Head of Venture @ Varys Capital | Ex: Sr. Analyst @ Messari | CFA/CAIA | NFA |

TG: dunleavy89 for dms

4 subscribers

How to get URL link on X (Twitter) App

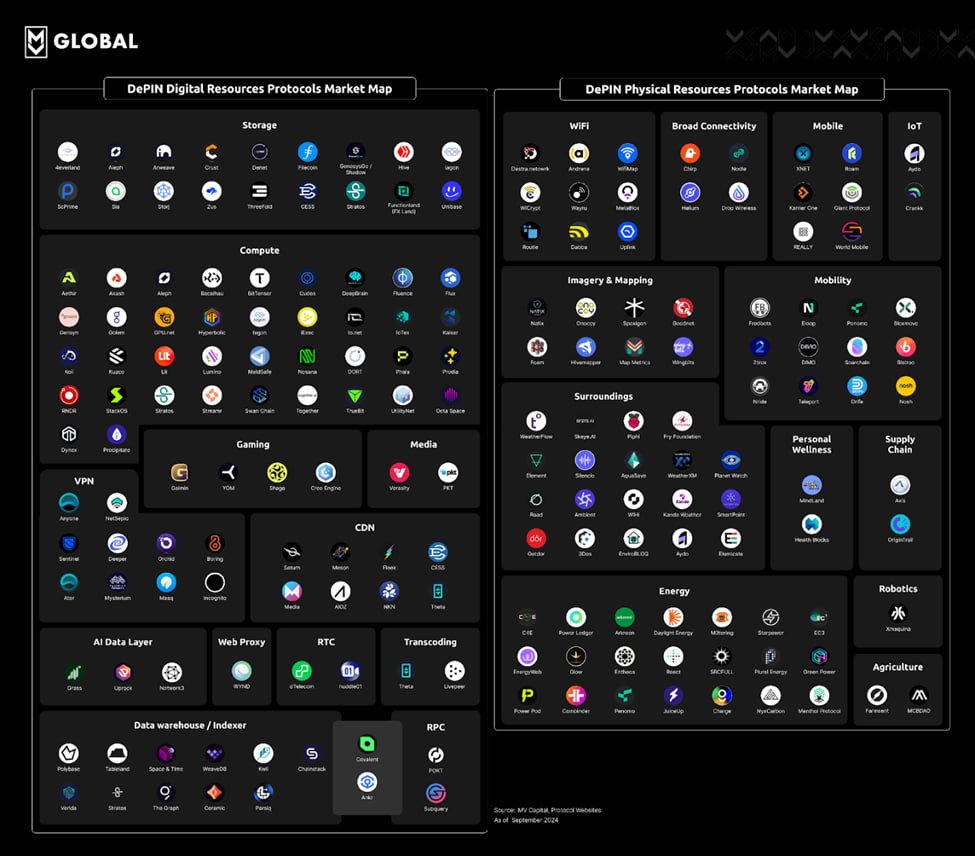

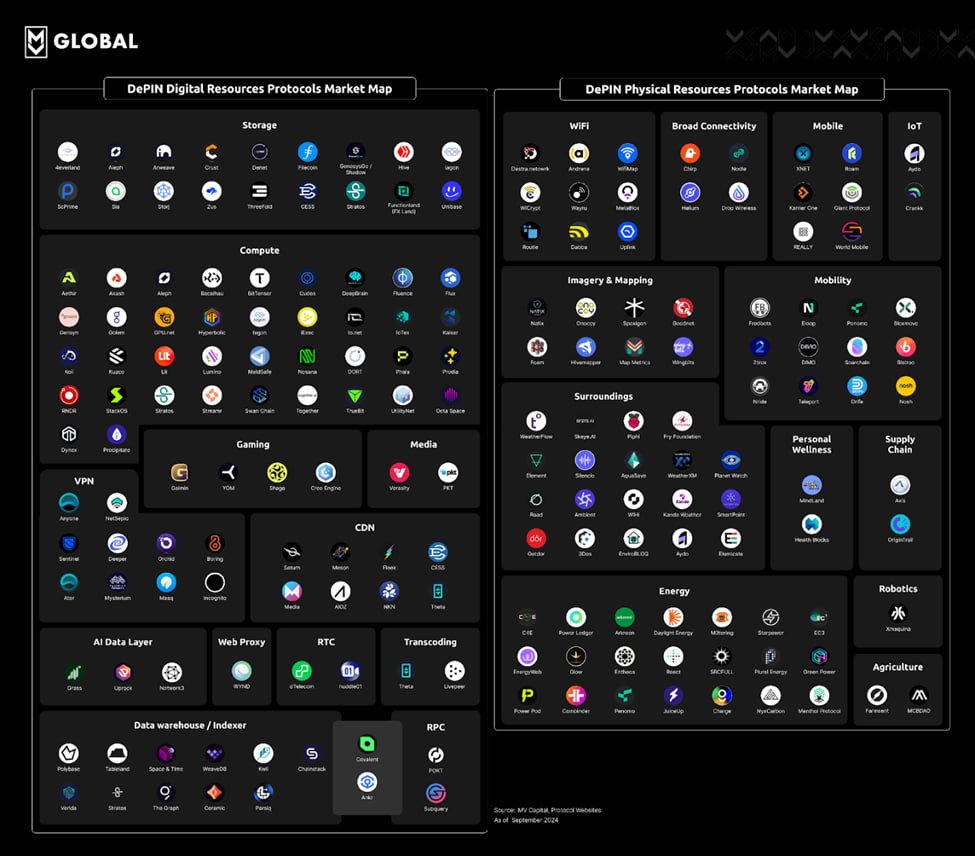

The DePIN landscape continues to rapidly evolve with over 1000 projects and over $50B in aggregate value built across both digital and physical resources.

The DePIN landscape continues to rapidly evolve with over 1000 projects and over $50B in aggregate value built across both digital and physical resources.

Attention

Attention

(2/6) Sizing the market. Potential AI benefits for all industries combined with strong funding leads to a massive expected impact on the global economy.

(2/6) Sizing the market. Potential AI benefits for all industries combined with strong funding leads to a massive expected impact on the global economy.

For Ethereum staking today there are a handful of major players with varying market shares: Lido (~31%) Coinbase (~12%), Rocketpool (~2%), Stakewise(<1%), and Frax (<1%).

For Ethereum staking today there are a handful of major players with varying market shares: Lido (~31%) Coinbase (~12%), Rocketpool (~2%), Stakewise(<1%), and Frax (<1%).

Starting with BTC/ETH.

Starting with BTC/ETH.

2/5 Network activity on blockchains has been known for quite some time to strongly correlate to prices

2/5 Network activity on blockchains has been known for quite some time to strongly correlate to prices

MEV is the ability for security providers to selectively insert, reorder, or censor user transaction requests during the block production process

MEV is the ability for security providers to selectively insert, reorder, or censor user transaction requests during the block production process

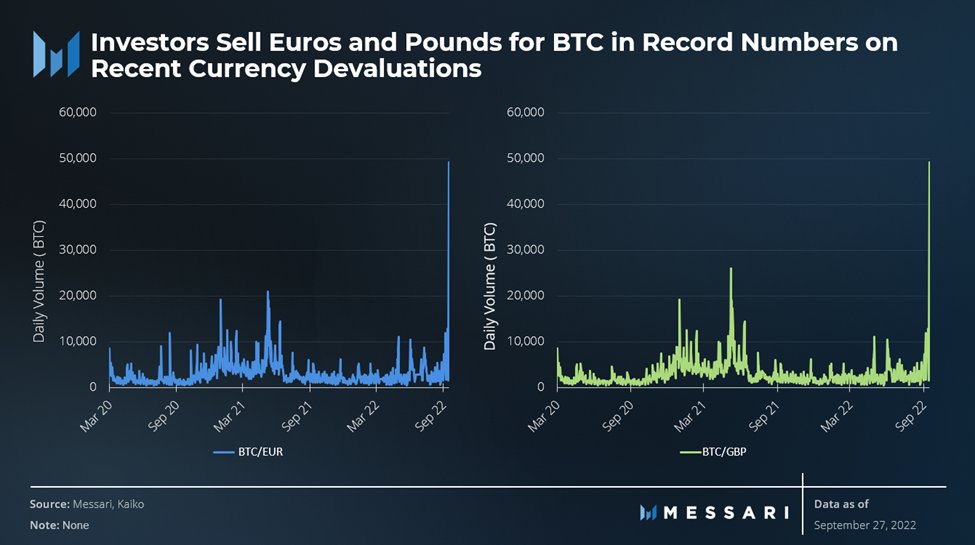

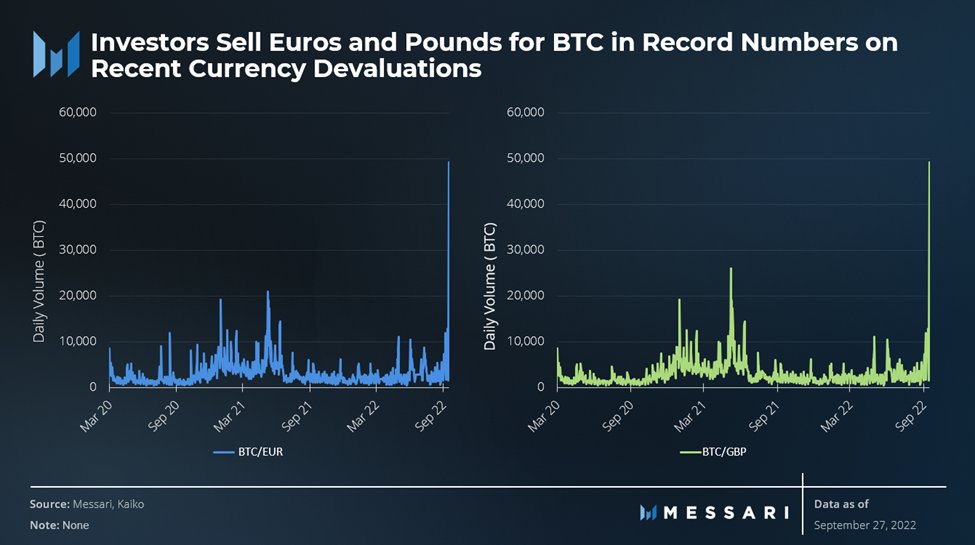

(2/6) What about other major crypto assets? Interestingly we haven't seen the same trend with Ether. Recent volumes are fairly unremarkable compared to the last 2 years. Hard money vs the world computer?

(2/6) What about other major crypto assets? Interestingly we haven't seen the same trend with Ether. Recent volumes are fairly unremarkable compared to the last 2 years. Hard money vs the world computer?

The consensus among CT is monolithic chains, wrapping exec, consensus, settlement + DA on one mainchain, are not the best way to scale

The consensus among CT is monolithic chains, wrapping exec, consensus, settlement + DA on one mainchain, are not the best way to scale

Lets start with the zk part. Each zkEVM plans to operate as an L2. L2s batch trans for cheaper costs + faster local processing while preserving sec of L1. L2s can by zk or op.

Lets start with the zk part. Each zkEVM plans to operate as an L2. L2s batch trans for cheaper costs + faster local processing while preserving sec of L1. L2s can by zk or op.

After sitting undeveloped for yrs, in 2021 Dogecoin found a recommitted group of developers.

After sitting undeveloped for yrs, in 2021 Dogecoin found a recommitted group of developers.

Today Cosmos allows builders more flexibility (language, inflation sch, trans fees, security, design, account model etc), interoperability between ecosystems, and also allows them the potential for value accrual (MEV, transaction costs, etc) for their own native token

Today Cosmos allows builders more flexibility (language, inflation sch, trans fees, security, design, account model etc), interoperability between ecosystems, and also allows them the potential for value accrual (MEV, transaction costs, etc) for their own native token