#TokenInsight Daily Crypto News📰 Recap, Dec 15th

1/ 𝑪𝒆𝑭𝒊🏛️

• @binance will delist $MITH, $TRIBE, $REP and $BTCST.

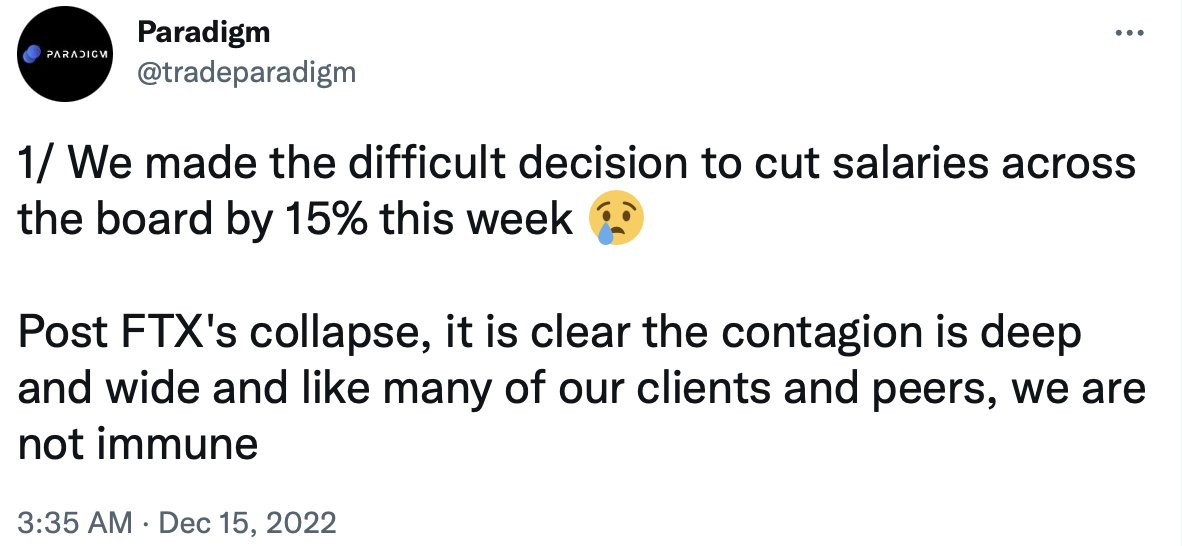

• Crypto derivatives firm @paradigm decides to cut salaries across the board by 15%.

• @ambergroup_io cancels staff bonuses for 2022, Bloomberg reports.

• @binance will delist $MITH, $TRIBE, $REP and $BTCST.

• Crypto derivatives firm @paradigm decides to cut salaries across the board by 15%.

• @ambergroup_io cancels staff bonuses for 2022, Bloomberg reports.

2/ 𝑰𝒏𝒇𝒓𝒂𝒔𝒕𝒓𝒖𝒄𝒕𝒖𝒓𝒆🛤️

• @TrustWallet integrates with THORChain to support in-app cross-chain swaps.

• @arbitrum will deprecate the support for Arbitrum Rinkeby on December 20th.

• Oracle network Pyth adds support for KCC.

• @TrustWallet integrates with THORChain to support in-app cross-chain swaps.

• @arbitrum will deprecate the support for Arbitrum Rinkeby on December 20th.

• Oracle network Pyth adds support for KCC.

3/ 𝑭𝒖𝒏𝒅𝒊𝒏𝒈𝒔💵

• Decentralized identity platform Nametag closes a $2 million seed round led by GSRV and OKX Ventures.

• Virtual-pet company Anima closes $3 million in funding led by Polygon Studios and others.

• Decentralized identity platform Nametag closes a $2 million seed round led by GSRV and OKX Ventures.

• Virtual-pet company Anima closes $3 million in funding led by Polygon Studios and others.

• • •

Missing some Tweet in this thread? You can try to

force a refresh