1- #ConnectingTheDots Commodities/Oil & Gas

We are currently in the ~4th inning of an economic slowdown

We are currently in the ~4th inning of an economic slowdown

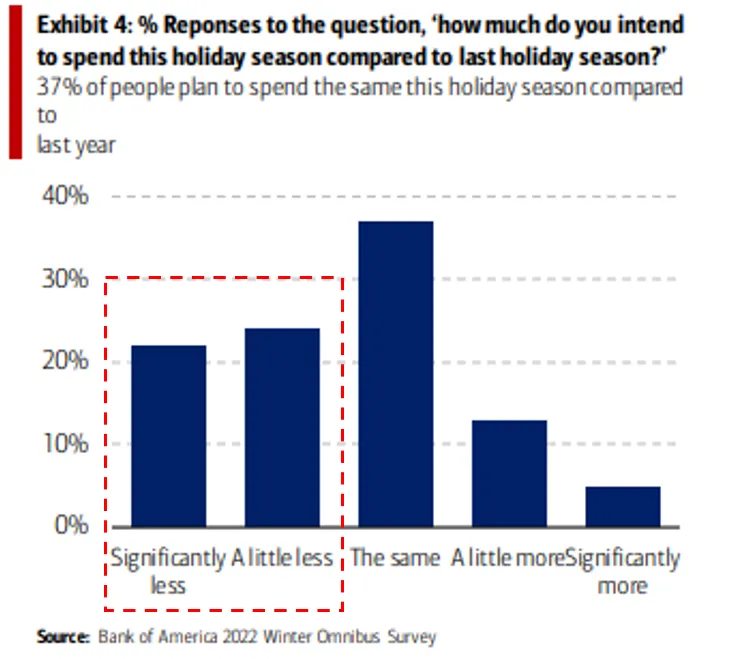

3- The world economy's last bastion, the US Consumer, shows signs of weakness

This is likely driven by lower income groups who used up their savings

This is likely driven by lower income groups who used up their savings

4- In China, Covid will suffocate economic activity for most of the winter

We are at the beginning of a big wave that likely peaks in 4-6 weeks

Chinese mobility very likely declines from here

We are at the beginning of a big wave that likely peaks in 4-6 weeks

Chinese mobility very likely declines from here

5- Meanwhile, the market perceives US monetary policy to have softened

This lead to a sell off in the US Dollar and US Treasuries that seems to near its end

J Powell speaks on the 30th November, what do you think he'll say?

brookings.edu/events/federal…

This lead to a sell off in the US Dollar and US Treasuries that seems to near its end

J Powell speaks on the 30th November, what do you think he'll say?

brookings.edu/events/federal…

6- Oil & Gas and commodities may be secular winners over the next 5-10 years, but they remain highly cyclical industries

Recently, they diverged significantly from their underlying cyclical trends

Recently, they diverged significantly from their underlying cyclical trends

7- $XLE $XME $SXPP are well-owned with many "believers". This creates downside risk as economic realities set in

Short term, I see much downside for these sectors

End.

Short term, I see much downside for these sectors

End.

• • •

Missing some Tweet in this thread? You can try to

force a refresh