1- #ConnectingTheDots On Friday, the US released employment numbers

Of particular note was strong wage growth for November, +0.6% m-o-m (>7% annualised)

US bond yields should have RALLIED on this highly inflationary signal, instead they FELL

Of particular note was strong wage growth for November, +0.6% m-o-m (>7% annualised)

US bond yields should have RALLIED on this highly inflationary signal, instead they FELL

2- Now, the wage data likely wasn't an error or outlier

As @jasonfurman highlights prior months saw upwards revisions, too

As @jasonfurman highlights prior months saw upwards revisions, too

https://twitter.com/jasonfurman/status/1598819086003159040

3- The US Treasury bond market is the most sophisticated asset market

No retail, no memes, mostly big institutions

Such a highly unusual "RISK-OFF" signal is worth paying attention to

So what is going on?

No retail, no memes, mostly big institutions

Such a highly unusual "RISK-OFF" signal is worth paying attention to

So what is going on?

4- In my view, the Treasury market is RIGHT to be worried

Looking at both Europe and the US, very challenging moments lie ahead for capital markets

Looking at both Europe and the US, very challenging moments lie ahead for capital markets

5- Europe is in bad shape, as recent retail sales data suggests

However, retail sales are a coincident indicator

Where will they be with blackouts this winter, as France currently anticipates?

Not an isolated issued, Europe is 20% of world GDP

france24.com/en/europe/2022…

However, retail sales are a coincident indicator

Where will they be with blackouts this winter, as France currently anticipates?

Not an isolated issued, Europe is 20% of world GDP

france24.com/en/europe/2022…

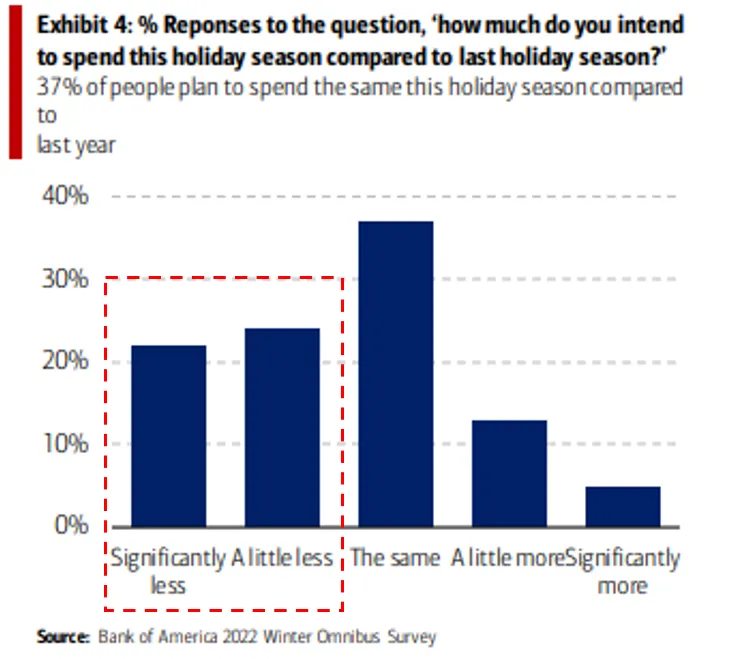

6- The US consumer is bound to run out of excess savings by mid-23

When that happens, demand likely takes a significant hit

Highly likely financial markets frontrun this development much earlier

h/t @DisruptorStocks

When that happens, demand likely takes a significant hit

Highly likely financial markets frontrun this development much earlier

h/t @DisruptorStocks

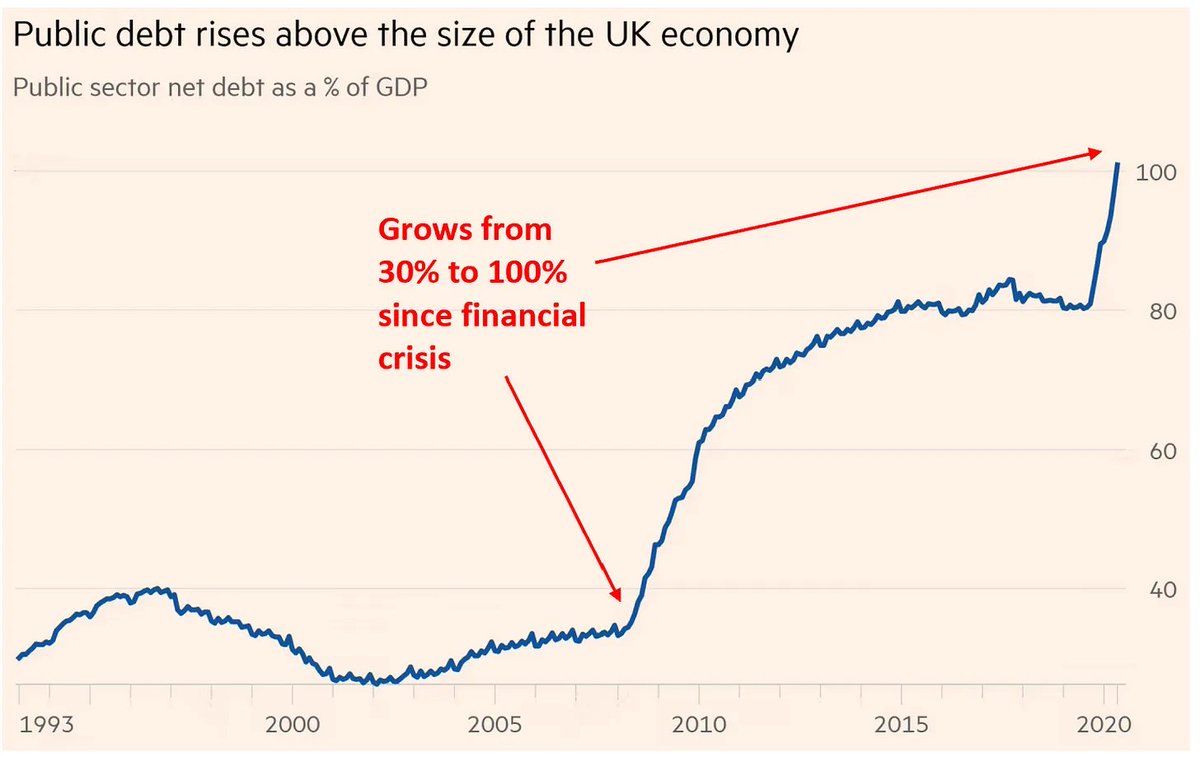

7- Any growth slowdown is amplified by significantly increased global debt levels

This makes a "hard landing" so perilous, with a high likelihood of credit events, defaults etc.

This makes a "hard landing" so perilous, with a high likelihood of credit events, defaults etc.

8- Many candidates for credit turbulence. But what stands out the most are levered loans

They are unregulated and off-balance sheet. Leverage went through the roof during the QE/Covid asset price bubble

Sounds familiar? Remember mortgages in 2008?

They are unregulated and off-balance sheet. Leverage went through the roof during the QE/Covid asset price bubble

Sounds familiar? Remember mortgages in 2008?

9- Treasury markets are shifting to a "Risk-Off"-regime, likely justifiably so

In my view, highly likely other assets classes to follow soon, including equities ⚠️

In my view, highly likely other assets classes to follow soon, including equities ⚠️

• • •

Missing some Tweet in this thread? You can try to

force a refresh