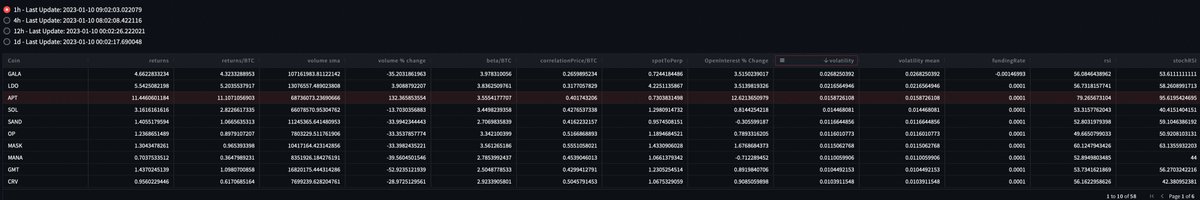

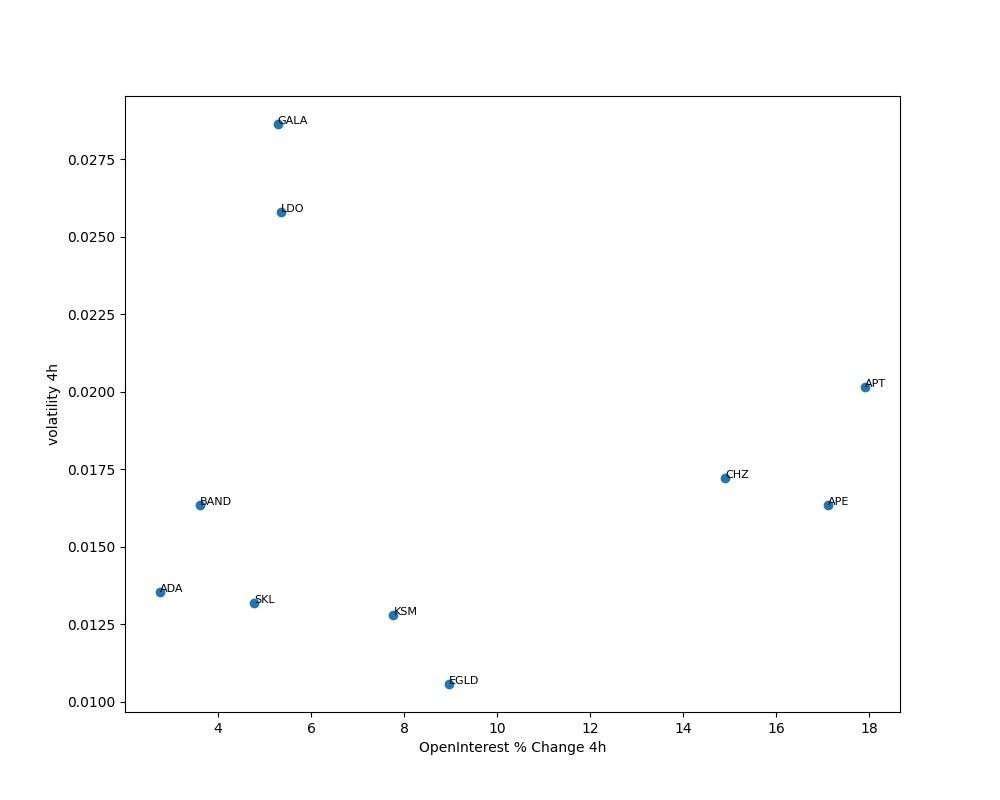

4/ #APT #APE and #CHZ overperforming BTC in past hours, while continuing to have increasing oi. Probably some more returns on it to come.

5/ There is a unlock on APT coming up tomorrow.

https://twitter.com/rogeravax/status/1612745887243030530

6/ #APT is a new coin and not much data to bank on. But seems like it is flipping a consolidation level (green) and could target the (pink) above. If rest of the market continues to hold that is.

7/ Check out Espresso for frequent coverage on macro and crypto confluences. jarvislabs.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh