1. Company Overview:

Apollo Pipes is among the top 10 leading piping solution providing Company in India. Headquartered at Delhi, the Company enjoys strong brand equity in the domestic markets. With more than three decades of experience in the Indian PVC Pipe Market, Apollo

Apollo Pipes is among the top 10 leading piping solution providing Company in India. Headquartered at Delhi, the Company enjoys strong brand equity in the domestic markets. With more than three decades of experience in the Indian PVC Pipe Market, Apollo

Pipes holds a strong reputation for high quality products and an extensive distribution network.

2. Management:

i. Mr Sanjay Gupta, Chairman, is an entrepreneur with an experience over three decades in various steel industry segments and he has spearheaded the Company’s growth.

2. Management:

i. Mr Sanjay Gupta, Chairman, is an entrepreneur with an experience over three decades in various steel industry segments and he has spearheaded the Company’s growth.

He is serving as Chairman and Managing Director of APL Apollo Tubes Limited, one of the leading manufacturing Companies in Steel & Iron Pipe segment of India.

ii. Mr Sameer Gupta, MD, has graduated from Shri Ram College of Commerce, Delhi University. He joined the family business in an early age and established the PVC Pipes unit business.

3. Products

HDPE - Used for gas and fluid transfer, also as a replacement for Steel pipes. It is a part of agri segments. The HDPE pipes are mainly supplied to governmental contracts and agri uses. It contributes around 9% of the revenue

HDPE - Used for gas and fluid transfer, also as a replacement for Steel pipes. It is a part of agri segments. The HDPE pipes are mainly supplied to governmental contracts and agri uses. It contributes around 9% of the revenue

UPVC plumbing pipes are made of Unplasticized Polyvinyl Chloride a low maintenance and low-cost material that is widely used in buildings for distribution of potable water, or water transfer in bathrooms, kitchens, sink, laboratories, etc. It is used in

both agri and buildings categories.

CPVC (chlorinated polyvinyl chloride) is a strong and rigid thermoplastic material that is used for hot and cold potable water applications in residential construction. Because of its makeup, CPVC is immune to damage from highly chlorinated

CPVC (chlorinated polyvinyl chloride) is a strong and rigid thermoplastic material that is used for hot and cold potable water applications in residential construction. Because of its makeup, CPVC is immune to damage from highly chlorinated

domestic water and has a higher temperature tolerance than PVC.

Bath Fittings - These product ranges from faucets, hand and head showers, health faucets, cisterns, seat covers, allied product and other bathroom accessories. These products have better margins of around 15-20%

Bath Fittings - These product ranges from faucets, hand and head showers, health faucets, cisterns, seat covers, allied product and other bathroom accessories. These products have better margins of around 15-20%

Water storage tanks, namely Apollo Life, is the new addition to company’s product portfolio in 2020. It is the fastest growing product of the company. This product was already being sold by existing dealers, who were very much keen regarding the same product being introduced by

the company.

Introduced PPR segment in Q1 FY23 with complete range of pipes and fittings products in major demand from north India and are receiving good response from distributors. Very few players dominate this space, with market of about 14 billion INR. Company is targeting

Introduced PPR segment in Q1 FY23 with complete range of pipes and fittings products in major demand from north India and are receiving good response from distributors. Very few players dominate this space, with market of about 14 billion INR. Company is targeting

100cr in 2-3 years from this product. PPR is comparatively expensive than other polymers. The product is even higher in quality than CPVC. In some cold regions, even CPVC fails. And it is only PPR which is used. Even in Europe PPR is widely used and accepted.

4. Margins:

Margins for irrigation and agriculture applications based products is less than 10% whereas for building products is around 15%. Bath Fittings products gives margins of around 15-20%. Water tanks gives margins over 25%.

Margins for irrigation and agriculture applications based products is less than 10% whereas for building products is around 15%. Bath Fittings products gives margins of around 15-20%. Water tanks gives margins over 25%.

5. Plants:

Apollo Pipes has a total capacity of 125200 MTPA. Company has 2 plants in UP in Dadri and Sikanderabad, to cater strong north market for the company. Company has 1 plant each in Ahmedabad, Bangalore, and Raipur to distribute in Western, Southern and eastern market.

Apollo Pipes has a total capacity of 125200 MTPA. Company has 2 plants in UP in Dadri and Sikanderabad, to cater strong north market for the company. Company has 1 plant each in Ahmedabad, Bangalore, and Raipur to distribute in Western, Southern and eastern market.

Company is currently planning capacity expansion in northern India, where company market is deeply penetrated. In other regions is increasing footholds, and thereby improving capacity utilisation before making any additional expansion.

6. Distribution network:

Apollo pipes has 600-700 direct channel partners and who are supplying its products to at least 25000 retailers. Company enjoys a dominant presence in North India, 60-70% of its channel partner are from this region. Company’s is planning dealer addition

Apollo pipes has 600-700 direct channel partners and who are supplying its products to at least 25000 retailers. Company enjoys a dominant presence in North India, 60-70% of its channel partner are from this region. Company’s is planning dealer addition

of 10-15% every year to have a pan India presence. Company is shifting its strategy towards increasing the number of dealers and retailers who are attached with the distributors, so the distributors have confidence that the Company is working with them for the post sales.

7. Marketing:

Apollo Pipes have recently appointed Tiger Shroff and Raveena Tandon as their brand ambassadors. Company launched social media campaign during Q3 FY 2022, which has generated strong response on social media platforms. Company launched TV commercial during the

Apollo Pipes have recently appointed Tiger Shroff and Raveena Tandon as their brand ambassadors. Company launched social media campaign during Q3 FY 2022, which has generated strong response on social media platforms. Company launched TV commercial during the

Q1 FY 23 which has garnered good response. This will help company strengthen its brand position in the market. Company also gives extra incentives to its distributors and influencers (plumbers).

8. Revenue Mix:

Company Earns 55% of its Revenue from Building products and remaining from Agri Products. This mix was 35-65 three years ago. Revenue share for Value Added products is 35%. Company’s Plan is to increase this share to 50% in next two years. The company is

Company Earns 55% of its Revenue from Building products and remaining from Agri Products. This mix was 35-65 three years ago. Revenue share for Value Added products is 35%. Company’s Plan is to increase this share to 50% in next two years. The company is

increasingly focused on Building segments which gives higher margins.

9. Company’s Key focus areas:

Company’s key focus areas are

a) Strengthen foothold in existing markets of North and West and South India.

b) Undertake a phase-wise capacity expansion at the existing

9. Company’s Key focus areas:

Company’s key focus areas are

a) Strengthen foothold in existing markets of North and West and South India.

b) Undertake a phase-wise capacity expansion at the existing

facilities over the next few quarters.

c) Register solid growth in sales – targeting revenue growth of around 25%+.

d) Penetrate and establish footprint into neighbouring markets in Central and Eastern India.

e) Improve utilization at the existing manufacturing plants at

c) Register solid growth in sales – targeting revenue growth of around 25%+.

d) Penetrate and establish footprint into neighbouring markets in Central and Eastern India.

e) Improve utilization at the existing manufacturing plants at

all facilities.

f) Undertake various brand building exercises and establish stronger brand recall in the established markets of North and Western India.

10. Future Capex:

Apollo is planning to expand further in North India, where its market are already deeply penetrated.

f) Undertake various brand building exercises and establish stronger brand recall in the established markets of North and Western India.

10. Future Capex:

Apollo is planning to expand further in North India, where its market are already deeply penetrated.

In other regions is increasing footholds, and thereby improving capacity utilisation before making any additional expansion. Any Capex, which will be incurred, will have three checks. One is, that Capex in a year will not exceed 30%, 35% of company’s EBITDA. Second, any organic

Capex will be funded from internal cash flows mostly, without stretching much of the balance sheet. Third, incremental Capex which will take place, will be mostly towards the value-added products and where ROCs or IRRs will be upwards of 25%, 30%.

11. Financials:

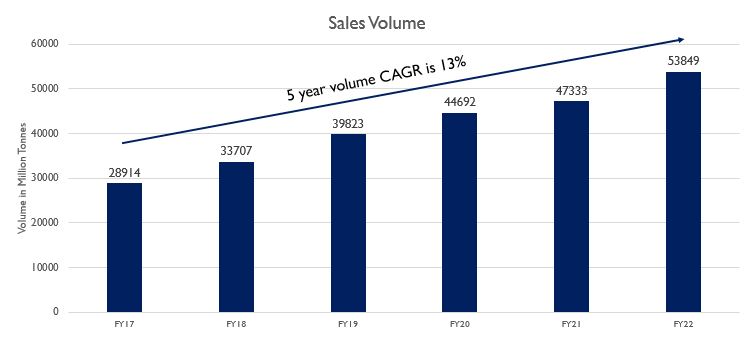

Apollo pipes revenue grew 27% CAGR to 784cr in FY22 from 241cr in FY17 in 5 years. Company is expecting revenue of 1000 cr this fiscal, almost doubling its revenue in 2 years. Company is targeting revenue at 30% CAGR for next three years and targeting 2000 crore

Apollo pipes revenue grew 27% CAGR to 784cr in FY22 from 241cr in FY17 in 5 years. Company is expecting revenue of 1000 cr this fiscal, almost doubling its revenue in 2 years. Company is targeting revenue at 30% CAGR for next three years and targeting 2000 crore

revenue. Volume has increased 13% CAGR in five years to 53849 MT

12. EBITDA Margins: Its EBITDA Margin is around 11%. It is expected that margins will improve because of

a) Falling PVC prices;

b) Increasing focus on value added product;

c) Branding expenditure; and

12. EBITDA Margins: Its EBITDA Margin is around 11%. It is expected that margins will improve because of

a) Falling PVC prices;

b) Increasing focus on value added product;

c) Branding expenditure; and

Check out the New Year Offer on the Micro Cap Club membership:

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh