Focusing on energy investing, #FIRE, bargain shopping, travel points, independent budget travel and food that doesn't involve eggs and organs

How to get URL link on X (Twitter) App

https://twitter.com/emmpeethree/status/1998936807061561429

2

2

https://twitter.com/emmpeethree/status/1736966200238948599

2/x

2/x

https://twitter.com/emmpeethree1/status/1641642307073216517

2/x

2/x

https://twitter.com/emmpeethree1/status/1617896498578223105

2/x

2/x

-Gas Resource Peer Comparables (Strip Pricing)

-Gas Resource Peer Comparables (Strip Pricing)

2/x

2/x

https://twitter.com/emmpeethree1/status/1603668107611996162

Cardium

Cardium

https://twitter.com/emmpeethree1/status/1613371189556133890

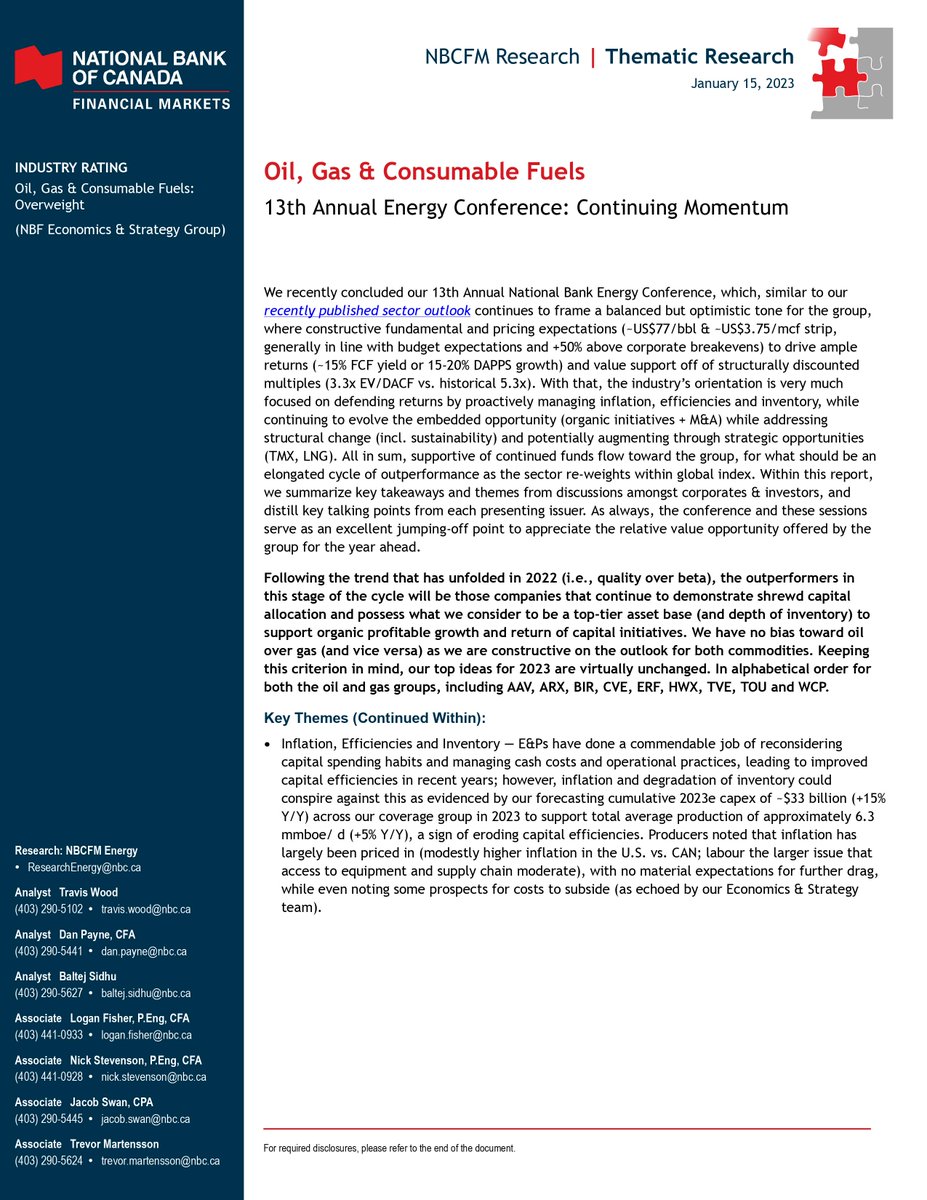

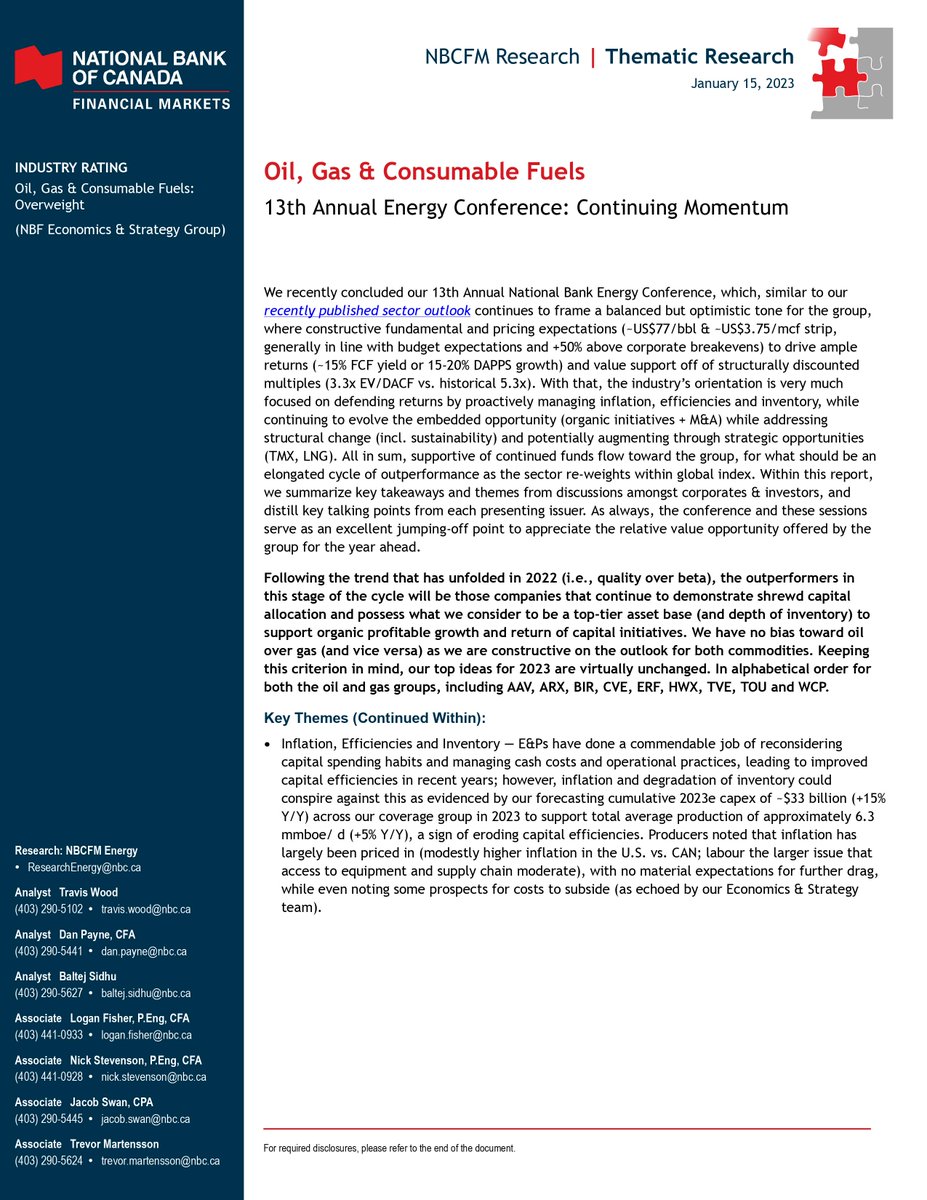

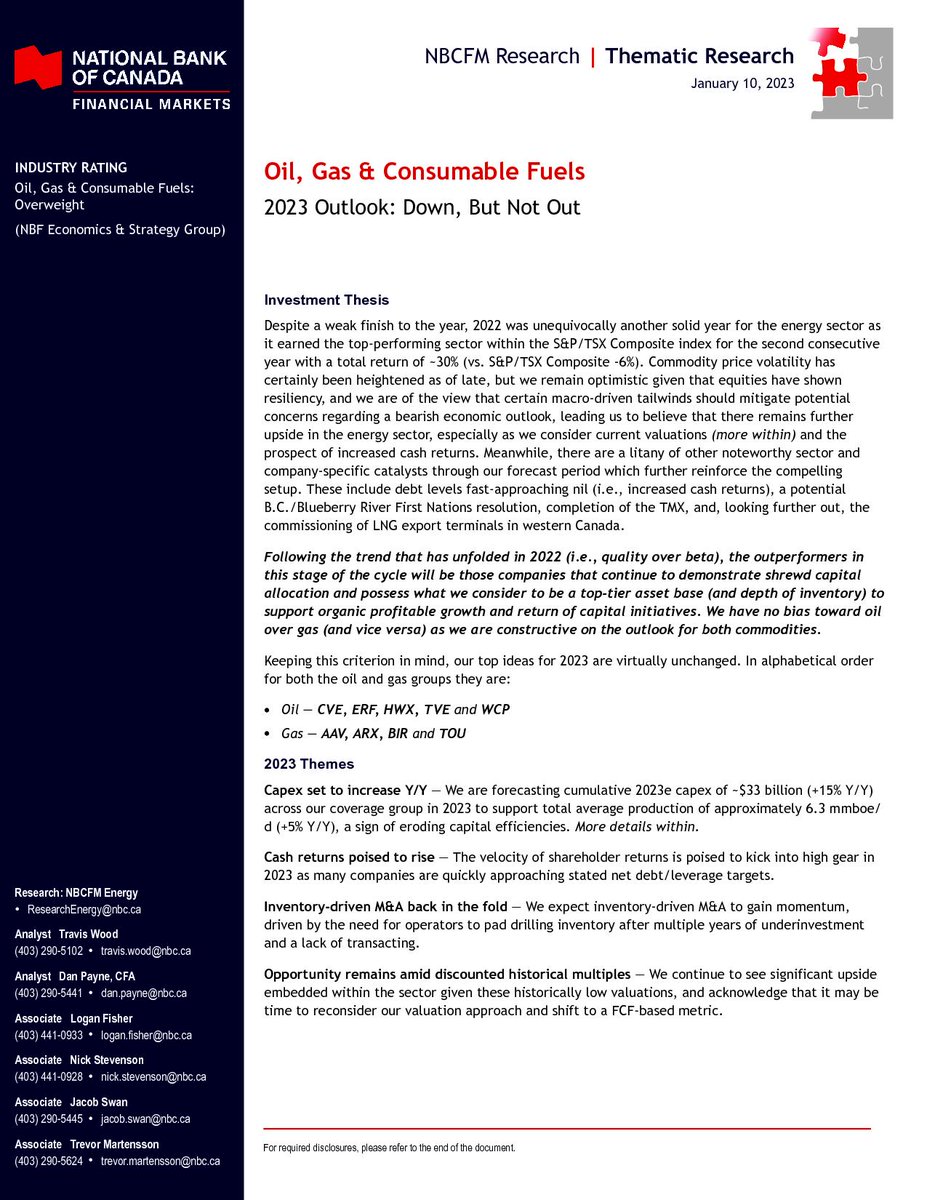

Key Themes (cont.)

Key Themes (cont.)

https://twitter.com/emmpeethree1/status/1590767099177480193

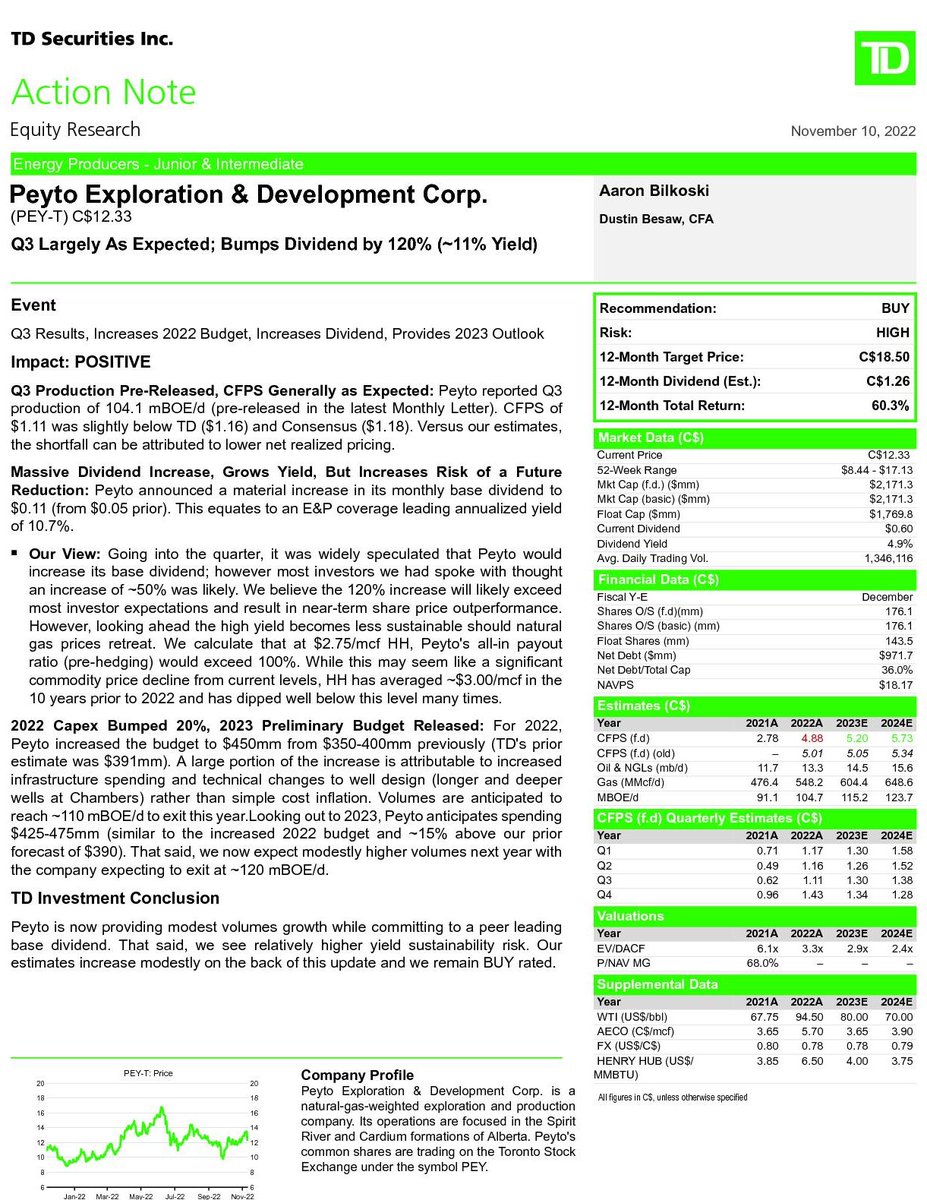

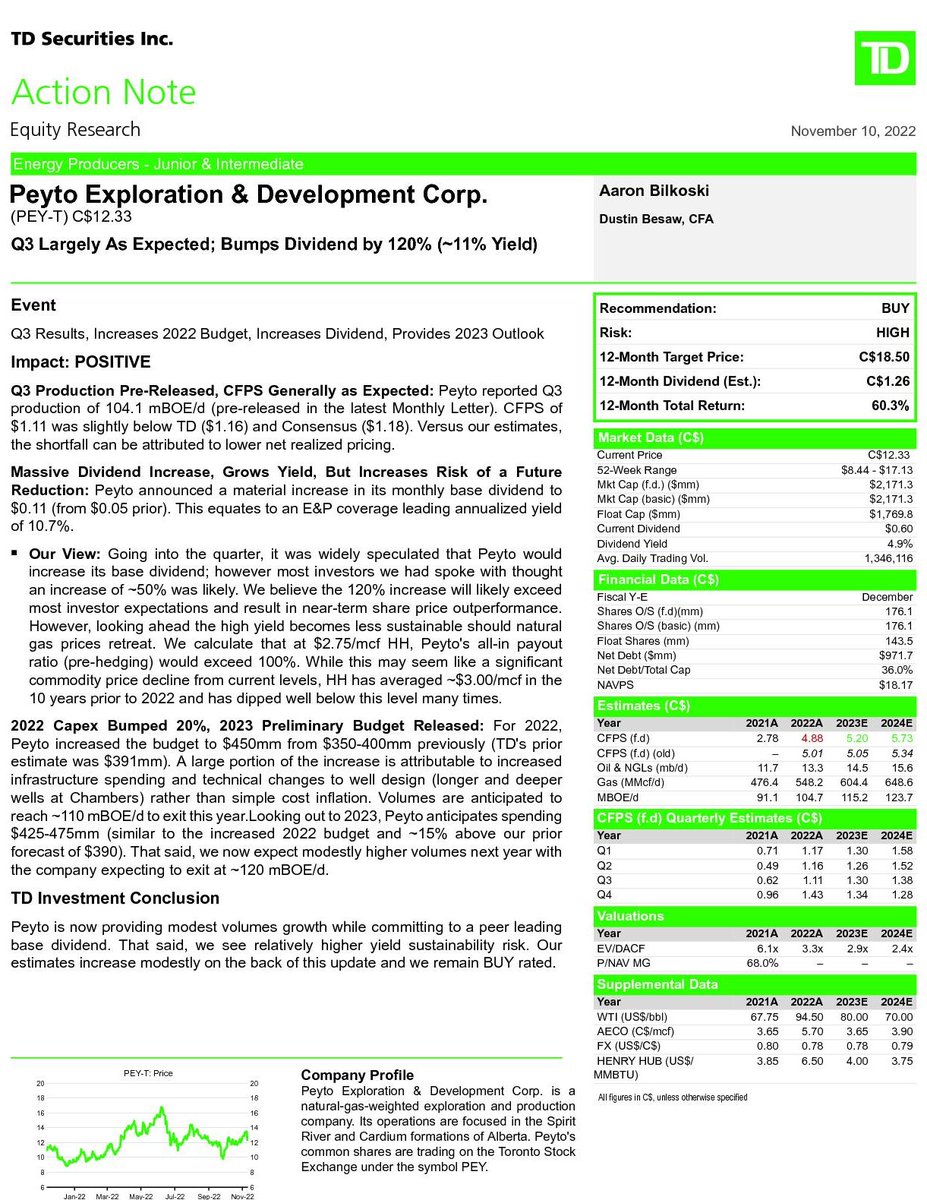

Netbacks and production rowing y/y

Netbacks and production rowing y/y

https://twitter.com/emmpeethree1/status/1583116972191285248