2.

Noah(@Noah_nftn) tweeted that Former employees of FTX @vydamo_ disclosed 0xd275e5cb559d6dc236a5f8002a5f0b4c8e610701 is one of the addresses of misappropriating customer funds.

Noah(@Noah_nftn) tweeted that Former employees of FTX @vydamo_ disclosed 0xd275e5cb559d6dc236a5f8002a5f0b4c8e610701 is one of the addresses of misappropriating customer funds.

3.

Starting on November 8th, 0xd275 carried out large-scale $ETH transfers, which has never happened before in history.

The time coincides with the time when the FTX exchange suspended user withdrawals.

Misappropriating client funds to make money?

Starting on November 8th, 0xd275 carried out large-scale $ETH transfers, which has never happened before in history.

The time coincides with the time when the FTX exchange suspended user withdrawals.

Misappropriating client funds to make money?

4.

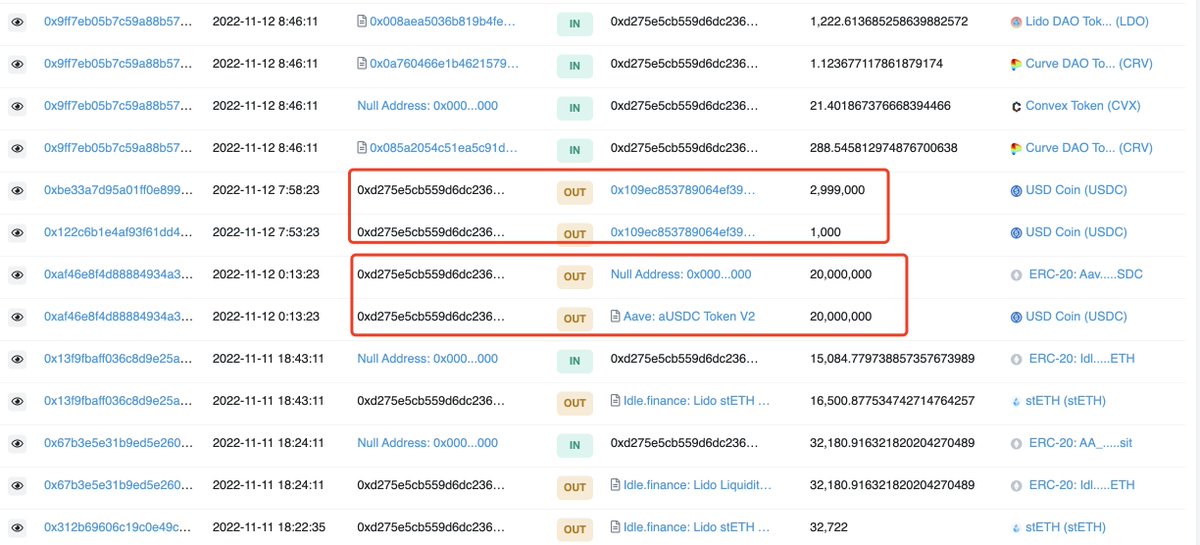

We found that 0xd275 transferred a large amount of $USDC to exchanges before the FTX Accounts Drainer dumping $ETH.

It seemed that he wanted to make a profit by shorting $ETH.

We found that 0xd275 transferred a large amount of $USDC to exchanges before the FTX Accounts Drainer dumping $ETH.

It seemed that he wanted to make a profit by shorting $ETH.

5.

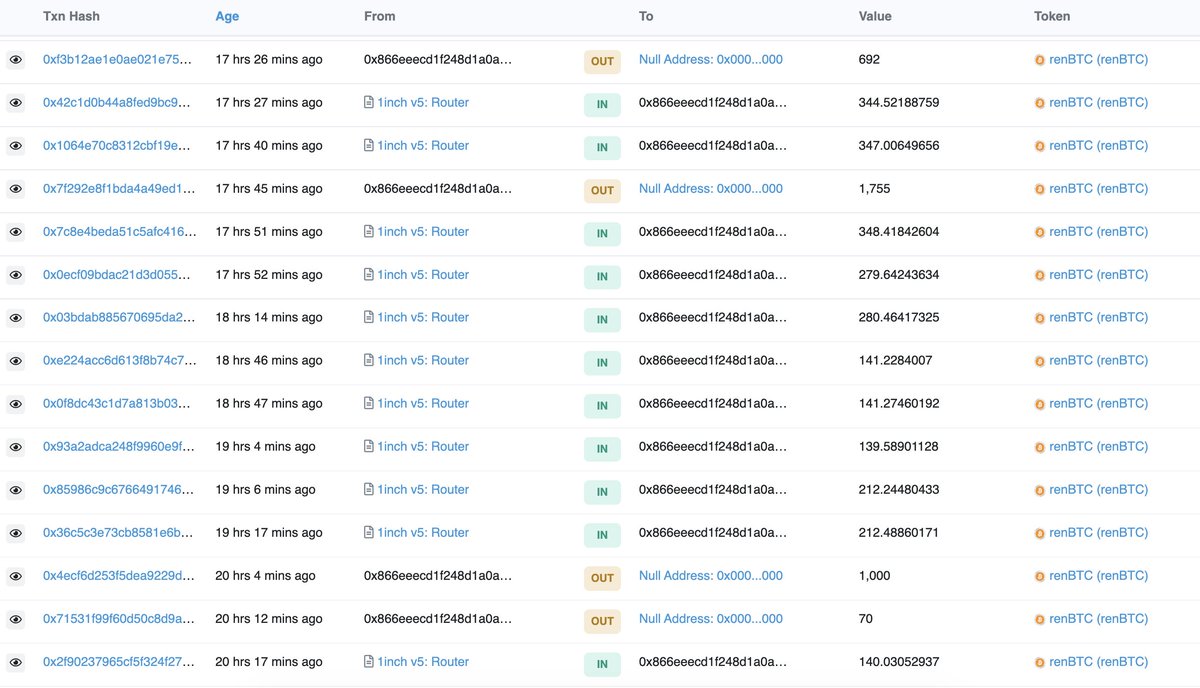

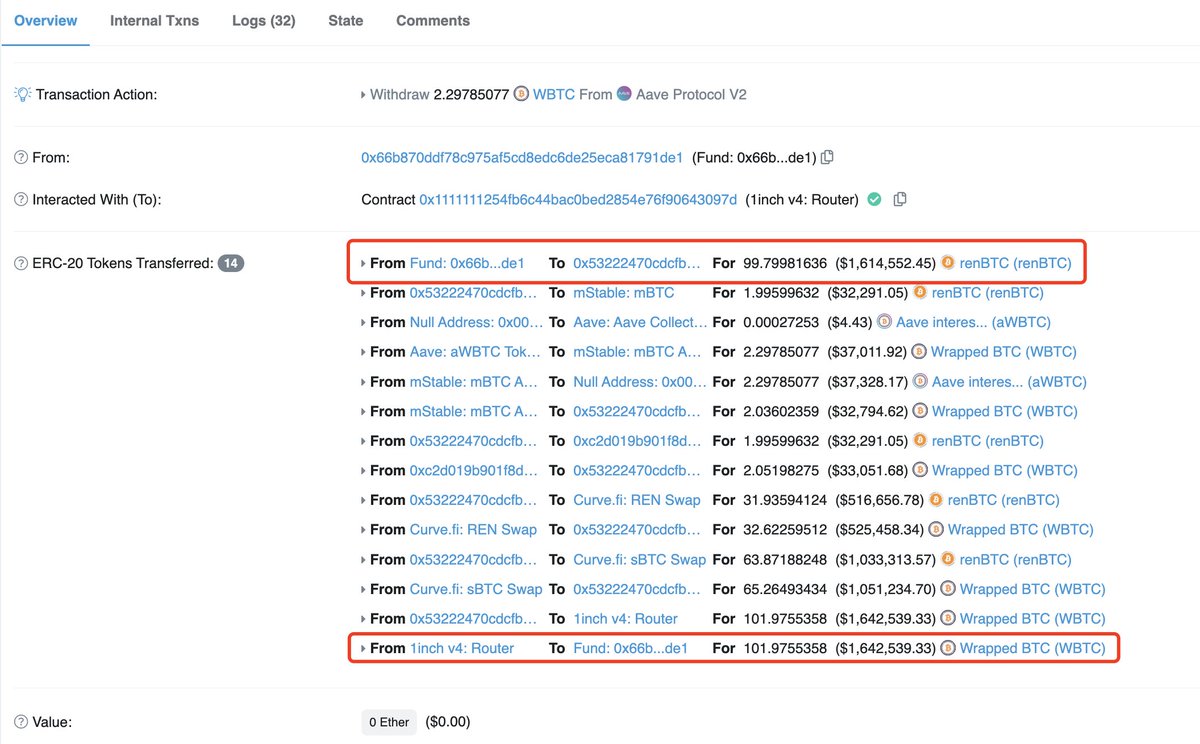

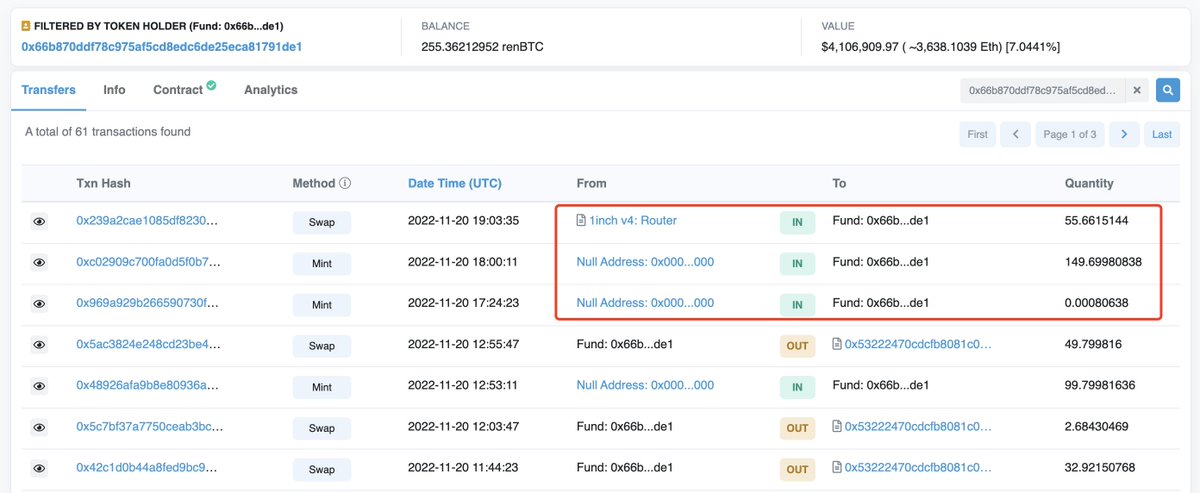

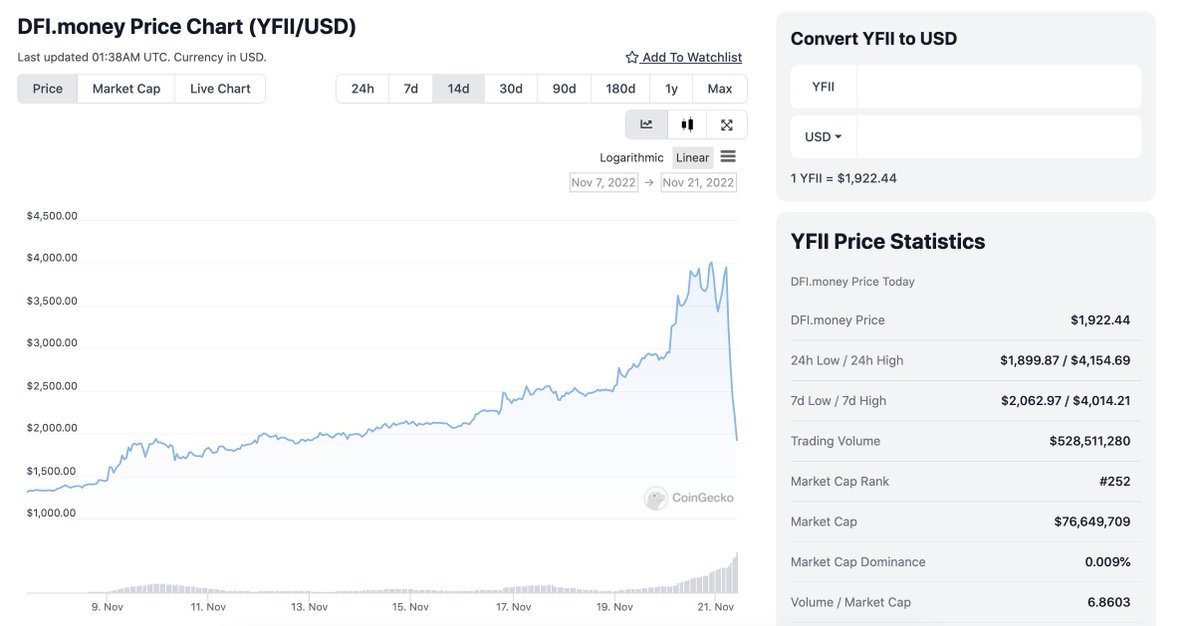

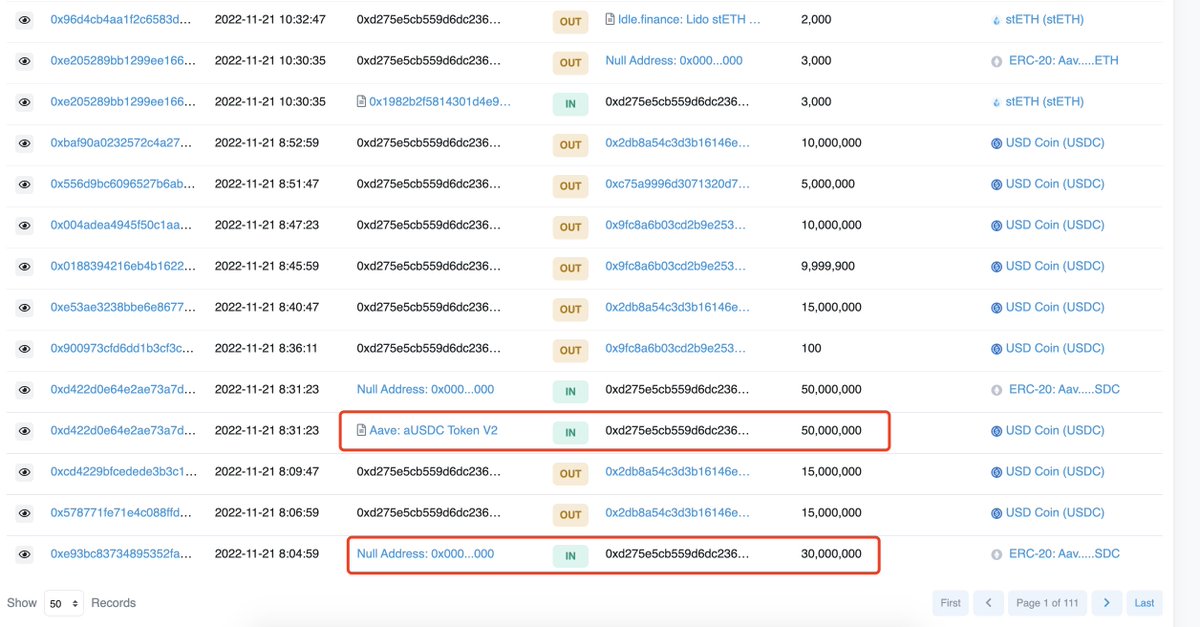

On November 21, 0xd275 borrowed 80M $USDC from #Aave and transferred to the exchanges.

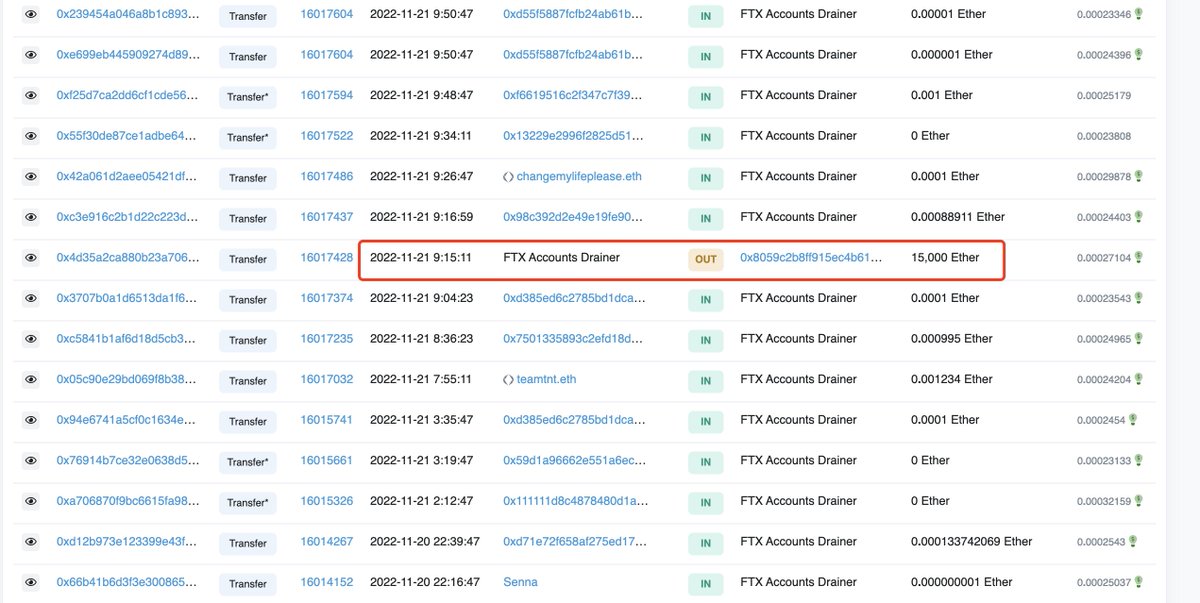

20 minutes later, FTX Accounts Drainer dumped 15,000 $ETH for renBTC.

It seems that 0xd275 went to the exchange to short $ETH.

On November 21, 0xd275 borrowed 80M $USDC from #Aave and transferred to the exchanges.

20 minutes later, FTX Accounts Drainer dumped 15,000 $ETH for renBTC.

It seems that 0xd275 went to the exchange to short $ETH.

6.

The transaction time of 0xd275 is very consistent with FTX Accounts Drainer, it seems that the same person is operating.

When 0xd275 stops trading, FTX Accounts Drainer starts trading; and when FTX Accounts Drainer stops trading, 0xd275 resumes trading.

The transaction time of 0xd275 is very consistent with FTX Accounts Drainer, it seems that the same person is operating.

When 0xd275 stops trading, FTX Accounts Drainer starts trading; and when FTX Accounts Drainer stops trading, 0xd275 resumes trading.

7.

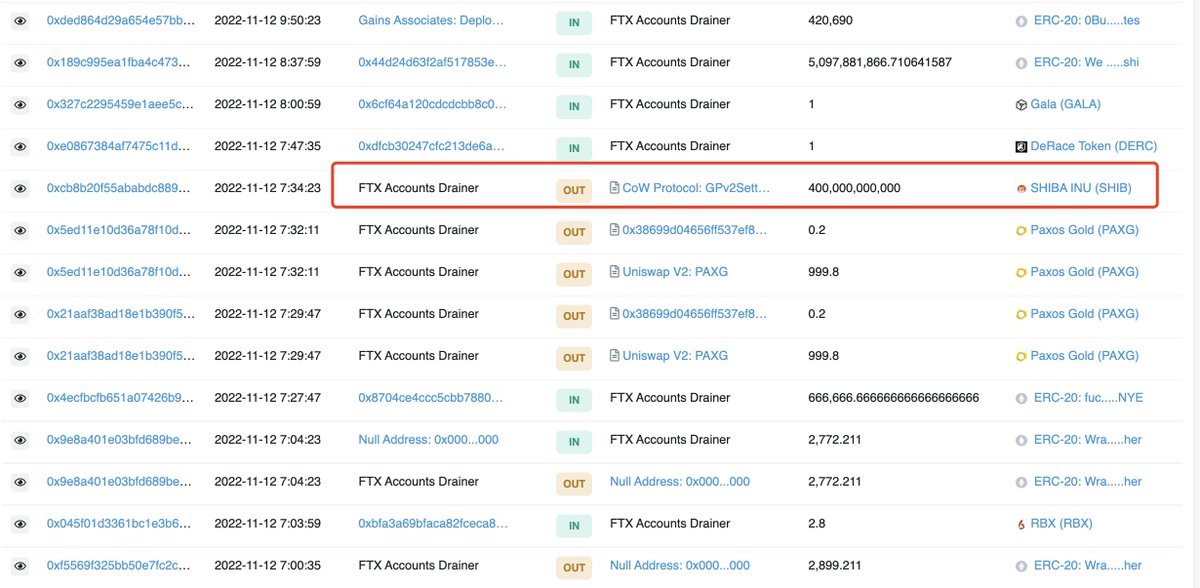

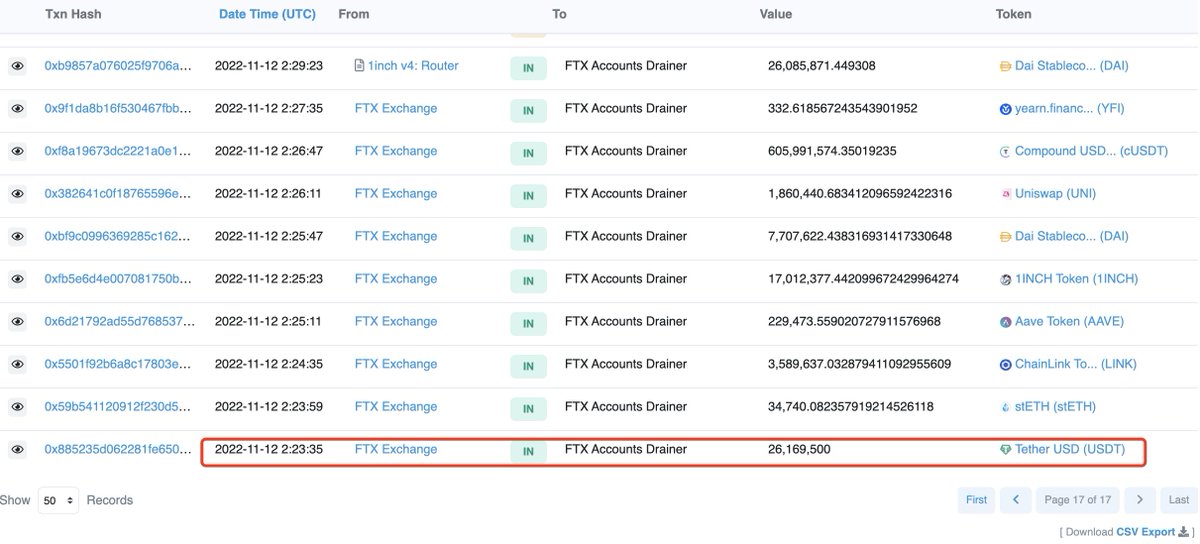

On November 12, 2 hours after the 0xd275 stopped trading, FTX Accounts Drainer began to steal assets from the FTX Exchange and sell them.

At 7:34:23, the FTX Accounts Drainer stopped selling.

And half an hour later, 0xd275 started trading.

What a coincidence!

On November 12, 2 hours after the 0xd275 stopped trading, FTX Accounts Drainer began to steal assets from the FTX Exchange and sell them.

At 7:34:23, the FTX Accounts Drainer stopped selling.

And half an hour later, 0xd275 started trading.

What a coincidence!

8.

The above is just a coincidence of discovery.

It does not mean that FTX Accounts Drainer and address 0xd275 are the same person.

Just a guess.

The above is just a coincidence of discovery.

It does not mean that FTX Accounts Drainer and address 0xd275 are the same person.

Just a guess.

9.

As for whether 0xd275 is the address for misappropriating FTX customer funds, exchanges such as @bitfinex, @cz_binance, @krakenfx, and @coinbase can tell us the answer.

Because 0xd275 withdrew/deposited funds on these exchanges.

As for whether 0xd275 is the address for misappropriating FTX customer funds, exchanges such as @bitfinex, @cz_binance, @krakenfx, and @coinbase can tell us the answer.

Because 0xd275 withdrew/deposited funds on these exchanges.

10.

Who do you think the FTX Accounts Drainer could be?

Write down your answers.👇

Who do you think the FTX Accounts Drainer could be?

Write down your answers.👇

https://twitter.com/lookonchain/status/1594996146694508545

• • •

Missing some Tweet in this thread? You can try to

force a refresh