Here is my morning run down of the current market outlook using Dark Pools, Dealer Positioning and market wide Options Flow to inform our #optionstrading and #futurestrading today. Data can change but it will help formulate a plan.

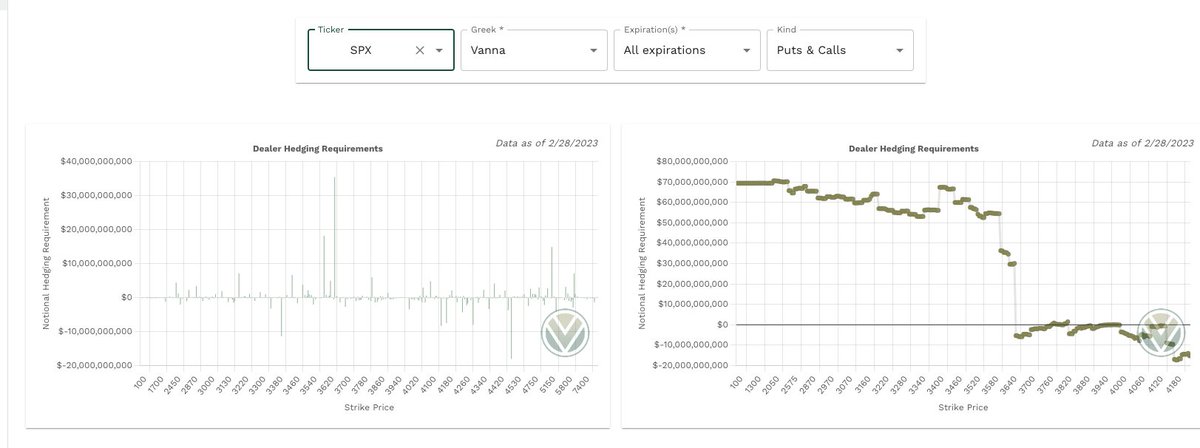

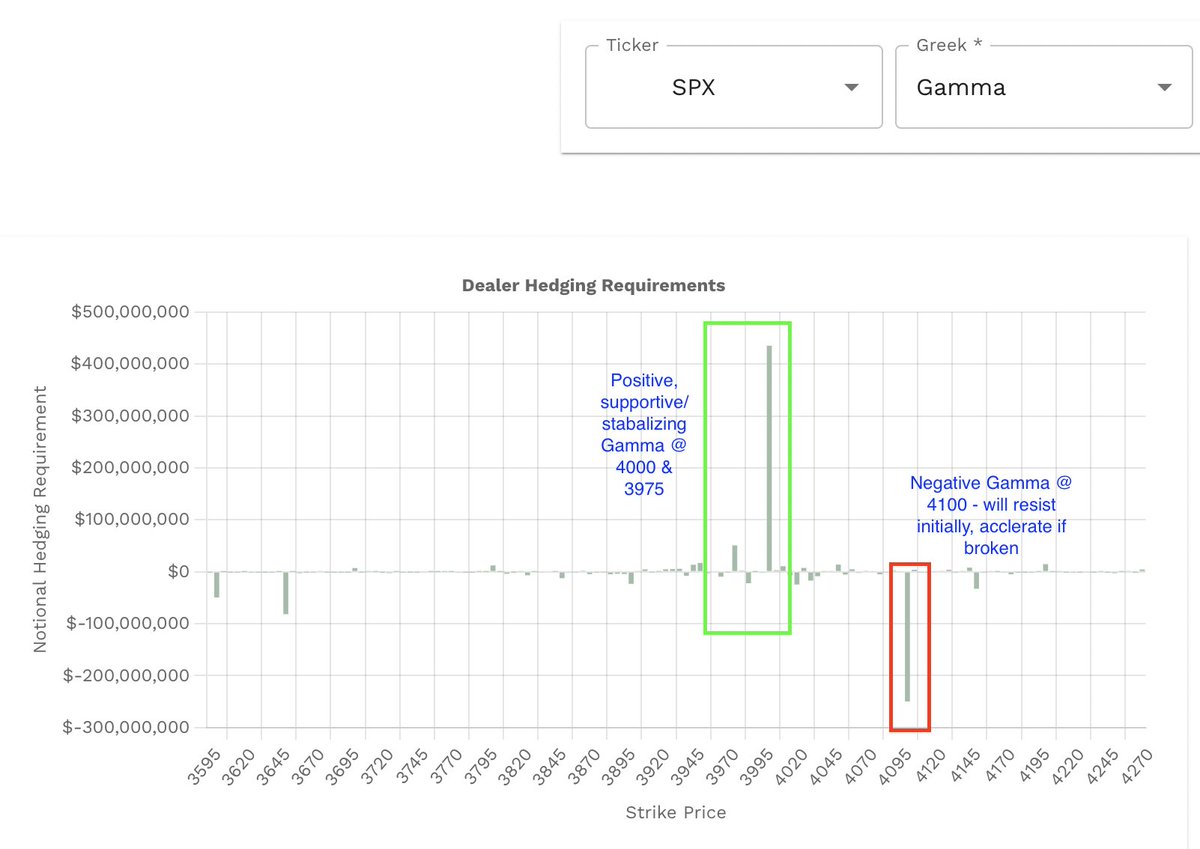

Lets start with $SPX Gamma and Vanna courtesy of @WizOfOps #volland. The Vanna magnet at $SPX 4000 remains along with the repellents at 4100. Supportive Gamma at 4000 as well. If 4100 were to break from an event, massive acceleration would occur to the upside. See screen shots.

Now let's do the same for $SPY but add in some additional data points from @Tradytics data driven insights. Vanna magnet @ $400. Repel @ $390. Neg vanna/gamma @ $404/405 could assist move higher IF broken. The 3-day delta structure indicates higher likelihood of downside.

$SPY Dark Pools help paint the the picture further. Sig prints "magnet" prints remain, also supportive if reached. Additional support/resistance compliment Gamma/Vanna levels. Block Trade sentiment remains bearish.

Now, take a look at 5-day market net flow and delta positioning across the market. Calls took the lead pre CPI. Market wide deltas relatively flat. Short term put protection remains. When they expire off on 12/16, will lead to a nice bullish OPEX move assuming it stays the same.

Lastly, we need to make sure we keep all the upcoming macro number releases in mind as they are the big fundamental drivers of the market. Rate raising and JPow speaking today, jobless claims tomorrow, PMI and major OPEX on Friday (see schedule below).

The Fed is expected to raise rates 50 bps today, however JPow's hawkish or dovish outlook will be primary driver of the follow up move. I prefer to be flat going into this from 2pm - 3pm then make my play once he's finished. Until then, things should be relatively flat.

Prior to JPow speaking but after the opening range is made, things can be difficult to trade unless you play the range and look for mean reversions. I covered how I play them here. If the range is broken, I'll shift my mindset.

If you are interested in viewing & using this data plus more with hundreds of other assets, use coupon code FattyTrades for discounts with #volland, @Tradytics & @elitetradefund funded futures accounts!

• • •

Missing some Tweet in this thread? You can try to

force a refresh