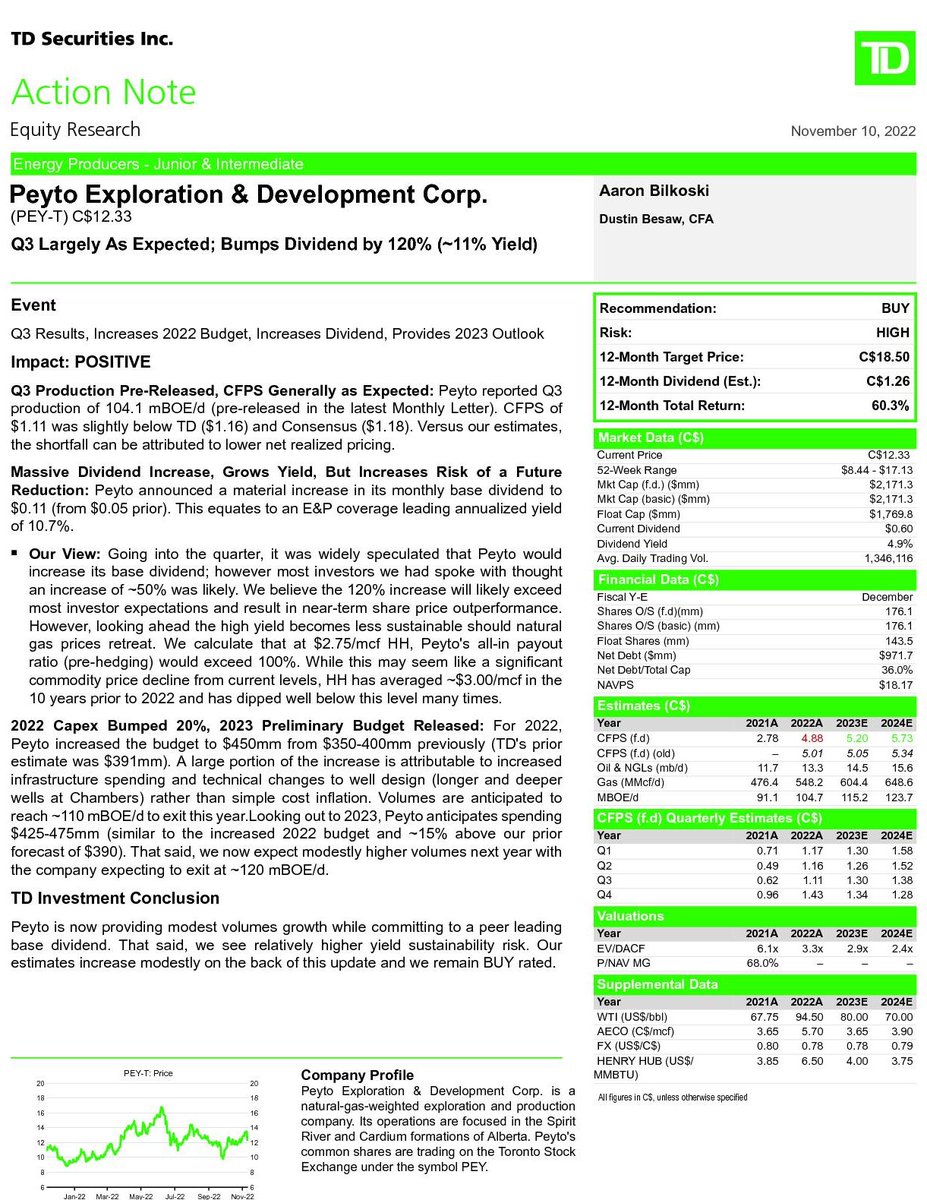

Peyto Exploration's next monthly dividend will be 11c and $1.32/year or a 9.8% yield. I've seen comparisons to $GXE.TO & $CJ.TO div, concerns on sustainability and concerns due to recent AECO/HH price drop. This report from TD shows it is sustainable.

1/x

#COM #OOTT $PEY $PEY.TO

1/x

#COM #OOTT $PEY $PEY.TO

https://twitter.com/emmpeethree1/status/1590767099177480193

-Currently trading @~2/3 of NAV

-EV/DACF trading near eight year low

-2P Reserve Life Index (RLI) of 23.5 years based on 105k boe/d, 2022 exit production (before addition of two acquisitions made in 2022)

3/x

-EV/DACF trading near eight year low

-2P Reserve Life Index (RLI) of 23.5 years based on 105k boe/d, 2022 exit production (before addition of two acquisitions made in 2022)

3/x

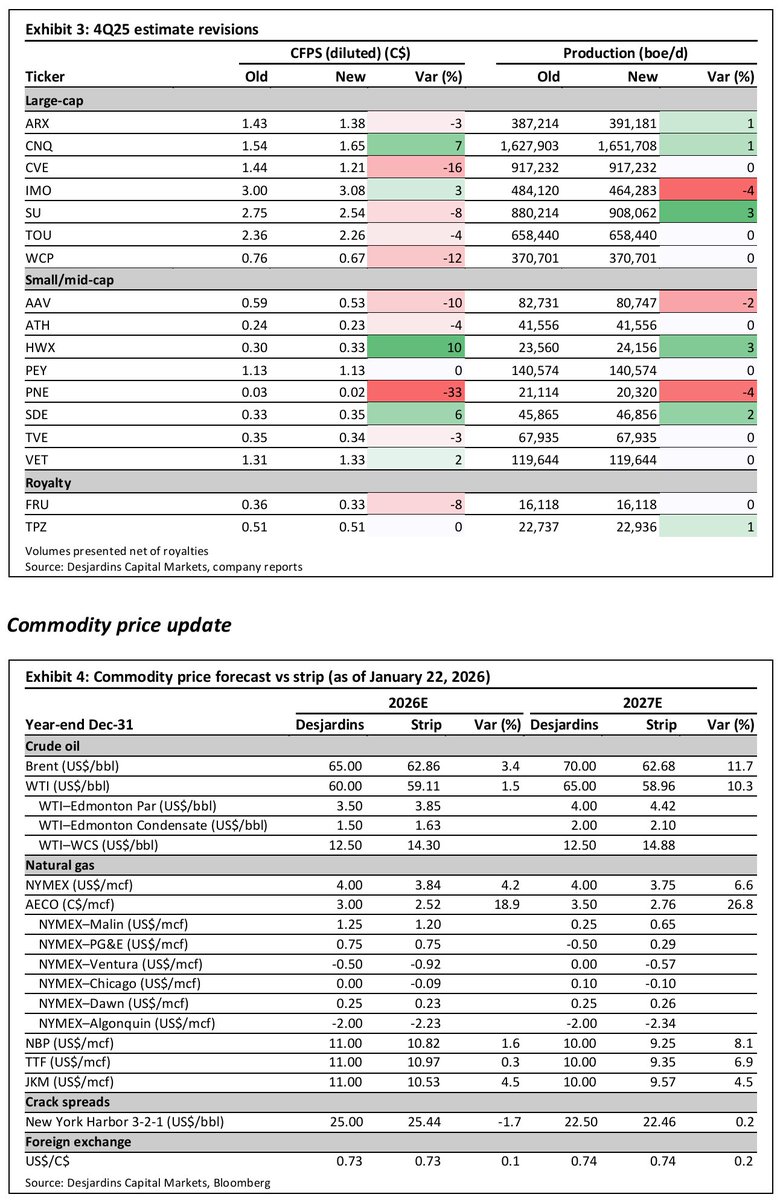

2023 EV/DACF was tied for lowest valuation of gassy and oily peers at 2.9, tied with $SDE and $CPG

($80 $WTI and $3.65 AECO)

4/x

($80 $WTI and $3.65 AECO)

4/x

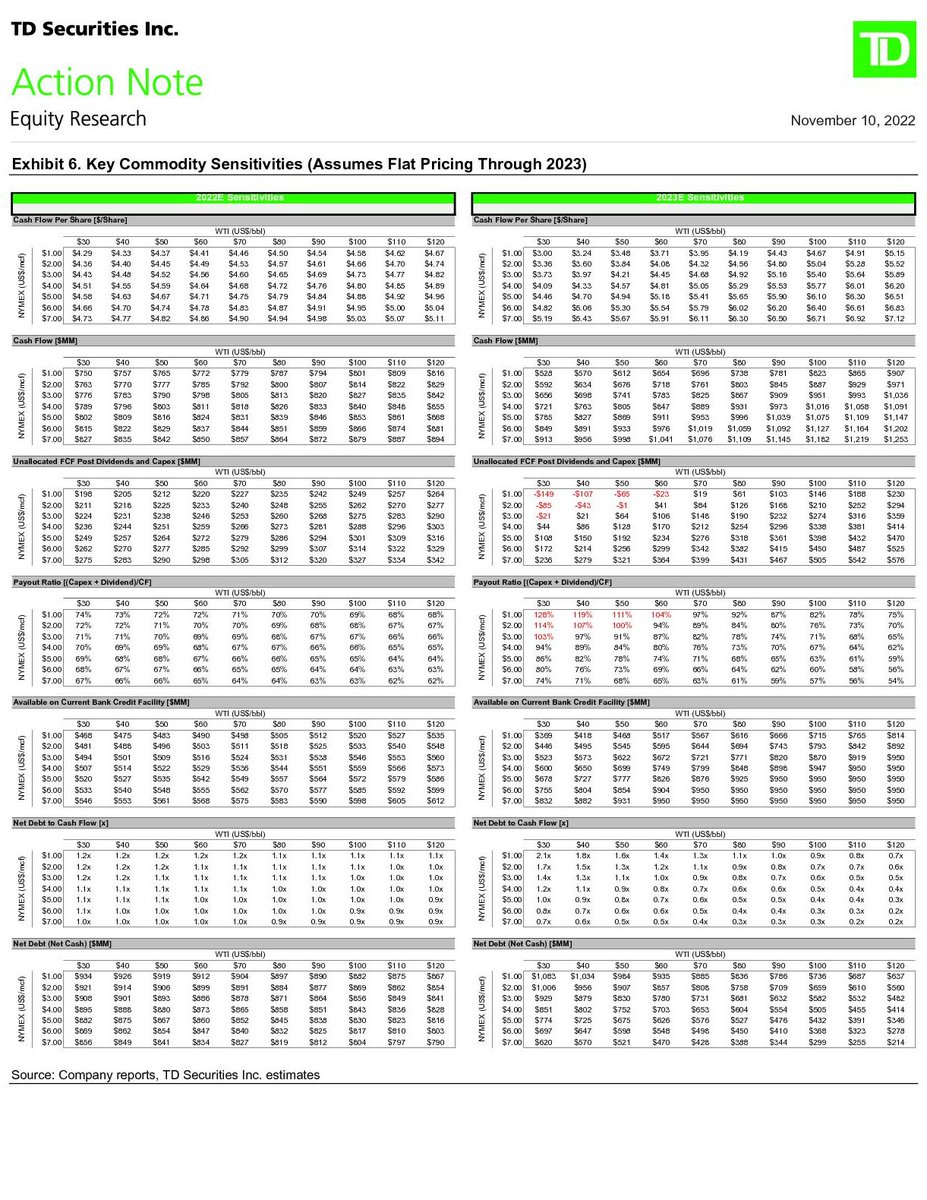

2022 and 2023 sensitivities $30-120 WTI vs $1-7 HH

CFPS, CF, FCF after CAPEX and dividends, available credit facility, net debt to cashflow, net debt (net cash)

5/x

CFPS, CF, FCF after CAPEX and dividends, available credit facility, net debt to cashflow, net debt (net cash)

5/x

Looking at unallocated FCF after dividends ($1.32/yr/sh @ 9.8% yield). $PEY can afford capex AND to dividend at approximately:

$3.5 HH & $30 WTI

$3.0 HH & $40 WTI

$2.0 HH & $50 WTI

$1.0 HH & $65 WTI

At current pricing, excess FCF could reduce debt by well over $200mm

6/x

$3.5 HH & $30 WTI

$3.0 HH & $40 WTI

$2.0 HH & $50 WTI

$1.0 HH & $65 WTI

At current pricing, excess FCF could reduce debt by well over $200mm

6/x

FFO increasing on lower WTI and HH pricing in 2023 and 2024 due to less hedging losses =higher realized pricing and increased production

19% FCF yield @ $80WTI, $3.65 HH

7/x

19% FCF yield @ $80WTI, $3.65 HH

7/x

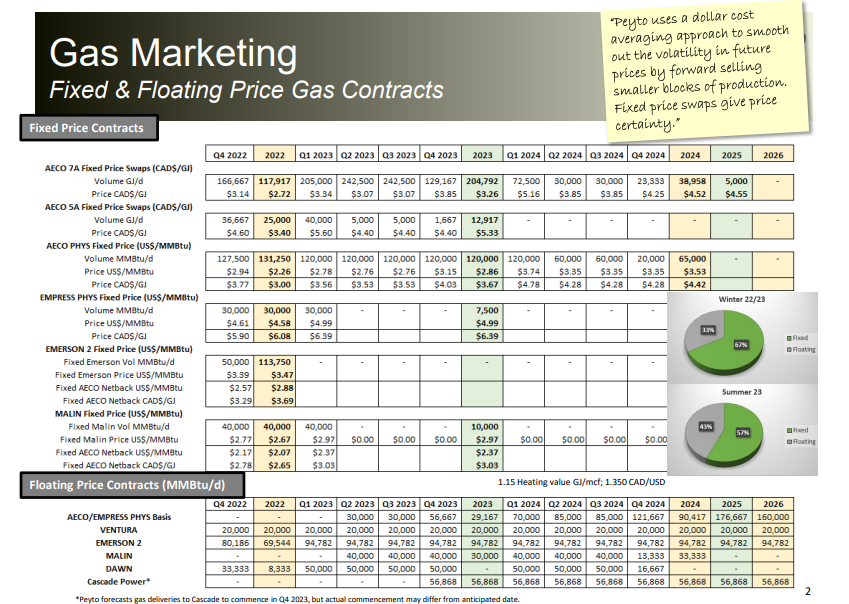

Highly hedged production through summer 2023. Hedgebook keeps improving as time goes on. While hedging limits upside, it protects downside (and the dividend)

8/x

peyto.com/Files/Operatio…

8/x

peyto.com/Files/Operatio…

Expected realized pricing by quarter @ $5 HH, $4 AECO, inclusive of current hedging. See how fixed price volumes steadily decrease in the favor of basis deals. Direct connection to Cascade Power will diversify pricing exposure to AB power pool

9/x

9/x

While the hedging has limited upside, due to being such a low cost operator, it somewhat compensates for lack of upside and ability to maintain profitability.

see latest presentation form Jan 13 2023

10/x

peyto.com/Files/Presenta…

see latest presentation form Jan 13 2023

10/x

peyto.com/Files/Presenta…

Valuing the company another way, using replacement values. The company owns significant infrastructure that would be very costly to buildout/replace.

11/x

11/x

Thanks for getting it this far, hopefully you understand this company a little better.

During high HH prices I wasn't a fan of the poor hedging. However, with the recent volatility and huge dividend increase, I have made $PEY.TO a significant holding in my portfolio.

14/x

During high HH prices I wasn't a fan of the poor hedging. However, with the recent volatility and huge dividend increase, I have made $PEY.TO a significant holding in my portfolio.

14/x

This is a long thread that also goes into recent company presentation and hedge book. See the whole thing here threadreaderapp.com/thread/1614493…

• • •

Missing some Tweet in this thread? You can try to

force a refresh