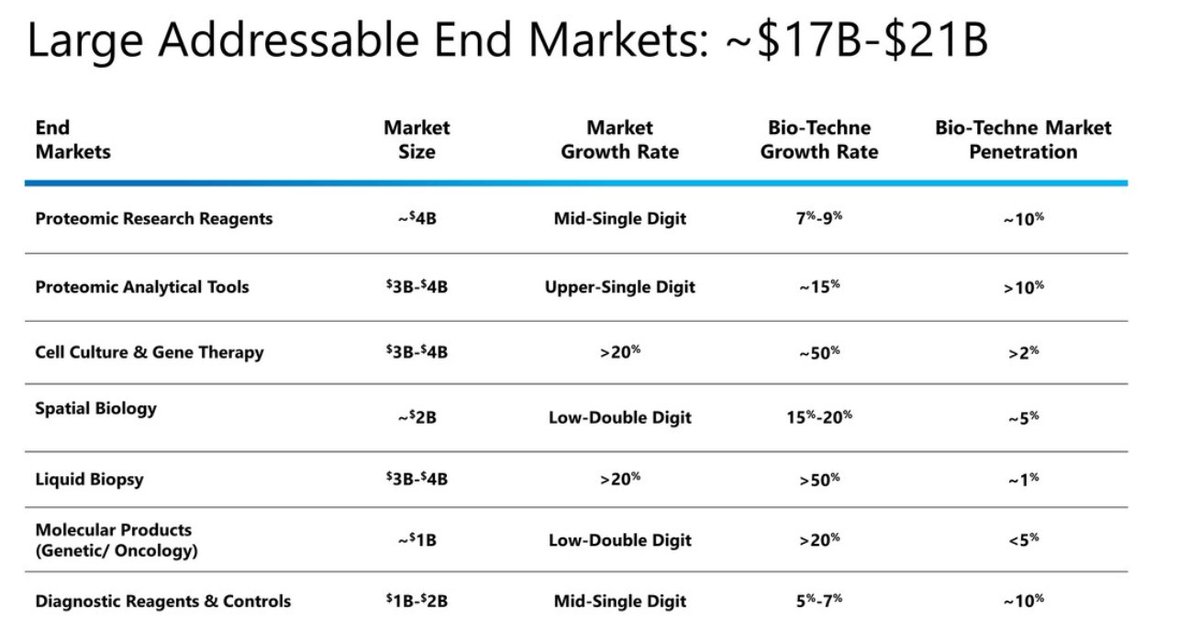

In #JPM2022 news, $TECH Bio-Techne is presenting. The company has started a play in #SpatialBiology using ACD probes.

The main play of interest for me from Bio-Techne is Liquid Biopsies with their Exosome-based assays. They want to expand to other cancers, e.g. Colorectal Cancer.

Bio-Techne values the Spatial Biology and Liquid Biopsy markets respectively at $2B and $3-4B. They are somewhat in the middle of their CAGR chart per segment at the moment.

• • •

Missing some Tweet in this thread? You can try to

force a refresh