1/7

#China activity indicators for Nov came in much weaker than expected on Covid-linked restrictions and protests

. Too early for easing property measures to have an impact: floor space started remained at 13-year lows and residential demand is back to new cyclical lows

thread

#China activity indicators for Nov came in much weaker than expected on Covid-linked restrictions and protests

. Too early for easing property measures to have an impact: floor space started remained at 13-year lows and residential demand is back to new cyclical lows

thread

2/7

. Overall construction activity was unchanged at cyclical lows and 24% below pre-pandemic trend while bottoming out on a y/y basis (-9.3% y/y vs -14.2% in Aug)

. Overall construction activity was unchanged at cyclical lows and 24% below pre-pandemic trend while bottoming out on a y/y basis (-9.3% y/y vs -14.2% in Aug)

3/7

√ #China home prices fell for an 8th consecutive month, down 2.3% y/y, with 23 of cities having rising prices (up from 15% in Oct)

√ #China home prices fell for an 8th consecutive month, down 2.3% y/y, with 23 of cities having rising prices (up from 15% in Oct)

4/7

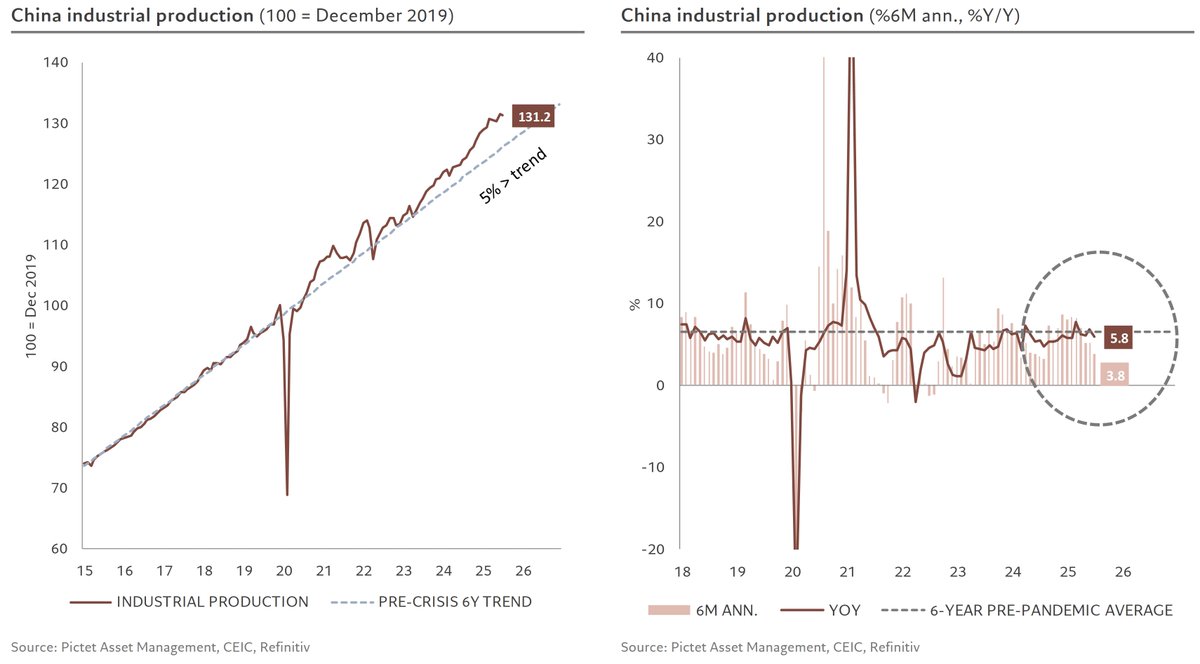

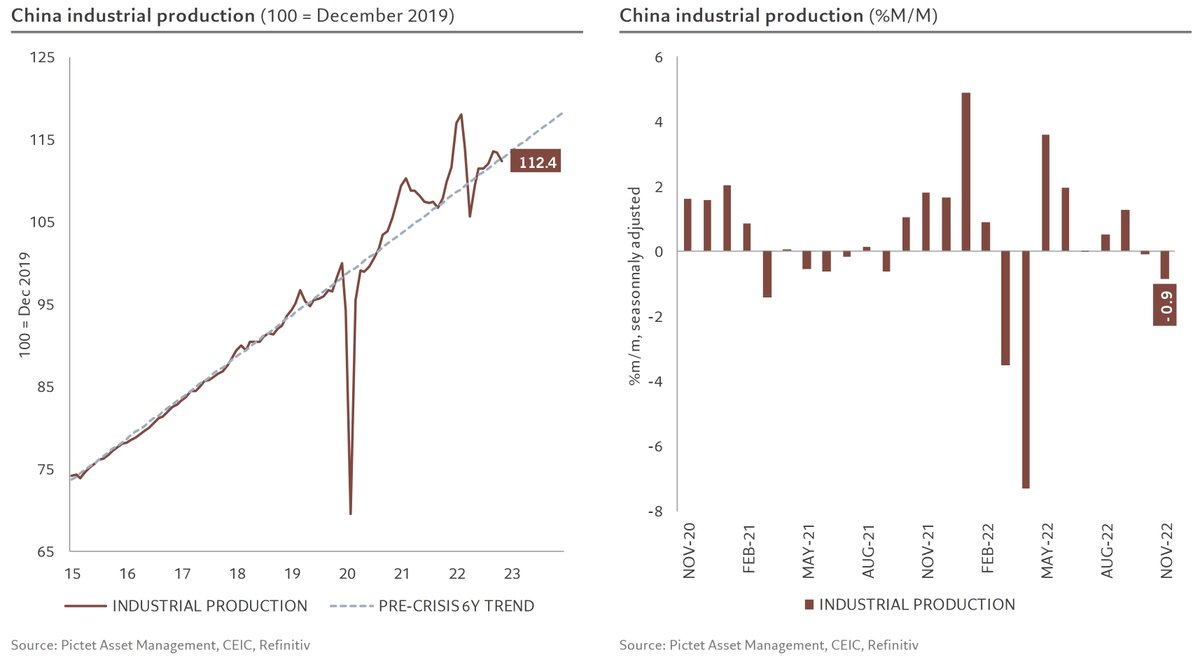

√ Industrial production declined over the month, but remains resilient as it has continued to move around trend

√ Industrial production declined over the month, but remains resilient as it has continued to move around trend

5/7

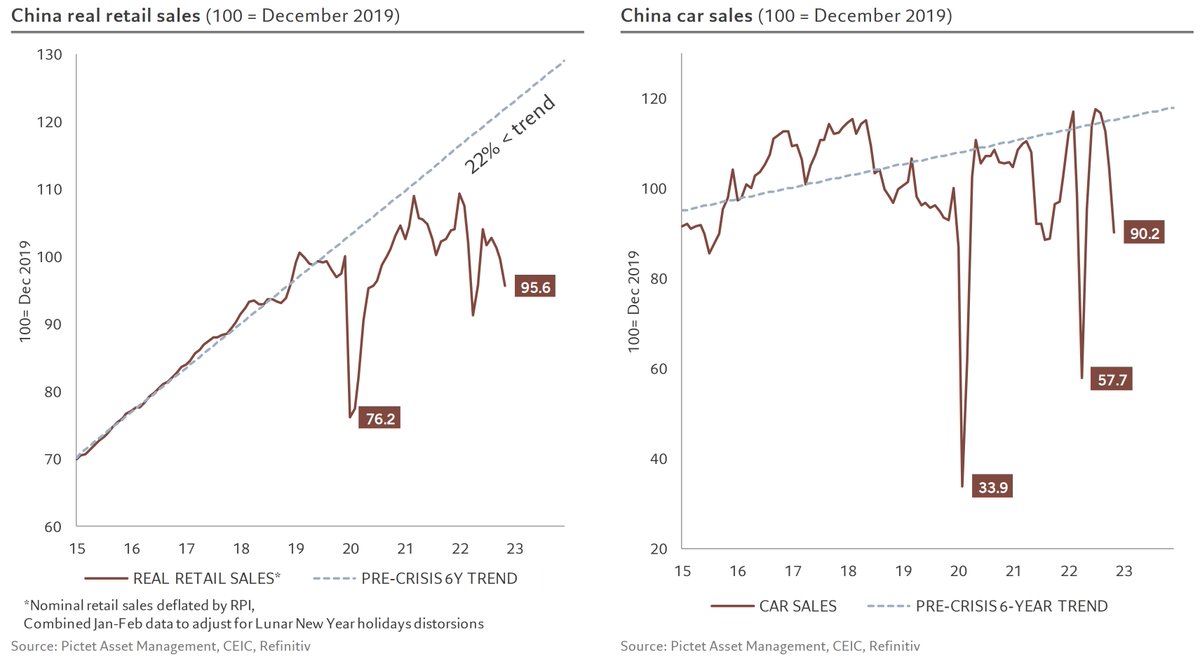

√ Real retail sales fell even further, to almost 5% below the pre-pandemic level and standing at 22% below trend

√ The only encouraging thing is that the 22% below trend gives an idea of how much pent-up demand is there when the economy finally reopens

√ Real retail sales fell even further, to almost 5% below the pre-pandemic level and standing at 22% below trend

√ The only encouraging thing is that the 22% below trend gives an idea of how much pent-up demand is there when the economy finally reopens

6/7

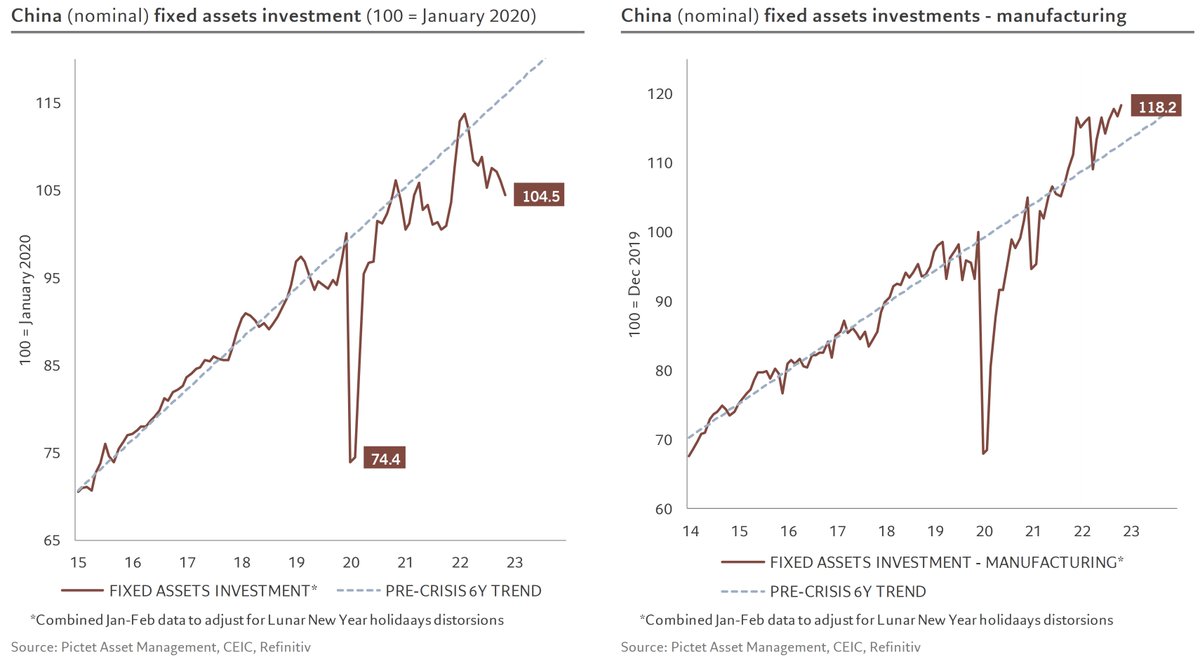

√ Fixed assets investment was also in contraction with manufacturing investment still rather resilient…

√ Fixed assets investment was also in contraction with manufacturing investment still rather resilient…

7/7

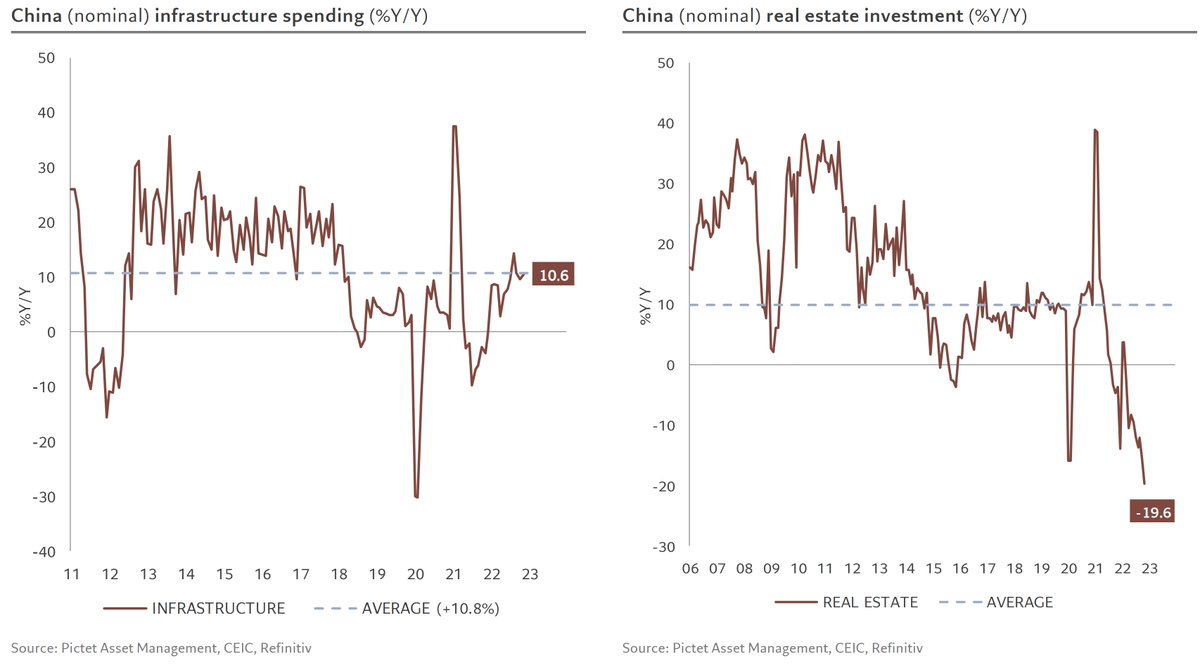

… the other components still show solid growth in infrastructure spending on the one hand, and on the other hand investment plunging at a rate not seen since the beginning of the series (mid-90s)

… the other components still show solid growth in infrastructure spending on the one hand, and on the other hand investment plunging at a rate not seen since the beginning of the series (mid-90s)

• • •

Missing some Tweet in this thread? You can try to

force a refresh