The Bank of Japan just set a new monthly record for bond purchases.

They bought more than $128 Billion in Japanese government bonds this month.

And today was the third day in a row of unscheduled purchases, including 2 year and 5 year bonds. Why it matters:

They bought more than $128 Billion in Japanese government bonds this month.

And today was the third day in a row of unscheduled purchases, including 2 year and 5 year bonds. Why it matters:

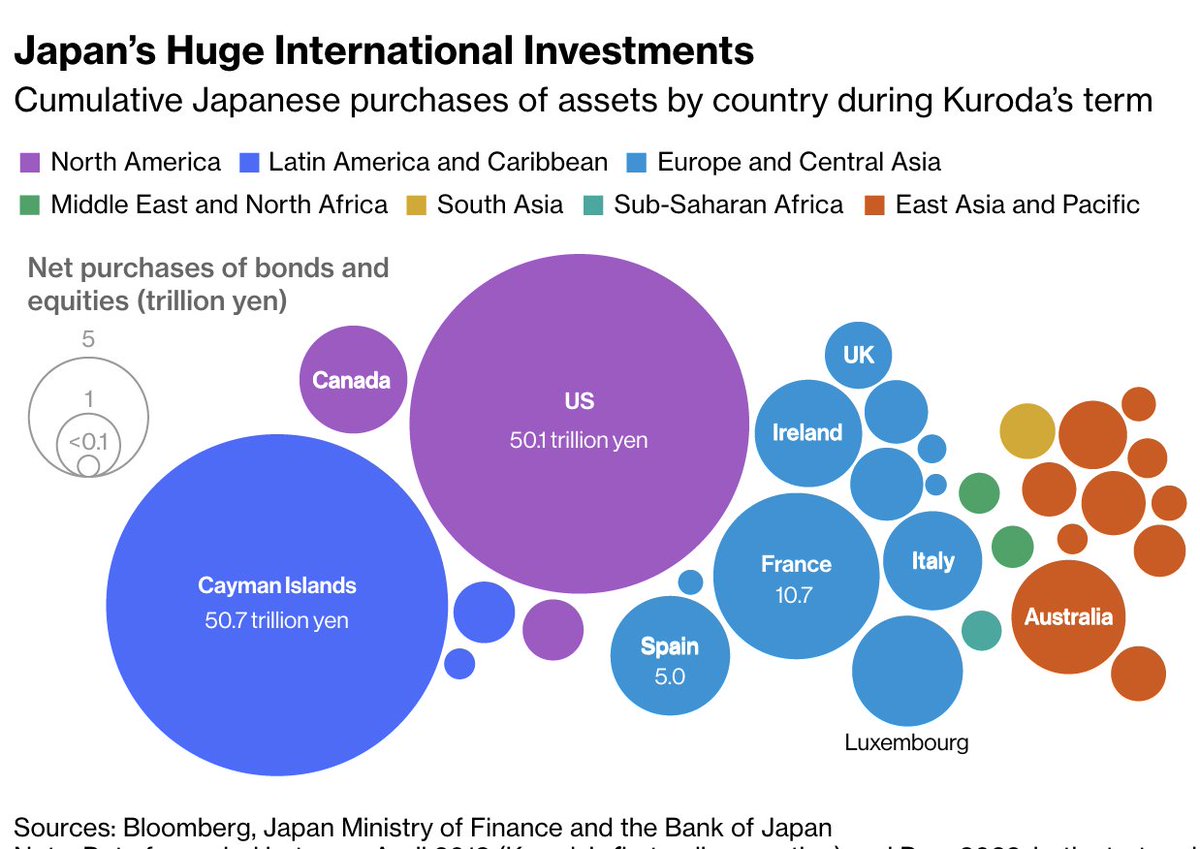

Japanese capital has propped up foreign debt and equity markets for years.

Ballpark figures: Japan has >$3 Trillion in foreign equity and >$5 Trillion in foreign debt instruments (IMF)

But what if that capital goes back to Japan, enticed by higher yields?

Ballpark figures: Japan has >$3 Trillion in foreign equity and >$5 Trillion in foreign debt instruments (IMF)

But what if that capital goes back to Japan, enticed by higher yields?

The YCC policy means Japanese bonds have had a price floor since 2016.

And global market participants have baked that floor into their calculations whether they know it or not.

If there are big changes to the YCC policy? All your models are destroyed. Completely devastated.

And global market participants have baked that floor into their calculations whether they know it or not.

If there are big changes to the YCC policy? All your models are destroyed. Completely devastated.

Spiking Japanese yields would lead to rising global yields (falling bond prices).

Rising global yields would worsen the sovereign debt trap in the medium term, and in the short term could cause global market chaos similar to the Gilt market blowup we saw in the fall (or worse).

Rising global yields would worsen the sovereign debt trap in the medium term, and in the short term could cause global market chaos similar to the Gilt market blowup we saw in the fall (or worse).

The BoJ insists they aren't turning hawkish.

But Japanese inflation is the highest its been since 1981.

And the unscheduled bond purchases in the past few days are an indication that traders believe the BoJ will be forced to let yields rise sometime in the near future.

But Japanese inflation is the highest its been since 1981.

And the unscheduled bond purchases in the past few days are an indication that traders believe the BoJ will be forced to let yields rise sometime in the near future.

Japan can't afford to turn hawkish.

They are so loaded with debt that an increase in rates will make their fiscal situation even more of a joke.

But they're stuck between a rock and a hard place.

They are so loaded with debt that an increase in rates will make their fiscal situation even more of a joke.

But they're stuck between a rock and a hard place.

Few understand the financial chaos that would be unleashed by significant changes to Japan's YCC policy.

Global asset prices, and really the whole fiat system, are largely held together by the money printers in the land of the rising sun.

That's why all eyes remain on Japan.

Global asset prices, and really the whole fiat system, are largely held together by the money printers in the land of the rising sun.

That's why all eyes remain on Japan.

• • •

Missing some Tweet in this thread? You can try to

force a refresh