Read our latest 📖policy note on #China 🇨🇳as a lender by FDL’s Research Director @ishacdiwan and Shang-Jin Wei of @ColumbiaSIPA, providing a conceptual framework to clarify when & how China could participate in #debt #restructuring processes. 👇

findevlab.org/chinas-develop…

findevlab.org/chinas-develop…

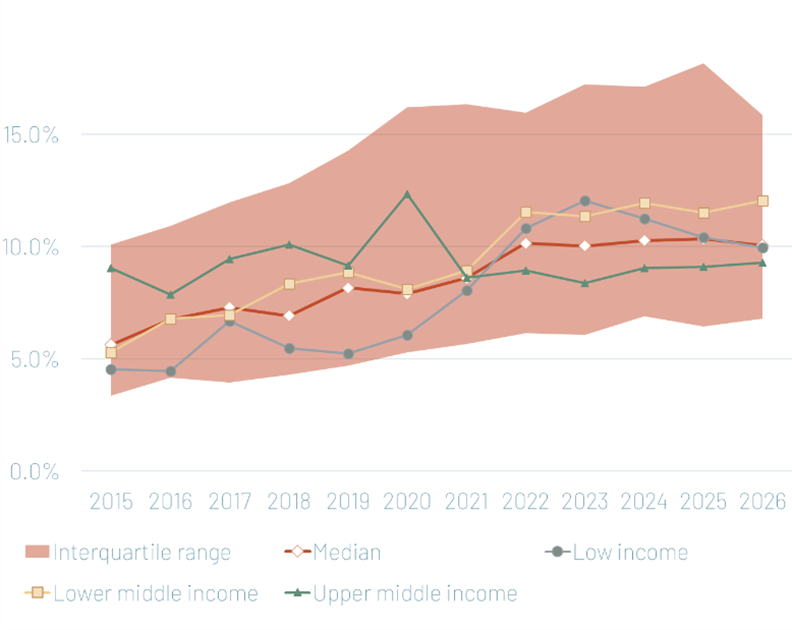

Top 50 countries in #China 🇨🇳debt portfolio and their quality

With #China now being a central creditor, question is whether it wants to work alone or with others, including the #IMF & how it would engage with the other creditors and with the #MDBs.

2 recommendations💡 to make progress on the #CommonFramework:1⃣Building trust with MDBs, especially #IMF, to reform debt restructuring process in mutually profitable ways 2⃣Domestic innovations to produce effective central coordination mechanism in Beijing.

1⃣Innovations should be driven by will to empower debtor countries to develop themselves, with recovery & growth strategies as backbones of debt restructuring deals, backed by fin. assurances for new money by #MDBs, adapted conditionalities & with fair burden sharing between all.

2⃣Chinese creditor organizations should coordinate their interests so as to be able to negotiate as one creditor group. Their control over a larger share of debt would improve their bargaining power.

• • •

Missing some Tweet in this thread? You can try to

force a refresh