NFTs not degen enough for you?

You need leverage?

Well leverage trading for NFTs coming soon to Arbitrum with @nftperp

You think BAYC is overvalued? Short it

You think the pengus are cute? Long it

And there might be a surprise for you if you get into the private beta 👀

👇🧵

You need leverage?

Well leverage trading for NFTs coming soon to Arbitrum with @nftperp

You think BAYC is overvalued? Short it

You think the pengus are cute? Long it

And there might be a surprise for you if you get into the private beta 👀

👇🧵

1/

I never really got into NFTs, i'm to lazy too buy and too lazy to sell them. They end up in the black hole of my wallet collecting dust

I felt pretty sure that BAYC was overvalued when Justin Bieber bought one, but there was no way to short it.. Now there is 👀

I never really got into NFTs, i'm to lazy too buy and too lazy to sell them. They end up in the black hole of my wallet collecting dust

I felt pretty sure that BAYC was overvalued when Justin Bieber bought one, but there was no way to short it.. Now there is 👀

2/ In this thread i'll go through

1️⃣ What is nftperp?

2️⃣ What problems is nftperp solving?

3️⃣ How does it work?

4️⃣ $VNFTP

5️⃣ Private Beta (real funds)

1️⃣ What is nftperp?

2️⃣ What problems is nftperp solving?

3️⃣ How does it work?

4️⃣ $VNFTP

5️⃣ Private Beta (real funds)

3/

1️⃣ What is nftperp?

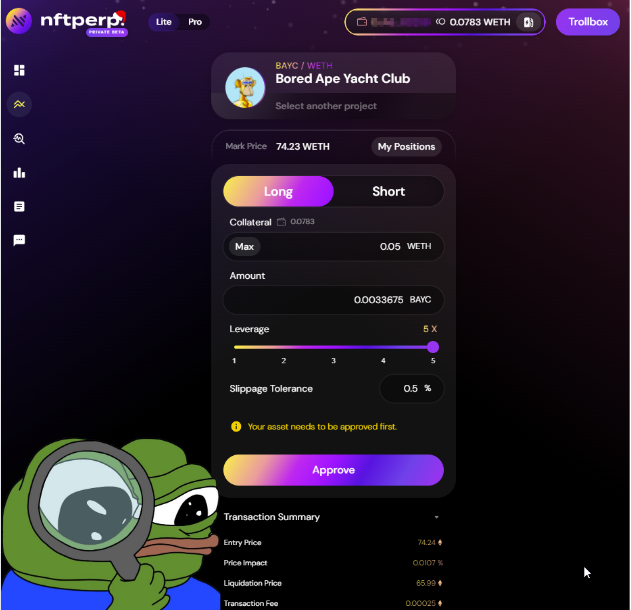

nftperp is a decentralized NFT perpetual futures decentralized exchange that tracks the floor price of NFT collections

You can go long or short on multiple blue chip NFT collections with up to 5x leverage

1️⃣ What is nftperp?

nftperp is a decentralized NFT perpetual futures decentralized exchange that tracks the floor price of NFT collections

You can go long or short on multiple blue chip NFT collections with up to 5x leverage

4/

2️⃣ What problems is nftperp solving?

☑️ There is no way to short NFTs, its normally only possible to buy and pray for price to go up

nftperp helps speculators being able to long and short with leverage, and helps holders hedge their position

2️⃣ What problems is nftperp solving?

☑️ There is no way to short NFTs, its normally only possible to buy and pray for price to go up

nftperp helps speculators being able to long and short with leverage, and helps holders hedge their position

5/

☑️ NFTs are generally very illiquid

With nftperp NFT holders are able to instantly hedge their position by taking out a short at the current price while they try to sell their NFT on a NFT marketplace

☑️ NFTs are generally very illiquid

With nftperp NFT holders are able to instantly hedge their position by taking out a short at the current price while they try to sell their NFT on a NFT marketplace

6/

☑️ Blue Chip NFTs are way too expensive for retail

$400k for a BAYC at the pico top is a bit expensive for most people

Now you get to join in on the price action by longing the floor price with any amount

☑️ Blue Chip NFTs are way too expensive for retail

$400k for a BAYC at the pico top is a bit expensive for most people

Now you get to join in on the price action by longing the floor price with any amount

7/

3️⃣ How does it work?

nftperp is based on a Virtual Automated Market Maker (vAMM), based on @perpprotocol original design.

There is no need for liquidity providers or order books with this model

It's a PvP model where one traders win is another traders loss

3️⃣ How does it work?

nftperp is based on a Virtual Automated Market Maker (vAMM), based on @perpprotocol original design.

There is no need for liquidity providers or order books with this model

It's a PvP model where one traders win is another traders loss

8/

Price feeds for the floor prices called "True Floor Price" comes from multiple different sources to be tamper-proof.

On chain and off chain verification, filter out outliers, wash trade detection and TWAP prices are used.

Price feeds for the floor prices called "True Floor Price" comes from multiple different sources to be tamper-proof.

On chain and off chain verification, filter out outliers, wash trade detection and TWAP prices are used.

9/

Funding fees is used to make sure NFT perps price stay close to the real floor price in the spot market

If the price of perps > index price, there are more longs than shorts in the market and vice versa

If price > index, longs pay shorts

If price < index, shorts pay longs

Funding fees is used to make sure NFT perps price stay close to the real floor price in the spot market

If the price of perps > index price, there are more longs than shorts in the market and vice versa

If price > index, longs pay shorts

If price < index, shorts pay longs

10/

Protocol revenue comes from trading fees and liquidations

There is a 0.3 % fee for opening a trade

0.15% goes to nftperp Insurance Fund

0.15% goes to nftperp Insurance Pool

Protocol revenue comes from trading fees and liquidations

There is a 0.3 % fee for opening a trade

0.15% goes to nftperp Insurance Fund

0.15% goes to nftperp Insurance Pool

11/

The team is investigating dynamic fees for future iterations where if the price is 2.5% away from the index, trading fees will increase for trades that increase the price difference, and decrease for going against the price difference

The team is investigating dynamic fees for future iterations where if the price is 2.5% away from the index, trading fees will increase for trades that increase the price difference, and decrease for going against the price difference

12/

There is a fluctiation limit of 2% per block to safeguard agains texploits like flash loan attacks

There is a fluctiation limit of 2% per block to safeguard agains texploits like flash loan attacks

13/

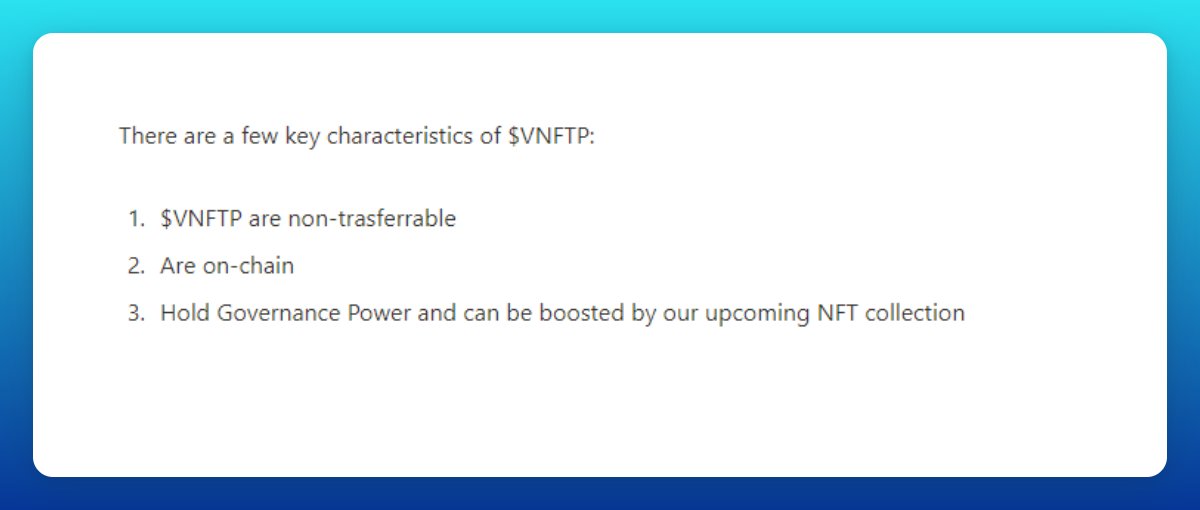

4️⃣ $VNFTP

nftperp does not have a $NFTP token yet, but there is an on-chain voucher system with a token $VNFTP which can be redeemed for $NFTP in the future

4️⃣ $VNFTP

nftperp does not have a $NFTP token yet, but there is an on-chain voucher system with a token $VNFTP which can be redeemed for $NFTP in the future

14/

There are multiple incentives to earn $VNFTP

☑️ Paper Trading Competition (ended)

☑️ Private Beta Program

☑️ Protocol Insurers

The incentives are distributed based on volume and funding fees paid, so you need to trade with some volume to qualify.

There are multiple incentives to earn $VNFTP

☑️ Paper Trading Competition (ended)

☑️ Private Beta Program

☑️ Protocol Insurers

The incentives are distributed based on volume and funding fees paid, so you need to trade with some volume to qualify.

15/

I'm sure a new competition will start in Q1 2023. Keep an eye out for the next round if you are interested

The trading competitions have high value additional prizes for winners

I'm sure a new competition will start in Q1 2023. Keep an eye out for the next round if you are interested

The trading competitions have high value additional prizes for winners

16/

5️⃣ Private Beta (NB: real funds)

Trading is live in the private beta.

You need to get an invitation by applying in discord channel #private-beta-wait-room to whitelist your wallet

5️⃣ Private Beta (NB: real funds)

Trading is live in the private beta.

You need to get an invitation by applying in discord channel #private-beta-wait-room to whitelist your wallet

17/

Remember that you are trading with real ETH on Arbitrum, this is not a testnet.

Remember that you are trading with real ETH on Arbitrum, this is not a testnet.

18/

There are frequent trading competitions

You can track the winners in the leaderboard

Notice the high volume people are going all in to secure a good allocation for the token launch

There are frequent trading competitions

You can track the winners in the leaderboard

Notice the high volume people are going all in to secure a good allocation for the token launch

19/

Roadmap for 2023

☑️ V1 public mainnet launch

☑️ Mafia Nuts NFT collection mint

☑️ L2 solution reevaluation

☑️ nftperp token distribution

☑️ NFT index derivatives

☑️ Permissionless markets

☑️ Structured products

Roadmap for 2023

☑️ V1 public mainnet launch

☑️ Mafia Nuts NFT collection mint

☑️ L2 solution reevaluation

☑️ nftperp token distribution

☑️ NFT index derivatives

☑️ Permissionless markets

☑️ Structured products

20/

So if you are a NFT degen, jump in and long those NFTs, and if you are a NFT hater, short it to the ground

It's an imperative piece of the web3 puzzle and i'm happy to see a protocol launch this highly anticipated functionality

This is probably gonna be a big one

So if you are a NFT degen, jump in and long those NFTs, and if you are a NFT hater, short it to the ground

It's an imperative piece of the web3 puzzle and i'm happy to see a protocol launch this highly anticipated functionality

This is probably gonna be a big one

21/

I hope you've found this thread helpful.

Follow me @Slappjakke for more alpha

Like/Retweet the first tweet below if you can:

I hope you've found this thread helpful.

Follow me @Slappjakke for more alpha

Like/Retweet the first tweet below if you can:

https://twitter.com/Slappjakke/status/1608387376828796929

• • •

Missing some Tweet in this thread? You can try to

force a refresh