Detailed Analysis on the business of #NavinFluorine 🧪🧪

CMP - ₹3942

Like and retweet for maximum reach!!

CMP - ₹3942

Like and retweet for maximum reach!!

1. COMPANY OVERVIEW

NFIL was incorporated in 1967 and is part of the Padmanabh Mafatlal Group. It is one of the largest manufacturers of specialty fluorochemicals in India with manufacturing facilities at Surat and Dahej in Gujarat and at Dewas in Madhya Pradesh. The company

NFIL was incorporated in 1967 and is part of the Padmanabh Mafatlal Group. It is one of the largest manufacturers of specialty fluorochemicals in India with manufacturing facilities at Surat and Dahej in Gujarat and at Dewas in Madhya Pradesh. The company

manufactures specialty fluorochemicals in its Surat and Dahej facility which find applications in end-use industries such as Pharmaceuticals, Agrochemicals, Dyes and Pigments and others. The company does its CRAMS operations from its facility at Dewas in Madhya Pradesh which

caters to European and American pharma innovator companies. The company produces over 60 fluorinated products and more than 40% of these products are exported to markets like North America, Europe, Middle East and Asia Pacific

2. BUSINESS SEGMENTS

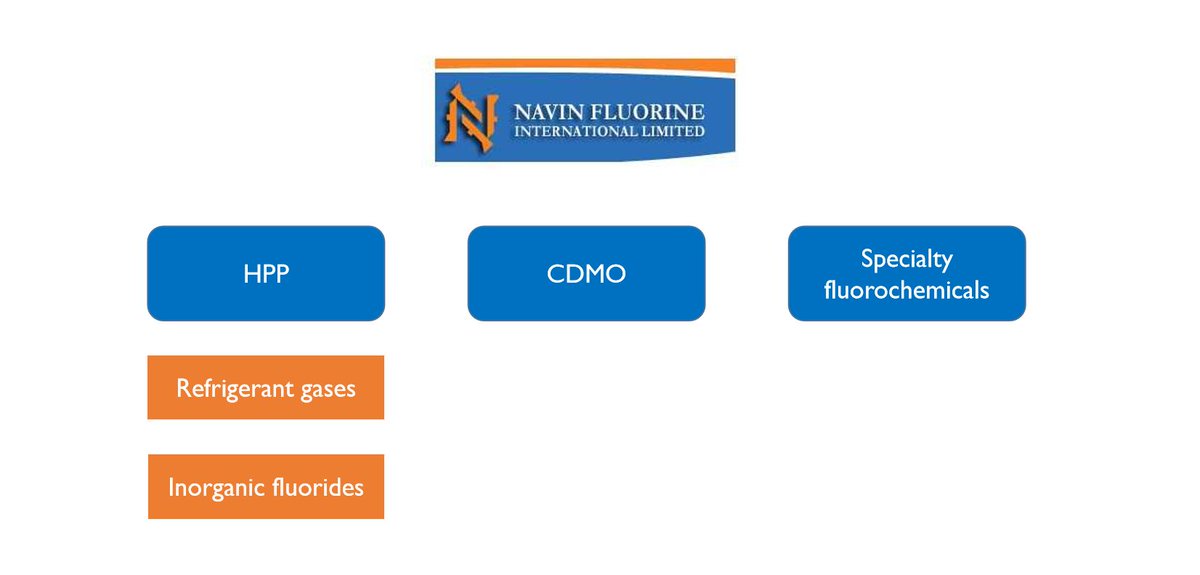

The company has done a corporate restructuring of their business. Earlier, the company had 4 business verticals which were Refrigerants, Bulk Fluorides, Specialty Fluorochemicals and CRAMS. Now, they have clubbed the Refrigerants, Bulk Fluorides and the newly

The company has done a corporate restructuring of their business. Earlier, the company had 4 business verticals which were Refrigerants, Bulk Fluorides, Specialty Fluorochemicals and CRAMS. Now, they have clubbed the Refrigerants, Bulk Fluorides and the newly

added High Performance Product(HPP) into HPP vertical which is headed by CEO Mr Partha Roychowdhury. The CRAMS vertical has been renamed as CDMO and is headed by CEO Mr Ravi Venkataramanan who has got around 30 years of experience in the pharma industry and has worked on both the

pharma side and CDMO side. The Specialty Fluorochemicals which is now known as Specialty Chemicals vertical is headed by CEO Mr Amrit Singh who has a good experience in agrochemicals. The new corporate structure of the company is as follows:

3. REVENUE SPLIT BY BUSINESS SEGMENTS

The charts shown in the images below show the revenue wise split of business segments of NFIL along with the revenue share of the refrigerant gas business. As you can see from the chart, NFIL reduced the contribution of refrigerant gases from

The charts shown in the images below show the revenue wise split of business segments of NFIL along with the revenue share of the refrigerant gas business. As you can see from the chart, NFIL reduced the contribution of refrigerant gases from

55% in 2011 to 19% in 2022. This shift was because of the conditions laid out by the Kyoto and Montreal Protocol and also the shift of focus of the company’s management from the legacy business of refrigerants to the high value business of Specialty Fluorochemicals and CRAMS.

This can be seen in the chart of the business segments where the Specialty Fluorochemicals and CRAMS together contributed 41% of the revenues in 2013 and in FY22 they contributed to almost 60% of the company’s revenues

4. JOINT VENTURE

SWARNIM GUJARAT FLUORSPAR PVT LTD

NFIL used to source most of its fluorspar from China in 2009. Due to export restrictions imposed by China, NFIL started sourcing fluorspar from Kenya and South Africa and as of now they source very a small portion of their

SWARNIM GUJARAT FLUORSPAR PVT LTD

NFIL used to source most of its fluorspar from China in 2009. Due to export restrictions imposed by China, NFIL started sourcing fluorspar from Kenya and South Africa and as of now they source very a small portion of their

fluorspar requirement from China. In 2012,NFIL entered into a joint venture with Gujarat Mineral Development Corporation and GFL with the name of the entity being Swarnim Gujarat Fluorspar Pvt Ltd. NFIL owns a 25% stake in this JV and with the help of this JV, NFIL has ensured

for itself a continuous supply of acid grade & metallurgical grade fluorspar from a local source

5. FUTURE OUTLOOK

i. HPP(REFRIGERANTS)

In 2020, NFIL entered into a long-term supply agreement with Honeywell for the supply of HFO-1233zd.The contract is worth $410 million and is

5. FUTURE OUTLOOK

i. HPP(REFRIGERANTS)

In 2020, NFIL entered into a long-term supply agreement with Honeywell for the supply of HFO-1233zd.The contract is worth $410 million and is

expected to give a total revenue of Rs 2800 crore over the next 7 years. To support this contract, NFIL through it’s wholly owned subsidiary NFASL did a capex of Rs 436 crore in Dahej out of which Rs 365 crores was for the dedicated manufacturing facility and the remaining amount

was for a captive power plant. This capacity has come online and the company has started trial supplies in Q2FY23. The company expects to begin commercial supplies shortly

The company had announced a capex of Rs 80 crores for R-32 plant in the last quarter. Before this capex announcement, the company was using one of it’s R22 lines for making R32. This capex is expected to come online in Q1FY24. The full ramp-up of the capacity is expected to

happen in CY24 and the expected revenue potential of this plant is around Rs 200 crores at ramp-up.The initial capacity of this plant would be 4000 TPA and the company has evaluated plans to add another 30000 TPA capacity using efficient liquid phase technology

The company is in discussions with it’s board of directors to set up a large facility at Dahej for HF of 3200 tons which will increase the overall HF capacity for the company once the project gets approved by the board and comes online

ii. CRAMS AND SPECIALTY FLUOROCHEMICALS

The board of directors of the company approved a capex of Rs 195 crores in December 2020 for the manufacturing of specialty fluorochemicals which will have use in life sciences and crop protection. This facility will be set up in Dahej.

The board of directors of the company approved a capex of Rs 195 crores in December 2020 for the manufacturing of specialty fluorochemicals which will have use in life sciences and crop protection. This facility will be set up in Dahej.

This capex has a revenue potential of Rs 260 to Rs 280 crores and asset turnover ratio of 1.35x to 1.45x at peak capacity. This plant will be operated by Navin Fluorine Advanced Sciences Ltd(NFASL) which is a fully owned subsidiary of NFIL. This capacity is expected to come

online in H1FY23

NFASL has entered into a multi-year agreement worth Rs 800 crore over a period of 5 years for the supply of a key agrochemical fluoro-intermediate to a multinational company. NFASL has announced a capex of Rs 125 crore in this regard which includes the Rs 14

NFASL has entered into a multi-year agreement worth Rs 800 crore over a period of 5 years for the supply of a key agrochemical fluoro-intermediate to a multinational company. NFASL has announced a capex of Rs 125 crore in this regard which includes the Rs 14

crore which will be used in the expansion of the effluent treatment plant. This facility will be setup in Dahej and the company plans to fund this investment with a mix of internal accruals and debt. The supplies are expected to being by the end of FY23

The investments in Dahej on the crop protection side will help the company to enhance its product offerings and strengthen it’s customer relationships. The company expects these investments to be the foundation for the next phase growth of their Specialty Fluorochemicals business

In 2022, NFASL announced a capital expenditure of Rs 540 crore to manufacture and supply a key fluoro specialty molecule to a multinational company under a multi-year agreement. This molecule has a peak revenue potential of Rs 600 crore. The plant will be setup in Dahej and is

expected to be come online in December 2023.The company plans to fund this capex with a mix of debt and internal accruals

The project has a strategic importance for the company as they will be selling part of the produced volume directly to their technology partner and the rest of the volume will be sold to other customers and also will be used captively for manufacturing of downstream derivatives.

This molecule which the company is planning to develop will act as a critical fluorine building block which will be used in a number of value chains to manufacture downstream derivatives. The company has tied up with a technology partner for the production of this product and the

company would be the only company to manufacture the product using this technology which is a much superior and environmentally friendly technology as compared to the other technologies which are environmentally unfriendly. Some of the plants using the other technology have

started to get closure notices.The company has strong relationships with it’s technology partner up to the CEO level and plans to grow this relationship to more than $100million going forward.

On the Specialty Chemicals side, the molecules which were developed by the company for

On the Specialty Chemicals side, the molecules which were developed by the company for

pharma were mostly going towards ARV, thus ARV was an important segment historically for the company. The company taking into account the current slowdown in that area has managed to shift its assets towards other product applications thus reducing it’s dependency on the ARV side

2 new additional plants are scheduled to come online in Q3 FY23 at Dahej. One of them is an MPP whose production will begin in a phased manner while the other plant is dedicated for an agrochemical customer whose production is expected to commence in December. The total capex

done here is of Rs 320 crores out of which Rs 195 crore is for the MPP and the remaining Rs 125 crore is for the dedicated facility

The debottlenecking process of the cGMP-3 plant in Dewas is under progress with a capital outlay of Rs 75 crores which will be completed by Q3FY23 leading to further capacity expansion.The company has received a purchase order of $16 million for a molecule which will be required

by one of their pharma clients for their late-stage clinical trials.The company is in discussions with it’s customer for specific delivery dates regarding this molecule and expects to begin supplying this molecule in the remaining 2 quarters of FY23.The company is in discussions

with it’s board of directors for a new cGMP-4 facility as it is expecting a strong demand on the CDMO side in Q4 and they expect to do $11 million worth of invoicing in Q3

Check out the New Year Offer on the Micro Cap Club membership:

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh