The @ethereum Shanghai Upgrade is around the corner, enabling the withdrawal of staked $ETH.

In this 👇🧵we will take you for a deep dive of the upgrade, an analysis of the potential outcomes.

#CryptoResearch

In this 👇🧵we will take you for a deep dive of the upgrade, an analysis of the potential outcomes.

#CryptoResearch

We'll cover👇:

1/ What is Shanghai Upgrade

2/ Withdrawals

3/ More people might stake $ETH afterwards

4/ Additional rewards

5/ Conclusion

1/ What is Shanghai Upgrade

2/ Withdrawals

3/ More people might stake $ETH afterwards

4/ Additional rewards

5/ Conclusion

1/

After the Merge on Sep 2022, the withdrawal of staked $ETH is the last puzzle. Shanghai Upgrade includes withdrawals of $ETH staked in the Beacon Chain since Dec 2020, finally giving the network participants the ability to take out their locked $ETH.

After the Merge on Sep 2022, the withdrawal of staked $ETH is the last puzzle. Shanghai Upgrade includes withdrawals of $ETH staked in the Beacon Chain since Dec 2020, finally giving the network participants the ability to take out their locked $ETH.

2/

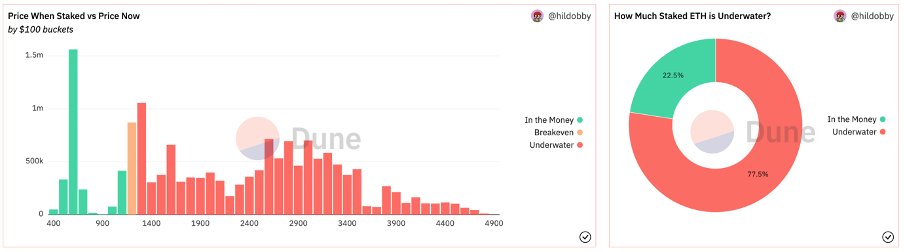

77% of the total staked $ETH was staked when the price was higher than the current price. Investors are unlikely to immediately withdraw and sell after the upgrade in such an under-watered position. They staked when there was no clear timeline for withdrawal.

77% of the total staked $ETH was staked when the price was higher than the current price. Investors are unlikely to immediately withdraw and sell after the upgrade in such an under-watered position. They staked when there was no clear timeline for withdrawal.

2.1/

A withdrawal queue is designed to prevent potential sell-off of staked $ETH as a result of full withdrawal. Only a total of 1,350 validators can exit per day with 43,200 $ETH. Even if all of these are sold within the same day, it's only 0.8% of the $ETH daily trading volume

A withdrawal queue is designed to prevent potential sell-off of staked $ETH as a result of full withdrawal. Only a total of 1,350 validators can exit per day with 43,200 $ETH. Even if all of these are sold within the same day, it's only 0.8% of the $ETH daily trading volume

2.2/

Besides full withdrawal, partial withdrawal is unlikely as well. It requires compounding the accrued rewards, which one needs to withdraw those $ETH that is more than 32 unit and re-deposit them. However, this is not possible before the withdrawal is enabled.

Besides full withdrawal, partial withdrawal is unlikely as well. It requires compounding the accrued rewards, which one needs to withdraw those $ETH that is more than 32 unit and re-deposit them. However, this is not possible before the withdrawal is enabled.

3/

Ethereum has the lowest staking ratio (amount staked/ total supply) among competitors. People are reluctant to stake because they can't withdraw. The staking ratio is expected to rise after the upgrade, since it would still be much lower than those of other PoS blockchains.

Ethereum has the lowest staking ratio (amount staked/ total supply) among competitors. People are reluctant to stake because they can't withdraw. The staking ratio is expected to rise after the upgrade, since it would still be much lower than those of other PoS blockchains.

4/

Eigenlayer created an innovative approach to re-use staked $ETH, meaning users can re-use staked $ETH to help secure other protocols such as oracles and cross-chain bridges. $ETH stakers can gain extra yield provided by those protocols in addition to the current staking yield.

Eigenlayer created an innovative approach to re-use staked $ETH, meaning users can re-use staked $ETH to help secure other protocols such as oracles and cross-chain bridges. $ETH stakers can gain extra yield provided by those protocols in addition to the current staking yield.

4.1/

In the future, the total yield of stakers will include a third component, a services fee paid by protocols that use Ethereum validating power. More people will stake their $ETH if the total staking yield is higher.

In the future, the total yield of stakers will include a third component, a services fee paid by protocols that use Ethereum validating power. More people will stake their $ETH if the total staking yield is higher.

5/

Shanghai upgrade is on the way, and Eigenlayer is probably the most innovative way to leverage Ethereum’s vast security power. They say that technological advancement only happens during a bear market, and this appears to be true.

Shanghai upgrade is on the way, and Eigenlayer is probably the most innovative way to leverage Ethereum’s vast security power. They say that technological advancement only happens during a bear market, and this appears to be true.

6/

If you find this interesting, give us a ❤️

Retweet it for us!

Read the full article at: tokeninsight.com/en/research/ma…

The author: @Edwardywu

If you find this interesting, give us a ❤️

Retweet it for us!

Read the full article at: tokeninsight.com/en/research/ma…

The author: @Edwardywu

• • •

Missing some Tweet in this thread? You can try to

force a refresh