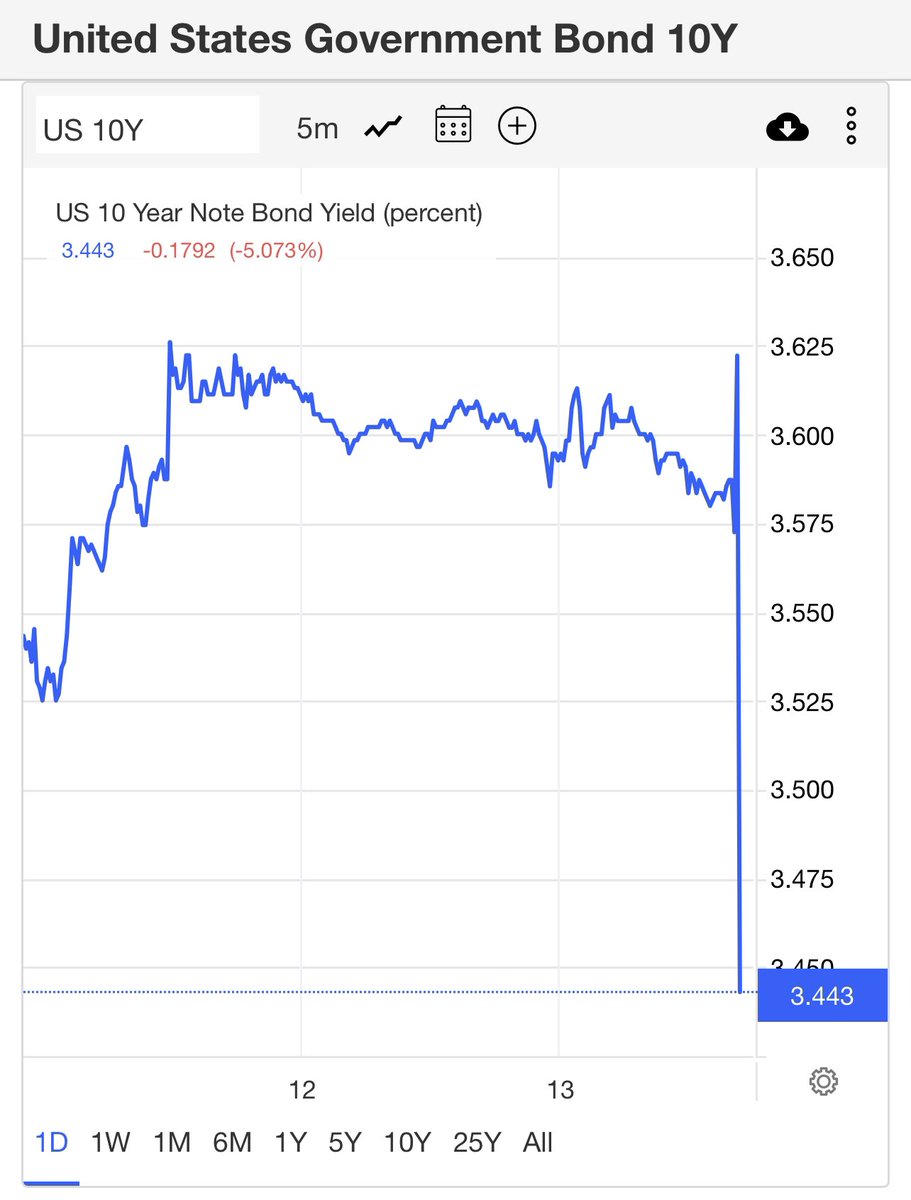

#CPI ✊🏽

#CPI 🔑✊🏽

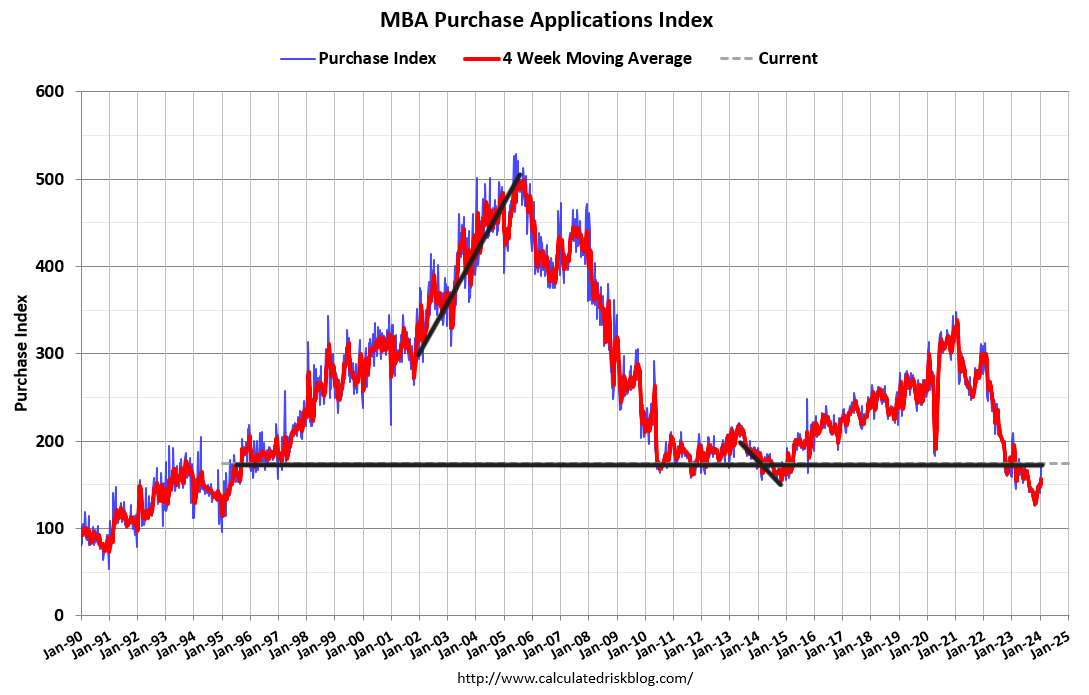

Shelter inflation is the big cheese for Core #CPI; we should all know by now this data line needs to catch up to the reality of real-time shelter data. The bond market gets it, the Fed to old to slow, and all of you have no excuse 😉

Remember, shelter inflation CPI lags 12 months from now; we are all in a different spot with inflation data ✊🏽💪🏽

If you don't know who Mad Max is you missed out #Thunderdome 😏

You can all see what is happening here; Core CPI is being held up by a lagging component, which is also roughly 42.4% of the index. 🤨

Remember, we will have nearly 1,000,000 rental units hitting the market next year on top of the real-time growth cool down in the data

Remember, we will have nearly 1,000,000 rental units hitting the market next year on top of the real-time growth cool down in the data

The Fed can act old and slow, but you don't have to be. 😉

• • •

Missing some Tweet in this thread? You can try to

force a refresh