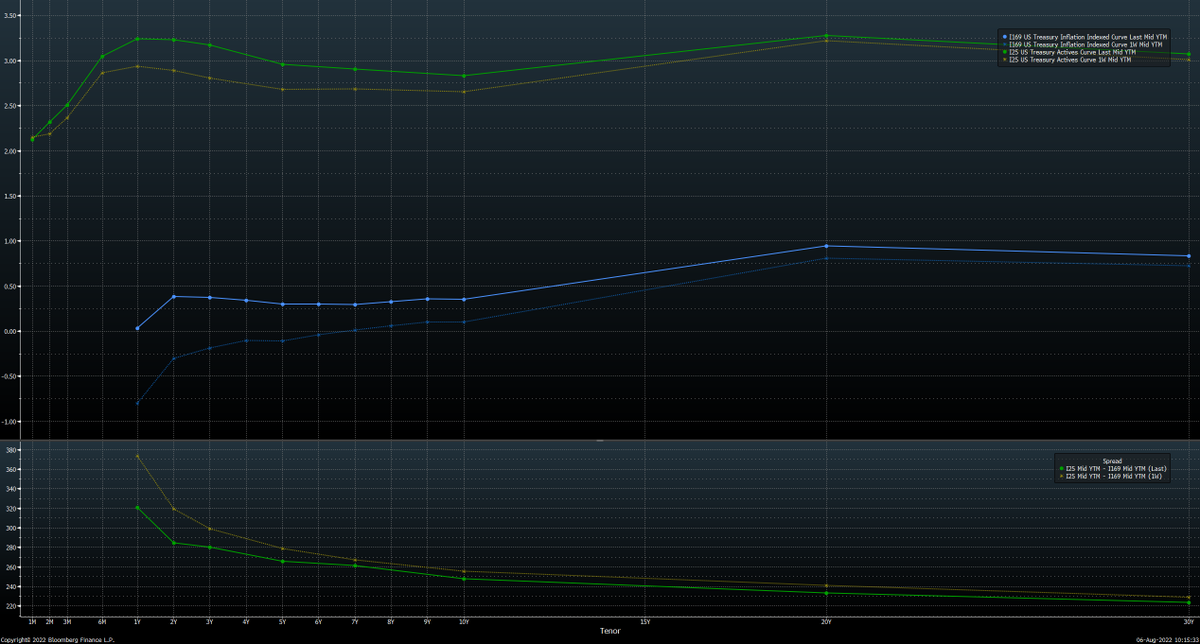

Treasury Inflation Protected Securities TIPS yield curve. Up sharply on the near.

Treasury Inflation Protected Securities TIPS yield curve. Up sharply on the near.

The shift up in TIPS curve is more than the shift in nominal yields lowering inflation expectations derived from the Nominal - TIPS spread in the bottom pane.

The shift up in TIPS curve is more than the shift in nominal yields lowering inflation expectations derived from the Nominal - TIPS spread in the bottom pane.

https://twitter.com/calculatedrisk/status/1378399197460766722?s=20