1/ For as long as there has been UN global climate diplomacy, developing countries have had 2 asks - rich countries should go green first & fast.

While they have argued for gradual transitions. 2022 showed developing countries underestimated 2 big factors

africanclimatefoundation.org/wp-content/upl…

While they have argued for gradual transitions. 2022 showed developing countries underestimated 2 big factors

africanclimatefoundation.org/wp-content/upl…

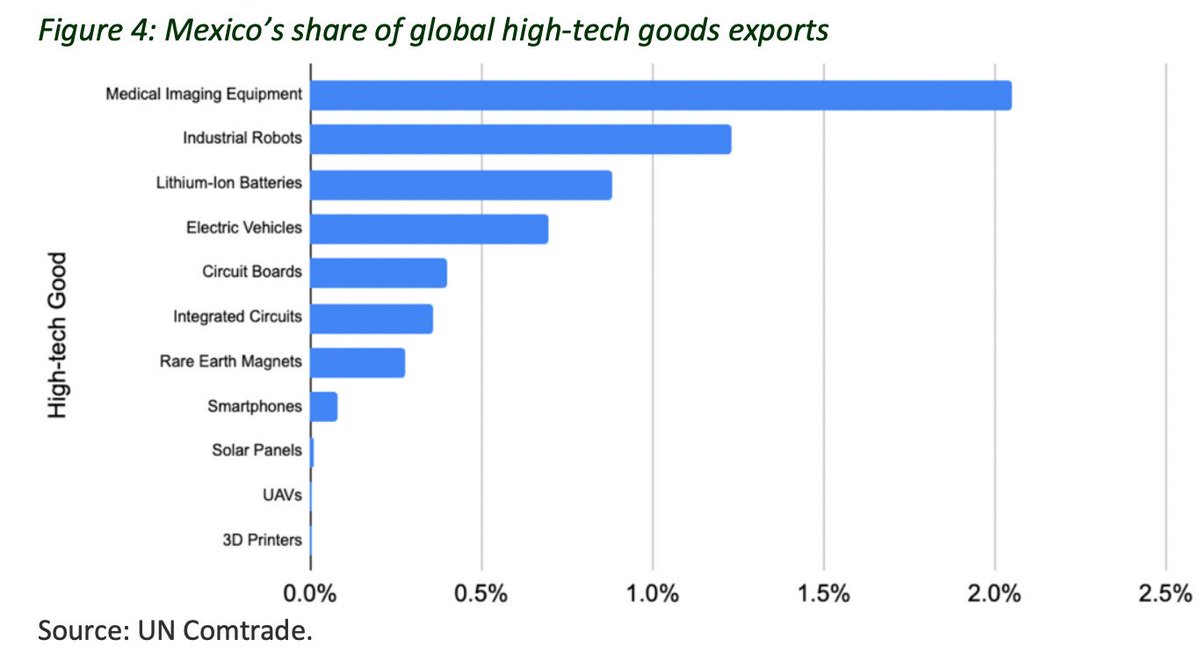

2/ Firstly, energy transitions do not happen in a vacuum. Each country is highly exposed to decisions made by others.

Decisions to launch wars,interest rate decisions, Industrial policy legislation in rich countries that can make developing countries export sectors uncompetitive

Decisions to launch wars,interest rate decisions, Industrial policy legislation in rich countries that can make developing countries export sectors uncompetitive

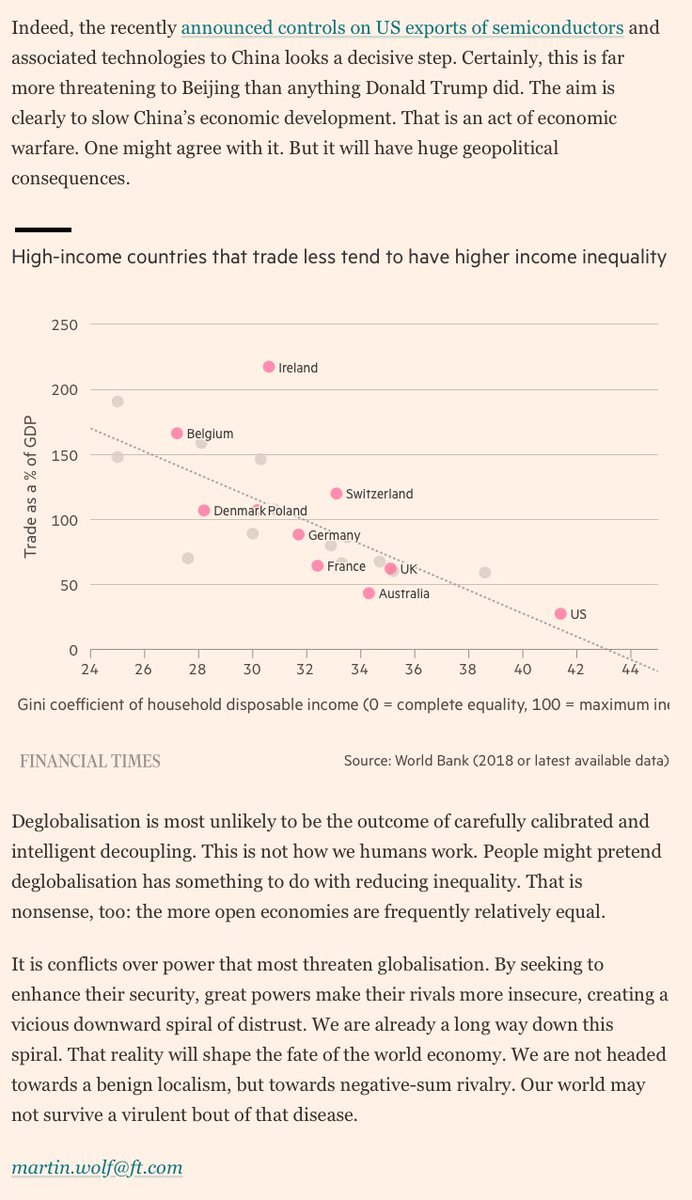

3/ Secondly, cost of capital is cheaper in rich world, pricier in developing countries. While Climate damages are concentrated in global south

So when climate risk is taken into account,developing countries have to pay even higher capital costs -> slowing their energy transition

So when climate risk is taken into account,developing countries have to pay even higher capital costs -> slowing their energy transition

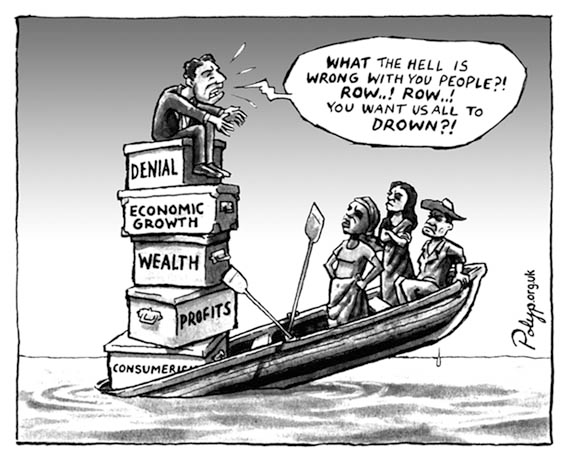

end/ Therefore, there is no solution to Climate crisis that does not change intl financial architecture.

No solution to Global Debt crisis that does not change the hierarchy of nations

Read @kmac on Debt & Climate

phenomenalworld.org/analysis/cop26…

No solution to Global Debt crisis that does not change the hierarchy of nations

Read @kmac on Debt & Climate

phenomenalworld.org/analysis/cop26…

Thread for those interested in our new polycrisis project. Sign up link here: mailchi.mp/newsletter.jfi…

https://twitter.com/70sBachchan/status/1608878657178832896

Without considering cost of capital,Greens risk "1) overpromise on pluses & ignore the real costs & trade-offs of #mitigation 2) tout the attractiveness & cheapness of #renewables as self-evident 3) & ignore the climate vs development trade-offs"

Thread

Thread

https://twitter.com/SonyKapoor/status/1616421189764935680

• • •

Missing some Tweet in this thread? You can try to

force a refresh