Here is my morning run down of the current market outlook using Dark Pools, Dealer Positioning and market wide Options Flow to inform our #optionstrading and #futurestrading today. Data can change but it will help formulate a plan.

Lets start with $SPX Gamma and Vanna courtesy of @WizOfOps Vol.land. Small Vanna magnets from 3820 - 3840. Repellent @ 3750 & 3900. Positive Gamma resistance from 3820 - 3840. Small support @ 3775. Negative Gamma will accelerate if broken through.

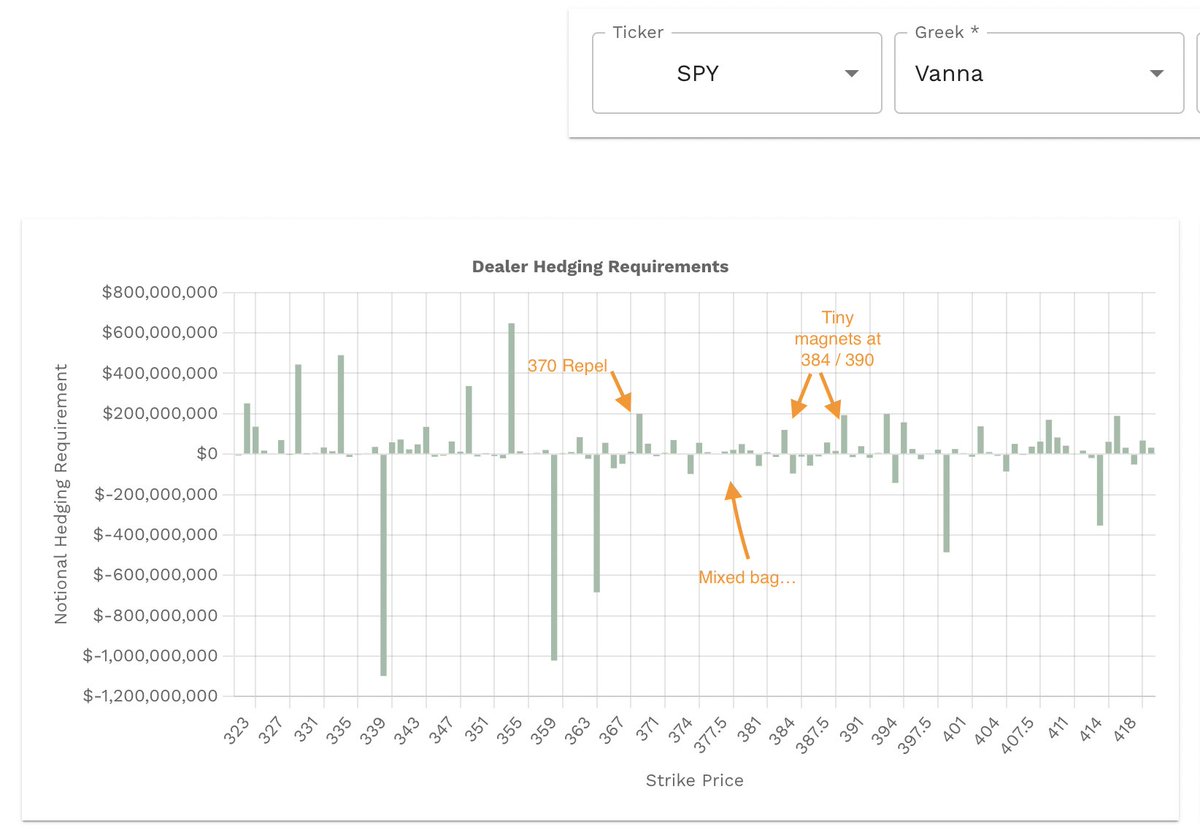

Let's do the same for $SPY using Vol.land Light Vanna repellents @ 370 & 385. Small vanna magnets @ 384 & 388. Gamma support @ 377, resist @ 384. Negative Gamma accelerants in between.

Let's add in data driven insights on $SPY from @Tradytics. 1-day delta correlations show 29% chance of a positive move up to 0.6%. 3-day shows 25% chance of up to 1.2%. Dealer delta momentum still negative (-0.363).

@Tradytics $SPY Dark Pools help paint the the picture further. Volume correlations seem to be positive, be mindful of all the resistance above. Block trade sentiment has shifted to be more bullish (but relatively close).

Now, take a look at @Tradytics 5-day market net flow and delta positioning across the market. Puts continue to accumulate, Market wide deltas shifted down as well. Put positions building a month or two out. However, flow divergences also showing mostly bullish.

We need to make sure we keep all the upcoming macro number releases in mind as they are the big fundamental drivers of the market. We had jobless claims this morning, with PMI tomorrow. Jobless claims has created a bullish move. Currently holding longs on $NQ.

With the massive put build up we've been experiencing, I've been waiting for the catalyst to create one of those infamous bull rallies we see in bear markets. We *may* be at the breaking point now. The key factor is IV dropping on contracts across the market.

Keep an eye on the big holdings today such as $TSLA, $AAPL, $MSFT, etc. Names like $META and $NVDA have also been getting hammered. Downside still favorable but I'm cautiously awaiting the IV drop that can fuel the temporary rally. We'll know more as the day progresses.

If you are interested in viewing & using this data plus more with hundreds of other assets, use coupon code "FattyTrades" for discounts with Vol.land, Tradytics, Sonarlabs indicators & Elite Trader Fund funded futures accounts!

• • •

Missing some Tweet in this thread? You can try to

force a refresh