I’m conducting institutional grade crypto research so you don’t have to|| research intern @patfscott||prev @dyorcryptoapp

How to get URL link on X (Twitter) App

NOTE: While memecoins could be a quick ticket to get rich, they are highly risky and could take away everything you have, so do well to apply proper risk management.

NOTE: While memecoins could be a quick ticket to get rich, they are highly risky and could take away everything you have, so do well to apply proper risk management.

When I joined crypto five years ago, I was always relying on influencers for signals, but most times, the turnout was bad.

When I joined crypto five years ago, I was always relying on influencers for signals, but most times, the turnout was bad.

Most of the projects mentioned below has interesting events coming up in the future which you won't like to miss.

Most of the projects mentioned below has interesting events coming up in the future which you won't like to miss.

A few of the upcoming catalysts that could supercharge growth in Metis L2 include;

A few of the upcoming catalysts that could supercharge growth in Metis L2 include;

Ve (3, 3) proposed by Andre Conje became popular during the "real yield" narrative as the best model that fairly incentives all protocol participants.

Ve (3, 3) proposed by Andre Conje became popular during the "real yield" narrative as the best model that fairly incentives all protocol participants.

The weekly round-up series typically includes four key metrics, which I had just altered to include more important stats.

The weekly round-up series typically includes four key metrics, which I had just altered to include more important stats.

@0xPolygonLabs (an L2 solution) built Polygon zkEVM by integrating zero knowledge technology with EVM to further scale Ethereum and reduce costs.

@0xPolygonLabs (an L2 solution) built Polygon zkEVM by integrating zero knowledge technology with EVM to further scale Ethereum and reduce costs.

https://twitter.com/HollaWaldfee100/status/1661469832511102977To verify the transactions of payments, check out the URLs below;

The concept of Alphas originated from the TradFi markets where it means the measure of performance of an investment over others.

The concept of Alphas originated from the TradFi markets where it means the measure of performance of an investment over others.

Following the merge, there has been a rise in LSD protocols with different technical structures, tokenomics, and governance consensus.

Following the merge, there has been a rise in LSD protocols with different technical structures, tokenomics, and governance consensus.

To start with, @HermesOmnichain is a DEX that facilitates the exchange of correlated (stable) and non-correlated assets( volatile) assets at a very low slippage deployed currently on #Metis.

To start with, @HermesOmnichain is a DEX that facilitates the exchange of correlated (stable) and non-correlated assets( volatile) assets at a very low slippage deployed currently on #Metis.

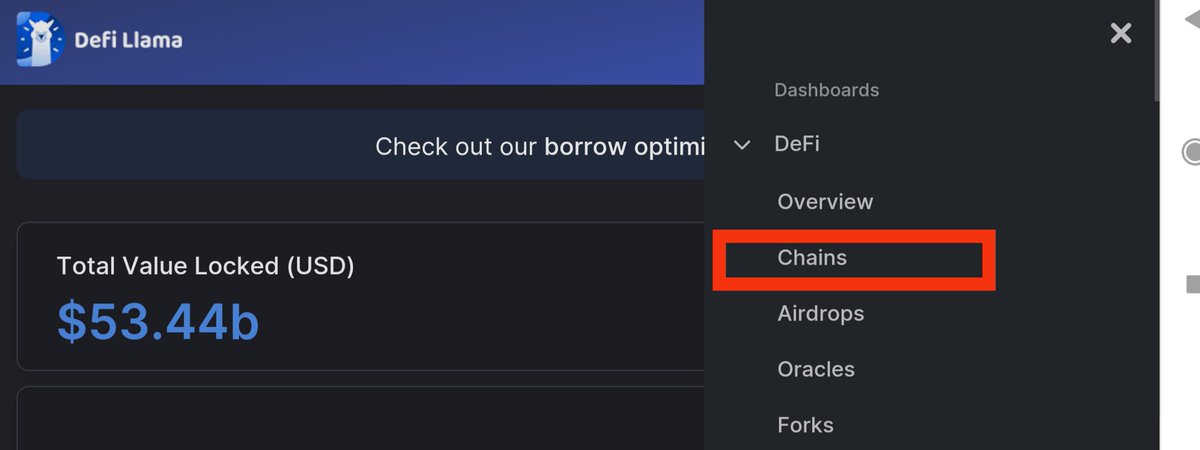

Basically, DefiaLlama is a TVL aggregator, but currently, it provides different dashboards for users to get different statistics about various protocols.

Basically, DefiaLlama is a TVL aggregator, but currently, it provides different dashboards for users to get different statistics about various protocols.

https://twitter.com/crypto25807202/status/1532986555178323968?t=WmwTWl4SbZowfQ8aiCgZwQ&s=19

A testnet can be said to be clones of a blockchain created for experimental purposes.

A testnet can be said to be clones of a blockchain created for experimental purposes.