With $USDT not accepted as collateral, $USDC, $DAI, $WETH remain the most common borrowed and collateral assets on @AaveAave and @compoundfinance

Nothing new so far. Market conditions are irrelevant when it comes to demand for an extra push in purchasing power

Nothing new so far. Market conditions are irrelevant when it comes to demand for an extra push in purchasing power

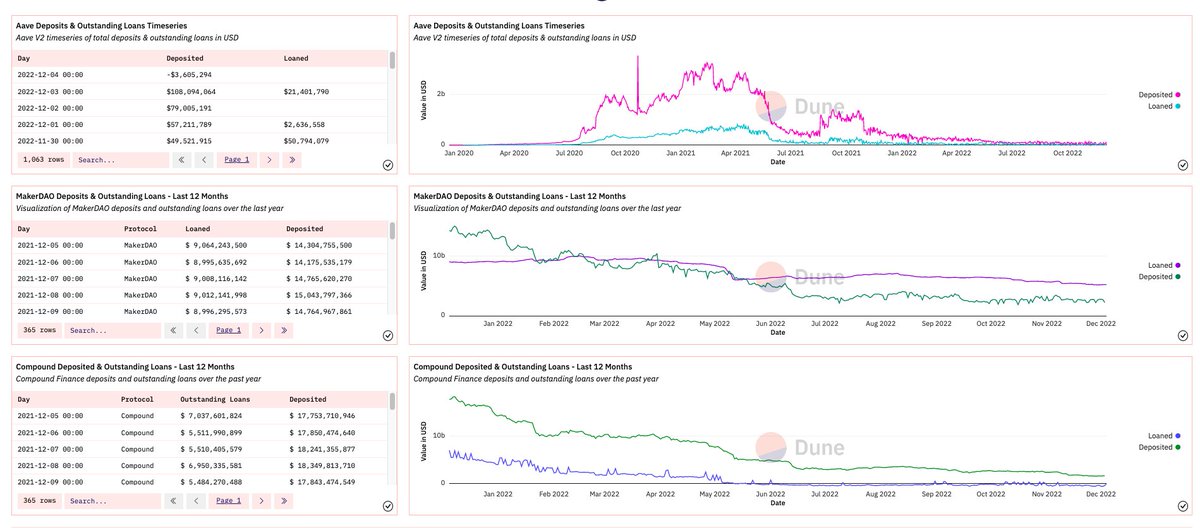

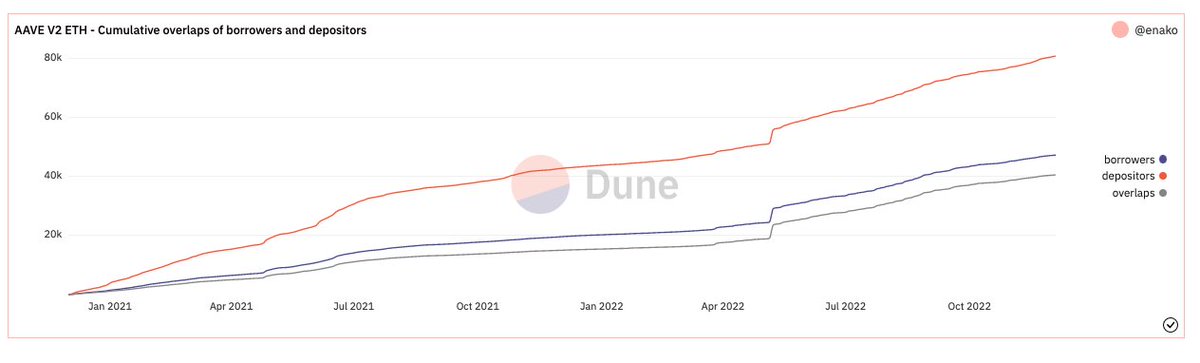

Truth is that liquidity is draining as the bear market prolongs. Now more than ever, "stablecoins are king"

More specifically, this chart is one of the most accurate representations of what a PvP zero-sum game market looks like

There has been a clear shift momentum: from an "up only, free money" mode, to an absence of reasons that justify keeping value on stablecoins instead of a bank

There has been a clear shift momentum: from an "up only, free money" mode, to an absence of reasons that justify keeping value on stablecoins instead of a bank

Eventually, the bear will hibernate, and while I don't want to sell the bear's skin before hunting, I can confidently say that fixed rate and undercollateralized lending will prove to be actual use cases of what #DeFi has to offer

For most investors, predictability in money markets is a wanted condition

That's essential what fixed rate lending has to offer, the service by which one can borrow over a period of time at a pre specified annualized rate

That's essential what fixed rate lending has to offer, the service by which one can borrow over a period of time at a pre specified annualized rate

The overlap seems so obvious, but yet most don't seem to realize the potential of fixed income protocols

The utility and capital efficiency that this new wave of protocols will unlock is massive and could potentially open up significant growth opportunities for DAOs

The utility and capital efficiency that this new wave of protocols will unlock is massive and could potentially open up significant growth opportunities for DAOs

And no, I am not talking about stable rates

Those simply act as a fixed rate in the short-term. They are exposed to rebalances in the long-term as soon as market conditions change

Those simply act as a fixed rate in the short-term. They are exposed to rebalances in the long-term as soon as market conditions change

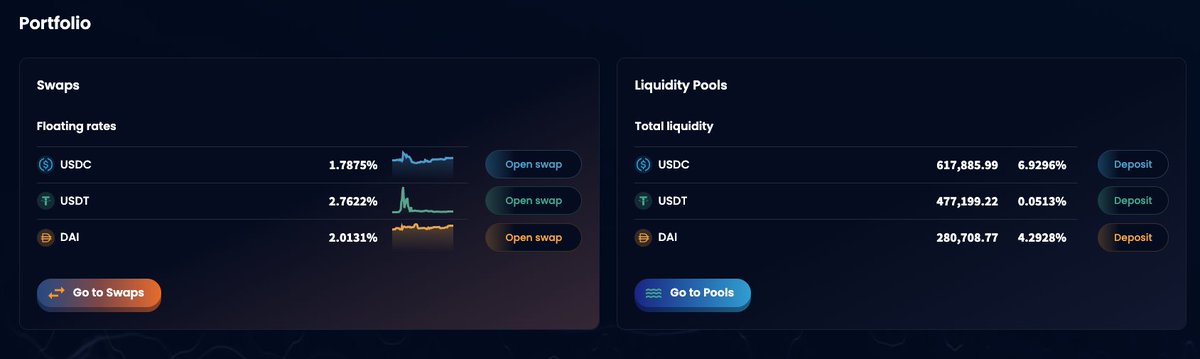

Now, most of the liquidity that sits on money markets relies on a floating rate. This exposes the "economy" to unpredictable outcomes that complicate the inception of effective hedging strategies

Interest Rates Derivatives are a huge step forward towards achieving maturity in crypto

I bet most DAOs and fixed income funds would rather pay a slightly higher interest now to fix their rates and be certain that the amount they have to pay on interest will not change over time

I bet most DAOs and fixed income funds would rather pay a slightly higher interest now to fix their rates and be certain that the amount they have to pay on interest will not change over time

I would even go further as to make the statement that fixed rates are a necessary condition for scaling decentralized economies and make of borrowing a productive activity

Not only that, but we can also standardize concepts and increase our expectations by enabling composability across protocols

After all, protocols that live in isolation have no influence beyond their own tiny market share

After all, protocols that live in isolation have no influence beyond their own tiny market share

For credit to evolve, the industry demands more than just price discovery. It demands appetite for cash flow and active portfolio management

As simple as it sounds, a composite weighted index is the first step towards the development of a yield curve

As simple as it sounds, a composite weighted index is the first step towards the development of a yield curve

This protects against liquidity fragmentation and will eventually lead to all rates converging to a true mid-market rate.

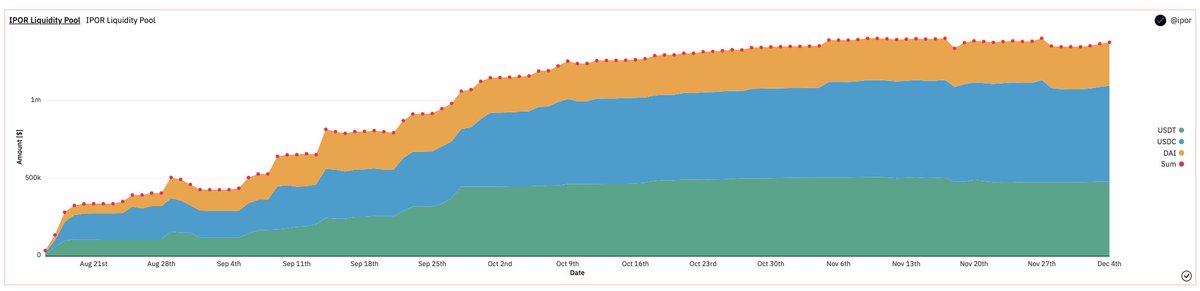

That's exactly what protocols like @ipor_io and @MorphoLabs facilitate, a better experience for both borrowers and lenders

That's exactly what protocols like @ipor_io and @MorphoLabs facilitate, a better experience for both borrowers and lenders

So far, this is one of the most sophisticated expressions of capital efficiency that DeFi money markets have experienced so far

It might go unnoticed for now, but by the time you want to realize, it might be too late 😈

It might go unnoticed for now, but by the time you want to realize, it might be too late 😈

I wrote about this topic in the past, and I encourage you to give it a second read, specially after the liquidity crunch and contagion effect that we are currently going through

https://twitter.com/ipor_intern/status/1587462042503593988?s=20&t=c5axIW2fs7Jhu-xaSsfhUQ

CCing some chads who might enjoy this thread, go follow them 🫡:

@ViktorDefi

@rektdiomedes

@DeFiMinty

@phtevenstrong

@crypto_klay

@TheDeFinvestor

@DAdvisoor

@Only1temmy

@crypto_linn

@Dynamo_Patrick

@DeFi_Dad

@RiddlerDeFi

@byChadManDan

@blocmatesdotcom

@ViktorDefi

@rektdiomedes

@DeFiMinty

@phtevenstrong

@crypto_klay

@TheDeFinvestor

@DAdvisoor

@Only1temmy

@crypto_linn

@Dynamo_Patrick

@DeFi_Dad

@RiddlerDeFi

@byChadManDan

@blocmatesdotcom

• • •

Missing some Tweet in this thread? You can try to

force a refresh