17 tools and tricks I use the most to generate impressive images with AI 🤖.

This is my christmas gift to all of you 🎁!

Follow me on this travel, you won't regret 🧵⤵️

This is my christmas gift to all of you 🎁!

Follow me on this travel, you won't regret 🧵⤵️

First of all, to arouse your interest...

Here you have 4 of the latest images that I have generated 100% with artificial intelligence using just a text description of mine.

Do you want to know what programs I have used?

The first 3 are obvious ⤵️

Here you have 4 of the latest images that I have generated 100% with artificial intelligence using just a text description of mine.

Do you want to know what programs I have used?

The first 3 are obvious ⤵️

1️⃣ MidJourney — #midjourney

One of the questions I get asked the most is: what is your favorite AI software to generate images?

Without a doubt, for me it is @midjourney, due to its balance between coherence and an "artistic" touch.

midjourney.com

One of the questions I get asked the most is: what is your favorite AI software to generate images?

Without a doubt, for me it is @midjourney, due to its balance between coherence and an "artistic" touch.

midjourney.com

2️⃣ StableDiffusion — #stablediffusion

You can try it in web version (DreamStudio), Google Colab version or even download it to your computer.

@StabilityAI is an Open Source monster that has revolutionized the world of generative AI in recent months.

beta.dreamstudio.ai/home

You can try it in web version (DreamStudio), Google Colab version or even download it to your computer.

@StabilityAI is an Open Source monster that has revolutionized the world of generative AI in recent months.

beta.dreamstudio.ai/home

3️⃣ DALL·E (@OpenAI) — #dalle2

The precursor of the revolution.

It has fallen a bit behind but it still hides some aces in the hole such as "in painting" and its "infinite canvas".

For the novel I'm writing I like the illustration style it achieves.

openai.com/dall-e-2/

The precursor of the revolution.

It has fallen a bit behind but it still hides some aces in the hole such as "in painting" and its "infinite canvas".

For the novel I'm writing I like the illustration style it achieves.

openai.com/dall-e-2/

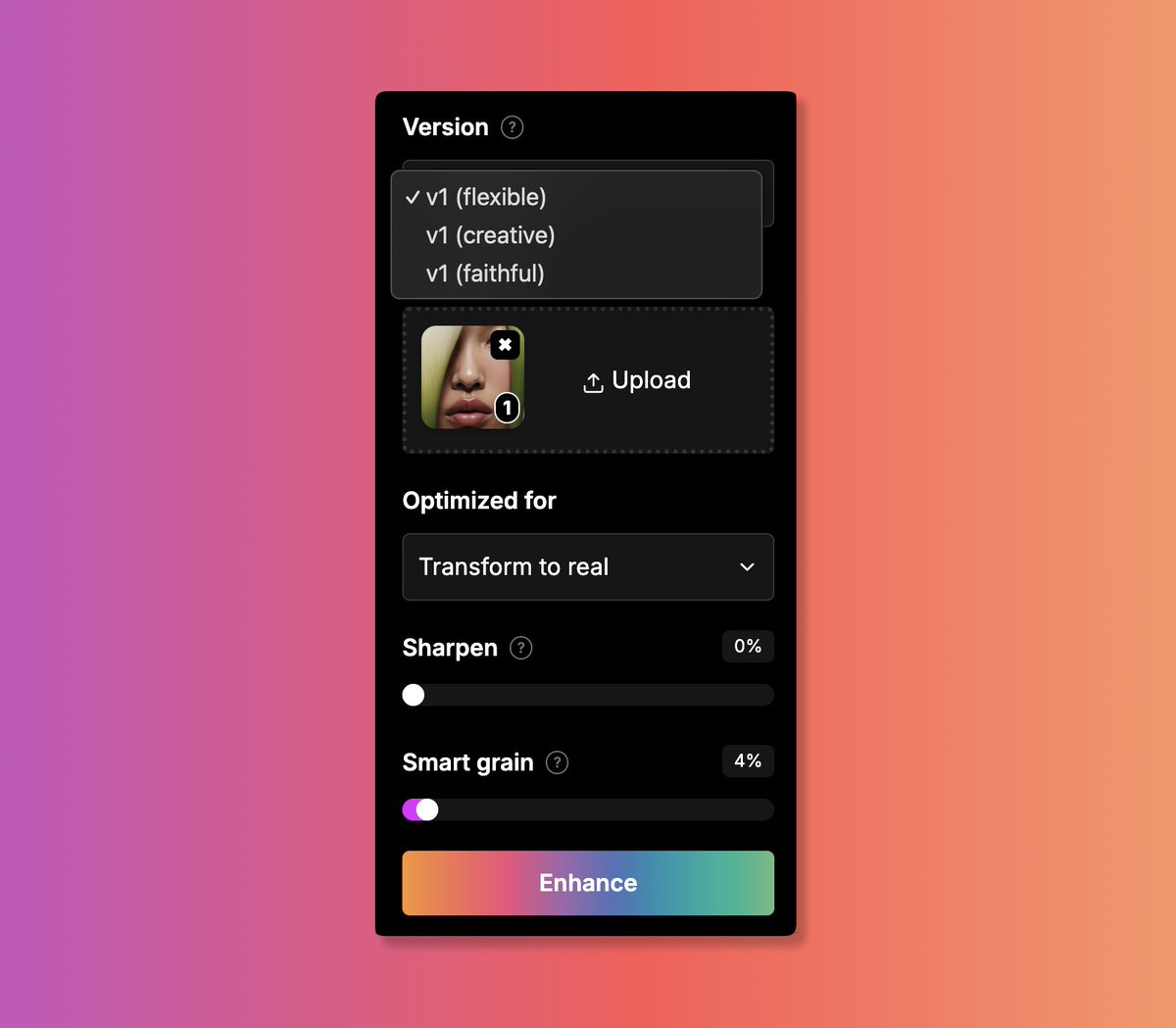

4️⃣ Tencent Face Restoration.

Ideal for retouching a previously generated portrait with one of the above. It adds lot of detail and realism. Especially in eyes, lips, nose and cheekbones.

Very powerful and simple.

replicate.com/tencentarc/gfp…

Ideal for retouching a previously generated portrait with one of the above. It adds lot of detail and realism. Especially in eyes, lips, nose and cheekbones.

Very powerful and simple.

replicate.com/tencentarc/gfp…

5️⃣ CodeFormer.

Similar to the previous one, but more focused in photo restoration and detail enhancing. Incredible results!

huggingface.co/spaces/sczhou/…

Similar to the previous one, but more focused in photo restoration and detail enhancing. Incredible results!

huggingface.co/spaces/sczhou/…

6️⃣ FaceApp.

One of my secrets 😉. Don't tell anyone! Haha!

This is one of the most used mobile apps by instagramers who want to look handsomer / prettier.

Remarkably, applied to an AI-generated face, it achieves brutal levels of realism and detail.

faceapp.com

One of my secrets 😉. Don't tell anyone! Haha!

This is one of the most used mobile apps by instagramers who want to look handsomer / prettier.

Remarkably, applied to an AI-generated face, it achieves brutal levels of realism and detail.

faceapp.com

7️⃣ Lexica.

The fastest way to learn this discipline is, undoubtedly, to see lot of example prompts (the text description that generates the image).

Lexica is the world's largest prompt repository. On the order of MILLIONS of indexed descriptions.

lexica.art

The fastest way to learn this discipline is, undoubtedly, to see lot of example prompts (the text description that generates the image).

Lexica is the world's largest prompt repository. On the order of MILLIONS of indexed descriptions.

lexica.art

8️⃣ Leiapix converter.

Simple and brutal.

Get a 3d effect on a 2d image. And it allows you to download it in video and GIF.

convert.leiapix.com

Simple and brutal.

Get a 3d effect on a 2d image. And it allows you to download it in video and GIF.

convert.leiapix.com

9️⃣ MugLife.

To animate faces: make them smile, talk, frown, stick out their tongues and much more!

muglife.com

To animate faces: make them smile, talk, frown, stick out their tongues and much more!

muglife.com

🔟 Relight.

Another easy to use but potentially brutal app.

Upload an image/photo (mostly portraits) and change the lighting as you wish, with just a few well-placed clicks...

I use it more than I admit 😉

clipdrop.co/relight

Another easy to use but potentially brutal app.

Upload an image/photo (mostly portraits) and change the lighting as you wish, with just a few well-placed clicks...

I use it more than I admit 😉

clipdrop.co/relight

1️⃣1️⃣ MovePic.

Another mobile app that I have fallen in love with.

For example: I have just generated this volcano in 5 minutes and with a few clicks I have animated the river of lava, the smoke and created a storm.

Who gives more for so little?

play.google.com/store/apps/det…

Another mobile app that I have fallen in love with.

For example: I have just generated this volcano in 5 minutes and with a few clicks I have animated the river of lava, the smoke and created a storm.

Who gives more for so little?

play.google.com/store/apps/det…

1️⃣2️⃣ I already talked about #dalle2, but I think I have to explain a bit more about its "out painting" capabilities: they need to have a special place on this list.

Check this out because It's awesome!

Check this out because It's awesome!

https://twitter.com/javilopen/status/1606245871791677440

1️⃣3️⃣ Lexica Aperture.

Do you need to generate photographies that appear to be 100% real? Well, you can!

Don't try to use the "bikini" word in your prompts because... oh, just check it out yourself 😂

lexica.art/aperture

Do you need to generate photographies that appear to be 100% real? Well, you can!

Don't try to use the "bikini" word in your prompts because... oh, just check it out yourself 😂

lexica.art/aperture

1️⃣4️⃣ Diffuse The Rest

You are going to have lots of fun with this one. Specially if you have children.

Just draw a quick and dirt sketch, write a prompt and watch magic happens! It converts your dirty sketch into something awesome.

huggingface.co/spaces/hugging…

You are going to have lots of fun with this one. Specially if you have children.

Just draw a quick and dirt sketch, write a prompt and watch magic happens! It converts your dirty sketch into something awesome.

huggingface.co/spaces/hugging…

1️⃣5️⃣ Img2img (Stable Diffusion).

Similar to the previous one, but more advanced. You will need some knowledge to install and run it in your computer. I'm sure that @NerdyRodent will be happy to help you :)

github.com/AUTOMATIC1111

Similar to the previous one, but more advanced. You will need some knowledge to install and run it in your computer. I'm sure that @NerdyRodent will be happy to help you :)

github.com/AUTOMATIC1111

1️⃣6️⃣ Prompt-to-Prompt.

Unfortunately you will also need some knowledge using Google Colab notebooks + Huggingface (token) for this one.

But if you give it some time, you really can convert ANYTHING to any OTHER thing. Like a miracle! 😂

Img by @DotCSV.

colab.research.google.com/drive/1pl7dPvV…

Unfortunately you will also need some knowledge using Google Colab notebooks + Huggingface (token) for this one.

But if you give it some time, you really can convert ANYTHING to any OTHER thing. Like a miracle! 😂

Img by @DotCSV.

colab.research.google.com/drive/1pl7dPvV…

1️⃣7️⃣ BONUS: Riffusion 🎵.

This is not for generative images... this is for generative MUSIC!

Yes, you heard me well: a "text prompt to music" generator. It's quite limited nowadays, but it can already create some cool "lofi hip hop" beats, for example.

huggingface.co/spaces/fffilon…

This is not for generative images... this is for generative MUSIC!

Yes, you heard me well: a "text prompt to music" generator. It's quite limited nowadays, but it can already create some cool "lofi hip hop" beats, for example.

huggingface.co/spaces/fffilon…

Hope u liked this thread!

Would you like to learn more about AI image generation?

🔥 Follow me! 🔥

I'm working on a prompts bundle I will release soon, with detailed explanations to be able to create awesome images! It will include the MOST ADVANCED prompts I found.

Would you like to learn more about AI image generation?

🔥 Follow me! 🔥

I'm working on a prompts bundle I will release soon, with detailed explanations to be able to create awesome images! It will include the MOST ADVANCED prompts I found.

BONUS TRACK!

@Scenario_gg will soon be released to everyone interested in creating resources for video games. I haven't had the opportunity of trying it yet, but the examples @emmanuel_2m is showing in his threads are awesome.

@Scenario_gg will soon be released to everyone interested in creating resources for video games. I haven't had the opportunity of trying it yet, but the examples @emmanuel_2m is showing in his threads are awesome.

If you know any other useful AI tool, please tell me 🙏 and I will add it to this list 😉

OK, let's continue!

2️⃣0️⃣. Remove.bg

The delete backgrounds and/or to add new ones!

remove.bg

Tip by @destinykrainbow.

2️⃣0️⃣. Remove.bg

The delete backgrounds and/or to add new ones!

remove.bg

Tip by @destinykrainbow.

2️⃣1️⃣ Cleanup Pictures.

For removing extra stuff in images. Bye, bye to those things you don't want! Super useful.

Tip by @destinykrainbow.

cleanup.pictures

For removing extra stuff in images. Bye, bye to those things you don't want! Super useful.

Tip by @destinykrainbow.

cleanup.pictures

• • •

Missing some Tweet in this thread? You can try to

force a refresh