Investment Manager. Ex-TD Bank options broker, 2x Inc. 500 CEO. Author of 'Strategic Options Trading'. Sharing Ideas only, grab my (free) book 👇

3 subscribers

How to get URL link on X (Twitter) App

2. Quantum Computer Producers are Insulated From Competition ( $GOOGL being one such name )

2. Quantum Computer Producers are Insulated From Competition ( $GOOGL being one such name )

Two of my previous reports:

Two of my previous reports:https://x.com/ProfitsTaken/status/1699146004644176046

https://x.com/ProfitsTaken/status/1756492680144552285

$AAPL hovering near all time highs is more than over extended.

$AAPL hovering near all time highs is more than over extended.

No momentum entry ideas yet but watching $AAPL for a possible momentum for a stall to the upside or sooner breakdown.

No momentum entry ideas yet but watching $AAPL for a possible momentum for a stall to the upside or sooner breakdown.

🎄🎅

🎄🎅

About momentum entries. If you generally struggle or are newer, these may be more difficult to execute.

About momentum entries. If you generally struggle or are newer, these may be more difficult to execute.

Momentum entry additions are likely. I'll post in thread then retweet.

Momentum entry additions are likely. I'll post in thread then retweet.

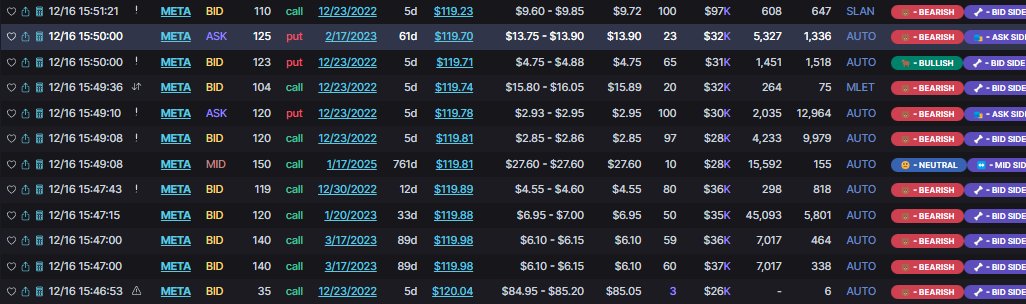

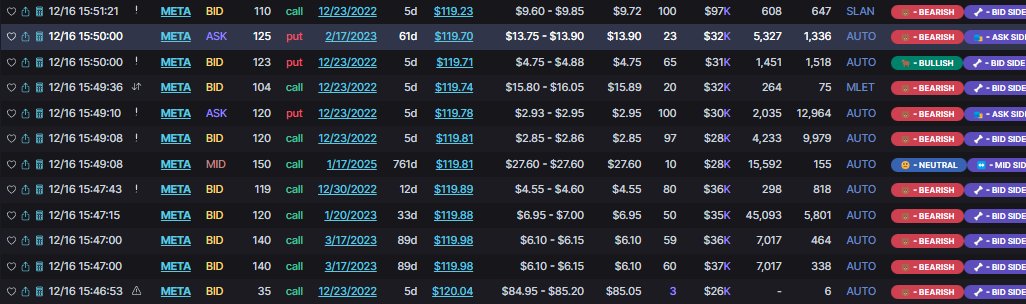

$META 110p < $116.65 scalp momentum entry

$META 110p < $116.65 scalp momentum entry

I don't like to chase price or wider spreads.

I don't like to chase price or wider spreads.

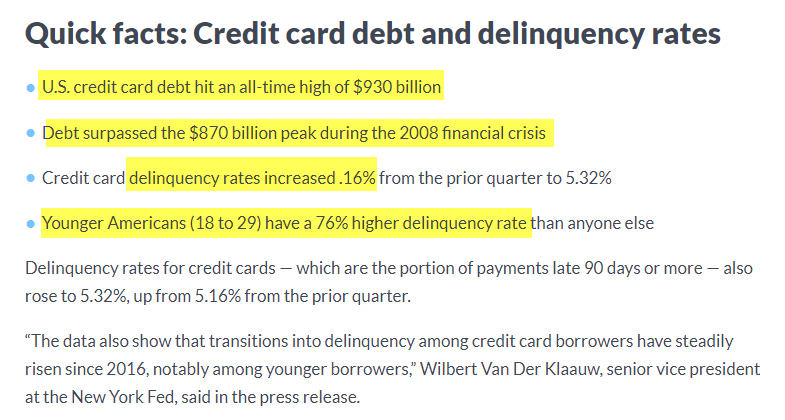

Tweet above may be of interest @unusual_whales @patrickbetdavid

Tweet above may be of interest @unusual_whales @patrickbetdavid

The question being,

The question being,

https://twitter.com/ProfitsTaken/status/1476196804459114499

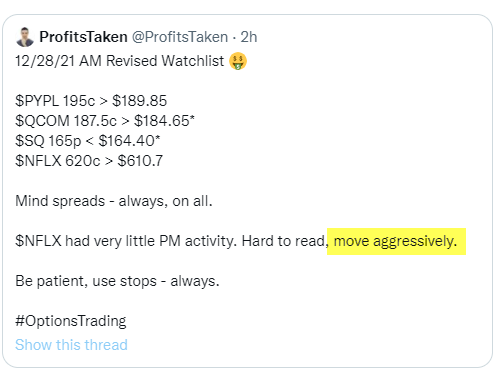

@ All, note that I stated that $NFLX would require anyone entering to move aggressively.

@ All, note that I stated that $NFLX would require anyone entering to move aggressively.