[1/11] "Token Allowances" sind integraler Bestandteil einer jeden #DeFi Applikation (Swap/#DEX), da mit der erteilten Freigabe, in deinem Namen Coins & Tokens, bis zu einer bestimmten Obergrenze hin, ausgegeben werden können.

Eine Anleitung und das Security 1 x 1 in einem 🧵

Eine Anleitung und das Security 1 x 1 in einem 🧵

https://twitter.com/ftso_eu/status/1596213314220179456

[2/11] Zuallererst muss man verstehen, dass eine "Allowance" keine Private-Keys klaut.

Vergleichbar mit einer Vollmacht (Allowance), ermächtigt (Approve TX) eine Person (Wallet) eine dApp als Bevollmächtigter (SmartC.) wirksam zu handeln & erhält dafür die Vertretungsmacht

Vergleichbar mit einer Vollmacht (Allowance), ermächtigt (Approve TX) eine Person (Wallet) eine dApp als Bevollmächtigter (SmartC.) wirksam zu handeln & erhält dafür die Vertretungsmacht

[3/11] Eine Eigenschaft dieser Vertretungsmacht ist es im Namen des Wallet-Inhabers die vollständige Kontrolle der "approve(ten)" #Tokens zu übernehmen, um diese im Sinne des Smart Contracts zu #swapen/#traden, zu #staken oder zu #delegieren.

⚠️ Klingt gefährlich? Ist es auch 😅

⚠️ Klingt gefährlich? Ist es auch 😅

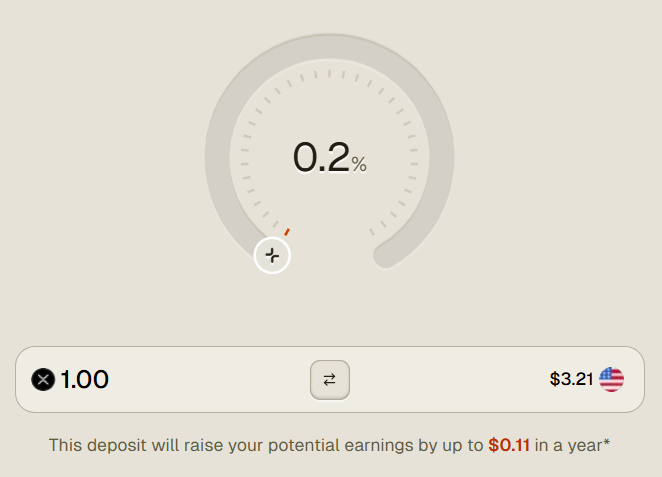

[4/11] Grundsätzlich werden die "Approves" meist mit der Obergrenze "Unlimited" signiert. Erteile ich dem SmartC. nun die #Allowance eine unlimit. Anzahl von $WSGB zu verwalten, möchte aber eig. nur 1000 $WSGB in den SmartC. legen, könnte ein Exploit die $WSGB vollst. leer räumen

[5/11] Dazu kommt, dass die #Allowance nicht auto. "#revoked" wird & im Hintergrund ein "vergessenes" Sicherheitsrisiko darstellen kann, wenn diese nicht limitiert o. besser gleich ganz widerrufen wird.

Die einzige Abhilfe für $SGB war es sonst, die Wallet gleich ganz aufzugeben

Die einzige Abhilfe für $SGB war es sonst, die Wallet gleich ganz aufzugeben

[6/11] Eine dieser "aufgegebenen #Wallets" werde ich nun mithilfe von @ftso_eu wiederbeleben ❤️🥳

Dabei handelt es sich um eine Allowance für einen SmartC. im @flrfinance Ökosystem, welcher "theoretisch" in der Lage wäre meine $CAND Tokens, im Falle eines Exploits, zu stehlen.

Dabei handelt es sich um eine Allowance für einen SmartC. im @flrfinance Ökosystem, welcher "theoretisch" in der Lage wäre meine $CAND Tokens, im Falle eines Exploits, zu stehlen.

[8/11] Schritt 2⃣ — evmallowance.com öffnen

[10/11] Schritt 4⃣ — Neu probieren mit Chrome, nicht aufgeben und die Allowance revoken (Auf 0 limitieren)

[11/11] Schritt 5⃣ — @ftso_eu bei Twitter folgen und sich bedanken 🥳❤️

(Optional) Schritt 6⃣ — @krippenreiter folgen 😉

(Optional) Schritt 6⃣ — @krippenreiter folgen 😉

• • •

Missing some Tweet in this thread? You can try to

force a refresh