🧵1/Ω

So RiotBlockchain:

➽ is apparently paying > $40,000 per $BTC

➽ turned off their brand new facility for "cold weather" (wtf? cold cools!)

➽ says it's for "safety of team" (wtf? its #bitcoinmining. $RIOT can't administer it remotely?)

Something smells.

So RiotBlockchain:

➽ is apparently paying > $40,000 per $BTC

➽ turned off their brand new facility for "cold weather" (wtf? cold cools!)

➽ says it's for "safety of team" (wtf? its #bitcoinmining. $RIOT can't administer it remotely?)

Something smells.

🧵2/Ω

The price of energy in Texas as reported by ERCOT is rising.

Texas taxpayers have, in their ∞ wisdom¹, decided to pay $RIOT a bunch of money to turn off during times of peak demand.

But this shutoff was for "safety"

¹ read as "stupidity"

energyonline.com/Data/GenericDa…

The price of energy in Texas as reported by ERCOT is rising.

Texas taxpayers have, in their ∞ wisdom¹, decided to pay $RIOT a bunch of money to turn off during times of peak demand.

But this shutoff was for "safety"

¹ read as "stupidity"

energyonline.com/Data/GenericDa…

🧵3/Ω

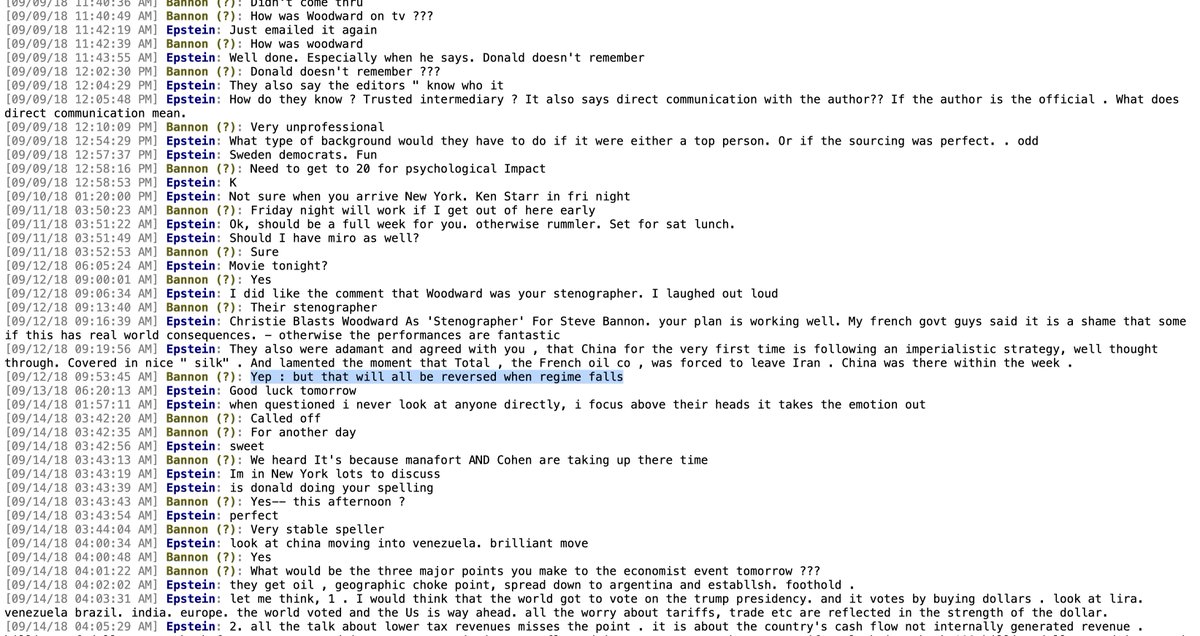

@WSJ article 2 weeks ago put the #SEC etc. filings of 22 publicly traded cryptocurrency companies through an AI tool that checks for anomalies. The vast majority were flagged as suspicious.

But $RIOT stood out most of all.

wsj.com/articles/accou…

@WSJ article 2 weeks ago put the #SEC etc. filings of 22 publicly traded cryptocurrency companies through an AI tool that checks for anomalies. The vast majority were flagged as suspicious.

But $RIOT stood out most of all.

wsj.com/articles/accou…

🧵4/Ω

@WSJ article singled out @RiotBlockchain for particular scrutiny because they seem to keep screwing up the very basic task of accounting for revenue correctly.

@WSJ article singled out @RiotBlockchain for particular scrutiny because they seem to keep screwing up the very basic task of accounting for revenue correctly.

🧵5/Ω

Remember this facility $RIOT is turning off is brand new. Massive capital costs went into getting it turned on and depreciation is running at a staggering rate.

Put together with the borderline fraudulent financials this fact pattern suggests something worse may be afoot.

Remember this facility $RIOT is turning off is brand new. Massive capital costs went into getting it turned on and depreciation is running at a staggering rate.

Put together with the borderline fraudulent financials this fact pattern suggests something worse may be afoot.

🧵6/Ω

Remember from 1/Ω that in good times $RIOT is paying $14K per $BTC... JUST FOR POWER.

Adding in depreciation they are paying $40K per $BTC. That's not counting taxes, salaries, rent, capital costs for mines, or the fact that a $675mm mkt cap co. tried to pay execs $90mm/yr

Remember from 1/Ω that in good times $RIOT is paying $14K per $BTC... JUST FOR POWER.

Adding in depreciation they are paying $40K per $BTC. That's not counting taxes, salaries, rent, capital costs for mines, or the fact that a $675mm mkt cap co. tried to pay execs $90mm/yr

🧵7/Ω

If I were a betting man I'd bet that @RiotBlockchain probably turned off their brand new facility because they can't afford to run it and are using "cold weather" and "safety of the team" as an excuse.

The problem is those excuses don't make any goddamned sense. $RIOT

If I were a betting man I'd bet that @RiotBlockchain probably turned off their brand new facility because they can't afford to run it and are using "cold weather" and "safety of the team" as an excuse.

The problem is those excuses don't make any goddamned sense. $RIOT

🧵8/Ω

$RIOT was barely squeaking by paying $14K per bitcoin mined. Now that the price of energy is rising in that part of Texas they are probably paying more than each coin is worth *just for energy*.

So they turned off... and then possibly lied? sus.

cc @DoombergT @librehash

$RIOT was barely squeaking by paying $14K per bitcoin mined. Now that the price of energy is rising in that part of Texas they are probably paying more than each coin is worth *just for energy*.

So they turned off... and then possibly lied? sus.

cc @DoombergT @librehash

🧵9/Ω

For anyone who thought that $RIOT needed to turn off because the ERCOT grid was under strain: it's not and it wasn't at any point. But it is pretty expsensive out there right now...

ercot.com/gridmktinfo/da…

cc: @bardicworks @NachshonPeleg

h/t: @CCofNavarro

For anyone who thought that $RIOT needed to turn off because the ERCOT grid was under strain: it's not and it wasn't at any point. But it is pretty expsensive out there right now...

ercot.com/gridmktinfo/da…

cc: @bardicworks @NachshonPeleg

h/t: @CCofNavarro

• • •

Missing some Tweet in this thread? You can try to

force a refresh