“No place like Home REIT… thankfully” – Viceroy Research’s latest report is now live:

viceroyresearch.org/2022/11/23/hom…

Viceroy’s investigation of $HOME investments & tenants suggests significant downside.

We are #short. #thread 1/

viceroyresearch.org/2022/11/23/hom…

Viceroy’s investigation of $HOME investments & tenants suggests significant downside.

We are #short. #thread 1/

THE TENANTS

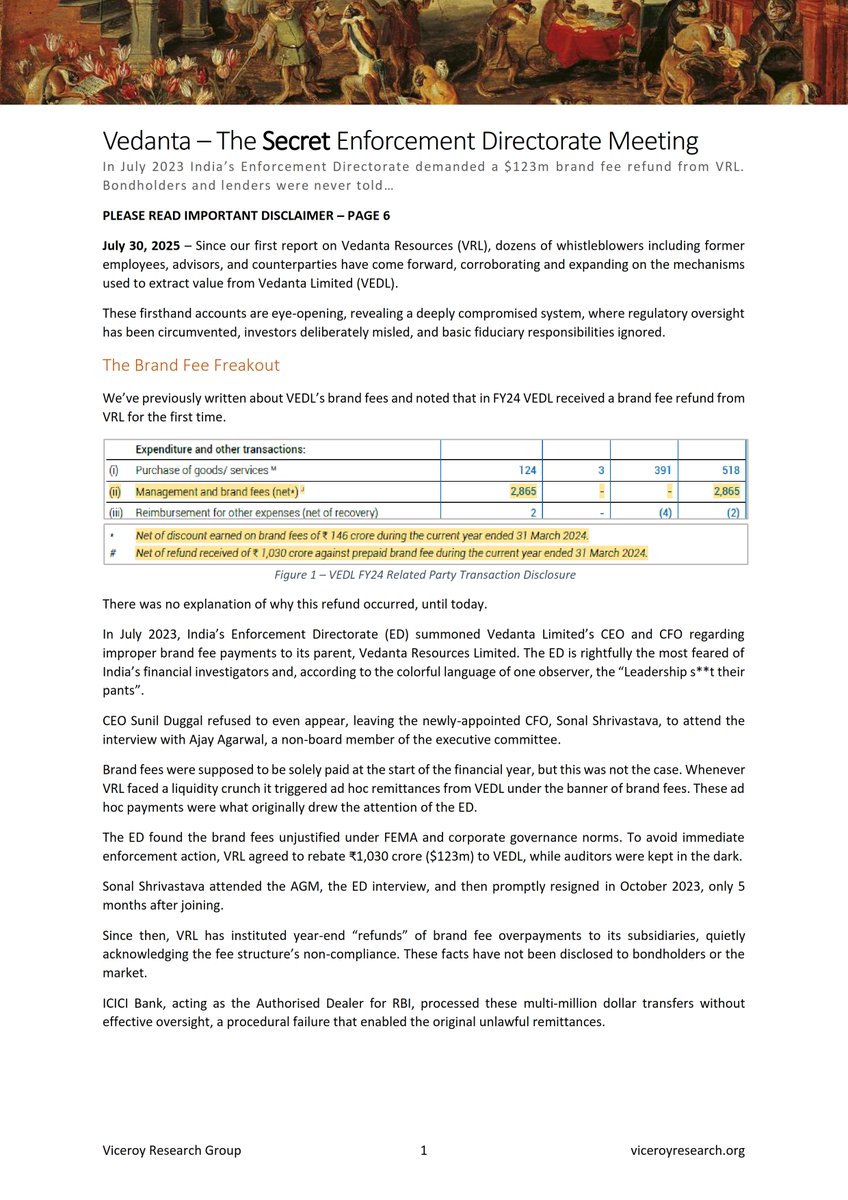

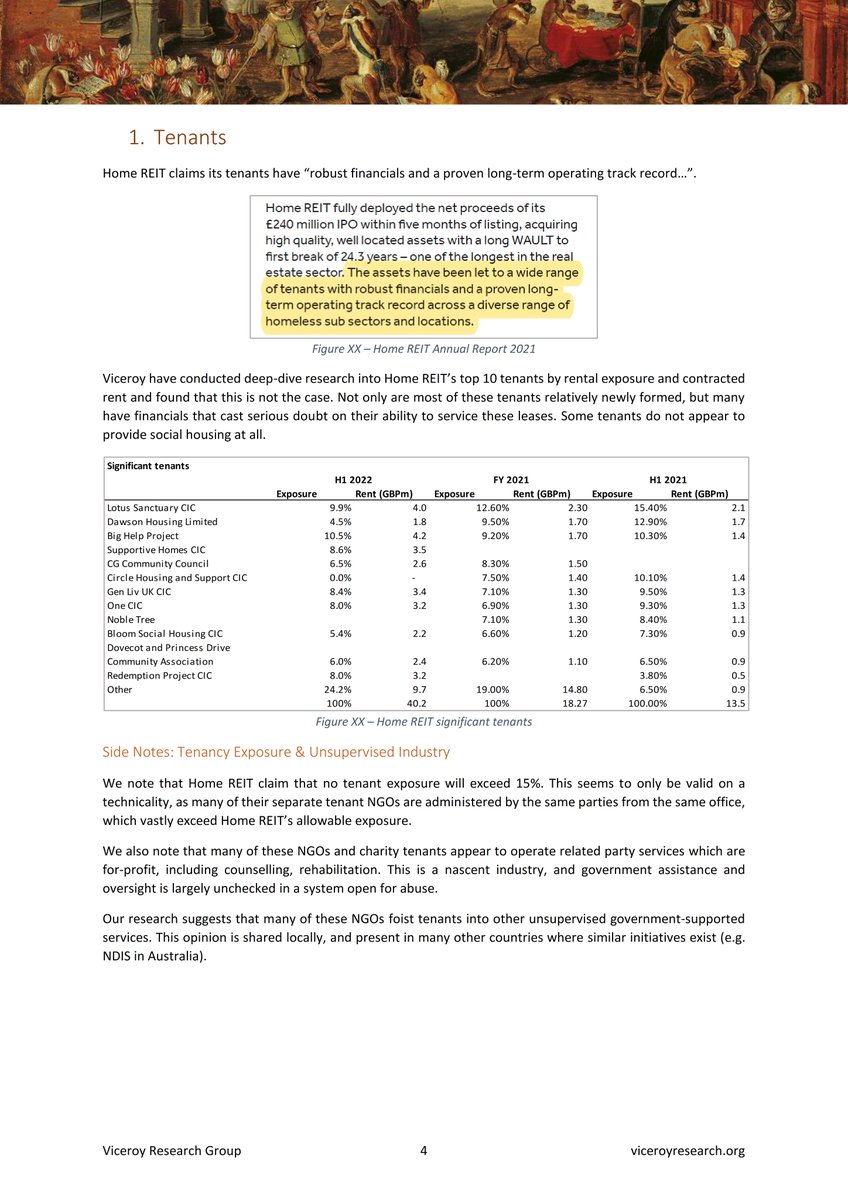

Financial data of $HOME's tenants show that many cannot afford rent, have not been paying rent, are in administration, are run by bad actors, and/or simply do not provide social housing services. 2/

Financial data of $HOME's tenants show that many cannot afford rent, have not been paying rent, are in administration, are run by bad actors, and/or simply do not provide social housing services. 2/

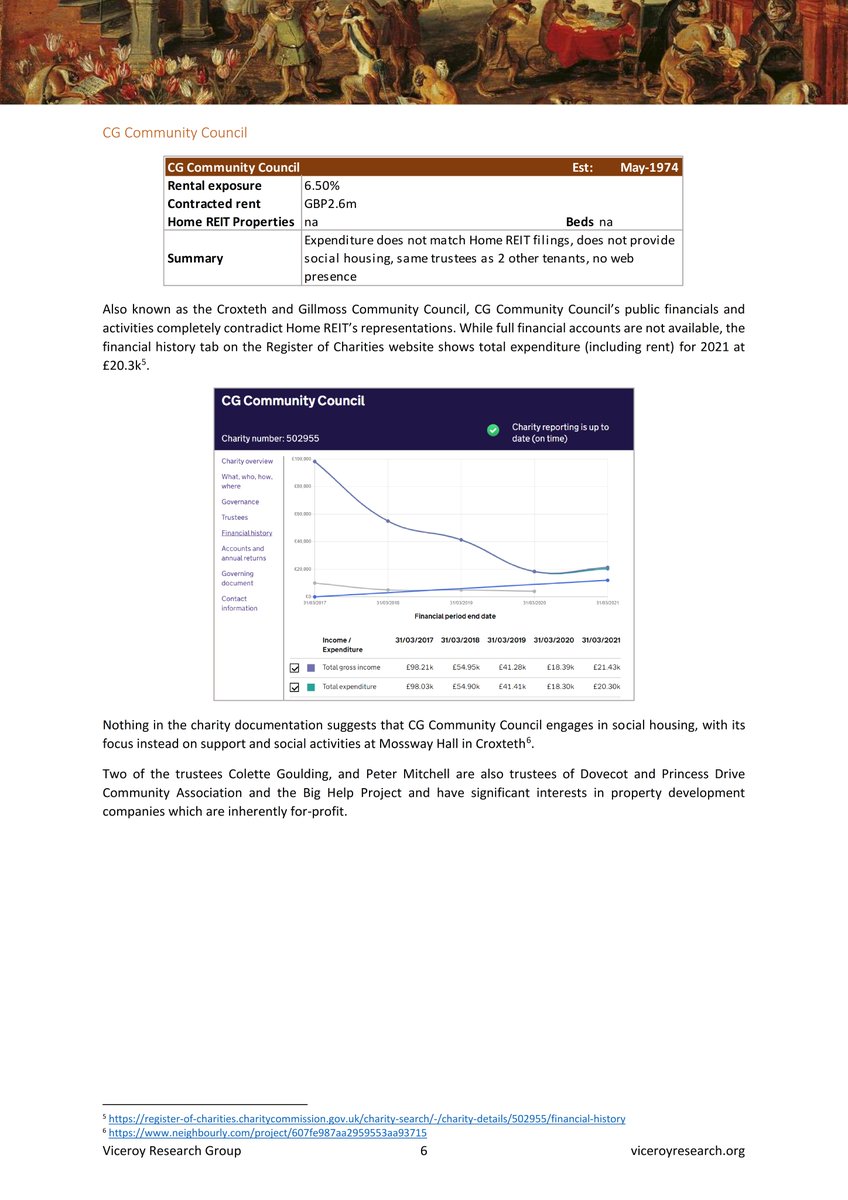

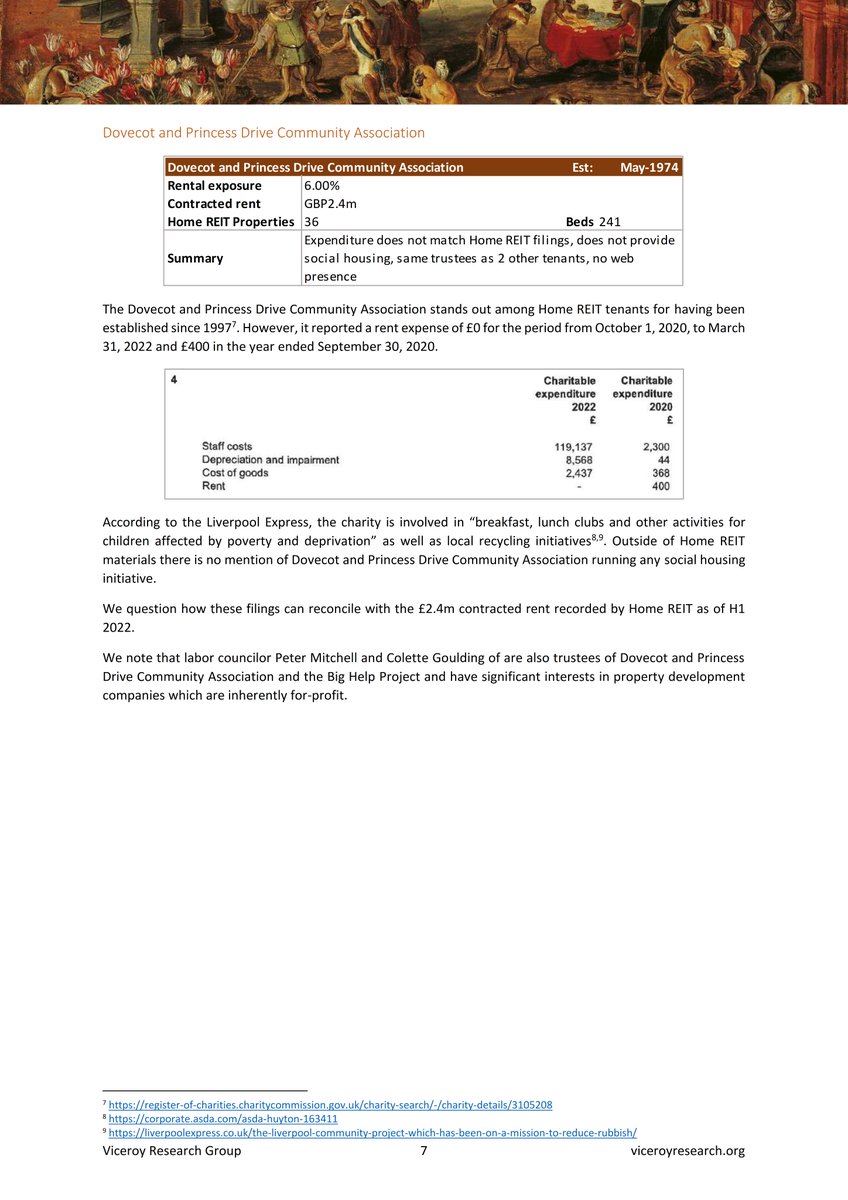

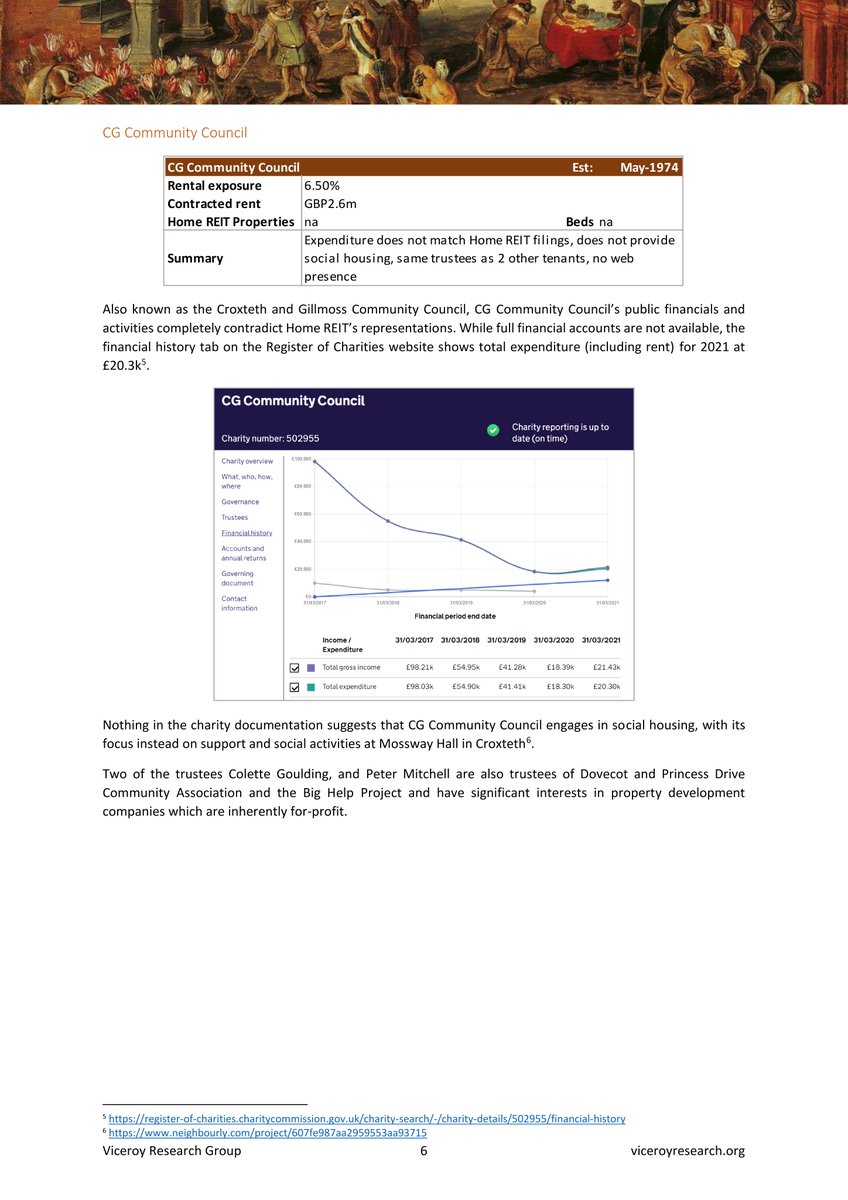

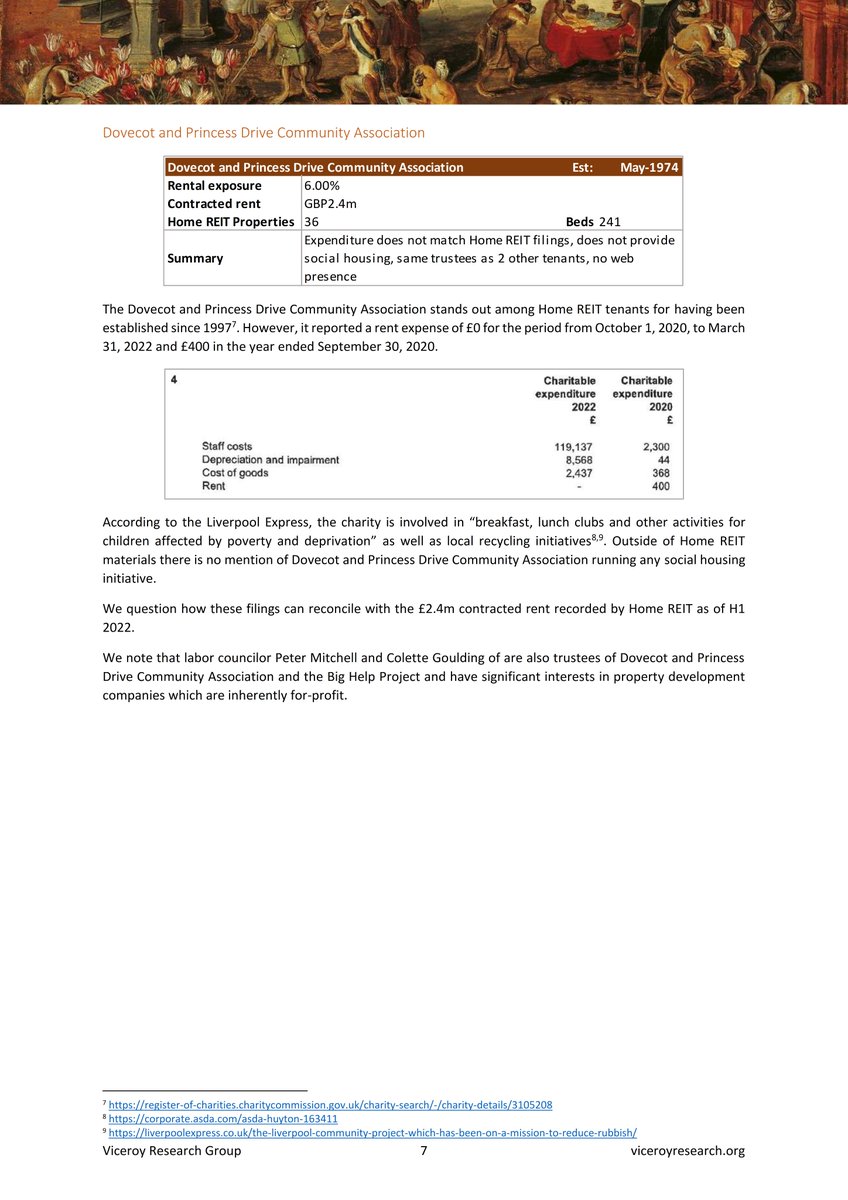

Several of $HOME's largest tenants do not appear to be paying any rent. Financial accounts show zero outflow, and charity activities do not appear to include social housing. 3/

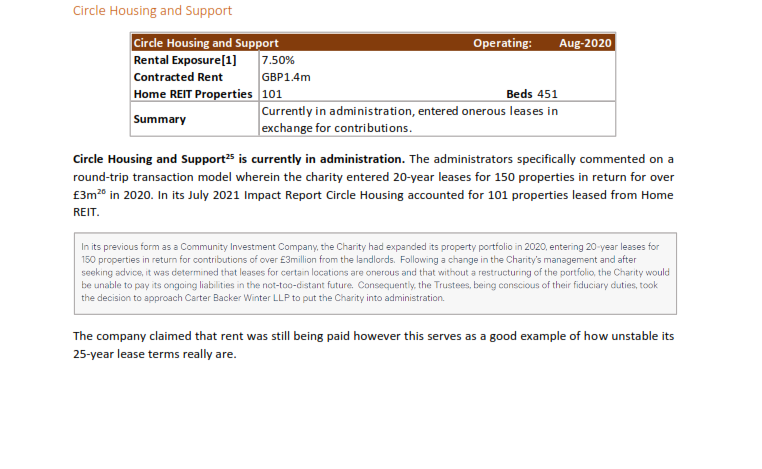

Circle Housing & Support, responsible for 7.5% of revenue in 2021, is in Administration. The administrator notes Circle had a round-robin transaction whereby it would receive donations from landlords to pay rent. $HOME 4/

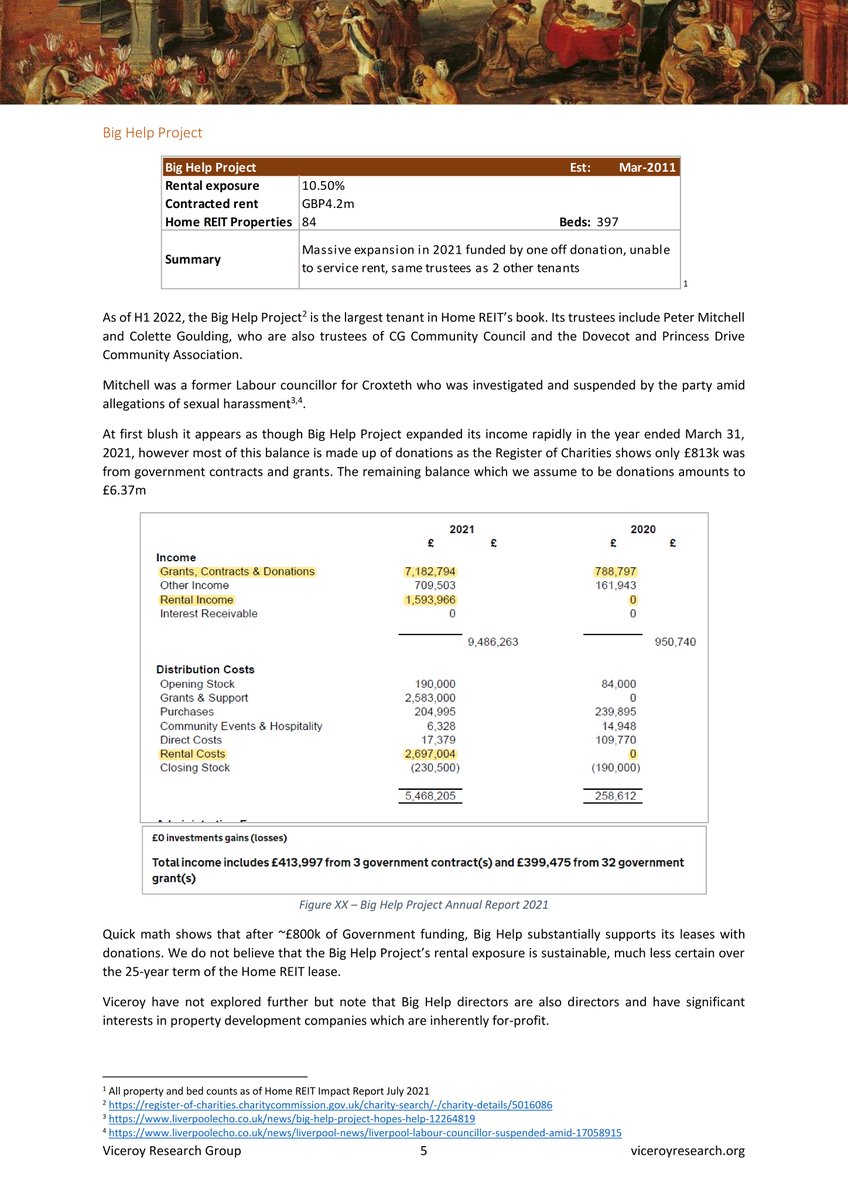

Publicly available charity financials show that many of these charities may not have the ability to service these leases on a long-term basis. Government grants are assessed year-to-year, and charities claim rent is renewed on this basis. $HOME 5/

Despite claims to limit exposure per client to 15%: $HOME's largest tenants all appear to share the same office and are run by the same people, including Peter Mitchell, who was suspended as Labour Councilor of Croxteth amid allegations of sexual harassment 6/

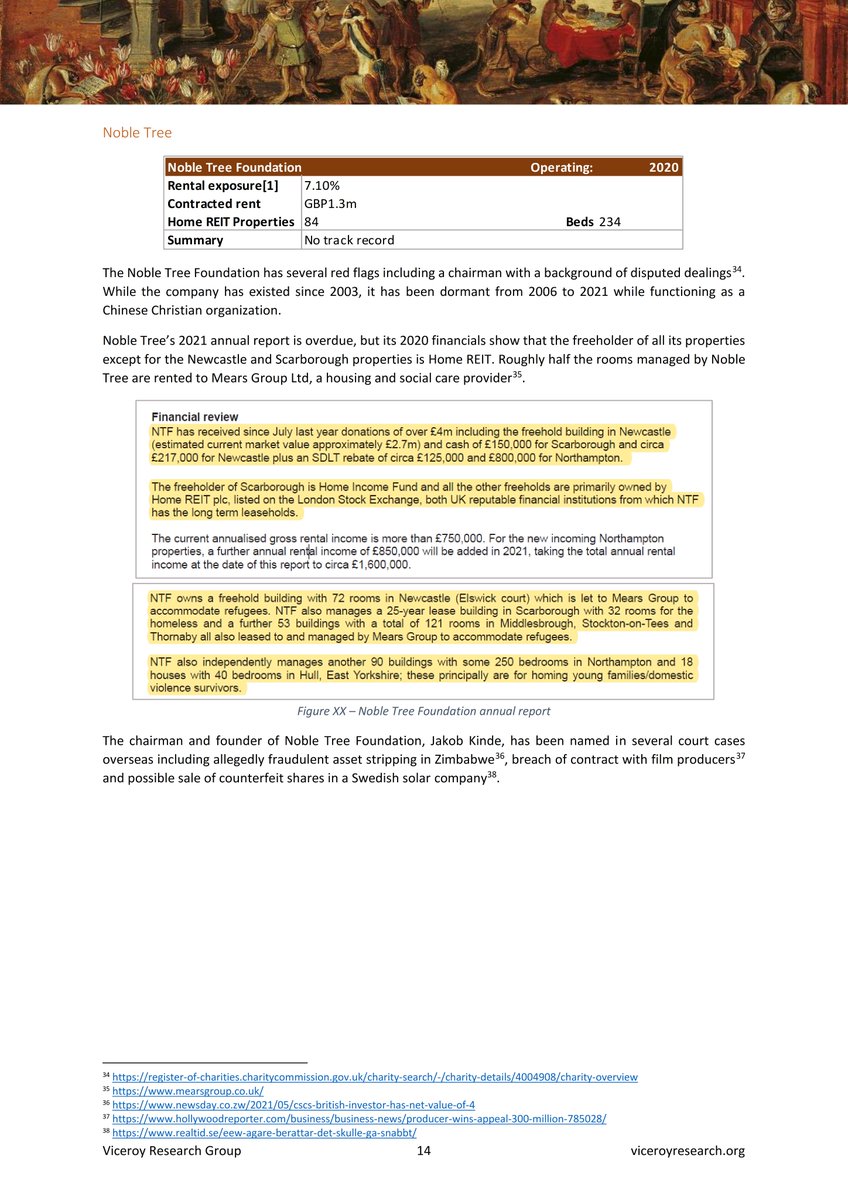

The founder of Noble Tree Foundation has been named in several court cases overseas including allegedly fraudulent asset stripping in Zimbabwe, breach of contract with film producers and possible sale of counterfeit shares in a Swedish solar company. $HOME 7/

Operators of various $HOME tenants also have significant interest in for-profit development companies and other for-profit government subsidized programs in which tenants are foisted into. 8/

THE FINANCIALS

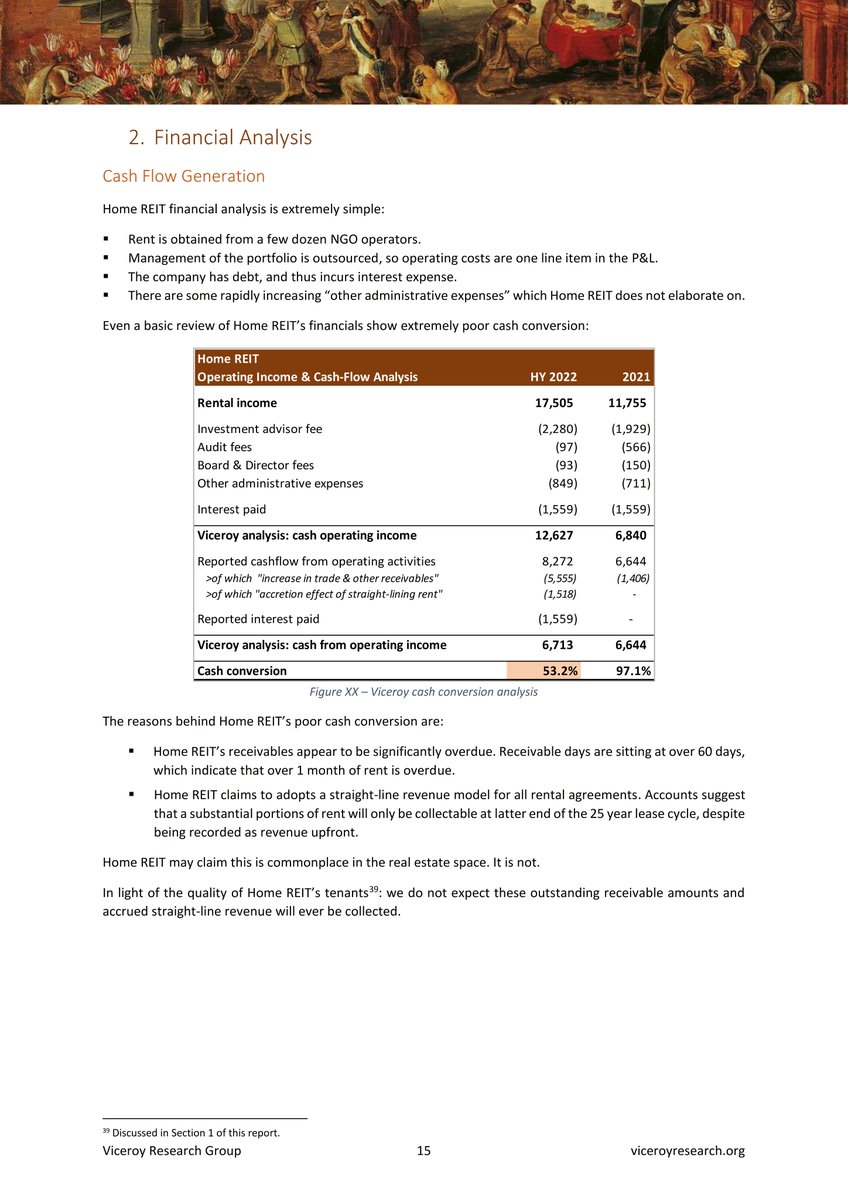

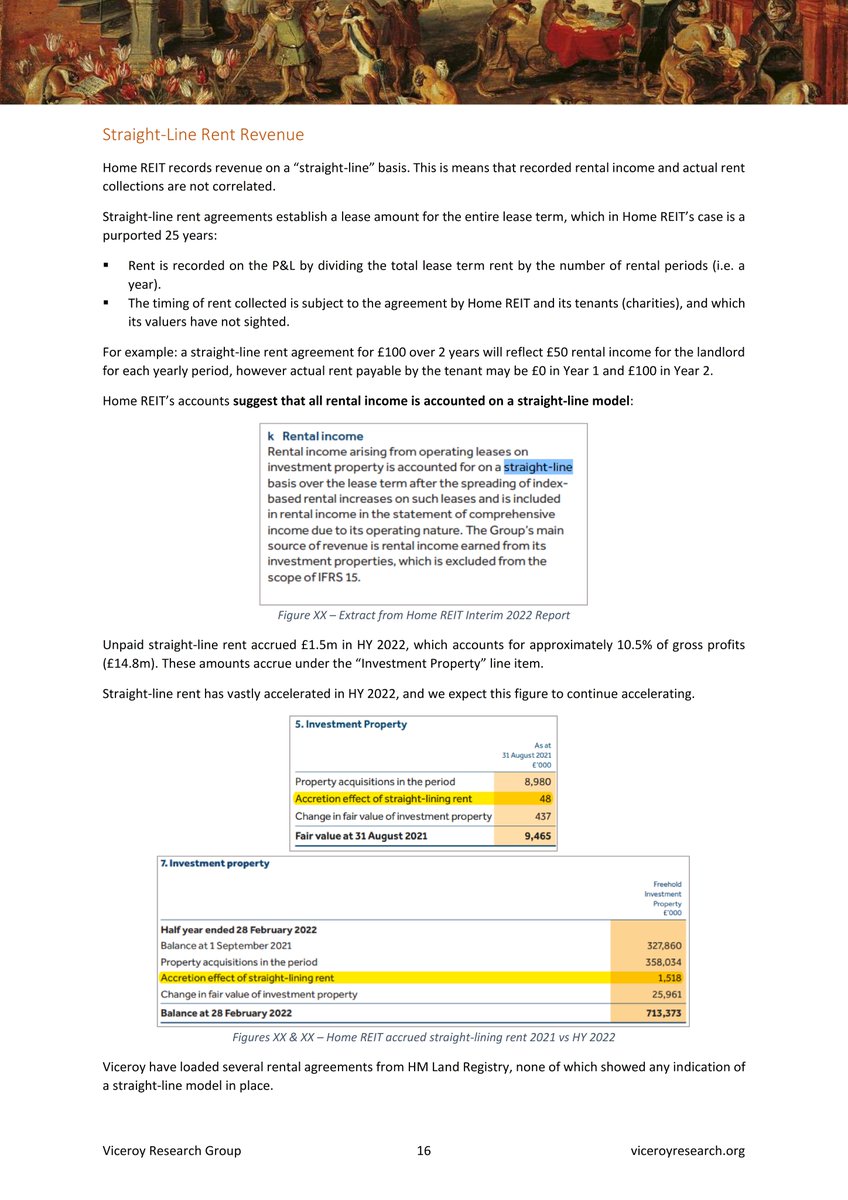

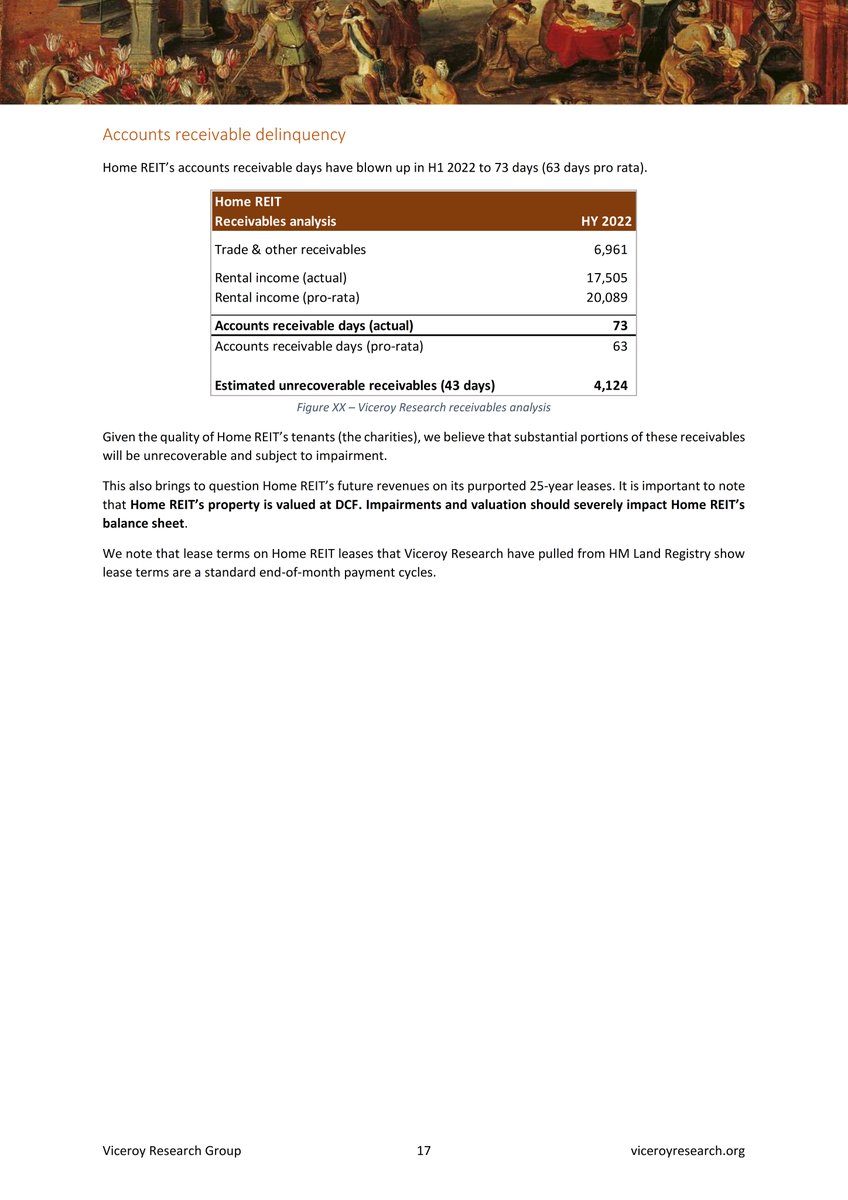

$HOME’s cash conversion is almost non-existent due to overdue receivables and straight-line uncollected rent. Given our review of $HOME's tenants, we do not believe these amounts are collectable. 9/

$HOME’s cash conversion is almost non-existent due to overdue receivables and straight-line uncollected rent. Given our review of $HOME's tenants, we do not believe these amounts are collectable. 9/

$HOME's accounts receivables are sitting at 70+ days as at HY 2022, with no impairments recorded. A review of various tenant leases lodged with HM Land Registry show payment terms are consistently 30 days. 10/

$HOME also claims to adopt a straight-line revenue model where substantial portions of rent are collected in the back-end of the 25-year lease terms. 11/

THE VALUATION

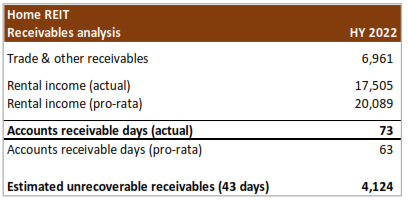

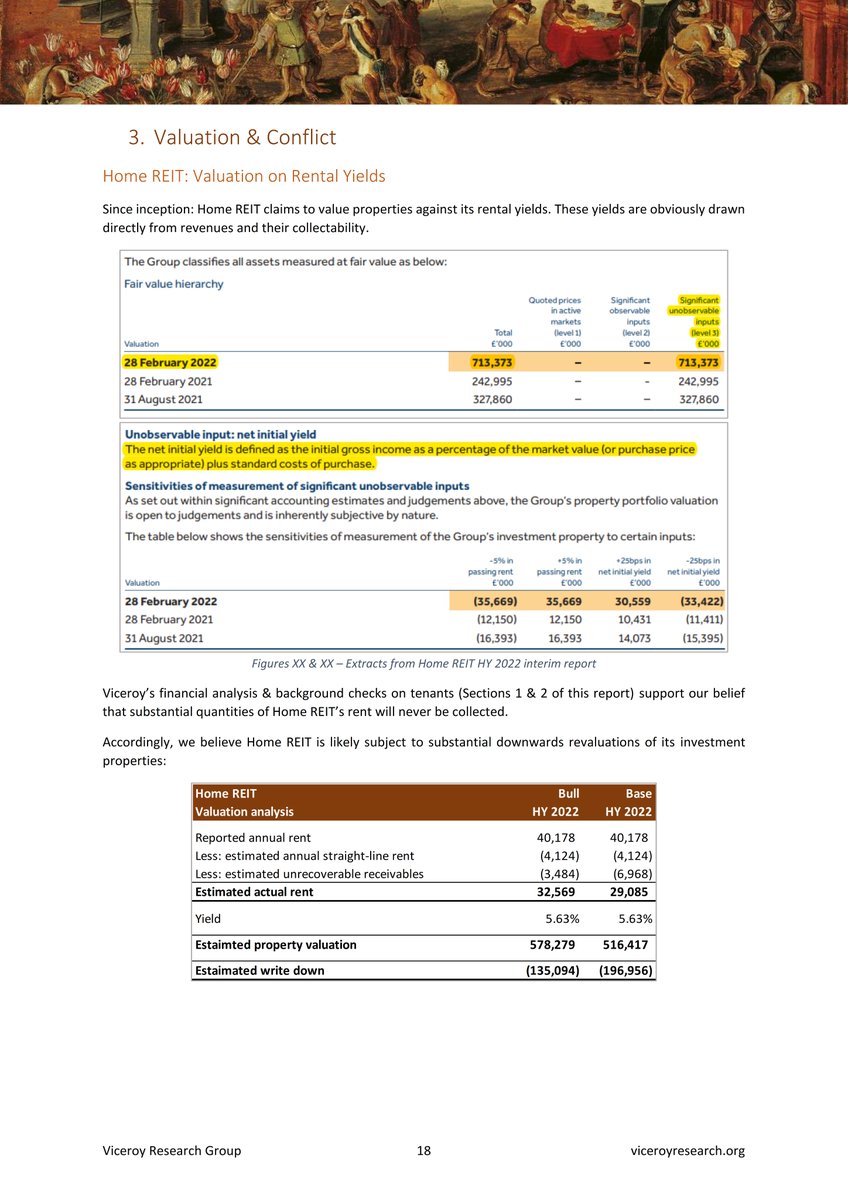

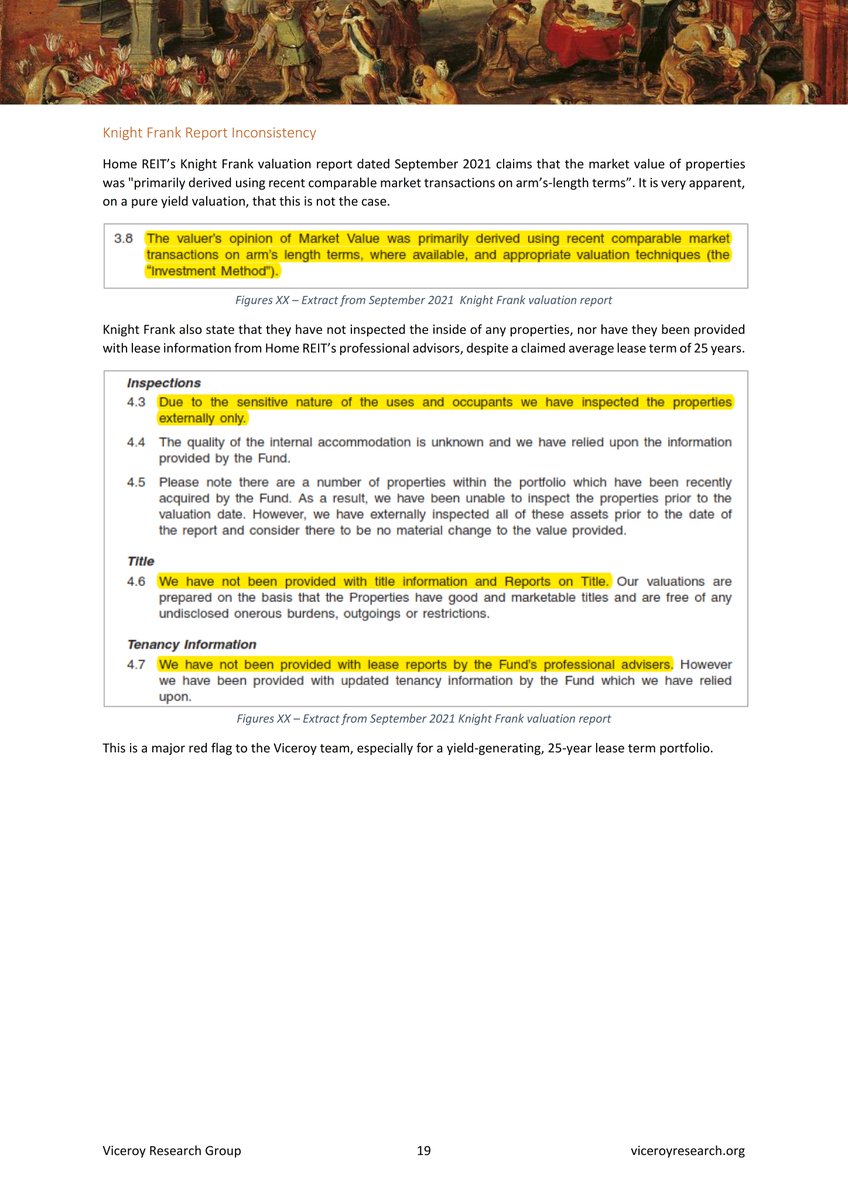

The valuation of $HOME's properties is entirely based on Yield (“Investment Method”). Any impairment to receivables, revenues, or yield will directly impact Home REIT’s balance sheet. 12/

The valuation of $HOME's properties is entirely based on Yield (“Investment Method”). Any impairment to receivables, revenues, or yield will directly impact Home REIT’s balance sheet. 12/

Viceroy Research has pulled transaction records for every single $HOME investment property. These show properties appear to have been flipped between tenants in a short space for immense profits and no evidence of capex. 13/

There appear to be various middle-men and development companies which we could not verify who interact between vendors and $HOME. Some properties are bought and re-sold between parties in a matter of days. These transactions should be scrutinized. 14/

THE MANAGEMENT

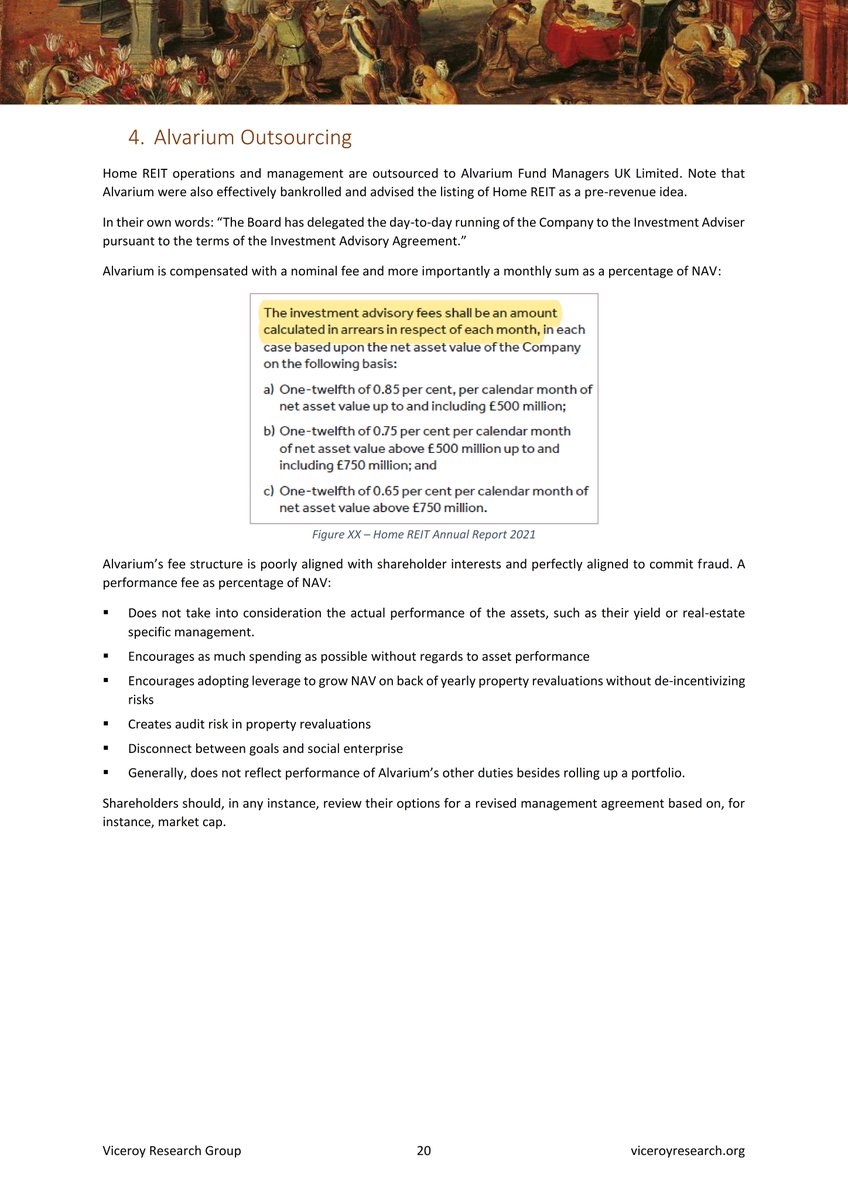

$HOME outsources management to Alvarium, who is compensated on a percentage of NAV and is responsible for asset acquisitions. 15/

$HOME outsources management to Alvarium, who is compensated on a percentage of NAV and is responsible for asset acquisitions. 15/

This model does not align Alvarium’s compensation with the performance of the portfolio, only with how much they spend on acquisitions. It also creates substantial audit risk in the revaluation of $HOME's book, and encourages fraud or other risk-taking behaviours. 16/

Alvarium appointed Gareth Jones to establish $HOME and subsequently become their CFO (now resigned). Gareth was previous Finance Director of Civitas, who has come under similar scrutiny. 17/

$HOME have nonetheless had three CFOs in 2022, the latest resigned less than 1 month before audited accounts are due. 18/

CONCLUSION

$HOME results are due on 28 November. We believe it will be a governance nightmare, and cash generation will decline.

$HOME results are due on 28 November. We believe it will be a governance nightmare, and cash generation will decline.

• • •

Missing some Tweet in this thread? You can try to

force a refresh