Today, ponzishorter.eth borrowed a large amount of $CRV from #Aave and pumped it.

Which caused the price of $CRV to drop from $0.537 to $0.407, a drop of 24%.

The sell-off continues for now.

1.🧵

A thread tells you what happened to $CRV.

Which caused the price of $CRV to drop from $0.537 to $0.407, a drop of 24%.

The sell-off continues for now.

1.🧵

A thread tells you what happened to $CRV.

2.

On November 13, ponzishorter.eth deposited about 40M $USDC into #Aave to borrow $CRV for selling.

Began to short $CRV for a week.

Which caused the price of $CRV to slowly drop from $0.625 to $0.464 over the past week, a drop of about 26%.

On November 13, ponzishorter.eth deposited about 40M $USDC into #Aave to borrow $CRV for selling.

Began to short $CRV for a week.

Which caused the price of $CRV to slowly drop from $0.625 to $0.464 over the past week, a drop of about 26%.

3.

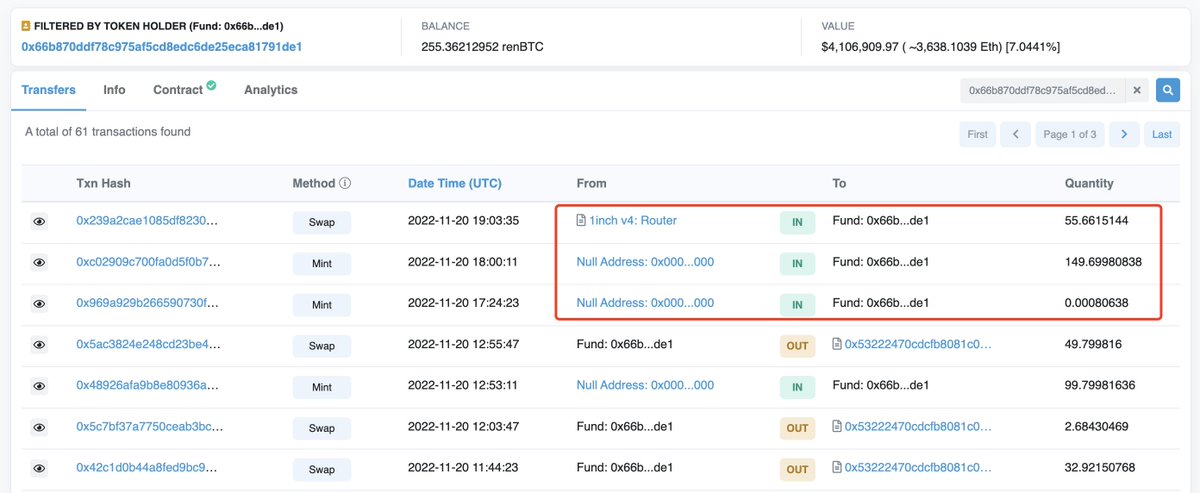

5 hours ago, ponzishorter.eth suddenly borrowed 20M $CRV ($9.9M) from #Aave and transferred to #OKEx for selling.

3 hours ago, borrowed 10M $CRV ($9.9M) from #Aave again.

etherscan.io/address/0x57e0…

5 hours ago, ponzishorter.eth suddenly borrowed 20M $CRV ($9.9M) from #Aave and transferred to #OKEx for selling.

3 hours ago, borrowed 10M $CRV ($9.9M) from #Aave again.

etherscan.io/address/0x57e0…

4.

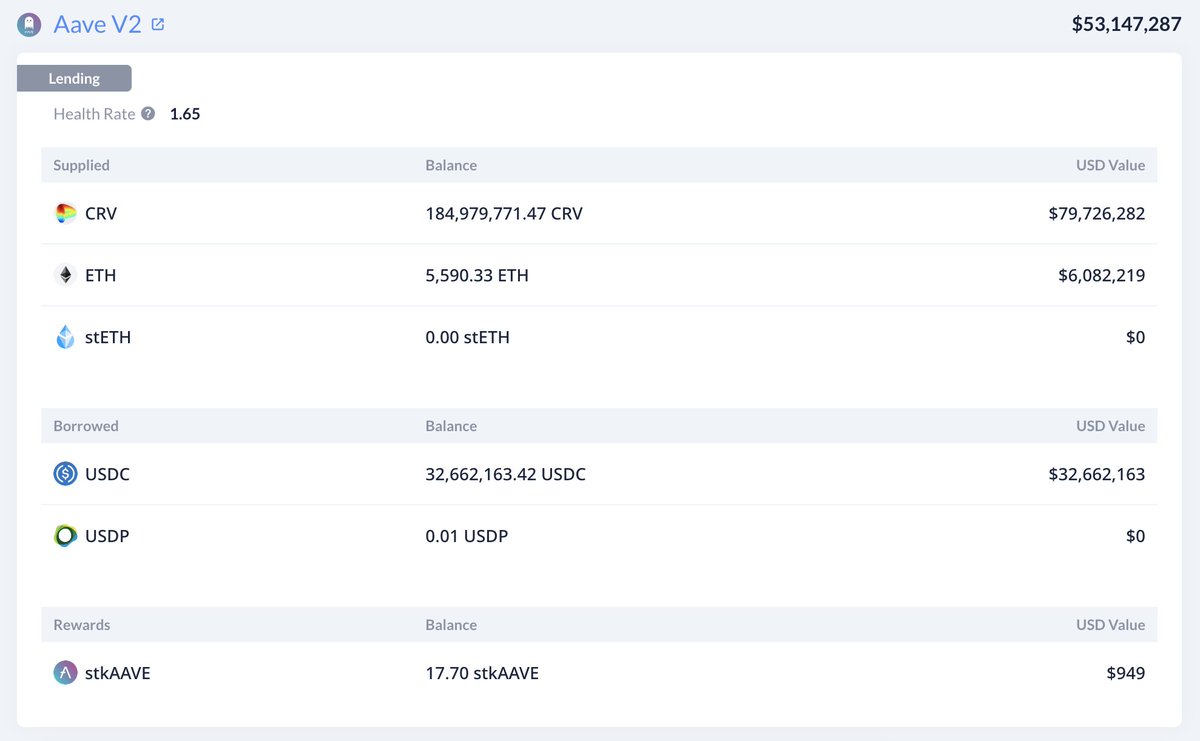

ponzishorter.eth sold $CRV in large quantities, so many people who used $CRV as collateral will face liquidation.

The founder of Curve.fi borrowed $USDC with $CRV as collateral and is about to be liquidated.

So 3 hours ago, he added 20M $CRV of collateral.

ponzishorter.eth sold $CRV in large quantities, so many people who used $CRV as collateral will face liquidation.

The founder of Curve.fi borrowed $USDC with $CRV as collateral and is about to be liquidated.

So 3 hours ago, he added 20M $CRV of collateral.

6.

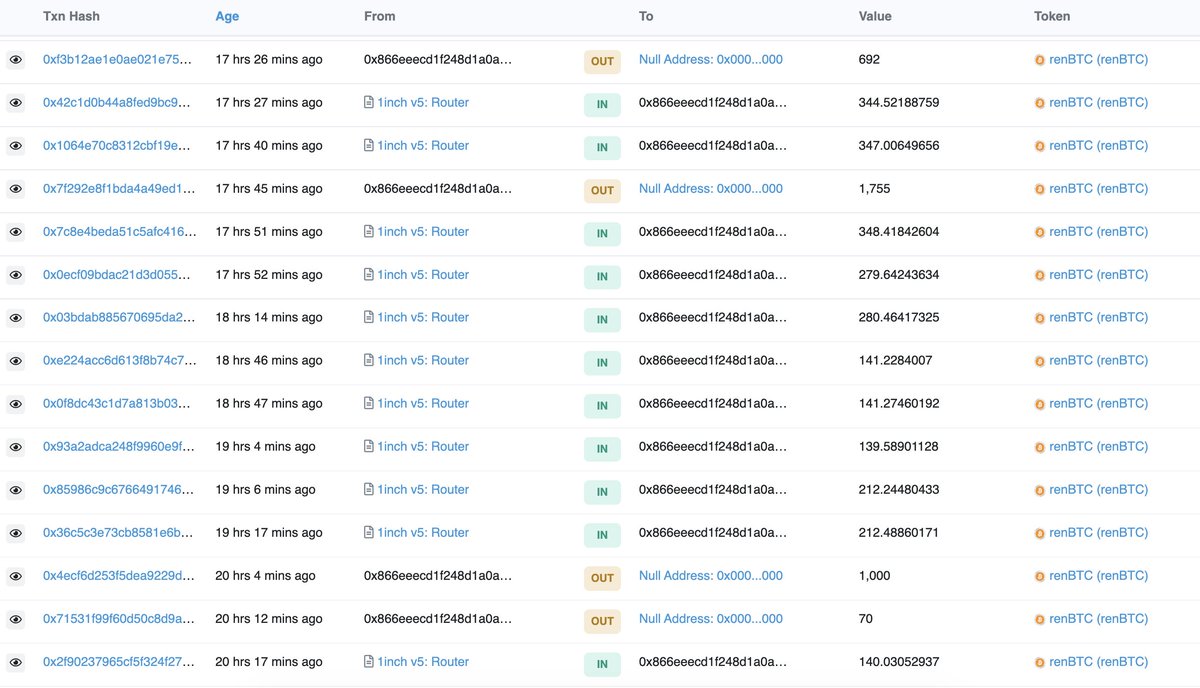

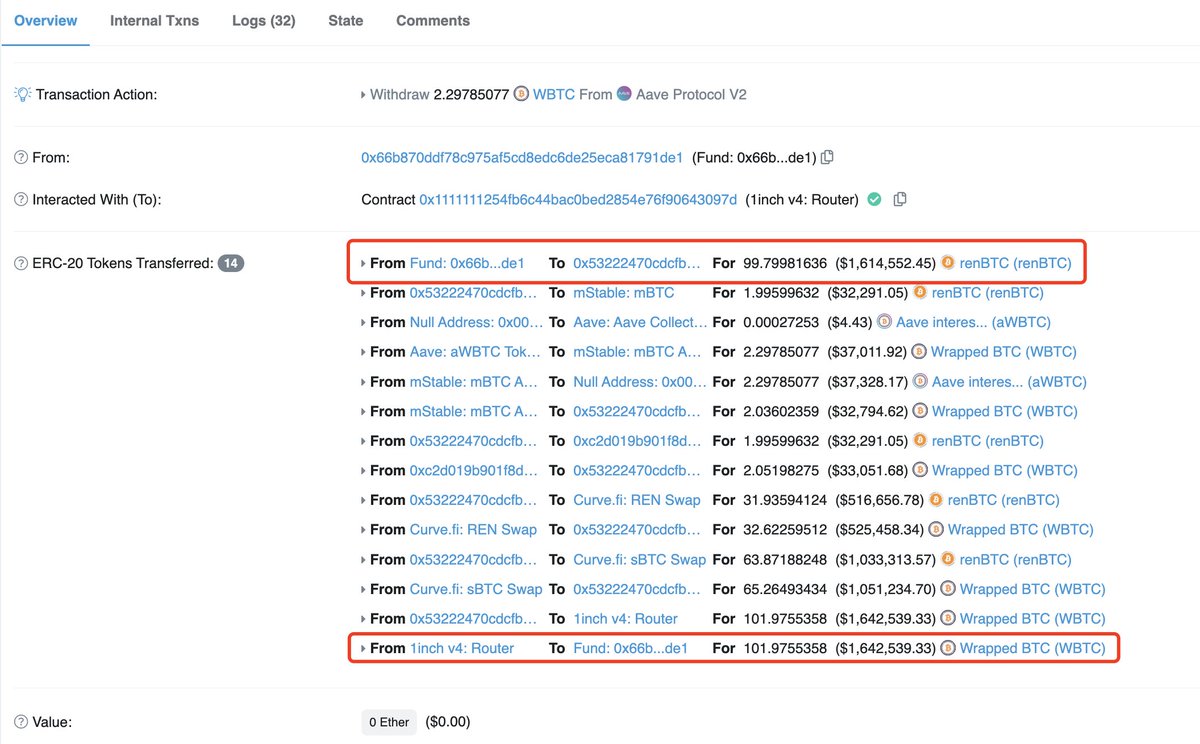

ponzishorter.eth added $USDC as collateral, continued to borrow $CRV from #Aave and sold.

He totally borrowed 92M $CRV($39.86M)

Now his Health Rate is 1.39.

And he also used MEV bots to dump $CRV in an attempt to drain CRV's liquidity.

ponzishorter.eth added $USDC as collateral, continued to borrow $CRV from #Aave and sold.

He totally borrowed 92M $CRV($39.86M)

Now his Health Rate is 1.39.

And he also used MEV bots to dump $CRV in an attempt to drain CRV's liquidity.

8.

If you like this thread, like and retweet it.

We will update the data on-chain for you.

Follow @lookonchain and turn on notifications.

Join our telegram group to receive alerts from SmartMoney.

t.me/lookonchain

If you like this thread, like and retweet it.

We will update the data on-chain for you.

Follow @lookonchain and turn on notifications.

Join our telegram group to receive alerts from SmartMoney.

t.me/lookonchain

https://twitter.com/lookonchain/status/1595022256018702339

• • •

Missing some Tweet in this thread? You can try to

force a refresh