12/23/22 Options Trading Watchlist ✅

$AAPL 132/133c > $130.25

$AMZN 84/85c > $82.15

$NVDA 150/152.5 < $156.6

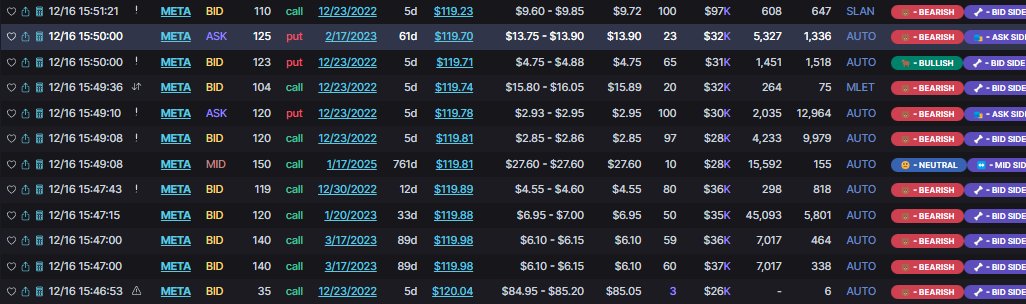

Will make adjustments in thread or add momentum entry points. Trade strategically & respect risk! Flow via Unusual Whales. See all images #optionstrading #StocksToBuy

$AAPL 132/133c > $130.25

$AMZN 84/85c > $82.15

$NVDA 150/152.5 < $156.6

Will make adjustments in thread or add momentum entry points. Trade strategically & respect risk! Flow via Unusual Whales. See all images #optionstrading #StocksToBuy

About momentum entries. If you generally struggle or are newer, these may be more difficult to execute.

Consider hanging back or just watching vs executing any scalp or momentum entry. Don't just enter because its an idea that triggers.

Always be protective first!

Consider hanging back or just watching vs executing any scalp or momentum entry. Don't just enter because its an idea that triggers.

Always be protective first!

Momentum

$AAPL 131/132c > $131.6

$NVDA 148/149p < $151.4

$AAPL 131/132c > $131.6

$NVDA 148/149p < $151.4

Per the live space. $AAPL re-entries at $131.6 off.

Noted this at 10:42 AM live - adding here as well.

Several strong moves from $AAPL and $NVDA.

Good enough for the AM!

Noted this at 10:42 AM live - adding here as well.

Several strong moves from $AAPL and $NVDA.

Good enough for the AM!

• • •

Missing some Tweet in this thread? You can try to

force a refresh