The Delta Neutral GLP vault competition is increasing every week

A new protocol Neutra Finance @Neutrafinance is coming to Arbitrum in Q1 2023

Let's take a look at what they can offer

👇🧵

A new protocol Neutra Finance @Neutrafinance is coming to Arbitrum in Q1 2023

Let's take a look at what they can offer

👇🧵

1/

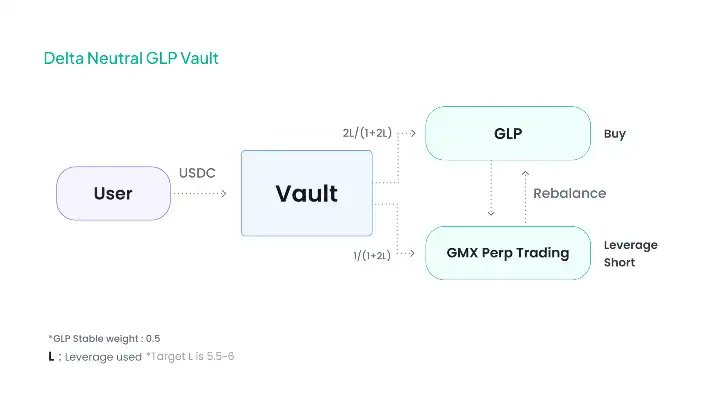

Neutra Finance is a Delta Neutral $GLP Vault built on top of $GMX

Deposit USDC in the vault and the protocol deposits it into GLP and returns yield to the users

But what makes it different from all the other Delta Neutral GLP vaults?

Neutra Finance is a Delta Neutral $GLP Vault built on top of $GMX

Deposit USDC in the vault and the protocol deposits it into GLP and returns yield to the users

But what makes it different from all the other Delta Neutral GLP vaults?

2/

It hedges GLPs ETH and BTC exposure by going short on GMX with an estimated leverage of 5.5x

This means all operations are done within the GMX protocol which reduces smart contract risk compared to other DN Vaults using multiple protocols

It hedges GLPs ETH and BTC exposure by going short on GMX with an estimated leverage of 5.5x

This means all operations are done within the GMX protocol which reduces smart contract risk compared to other DN Vaults using multiple protocols

3/

There are two known models for rebalancing.

✅️ Calendar rebalancing, which rebalances periodically at set time intervals e.g. every 12 hours

✅️ Tolerance Band model, which rebalances when asset weights reach a certain threshold.

There are two known models for rebalancing.

✅️ Calendar rebalancing, which rebalances periodically at set time intervals e.g. every 12 hours

✅️ Tolerance Band model, which rebalances when asset weights reach a certain threshold.

4/

Neutra Finance uses Tolerance Band model for rebalances, which is

✅️ More actively reflect the volatile crypto market. This enables preemptive rebalancing, which then enables them to achieve true “delta neutrality”.

Neutra Finance uses Tolerance Band model for rebalances, which is

✅️ More actively reflect the volatile crypto market. This enables preemptive rebalancing, which then enables them to achieve true “delta neutrality”.

5/

✅️ Deriving an optimal rebalancing timing, which makes it possible to provide attractive returns to users.

✅️ Deriving an optimal rebalancing timing, which makes it possible to provide attractive returns to users.

6/

Backtesting shows steady returns for the vault and that around 90% of TVL would be used for GLP and around 10% would be used for hedging

Backtesting shows steady returns for the vault and that around 90% of TVL would be used for GLP and around 10% would be used for hedging

8/

There are also other market neutral strategies in testing, along with token economics and insurance policies that will help you sit back and comfortably earn passive income in any market condition.

There are also other market neutral strategies in testing, along with token economics and insurance policies that will help you sit back and comfortably earn passive income in any market condition.

9/

Join their discord to get involved early.

This might lead to you getting early access to vaults like we saw on Rage Trade

discord.gg/QnYcUmAf

Join their discord to get involved early.

This might lead to you getting early access to vaults like we saw on Rage Trade

discord.gg/QnYcUmAf

10/

It's nice to see novel implementations for DN GLP vaults. Looking forward to testing this out

Follow me @Slappjakke for more alpha and deep dives in the Arbitrum ecosystem

Like/Retweet the first tweet below if you can:

It's nice to see novel implementations for DN GLP vaults. Looking forward to testing this out

Follow me @Slappjakke for more alpha and deep dives in the Arbitrum ecosystem

Like/Retweet the first tweet below if you can:

https://twitter.com/Slappjakke/status/1604905783711346688

11/

There is now also a contest to get OG role in discord 👀

#marketneutral #deltaneutral #arbitrum #neutrafinance #ogcontest

There is now also a contest to get OG role in discord 👀

#marketneutral #deltaneutral #arbitrum #neutrafinance #ogcontest

• • •

Missing some Tweet in this thread? You can try to

force a refresh