My personal top 25 predictions for 2023

1-2 tweets per #taek, 1 chart/pic to make it EZ on the eyes/brain

Some overlap with @twobitidiot and our firmwide theses but some notable deviations

Thanks to my awesome colleagues @MessariCrypto research for shaping many of these

1-2 tweets per #taek, 1 chart/pic to make it EZ on the eyes/brain

Some overlap with @twobitidiot and our firmwide theses but some notable deviations

Thanks to my awesome colleagues @MessariCrypto research for shaping many of these

1. Macro still matters. Q1 is likely to be rough

Rapid incr. in IRs + removal of liq have hist. been followed by crises as the receding tide of ez mon. policy exposes systemic weaknesses

Something will break in tradfi. Watch credit spreads

ETH 1k BTC 15k arent unreasonable Q1

Rapid incr. in IRs + removal of liq have hist. been followed by crises as the receding tide of ez mon. policy exposes systemic weaknesses

Something will break in tradfi. Watch credit spreads

ETH 1k BTC 15k arent unreasonable Q1

2. Late Q3/Q4 we are full go bull market w/ macro tailwinds

The FED doesnt cut but pauses + stops QT

Liq. correlation with risk assets = ~1

Disinflation becomes a bigger risk v infl. w/ supply chains fully healed, wages/housing stagnating, unem. rising + ex. savings warn off

The FED doesnt cut but pauses + stops QT

Liq. correlation with risk assets = ~1

Disinflation becomes a bigger risk v infl. w/ supply chains fully healed, wages/housing stagnating, unem. rising + ex. savings warn off

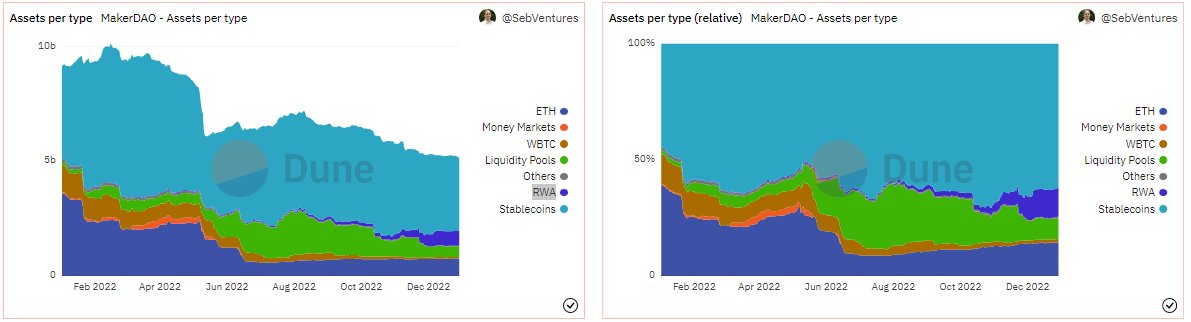

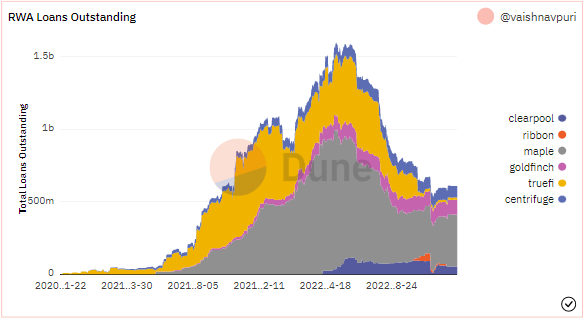

3. Defi stops being just ponzi games

More and more real-world assets (RWA) will be secured on-chain

Today $635M/~12% of DAI supply is collateralized by RWA. RWA asset loans will grow to 1/3rd of DAI/over $2b

@goldfinch_fi @maplefinance + others see RWA loans grow to $2b+ too

More and more real-world assets (RWA) will be secured on-chain

Today $635M/~12% of DAI supply is collateralized by RWA. RWA asset loans will grow to 1/3rd of DAI/over $2b

@goldfinch_fi @maplefinance + others see RWA loans grow to $2b+ too

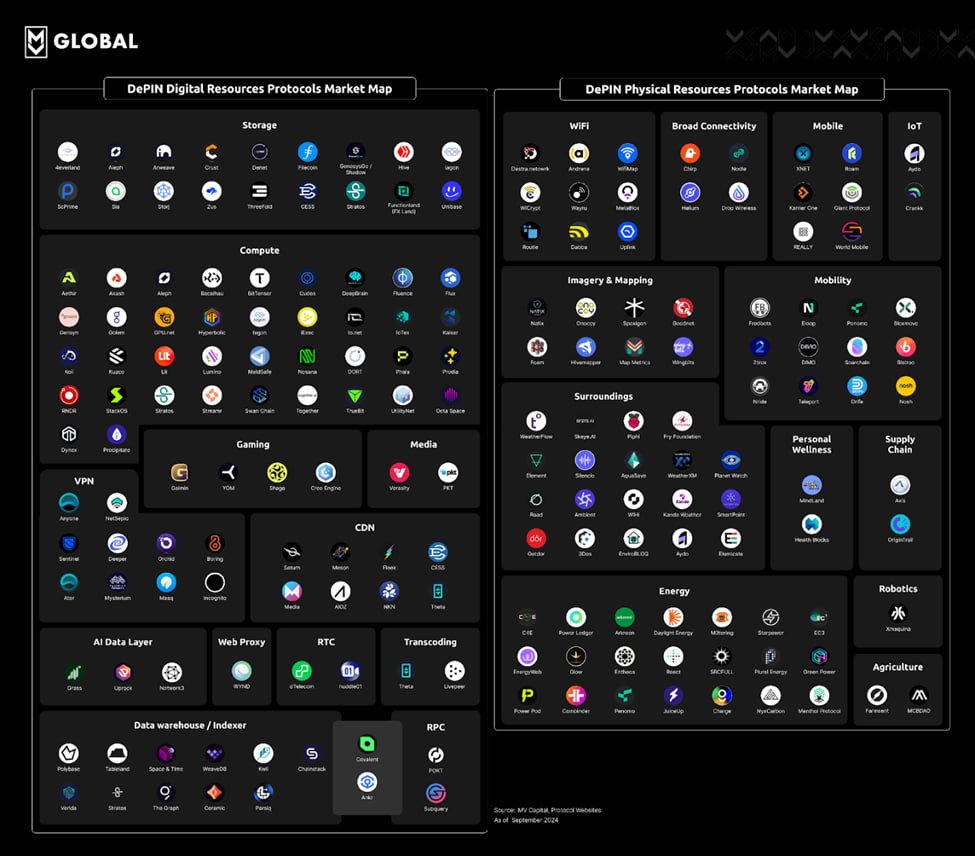

4. Decent. physical infra (DePIN) 10xs $3b to $30b+

Wireless/compute/storage/sensor are ripe for crypto

Token incen. + dist workers > centralized parties (amzn/goog)

DEPIN token flywheel works + in bulls

@Livepeer, @RenderToken, @Hivemapper, @ArweaveTeam win

h/t @Old_Samster

Wireless/compute/storage/sensor are ripe for crypto

Token incen. + dist workers > centralized parties (amzn/goog)

DEPIN token flywheel works + in bulls

@Livepeer, @RenderToken, @Hivemapper, @ArweaveTeam win

h/t @Old_Samster

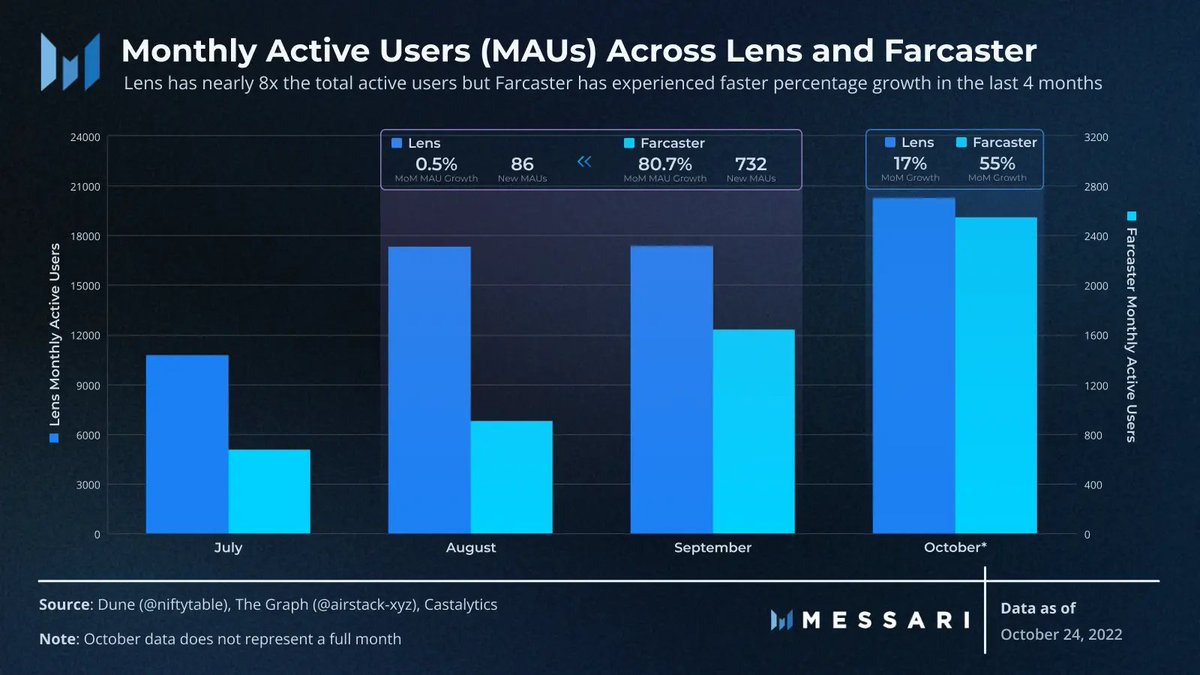

5. DeSo user adoption grows 5x to 100k+ MAUs (@LensProtocol/@farcaster_xyz)

Onchain rep=undercol. lending which opens up the liq taps in defi

Cred. as a service (h/t @jerrysun_ )+ web3 identity stack becomes a mjr investible vertical

h/t @nichanank / @Saypien_ for the visuals

Onchain rep=undercol. lending which opens up the liq taps in defi

Cred. as a service (h/t @jerrysun_ )+ web3 identity stack becomes a mjr investible vertical

h/t @nichanank / @Saypien_ for the visuals

6. BTC nation-state CB buy by one G20 country (Argentina?)

This recent study can be taken with a grain of salt bc it comes from noted crypto firm HarvardU but the crux is BTC+gold will become a larger share of cb reserves bc the risk of holding treasuries post Russia sanctions

This recent study can be taken with a grain of salt bc it comes from noted crypto firm HarvardU but the crux is BTC+gold will become a larger share of cb reserves bc the risk of holding treasuries post Russia sanctions

6. (cont.) Corps too. We also get 2+ S&P 500 companies to add BTC to their BS

Largely bc accting rules are less punitive

In 2023 corps can mark crypto holdings up AND down rather than just mark losses (they were intang. assets). This makes it easier for corps to hold crypto

Largely bc accting rules are less punitive

In 2023 corps can mark crypto holdings up AND down rather than just mark losses (they were intang. assets). This makes it easier for corps to hold crypto

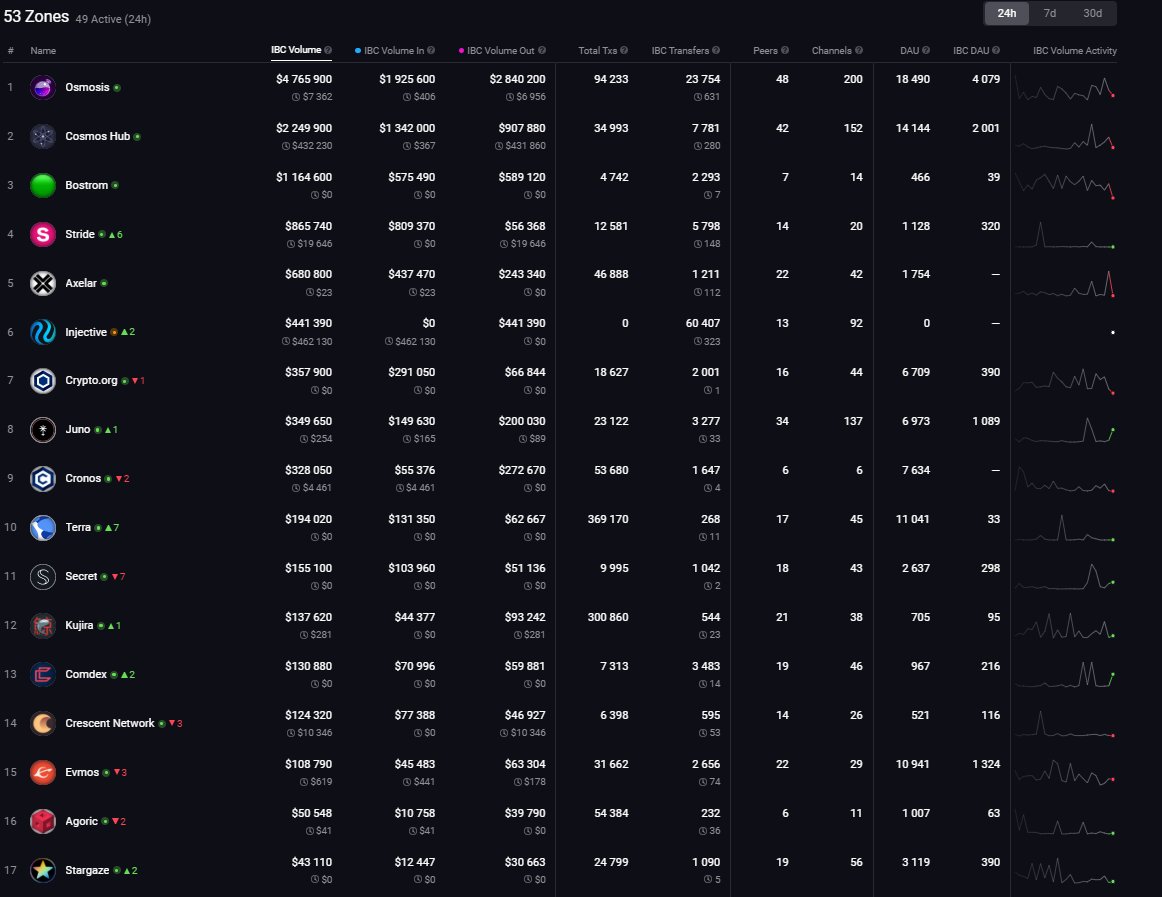

7. # / TVL on appchains 2xs. @cosmos 2.0 is a hit

The next bull we see many spec projs/L2 projs who don’t need the eco. security of Eth jump to @cosmos and get mon prem/MEV a la @dYdX

The sec flywheel works in bulls. Chain sec incr as token does. Also shared sec finally lands

The next bull we see many spec projs/L2 projs who don’t need the eco. security of Eth jump to @cosmos and get mon prem/MEV a la @dYdX

The sec flywheel works in bulls. Chain sec incr as token does. Also shared sec finally lands

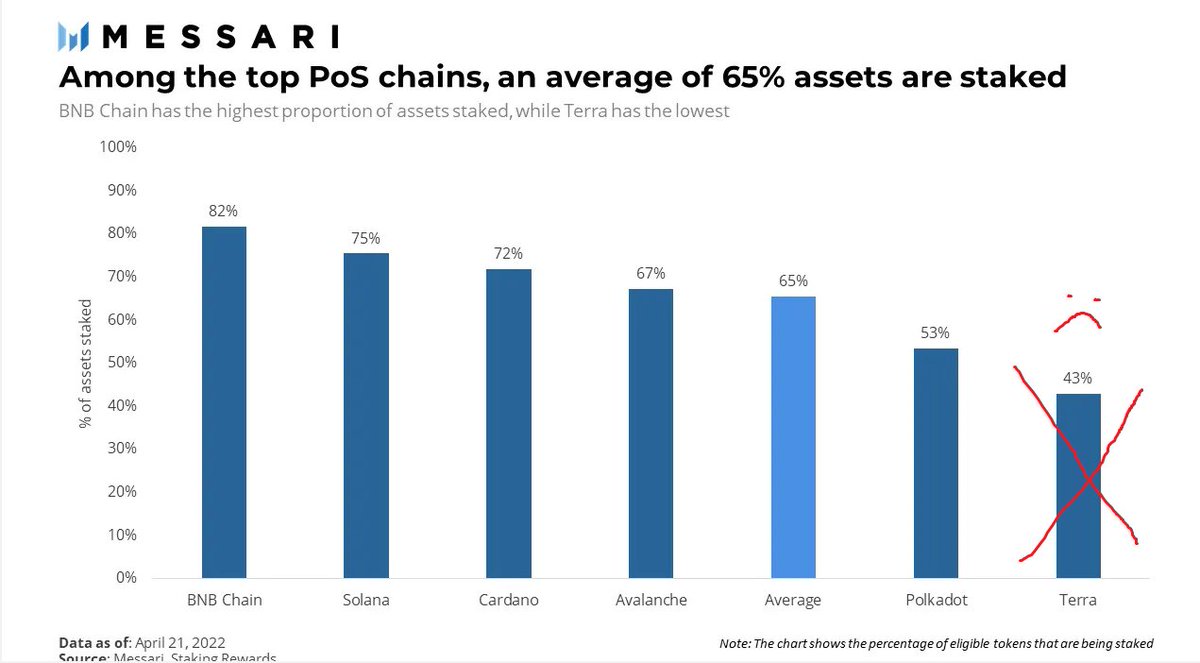

8. LSD bull market

Withdrawals in March lead to buyers looking for liq. Yields jump with trading inc in nxt bull. Eth staking is <15%. Other L1s 60+

Unlocks for @LidoFinance are done @Rocket_Pool lowers staking req inc demand. These tokens 2x+(NFA)

h/t@kunalgoel + @NorthRockLP

Withdrawals in March lead to buyers looking for liq. Yields jump with trading inc in nxt bull. Eth staking is <15%. Other L1s 60+

Unlocks for @LidoFinance are done @Rocket_Pool lowers staking req inc demand. These tokens 2x+(NFA)

h/t@kunalgoel + @NorthRockLP

9. Options notional$ exceeds $100b a mth

Options volume > spot in equities

Crypto spot > options volume by ~20x

Derbit has 92% of volume. Too high

The traditional options market has 4 major players vs 1 here. Watch for:

@lyrafinance

@dopex_io

@Buffer_Finance

@PremiaFinance

Options volume > spot in equities

Crypto spot > options volume by ~20x

Derbit has 92% of volume. Too high

The traditional options market has 4 major players vs 1 here. Watch for:

@lyrafinance

@dopex_io

@Buffer_Finance

@PremiaFinance

10. Move blockchains provide advantages vs solidity/rust based. These garner some interest/TVL. Aptos/Sui see over $1b in TVL as projects explore esp with ecosytem incent.

But unless a killer app hits they remain on the fringes of the L1 debate esp as Sol becomes Move compat.

But unless a killer app hits they remain on the fringes of the L1 debate esp as Sol becomes Move compat.

11. At least one AAA quality game launches...but game tokenomics remain a challenge

$3B invested in games in the last 2 years

Fun game plus upside opp / asset ownership > fun game where I dont own my assets

The fun part will happen in 2023

@illuviumio looks like a slam dunk

$3B invested in games in the last 2 years

Fun game plus upside opp / asset ownership > fun game where I dont own my assets

The fun part will happen in 2023

@illuviumio looks like a slam dunk

12. Eth dominance is cemented and rises to 70%+

-The bear helps Eth hit L1 escape velocity as it is as fast and as cheap as most need it to be by the end of 23

-Multiple zkEVMs hit mainnet

-Improvements to the EVM help mostly fight off new chains

-L2/L3s continue to incr. usage

-The bear helps Eth hit L1 escape velocity as it is as fast and as cheap as most need it to be by the end of 23

-Multiple zkEVMs hit mainnet

-Improvements to the EVM help mostly fight off new chains

-L2/L3s continue to incr. usage

13. Yet alt L1s still have a place..

-@solana regains top 10 status by mkt cap

-Decentralization is happening. Validator count 3xed in 21/22 across 35 countries + 100 data centers (h/t @JamesTrautman_)

-Strongest community/ecosys outside of Eth

-Most oversold

-Neon/SMS help

-@solana regains top 10 status by mkt cap

-Decentralization is happening. Validator count 3xed in 21/22 across 35 countries + 100 data centers (h/t @JamesTrautman_)

-Strongest community/ecosys outside of Eth

-Most oversold

-Neon/SMS help

14. Yet alt L1s still have a place..(continued)

-@cosmos enters the top 10. The app chain model is attractive for new protocols and diff value prop than Eth not just an EVM vamp attack

-Cosmos 2.0 finally lands and tokenomics are solved

-TVL recovers to half of pre Terra levels

-@cosmos enters the top 10. The app chain model is attractive for new protocols and diff value prop than Eth not just an EVM vamp attack

-Cosmos 2.0 finally lands and tokenomics are solved

-TVL recovers to half of pre Terra levels

15. Continued consolidation of L1s.

Eth, Cosmos, BNB and Solana occupy 90% market share of TVL up from ~70% today.

The risk of building mjr projects on alt L1s is too high. By the end of 2023 these handful of ecosystems can serve just about every use case imaginable.

Eth, Cosmos, BNB and Solana occupy 90% market share of TVL up from ~70% today.

The risk of building mjr projects on alt L1s is too high. By the end of 2023 these handful of ecosystems can serve just about every use case imaginable.

16. NFTs keep expanding beyond PFPs. At least 3 more major companies launch projects.

Ticketing, rewards programs, membership programs, in-game assets all continue to grow.

More companies get involved like @Starbucks, @BMW and @Reddit.

@0xPolygon is a big winner.

Ticketing, rewards programs, membership programs, in-game assets all continue to grow.

More companies get involved like @Starbucks, @BMW and @Reddit.

@0xPolygon is a big winner.

17. DAOs adoption, gov AUM (outside of Uni) and user growth stagnates.

DAO governance is too clunky and even the best DAOs dont do it. well. DAOs need better tooling, coordination models and trial/error.

Maybe this is a 2024 story.

DAO governance is too clunky and even the best DAOs dont do it. well. DAOs need better tooling, coordination models and trial/error.

Maybe this is a 2024 story.

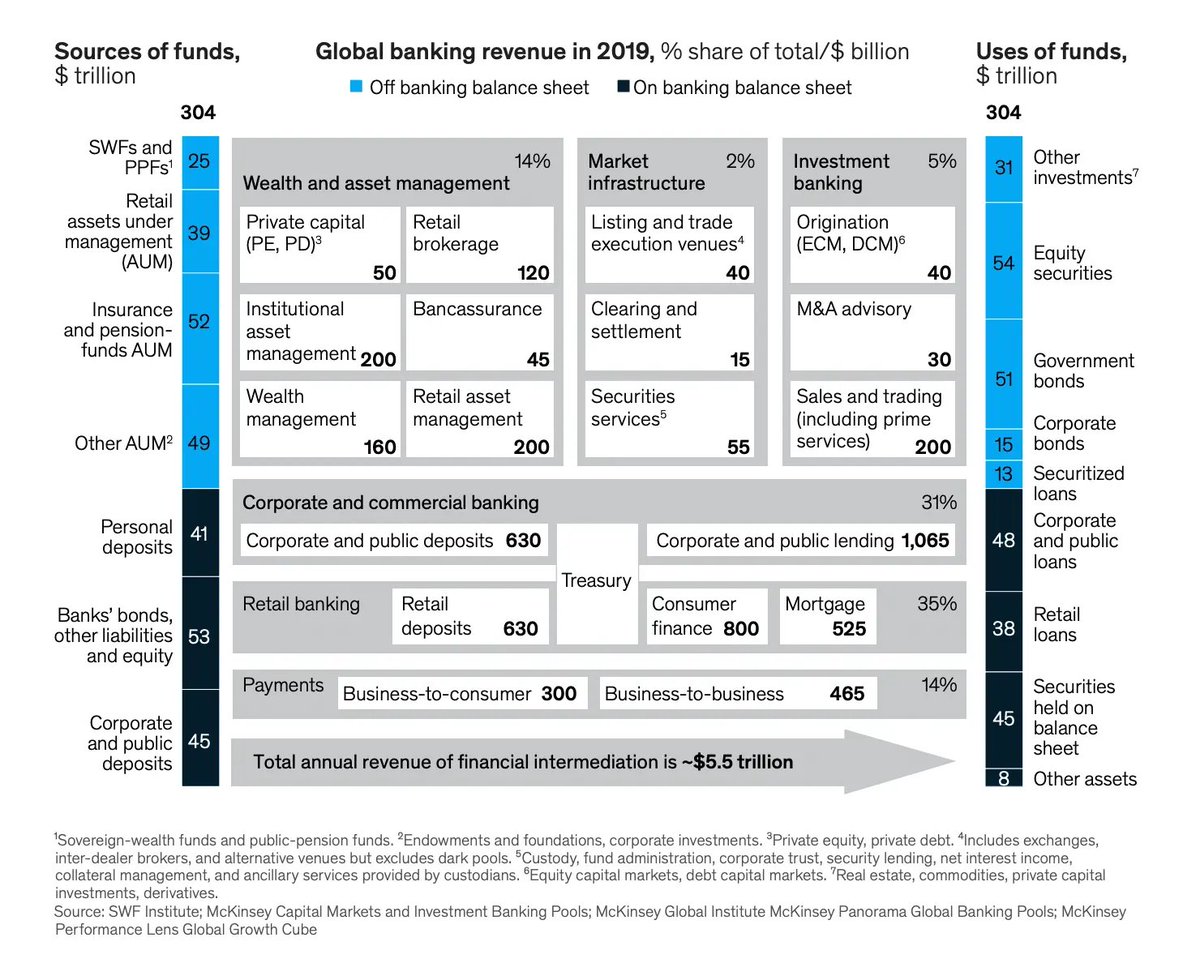

18. Inst. use the bear market + clearing regulatory environ. as an entry point. At least one big bank gets involved in a big way.

$5.5T take rate across transaction intermediaries. Tradfi needs to get in on disintermediating that bf defi eats their lunch. These guys arent dumb

$5.5T take rate across transaction intermediaries. Tradfi needs to get in on disintermediating that bf defi eats their lunch. These guys arent dumb

19. Crypto adoption continues to be a non-US story

Costs+corruption make stables go

The avg cost of sending money int. is 6%, according to the world bank, or $16B a yr

Stablecoins are effectively free.

This is crypto's most simple and straightforward use case at the moment

Costs+corruption make stables go

The avg cost of sending money int. is 6%, according to the world bank, or $16B a yr

Stablecoins are effectively free.

This is crypto's most simple and straightforward use case at the moment

20. Web2 devs move to Web3. We see close to 100k monthly active devs.

-Proliferation of Rust w/ EVM integrations (and Move which is v. sim) helps

-Layoffs in big tech

-Opp token upside > stock based comp post FANG meltdown

-College grads lean tech heavy. More crypto curious

-Proliferation of Rust w/ EVM integrations (and Move which is v. sim) helps

-Layoffs in big tech

-Opp token upside > stock based comp post FANG meltdown

-College grads lean tech heavy. More crypto curious

21. Self-custody has a new bull mkt w/ innovations like account abstraction/MPC @Ledger + @Trezor sales 2x. But this is a long term trend.

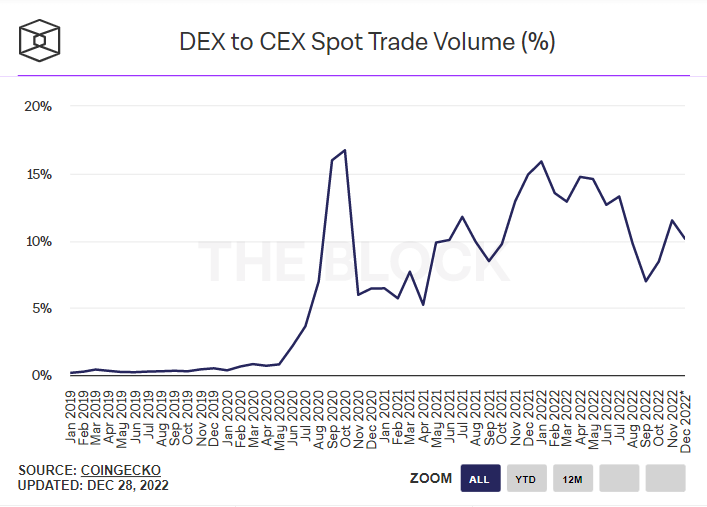

We see CEX volumes v DEX move back to ATHs as we onboard the normies. @coinbase finally finds a bottom in Q1 and runs in the Q3/Q4 23

We see CEX volumes v DEX move back to ATHs as we onboard the normies. @coinbase finally finds a bottom in Q1 and runs in the Q3/Q4 23

22. The #Flippening in Q4 23

BTC miners sell ~100% of the coins they mine

The 10 btc miners mined ~40.7k BTC + sold ~40.3k in 2022

This is a persistent headwind for BTC and for no other reason a good thesis to be bullish the ETCBTC ratio

Use cases > hard money in the nxt bull

BTC miners sell ~100% of the coins they mine

The 10 btc miners mined ~40.7k BTC + sold ~40.3k in 2022

This is a persistent headwind for BTC and for no other reason a good thesis to be bullish the ETCBTC ratio

Use cases > hard money in the nxt bull

23. MEV becomes the primary source of revenue for stakers and/or protocols (ie Uniswap) and trans fees trend towards zero across protocols

Hidden fees (ie payment for order flow) > explicit fees in tradfi. Same story here

(See our Book of MEV here messari.io/report/the-boo…)

Hidden fees (ie payment for order flow) > explicit fees in tradfi. Same story here

(See our Book of MEV here messari.io/report/the-boo…)

24. Fundamentals matter again.

Doge, Shiba, ETC, LTC all exit the top 20.

FDV, unlocks and inflation schedules are put in focus. Low float tokens are seen for what they are and valued as such.

Doge, Shiba, ETC, LTC all exit the top 20.

FDV, unlocks and inflation schedules are put in focus. Low float tokens are seen for what they are and valued as such.

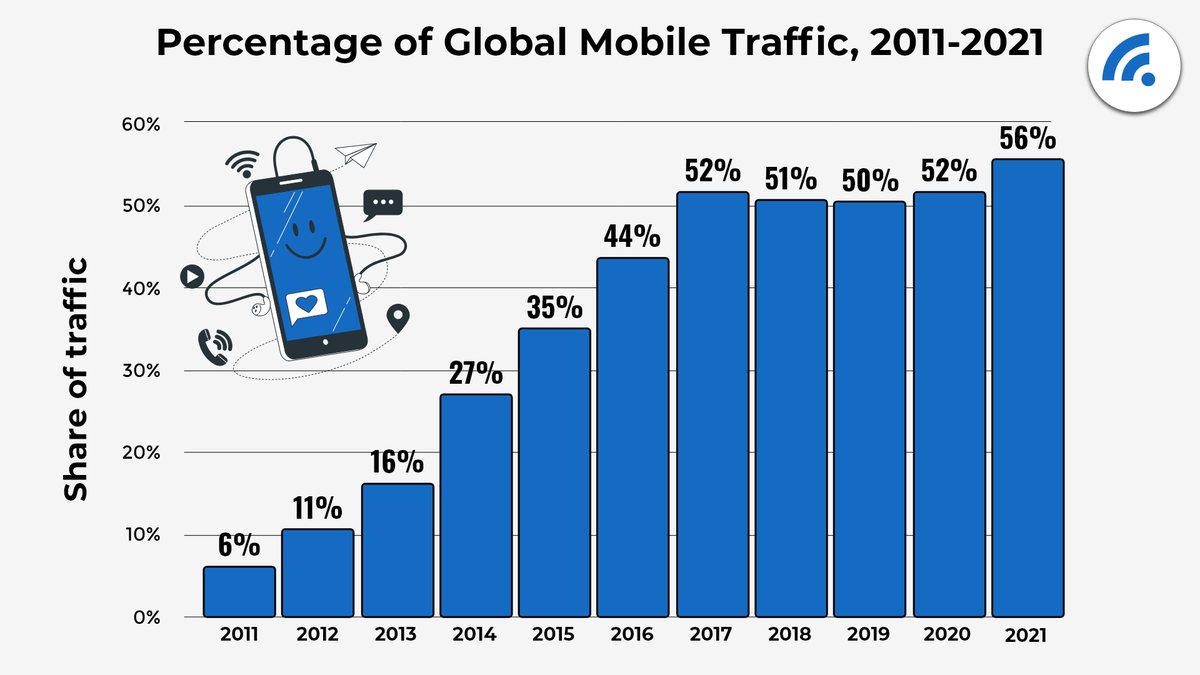

25. Mobile is the red pill many devs and consumers were looking for. @solana mobile is a hit. Many protocols follow suit.

Mobile greatly improves the UX. The friction of onboarding to trans/app use goes away.

Today we are effectively are ignoring 56% of int. traffic.

Mobile greatly improves the UX. The friction of onboarding to trans/app use goes away.

Today we are effectively are ignoring 56% of int. traffic.

Finally...

We look alot better at the 2023 Christmas/Thanksgiving parties.

You no longer get that "how you doing" look when you say you work and/or invest in crypto.

We look alot better at the 2023 Christmas/Thanksgiving parties.

You no longer get that "how you doing" look when you say you work and/or invest in crypto.

If you enjoyed RT and follow along

Read the theses from @MessariCrypto

Follow the smarter analysts for alfa: @jerrysun_ @kunalgoel @0xallyzach @_ChrisCollar @Saypien_ @chasedevens @eshita @kelxyz_ @Old_Samster @sunnydece @john_tv_locke

Read the theses from @MessariCrypto

https://twitter.com/twobitidiot/status/1605941285210054656?s=20&t=wDNZ9ZNE7iHX5Wiw_Gp8Og

Follow the smarter analysts for alfa: @jerrysun_ @kunalgoel @0xallyzach @_ChrisCollar @Saypien_ @chasedevens @eshita @kelxyz_ @Old_Samster @sunnydece @john_tv_locke

Coming for your crown @adamscochran

• • •

Missing some Tweet in this thread? You can try to

force a refresh