M&A always gets buzz in the public markets

But, many investors don't understand what a deal means for them as a shareholder

Also, most can't be bothered reading thousands of pages of underlying documentation (or just get it very wrong)

Here are the SEC filings to dig into🧵

But, many investors don't understand what a deal means for them as a shareholder

Also, most can't be bothered reading thousands of pages of underlying documentation (or just get it very wrong)

Here are the SEC filings to dig into🧵

⏳At Announcement ("T+0")

8-K & 425

✅Press Release

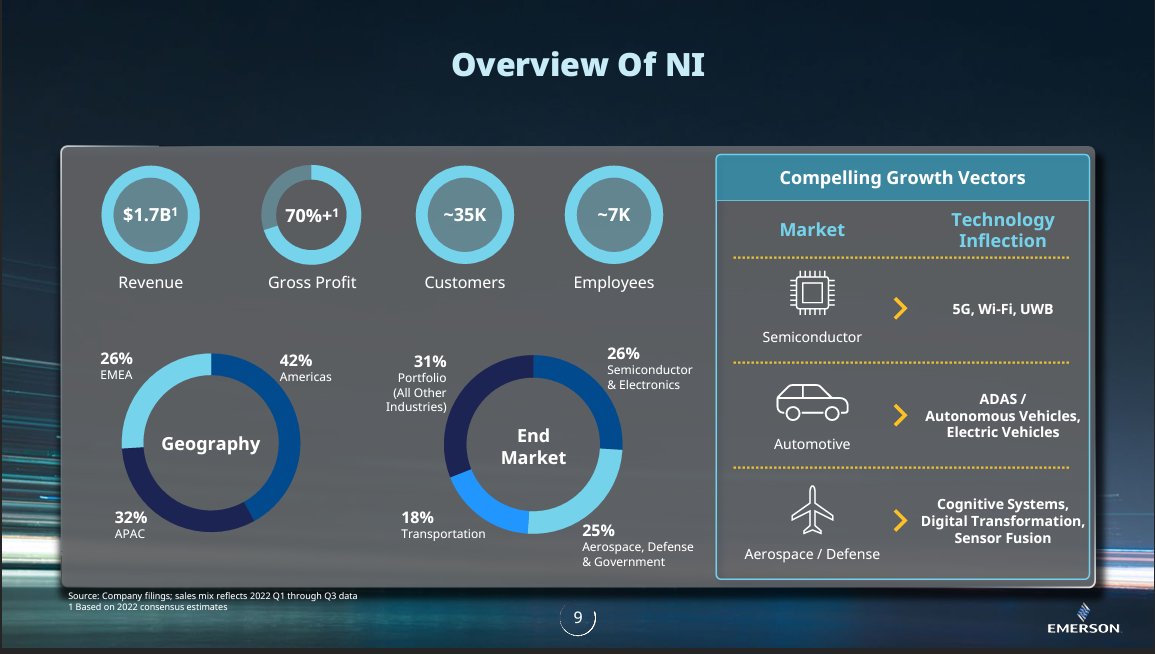

✅Investor Presentation

✅Transaction Docs

Takeaways:

🤔Focus on "how it works" (rationale + mechanics)

🤔Ask yourself: "what do I get or give here?"

Example: how the $10bn $ADBE stock part of Figma deal *technically* works

8-K & 425

✅Press Release

✅Investor Presentation

✅Transaction Docs

Takeaways:

🤔Focus on "how it works" (rationale + mechanics)

🤔Ask yourself: "what do I get or give here?"

Example: how the $10bn $ADBE stock part of Figma deal *technically* works

Takeaway #2: "Read Between the Lines"

🤔Stop and ask "why did they do this?"

🤔Stop and ask "where's the risk?"

Examples (all co-dependent variables)

1⃣Deal Closing (i.e. why close on X date)

2⃣Termination (i.e. who's at risk of not closing)

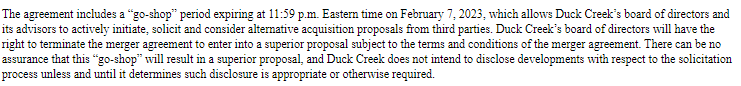

3⃣Others (i.e. "go shop" in PE deals)

🤔Stop and ask "why did they do this?"

🤔Stop and ask "where's the risk?"

Examples (all co-dependent variables)

1⃣Deal Closing (i.e. why close on X date)

2⃣Termination (i.e. who's at risk of not closing)

3⃣Others (i.e. "go shop" in PE deals)

⏳After Announcement, Prior to Closing (T+30)

PREM14A / 14D-9

1⃣Background of the Merger

2⃣Reasons for the Merger

3⃣Certain Financial Forecasts

4⃣Opinion of Company's Advisor

"80/20" rule here but activists read everything (prior to teeing up their PREC14As)

#1-4 deep dive...

PREM14A / 14D-9

1⃣Background of the Merger

2⃣Reasons for the Merger

3⃣Certain Financial Forecasts

4⃣Opinion of Company's Advisor

"80/20" rule here but activists read everything (prior to teeing up their PREC14As)

#1-4 deep dive...

1⃣Background of the Merger

TLDR: "narrative of record" for events & circumstances leading up to signing

Key Learnings:

✅See # of buyers & interactions (anonymized)

✅See how negotiations "played" over time

✅Give you comfort on "bona fide" process

TLDR: "narrative of record" for events & circumstances leading up to signing

Key Learnings:

✅See # of buyers & interactions (anonymized)

✅See how negotiations "played" over time

✅Give you comfort on "bona fide" process

https://twitter.com/GlogauGordon/status/1602307309132079104

2⃣Reasons for the Merger

This is the non-exhaustive list of factors the Board considered in approving the merger

Usual Reasons:

✅Attractive offer premium

✅"Standalone" execution risk (common today)

✅Certainty of closing the deal

✅Tax treatment, regulatory / litigation risk

This is the non-exhaustive list of factors the Board considered in approving the merger

Usual Reasons:

✅Attractive offer premium

✅"Standalone" execution risk (common today)

✅Certainty of closing the deal

✅Tax treatment, regulatory / litigation risk

3⃣Certain Financial Forecasts

These are the Board-approved "business case" projections buyers in the M&A process saw

Serves as the the basis of evaluation of the financial merits and "fairness" of the offer (covered in the the next🧵)

(e.g. $COUP attached here from PREM14A)

These are the Board-approved "business case" projections buyers in the M&A process saw

Serves as the the basis of evaluation of the financial merits and "fairness" of the offer (covered in the the next🧵)

(e.g. $COUP attached here from PREM14A)

4⃣Opinion of Company's Advisor

This is the bank's work evaluating the financial "fairness" of the offer:

E.g. $COUP "Football Field" for offer @ $81.00

1⃣DCF: $40.30 - $79.42

2⃣Comps: 27.70 - $64.54

3⃣Precedents: $47.07 - $92.83

"Litigation" Rule of Thumb: Offer > DCF = "👍"

This is the bank's work evaluating the financial "fairness" of the offer:

E.g. $COUP "Football Field" for offer @ $81.00

1⃣DCF: $40.30 - $79.42

2⃣Comps: 27.70 - $64.54

3⃣Precedents: $47.07 - $92.83

"Litigation" Rule of Thumb: Offer > DCF = "👍"

⌛️After Announcement, Prior to Closing (T+?)

PREC14A (along with DEF14As)

😠Sometimes you get a "contested situation"

Typical Reasons Cited:

⁉️ Value destructive

⁉️ Timing is wrong

⁉️ Bad M&A process

Examples:

$AVLR (deal went through)

$ZEN / $MNTV (worked, deal cancelled)

PREC14A (along with DEF14As)

😠Sometimes you get a "contested situation"

Typical Reasons Cited:

⁉️ Value destructive

⁉️ Timing is wrong

⁉️ Bad M&A process

Examples:

$AVLR (deal went through)

$ZEN / $MNTV (worked, deal cancelled)

TLDR on "M&A":

🕵️Read announcement docs

🔭Keep an eye out for the proxy

🤔Think about merits & risks, always

💡Inspired by "Tear Downs" authors below (w/ esoteric flair)😉

@BrianFeroldi, @10kdiver, @cjgustafson222, @BreakingSaaS, @NonGaap, @QCompounding, @WOLF_Financial

🕵️Read announcement docs

🔭Keep an eye out for the proxy

🤔Think about merits & risks, always

💡Inspired by "Tear Downs" authors below (w/ esoteric flair)😉

@BrianFeroldi, @10kdiver, @cjgustafson222, @BreakingSaaS, @NonGaap, @QCompounding, @WOLF_Financial

Soon enough you can all be merger arb gurus like @compound248 & @akramsrazor!

Follow me at @GlogauGordon & you enjoy some steam of consciousness on #mergersandacquisitions, #SaaS and other topics

RT, like, spread the word (first tweet below) 🙏

Follow me at @GlogauGordon & you enjoy some steam of consciousness on #mergersandacquisitions, #SaaS and other topics

RT, like, spread the word (first tweet below) 🙏

https://twitter.com/GlogauGordon/status/1614046406825881600

• • •

Missing some Tweet in this thread? You can try to

force a refresh