Hermes V2 is set to launch in a few weeks.

Here are exciting facts you need to know about #Hermes V2.

Here are exciting facts you need to know about #Hermes V2.

To start with, @HermesOmnichain is a DEX that facilitates the exchange of correlated (stable) and non-correlated assets( volatile) assets at a very low slippage deployed currently on #Metis.

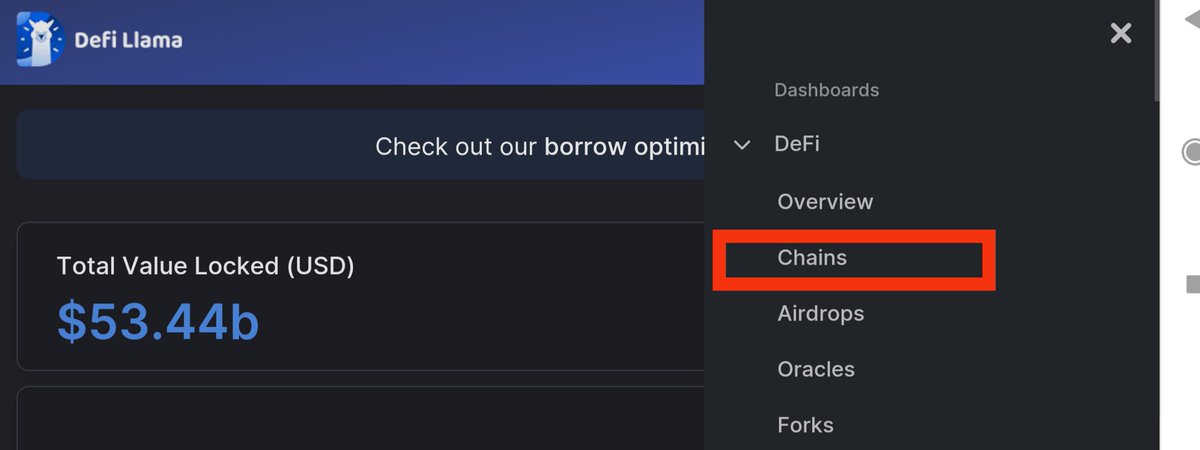

With V2, they are set to deploy on Arbitrum and every other chain UNI v3 deploys to.

Interestingly as UNI V3 BUSL expires next year, more protocols can easily fork them and it will provide more products to build on top of Hermes V2.

Interestingly as UNI V3 BUSL expires next year, more protocols can easily fork them and it will provide more products to build on top of Hermes V2.

Launched on February 26th, 2022, Hermes has gone through the rigors of a bad market cycle and represents the very few protocols still building in this turbulent moment.

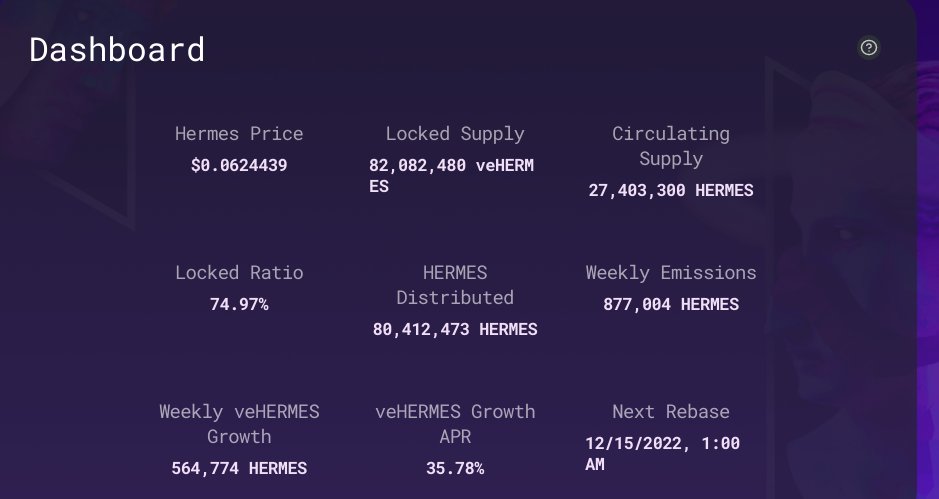

With a TVL of less than 9M, Hermes protocol pays out 100% of fees to Voters while emissions go to liquidity providers.

However, in the coming V2, it's not only liquidity providers that will get emissions, but custom gauges that will help users to price yield will also get emissions too.

As of the time of this writing, weekly emissions are 877,003 $HERMES, and over 500K is locked showing an over 60% lock of Hermes emitted weekly.

Some of the features coming with V2 that interest me include the following;

*Unified liquidity.

*Omnichain DEX.

*Concentrated liquidity.

*Introduction of bhermes.

*launch of custom gauges.

*Full integration of TALOS Strategy.

*Unified liquidity.

*Omnichain DEX.

*Concentrated liquidity.

*Introduction of bhermes.

*launch of custom gauges.

*Full integration of TALOS Strategy.

Renting liquidity and liquidity fragmentation has been one of the greatest challenges we have in DeFi.

Although giving out incentives retained most liquidity providers for a while, it doesn't stop them from looking out for places where there are better incentives (yield).

Although giving out incentives retained most liquidity providers for a while, it doesn't stop them from looking out for places where there are better incentives (yield).

Leveraging on novel concepts like concentrated liquidity, unified and omnichain technology, Hermes V2 is set to provide a cutting-edge solution to liquidity defragmentation and easy retention of liquidity providers with commensurate emissions.

Thus Hermes V2 is a decentralized permissionless Omnichain dex that utilizes the concept of Unified and concentrated liquidity to build an efficient Dex that spreads across multiple chains wherever UNI v3 is deployed.

Being an Omnichain DEX, it enables users (traders, lp providers, voters, and protocols) to swap native tokens across chains without bridging, provide liquidity across chains without bridging, etc.

Also, different protocols can incentivize their gauges and distribute incentives using native tokens.

For example, a protocol on ETH mainnet can distribute XYZ incentives on the mainnet for users to vote their pool on the Metis ecosystem.

For example, a protocol on ETH mainnet can distribute XYZ incentives on the mainnet for users to vote their pool on the Metis ecosystem.

In essence, Hermes V2 allows for the interoperability of chains it's being deployed to.

Unified Liquidity refers to sharing access to a single liquidity pool between multiple chains.

In other words, multi-chain swaps can occur by utilizing the assets in a pool.

In other words, multi-chain swaps can occur by utilizing the assets in a pool.

Concentrated Liquidity entails providing assets to liquidity on a specific price range. This ensures that only assets within such a range are rewarded with fees.

It's a very constructive way to put the assets in a pool to good use other than spreading them on a zero to infinity range where most assets will be dormant.

For example, depositing liquidity on Metis/Hermes pool currently will spread liquidity from zero to infinity while on v2 you can choose to deposit in the range of 14-19$ METIS price.

These concepts provided the foundation to deepen liquidity across the whole metis ecosystem as users across multiple chains can be quickly onboarded through the omnichain feature,

Also through unified liquidity, traders will have deep liquidity to make swaps thus generating more fees for each pool while the concentrated liquidity feature makes it possible for liquidity providers with the best strategies to be rewarded.

Another great feature coming with v2 is the launch of custom gauges.

Popularized by curve finance, gauges represent an incentive system.

In other words, it represents the structure that illustrates how incentives are paid out.

Popularized by curve finance, gauges represent an incentive system.

In other words, it represents the structure that illustrates how incentives are paid out.

For protocols that employed ve(3,3) tokenomics, there is a flywheel that represents how incentives are captured.

@stkmaAkita created a wonderful picture on that that I will like to reference below.

Thus, protocols create gauges for their pools, and voters will vote on the amount of emission that goes into the gauge for liquidity providers while traders utilize pools with more liquidity.

Custom gauges for V2 however, represent gauges for pools that employs other strategies other than being an AMM.

It entails pricing in the future yield of any revenue-generating asset.

It entails pricing in the future yield of any revenue-generating asset.

This feature is a fantastic one as money markets, yield-bearing assets, and yield marketplace can create these pools after the v2 launch on hermes protocol to build liquidity for their pool without emission of their native token.

Moving on, the next feature introduced is the b(3,3) tokenomics model.

For protocols using ve(3,3) tokenomics model, there is usually a challenge for users to manage their positions while capturing all the potential rewards a user is available for.

For protocols using ve(3,3) tokenomics model, there is usually a challenge for users to manage their positions while capturing all the potential rewards a user is available for.

In V2, these actions like locking, claiming bribes and distributions, casting votes, etc were automated by permanently locking the $HERMES token and users earning perpetually.

This feature removes $HERMES from circulation however, users can swap bHermes for Hermes.

This feature removes $HERMES from circulation however, users can swap bHermes for Hermes.

Lastly, the integration of TALOS is a game changer for the whole ecosystem.

TALOS essentially provides a way to manage your liquidity leveraging automated strategies.

This means having a fully decentralized rebalancing pool.

E.g, strategies that can rebalance positions in a concentrated liquidity pool when the price changes from the range.

This means having a fully decentralized rebalancing pool.

E.g, strategies that can rebalance positions in a concentrated liquidity pool when the price changes from the range.

Tagging other gigabrains

@rektdiomedes

@ViktorDefi

@Only1temmy

@TheDeFISaint

@defiprincess_

@defi_naly

@apollo_wayne

@stkmaAkita

@crypto_linn

@kindahangry

@rektdiomedes

@ViktorDefi

@Only1temmy

@TheDeFISaint

@defiprincess_

@defi_naly

@apollo_wayne

@stkmaAkita

@crypto_linn

@kindahangry

And that's a wrap.

Follow me for more threads like this, the like, and retweet.

Follow me for more threads like this, the like, and retweet.

• • •

Missing some Tweet in this thread? You can try to

force a refresh