CRV war was played out on #Aave yesterday and ended with the longer defeating the shorter.

1.🧵

ponzishorter.eth shorted $CRV by borrowing and dumping $CRV;

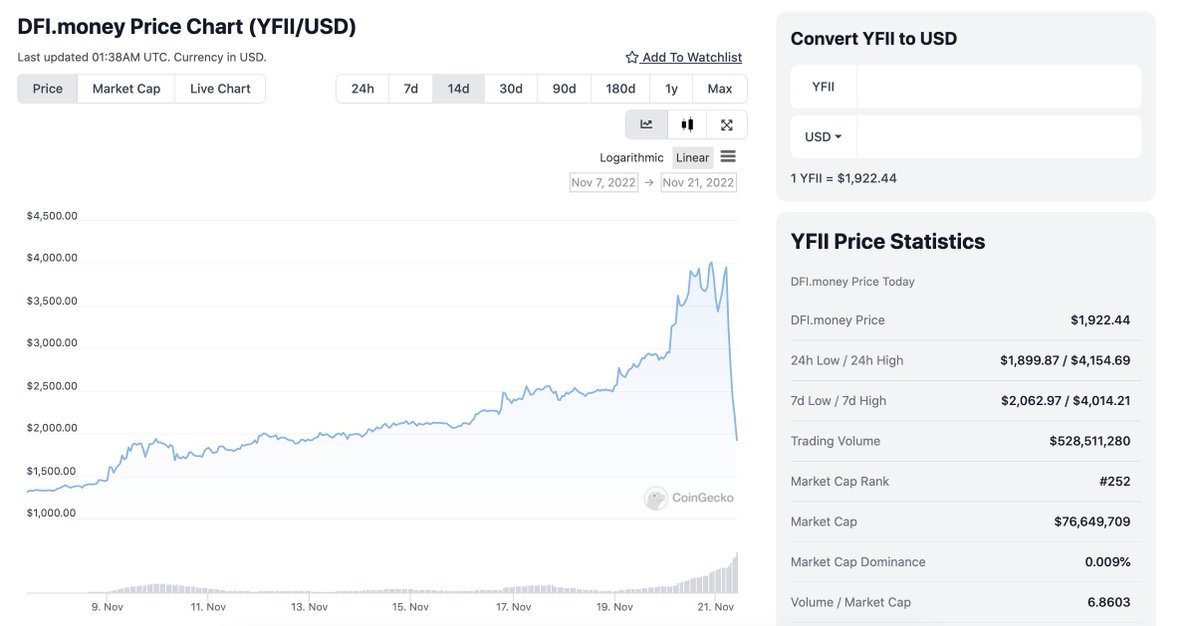

$CRV guardians bought $CRV, soaring the price to $0.72, and liquidating all collateral of ponzishorter.eth.

1.🧵

ponzishorter.eth shorted $CRV by borrowing and dumping $CRV;

$CRV guardians bought $CRV, soaring the price to $0.72, and liquidating all collateral of ponzishorter.eth.

2.

Why did ponzishorter.eth short $CRV?

There maybe 2 reasons.

1⃣ Profit by shorting $CRV.

2⃣ Liquidate Curve.fi founder's $CRV on #Aave by shorting $CRV.

Why did ponzishorter.eth short $CRV?

There maybe 2 reasons.

1⃣ Profit by shorting $CRV.

2⃣ Liquidate Curve.fi founder's $CRV on #Aave by shorting $CRV.

3.

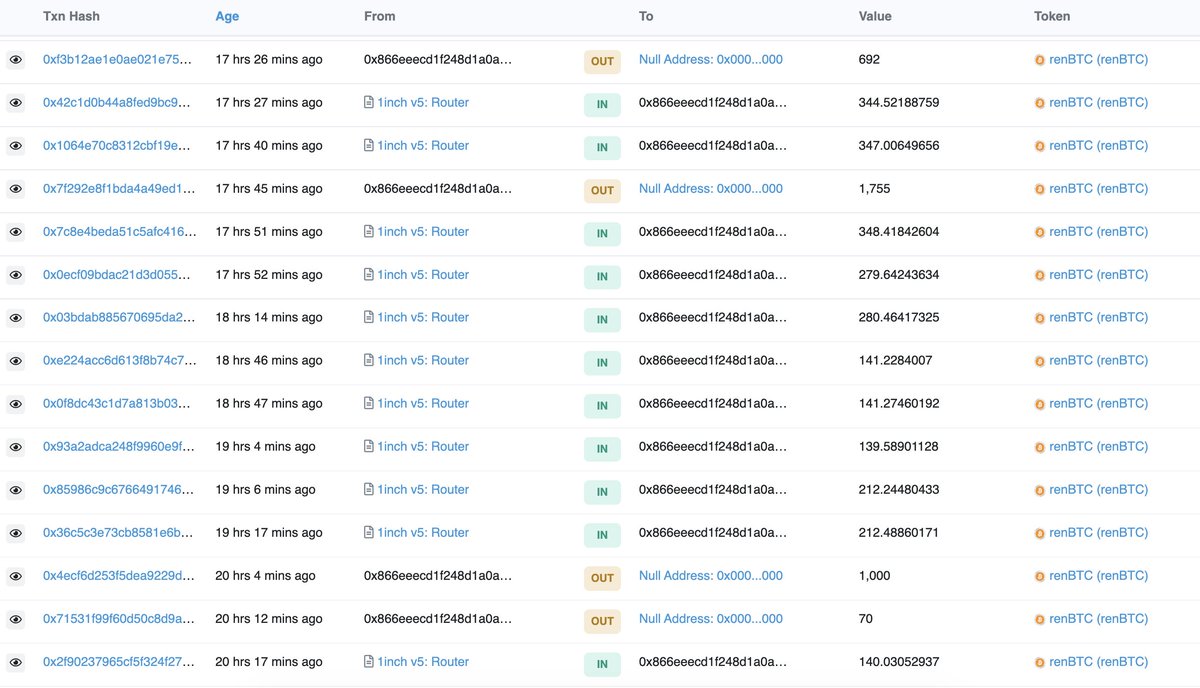

ponzishorter.eth began to borrow a small amount of $CRV and sell from Nov 14, causing the price to slowly drop from $0.625 to $0.464, a drop of 26%.

If he shorts $CRV through the perpetual contract on CEX, he will make a great profit.

etherscan.io/address/0x57e0…

ponzishorter.eth began to borrow a small amount of $CRV and sell from Nov 14, causing the price to slowly drop from $0.625 to $0.464, a drop of 26%.

If he shorts $CRV through the perpetual contract on CEX, he will make a great profit.

etherscan.io/address/0x57e0…

4.

ponzishorter.eth's shorting of $CRV also makes many people who use $CRV as collateral face liquidation.

Among them is the Curve.fi founder, whose health rate on Aave has dropped to 1.5( currently 1.62)

debank.com/profile/0x7a16…

ponzishorter.eth's shorting of $CRV also makes many people who use $CRV as collateral face liquidation.

Among them is the Curve.fi founder, whose health rate on Aave has dropped to 1.5( currently 1.62)

debank.com/profile/0x7a16…

5.

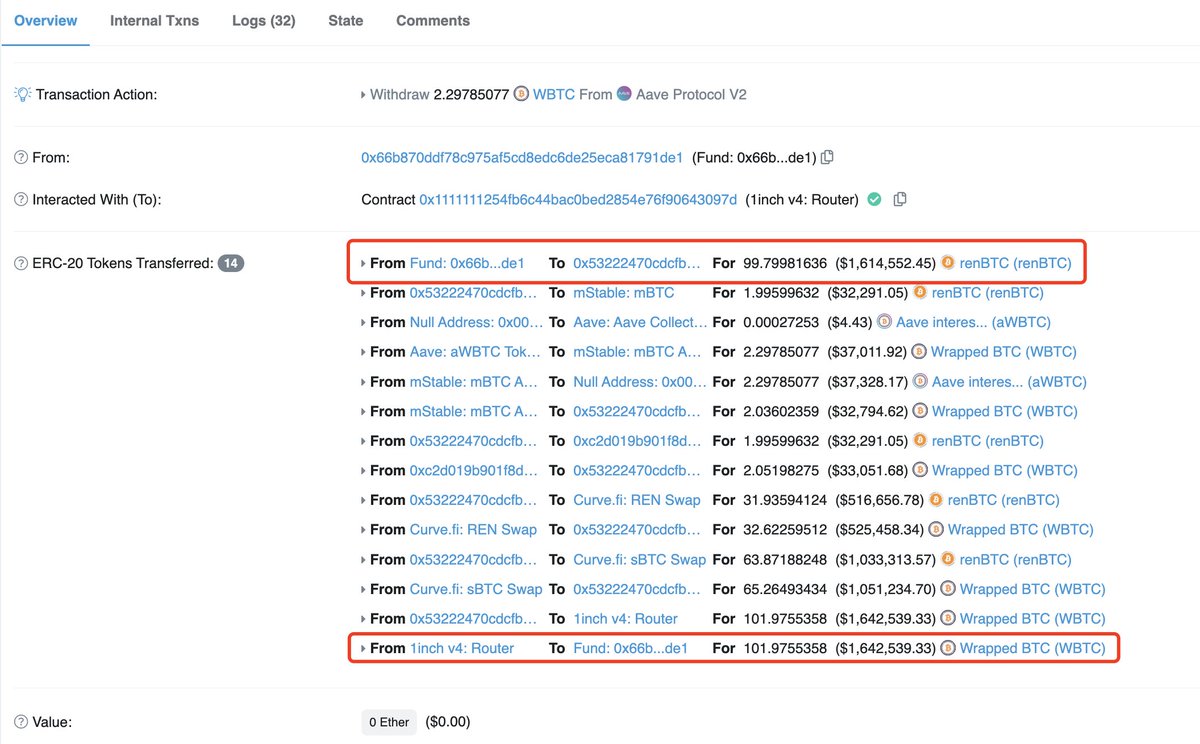

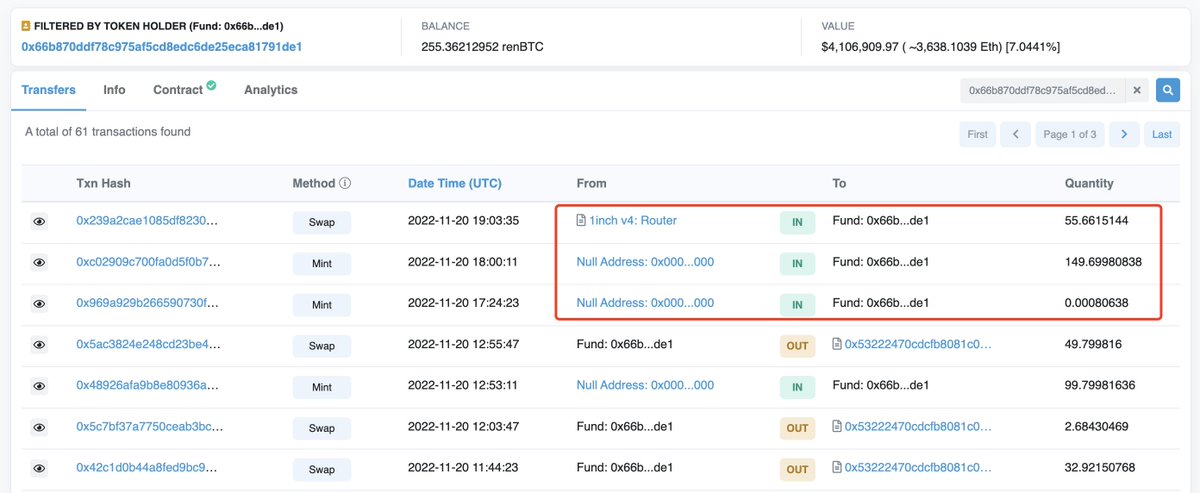

So, ponzishorter.eth increased the scale of borrowing and selling $CRV.

The Curve.fi founder also increased the collateral.

ponzishorter.eth attempt liquidate https://t.co/KJyxZS0Yto founder's $CRV on #Aave by shorting $CRV.

So, ponzishorter.eth increased the scale of borrowing and selling $CRV.

The Curve.fi founder also increased the collateral.

ponzishorter.eth attempt liquidate https://t.co/KJyxZS0Yto founder's $CRV on #Aave by shorting $CRV.

6.

Why did ponzishorter.eth choose to short $CRV instead of other tokens?

We try to introduce the $CRV token and the war on $CRV last year.

Why did ponzishorter.eth choose to short $CRV instead of other tokens?

We try to introduce the $CRV token and the war on $CRV last year.

7.

$CRV is the governance token of the Curve Finance.

$CRV holders stake and lock $CRV for 1 week to 4 years to obtain $veCRV.

So that they can vote to determine how many $CRV token rewards each pool can get.

$CRV is the governance token of the Curve Finance.

$CRV holders stake and lock $CRV for 1 week to 4 years to obtain $veCRV.

So that they can vote to determine how many $CRV token rewards each pool can get.

8.

The current total supply of $CRV is 1,856,964,180 $CRV and the circulating supply is 636,299,989 $CRV.

Only 30.3% of the total supply is in circulation.

The current total supply of $CRV is 1,856,964,180 $CRV and the circulating supply is 636,299,989 $CRV.

Only 30.3% of the total supply is in circulation.

9.

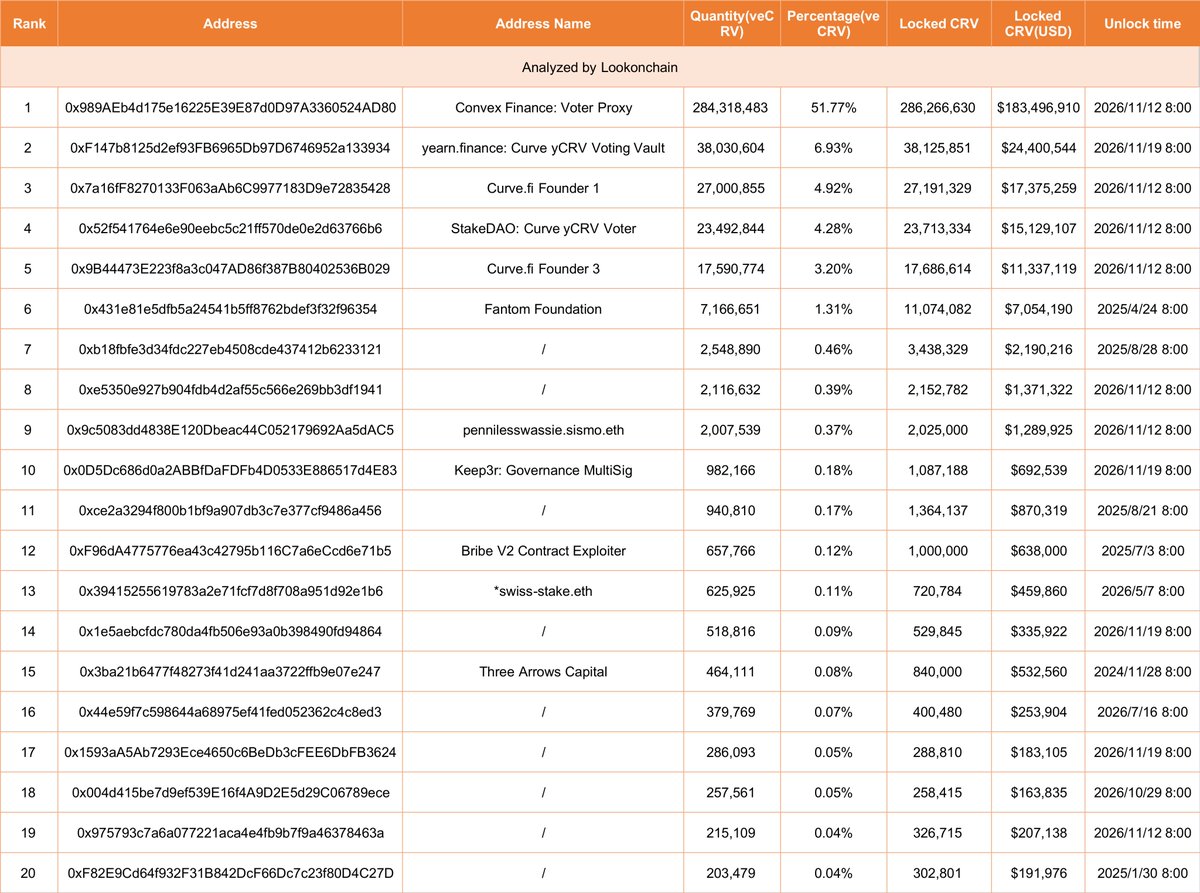

Here is the top 20 holders of $CRV.

The top 20 holders hold a total of 1.59M $CRV, accounting for 85.76% of the total supply.

Here is the top 20 holders of $CRV.

The top 20 holders hold a total of 1.59M $CRV, accounting for 85.76% of the total supply.

10.

Since locking $CRV can gain voting weight, many protocols such as Convex, Frax, Spell, etc. want to gain the control of Curve voting rights by accumulating $CRV to the greatest extent.

You can read @JackNiewold's thread about $CRV War here.

Since locking $CRV can gain voting weight, many protocols such as Convex, Frax, Spell, etc. want to gain the control of Curve voting rights by accumulating $CRV to the greatest extent.

You can read @JackNiewold's thread about $CRV War here.

https://twitter.com/JackNiewold/status/1476334616797749248

11.

Here is the top 20 holders of $veCRV.

Convex holds 284M $veCRV, accounting for 51.77%, and has gain the relative control of Curve voting rights.

Convex totaly locked 286M $CRV($183.5M) for 4 years.

Here is the top 20 holders of $veCRV.

Convex holds 284M $veCRV, accounting for 51.77%, and has gain the relative control of Curve voting rights.

Convex totaly locked 286M $CRV($183.5M) for 4 years.

12.

If you like this thread, like and retweet it.

Follow @lookonchain and turn on notifications.

Join our telegram group to receive alerts from SmartMoney.

t.me/lookonchain

If you like this thread, like and retweet it.

Follow @lookonchain and turn on notifications.

Join our telegram group to receive alerts from SmartMoney.

t.me/lookonchain

https://twitter.com/lookonchain/status/1595354561145114626

• • •

Missing some Tweet in this thread? You can try to

force a refresh