The (lack of realistic) debate about excluding Russian #fertilizers from sanctions shows how the West is still susceptible to Russian propaganda. As the 9th #sanctions package is getting bogged down in a stalemate, it's worth to unpack is to realize what is actually going on. 🧵

https://twitter.com/dafyddabiago/status/1602512893886533632

As news outlets report, a number of major Western EU countries, including Germany, France and Belgium (and some others) are blocking the adoption of the 9th sanctions package with their request to create an exemption for transactions involving agriculture and fertilizers.

By way of background, EU sanctions do not, per se, block imports of Russian fertilizers into the EU. Except for potash and some multi-nutrient fertilizers (so-called NPKs), which are subject to a quota 👇, all other fertilizers can be imported into the EU.

There is also no overall ban on EU firms participating in any way in Russian exports of fertilizers to 3rd countries. EU companies are - in general - allowed to transport Russian fertilizers to 3rd countries, finance or insurance such shipments.

So the situation is different than with the oil sanctions before the price cap was introduced (where there was a ban on financing or insurance of 3rd country shipments) or after the price cap (the ban on financing, insurance, transport, brokering, trade above the cap).

So - again - to emphasize. The importation of Russian fertilizers to the EU, the exports, trade, brokering of Russian fertilizers to 3rd countries is allowed, as is shipping, brokering, financing or insuring of such shipments.

The alleged problem is elsewhere. Supposedly, other EU sanctions, in particular asset freezes on Russian fertilizer oligarchs make imports of Russian fertilizers to the EU, or exports of Russian fertilizers to 3rd countries, difficult.

But is that true?

Lets take a look.

But is that true?

Lets take a look.

The first concern is that there is no way to make payments for Russian fertilizers, because many Russian banks are sanctioned. It is true they are sanctioned, but the EU already introduced 👇a special waiver for fertilizer transactions.

The entities listed there are RU banks.

The entities listed there are RU banks.

The second concern is that transportation is restricted. Supposedly trucks, trains, ships carrying fertilizers can't access the EU. But is that true?

Lets take a look.

Lets take a look.

Trains? There is no ban on train service between Russia and EU. No ban on importing cargo from Russian via trains (re-loaded, of course, due to the track width deference).

Road transport? Trucks? Well, although there is a ban on providing road transport services in the EU by Russian entities, there also an existing exemption for agriculture, wheat and fertilizers.👇

Add to this: no restrictions on EU or other trucks bringing in RUS fertilizers.

Add to this: no restrictions on EU or other trucks bringing in RUS fertilizers.

Ships? Similar. Although there is a ban on Russian-flagged vessels entering EU ports, there - just as with road transport - is an existing exemption for agriculture, wheat and fertilizers.👇

Add to this: no restrictions on EU or other ships bringing in RUS fertilizers.

Add to this: no restrictions on EU or other ships bringing in RUS fertilizers.

So, to conclude, to the extent that any of transport sanctions could impact imports or exports of Russian fertilizers, there is always the option of relying on an exemption from a Member State or using non-Russian means of transport.

Third, EU has a ban on transactions with state-owned or state-controlled entities listed in Annex XIX (most are defence & energy).

So even though these companies have nothing to do w/ fertilizers & agriculture, EU still provided an exemption for these transactions.

What's even more bizarre, in contrast to transport exemptions, which require gov't to approve the exemption, here the exemption is automatic.

What's even more bizarre, in contrast to transport exemptions, which require gov't to approve the exemption, here the exemption is automatic.

So as you can tell, the EU has gone out of its way - at a really wide angle - to ensure that any agricultural & fertilizer transactions accidently caught in EU sanctions are not actually sanctioned.

And here we get to the last and by far most serious issue.

And here we get to the last and by far most serious issue.

Fourth. Asset freeze. The asset freeze not only mandates that any funds, property, rights etc. of the sanctioned persons are frozen, but also that no funds, property ("economic resources"), rights, etc. can be provided to the sanctioned persons and entities.

Although the EU has not sanctioned any Russian fertilizer companies, it has sanctioned a number of fertilizer oligarchs and executives, connected with 4 major fertilizer firms: Eurochem, Phosagro, Uralchem and Acron.

On March 9th, the EU sanctioned:

- A. Melnichenko, Board Member of EUROCHEM;

- A. Guryev, CEO and Chairman of PHOSAGRO (also, son of majority owner)

- D. Mazepin, owner and former CEO of Uralchem

- A. Melnichenko, Board Member of EUROCHEM;

- A. Guryev, CEO and Chairman of PHOSAGRO (also, son of majority owner)

- D. Mazepin, owner and former CEO of Uralchem

Finally, on June 3rd, Melnichenko's wife Alexandra got sanctioned as well, due to Melnichenko's attempts to circumvent the sanctions by passing the company to his wife.

So why does it matter that the owners of these companies got sanctioned? Because under EU sanctions, the assets that get frozen are not only those "owned" by the sanctioned person, but also that are "controlled by" or "associated with" the sanctioned person.

In this context, it is relevant to note what the Council stated, when sanctioning the various oligarchs.

With respect to both Melnichenkos and Mazepin, the Council noted that they "owned", respectively, Eurochem and Uralchem.

With respect to both Melnichenkos and Mazepin, the Council noted that they "owned", respectively, Eurochem and Uralchem.

With respect to Kantor, the Council didn't say he owns Acron, but notes that he is "a large shareholder" and goes out of its way to note that Acron is "publicly listed". That has clear implications for determining whether Kantor can actually "own" or "control" Acron.

Phosagro is a special case. In contrast to the other three companies (Eurochem, Acron, Uralchem), the real oligarch behind Phosagro (Guryev, the father) did not get sanctioned and it would be interesting to know why.

Only the son got listed and he resigned immediately. phosagro.com/press/company/…

The same was done by Eurochem's CEO Rashevsky. eurochemgroup.com/media-announce…

Now, the obvious question is - in light of the fact that presumed beneficial owners of RUS fertilizer companies are listed - whether their companies are also indirectly sanctioned.

If so, they cannot be traded with, because payments to them are actually payments to the listed oligarchs or executives and the fertilizers bought them should have been frozen. In other hands, trading in their fertilizers would violate EU sanctions.

(I'll be back with this after the second half of #FRAMAR #Qatar2022 )

OK, so while the purpose of this thread is not to analyze the legal complexities of asset freeze, lets just recall that when assessing "control", a number of factors have to be looked at. 👇

For anyone that knows anything about Russia, the oligarch wars of 1990s and the nature of oligarch property, the idea that any of these oligarchs does not "control" their companies is just laughable.

We should add here that the most legally uncertain and questionable term is the phrase "associated with". What exactly does it mean that some assets are "associated with" an oligarch?

The Council does not clarify what this means in its own internal documents and the Commission only points out that if a company is listed in the "reasons for listing" section then "highest caution" is required.

So if mentioning the companies in the oligarchs' "reasons for listing" section suggests that they too are listed, then Eurochem, Phosagro, Acron and Uralchem are to be treated as sanctioned.

I may be taking too much time with this, but my point here is that there is a very powerful case to be made that the three oligarch's companies: Eurochem, Acron and Uralchem are actually covered by their oligarchs' asset freezes.

The problem here is of course that the ownership structures of all these companies are so complicated and the nature of control by the oligarchs so concealed that it is difficult to confirm with absolute clarity what they control.

Good example of this is Eurochem, which is fighting all-out battle to get out from EU sanctions. In addition to this trust maneuver where Melnichenko claims the company isnt owned or controlled by him but run by a trust in his wife's name (which got her on the sanctions list)...

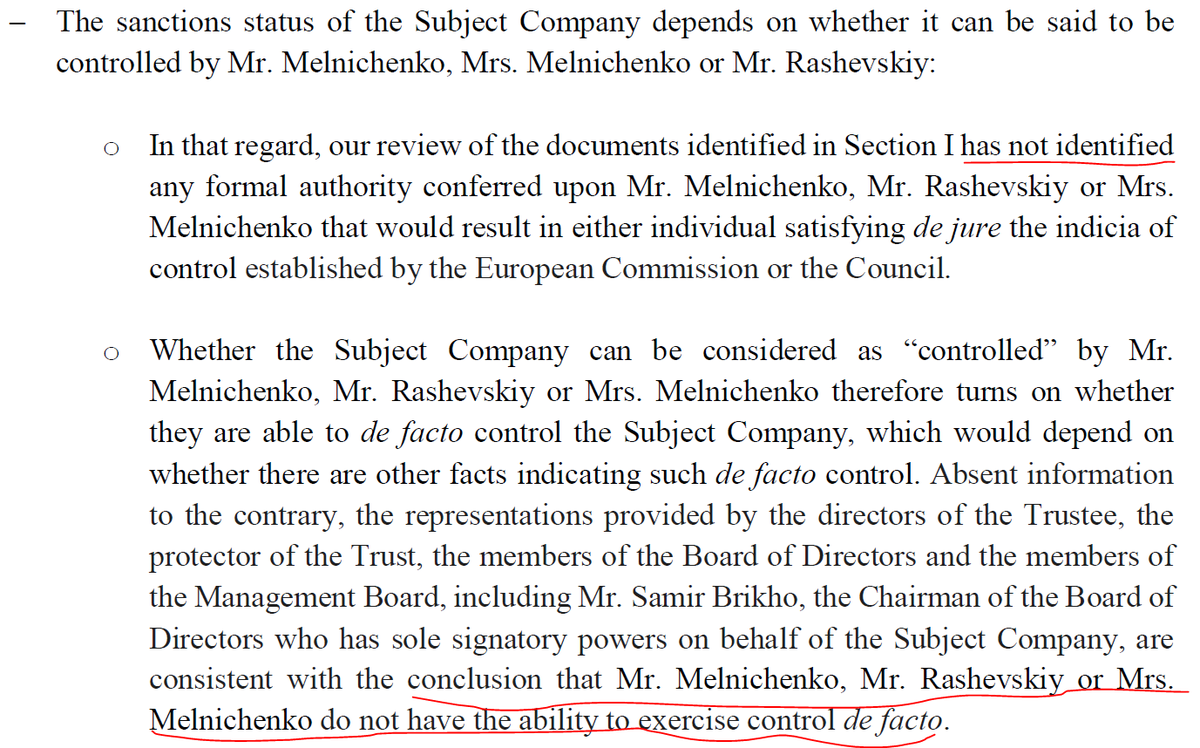

... they've also hired a law firm to produce a massive memorandum, in which they claim Eurochem is not controlled by Melnichenkos.

The funny thing abt this memo is that the law firm that wrote it doesn't stand by its findings, because they completely relied on statement made by a number of people associated with Eurochem and Melnichenkos, but haven't verified whether these statements and docs are true.

So - spoiler alert - the memo that Eurochem paid for concludes that .... no, you could not have guessed - that Eurochem is NOT controlled by Melnichenkos and isn't subject to sanctions.

I know, real shocker.

I know, real shocker.

For sure, the memo - which was shared with numerous outside parties - is riddled with qualifying statements and complicated sentence structure to ensure that the memo only misleads the reader to think Eurochem is not sanctioned, without actually saying it.

As most of my followers know, EU sanctions are enforced by EU Member States, so in an area where EU regs are vague or unclear, the Member States decide. So whether these oligarch-owned companies are treated as sanctioned or not depends on the position of a given Member State.

Many differ. Eurochem is treated as sanctioned in PL , but after some back & forth, has been reopened in Belgium, where it has a plant. In Lithuania, where it has another plant, it was frozen until the govt appointed a receiver to run the local company independently of Eurochem

The point being, there is different treatment of these companies across Member States. In some they are sanctioned, in others they aren't. Which brings us to what is happening this week.

A number of EU Member States, including Italy, Belgium, Germany and France have requested that transactions related to fertilizers and agriculture get exempted from the asset freeze. We have seen similar language quoted above in reference to other sanctions.

Now why is this a ridiculous proposition? Lets take a look.

First, these fertilizers are produced by fertilizer companies owned by the sanctioned fertilizer oligarchs. We have sanctioned these oligarchs to deprive them of assets and ability to continue running their companies.

Exempting their companies from asset freeze will only allow them - the companies - to make sales, so generate revenue which they will then distribute - outside of the EU sanctions regime - to their owner, i.e., the sanctioned oligarch.

So its extremely puzzling that the EU first sanctions these guys to deprive them of money, but then seeks to exempt from sanctions their main way of making money. The two things are completely contradictory.

It's like we froze the assets of a drug dealer, but then exempted drug sales from this asset freeze.

The second point is that - asset freeze or not - EU sanctions are not preventing the importation of Russian fertilizers into Europe. Russian urea and UAN is flooding the EU market. So obviously the concern with EU sanctions is simply not supported by evidence.

Third, if we are concerned abt Russia's ability to keep exporting fertilizers to 3rd countries and we are worried EU sanctions preventing EU companies from participating, nobody said it has to be the EU companies participating in this trade, right?

I mean look at the oil price cap, where the Russian are claiming Western sanctions won't stop Russian exports of oil in a sector that the EU wants to target.

So how is it that EU sanctions, which cant stop Russian oil exports, are somehow able to stop Russian fertilizer exports, even though we are not even targeting this sector?

Clear nonsense.

Clear nonsense.

Russia is absolutely able to ship Russian food and Russian fertilizers to 3rd countries with its own ships, its own finance, its own insurance if it wants to. EU participation in this trade is not necessary for it to materialize.

Fourth, it needs to be asked why the EU is seeking to help Russia keep the rest of the world dependent on its fertilizers and agriculture.

As Europe, we are abandoning Russian gas, Russian oil, Russian coal.

We have learned that no dependency on Russia is safe.

As Europe, we are abandoning Russian gas, Russian oil, Russian coal.

We have learned that no dependency on Russia is safe.

So why do we want to carve out an exemption from our own sanctions, to help them dominate 3rd countries with their food and fertilizers, while making the very oligarchs that we seek to sanction, rich? That just defeats any reason.

Fifth: nitrogen fertilizer are gas. Gas constitutes abt 80% of cost of production of some N fertilizers. RUS fertilizer exports are just RUS gas exports in a different form.

If we are trying to defeat RUS fossil industry, why are we seeking to promote their fertilizer exports?

If we are trying to defeat RUS fossil industry, why are we seeking to promote their fertilizer exports?

Our sanctions already have the objective of weaking Russian industrial capacities. We ban exports of technologies and goods that can help them develop that. We have a ban on exporting items that can help RUS with gas liquefaction and oil refining.

So if the purpose of our sanctions is to weaken the Russian industry, in particular that based on fossil fuels, we shouldn't be helping them run one of the main industries that supports gas exploration.

That's even skipping the whole part of the story were we explore how subsidized their fertilizer industry is (dual-pricing of natural gas).

What's puzzling in this story is that if Member States want to import of fertilizers from sanctioned Russian oligarchs, they can already do that by finding Eurochem, Uralchem and Acron not be controlled by their oligarchs. They don't need a special exemption.

So in fact, by insisting so intensely on an exemption from the asset freeze, the Member States indirectly confirm that they believe the oligarchs do indeed still control their companies, their protestations to the contrary notwithstanding.

Another topic requiring explanation is why the EU seeks to lift the asset freeze on fertilizer oligarchs for FOOD transactions. Its not like fertilizer companies export food. Something is off in this.

If you've gotten this far, I have one more suggestion for you. Go into the Twitter search function and type in sanctions & fertilizers. And see what posts from what accounts show up. For me, its clear that this fertilizer push is a big topic for RUS trolls and bots.

So to conclude, given that there is no real justification for the exemption (as EU can and does import Russian fertilizers, sanctions notwithstanding, and Russia can export their fertilizers to 3rd countries without any new exemptions) its clear this is a propaganda push.

Clearly, there are some interests on the EU side aligned with the Russians.

Three of countries involved - BE, NL & DE - have the largest ports through which Russian fertilizers enter the EU.

Three of countries involved - BE, NL & DE - have the largest ports through which Russian fertilizers enter the EU.

Also, given that Russia can easily export its fertilizer directly to 3rd countries without any help from EU firms, there may also be a push to loosen up sanctions from some EU firms wanting to get more directly involved in trade of Russian fertilizers & food to 3rd countries.

Either way, the pressure to conclude the 9th EU sanctions package is intense, so let's see if the fertilizer exemption gets implemented, watered down, rejected or turns out to be the death knell of this package.

We'll soon find out. /END

We'll soon find out. /END

I forgot to add an important additional factor: there are other fertilizer producers in Russia that are connected to sanctioned oligarchs: KuybyshevAzot, ShchekinoAzot, etc. So it is possible to import Russian fertilizers without touching on the asset freeze provisions.

• • •

Missing some Tweet in this thread? You can try to

force a refresh