1/ #BTC is above $20k for the first time since the collapse of FTX.

While its narrative has struggled to find traction compared to other chains/protocols...

There's no better time than now to dive into the data regarding Bitcoin's 2022 & its future. 🧵⬇️

members.delphidigital.io/reports/bitcoi…

While its narrative has struggled to find traction compared to other chains/protocols...

There's no better time than now to dive into the data regarding Bitcoin's 2022 & its future. 🧵⬇️

members.delphidigital.io/reports/bitcoi…

We'll look at 5 metrics to gauge how Bitcoin is doing:

🔹Activity

🔹Lightning Adoption

🔹Miners

🔹Energy Prices

🔹HashRate/Difficulty

Okay, let's dive in! ⬇️

🔹Activity

🔹Lightning Adoption

🔹Miners

🔹Energy Prices

🔹HashRate/Difficulty

Okay, let's dive in! ⬇️

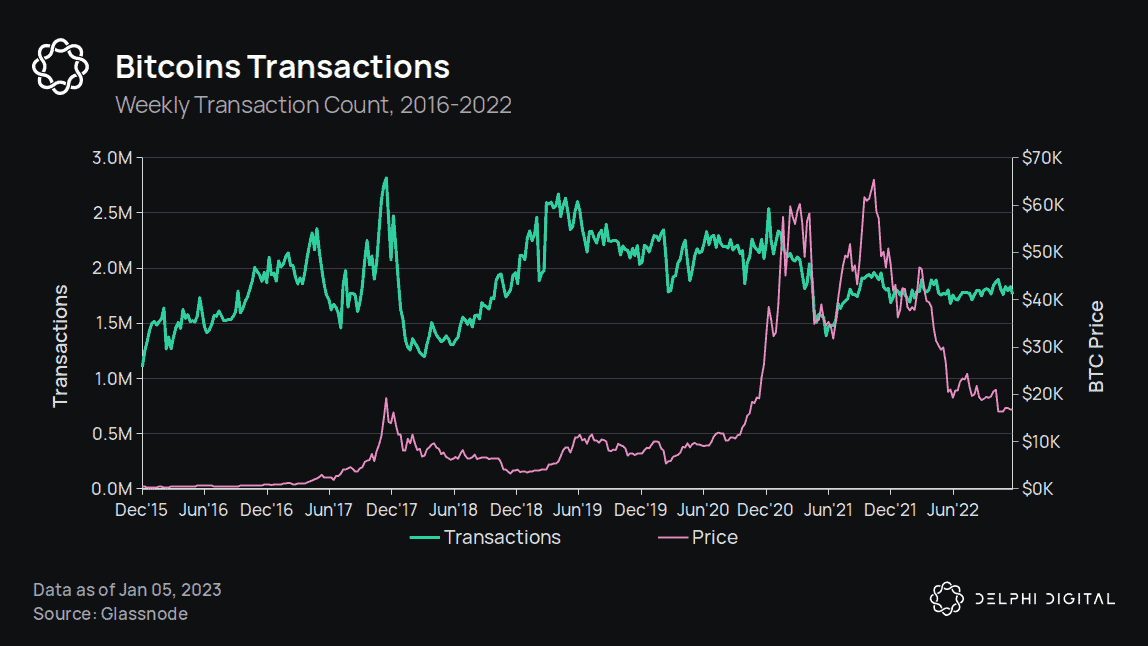

1. Activity

Transaction counts were relatively stable throughout 2022, but have declined overall since the peak of the 2021 bull market.

Notably, Bitcoin’s transaction count has failed to surpass its peak from 2017.

Transaction counts were relatively stable throughout 2022, but have declined overall since the peak of the 2021 bull market.

Notably, Bitcoin’s transaction count has failed to surpass its peak from 2017.

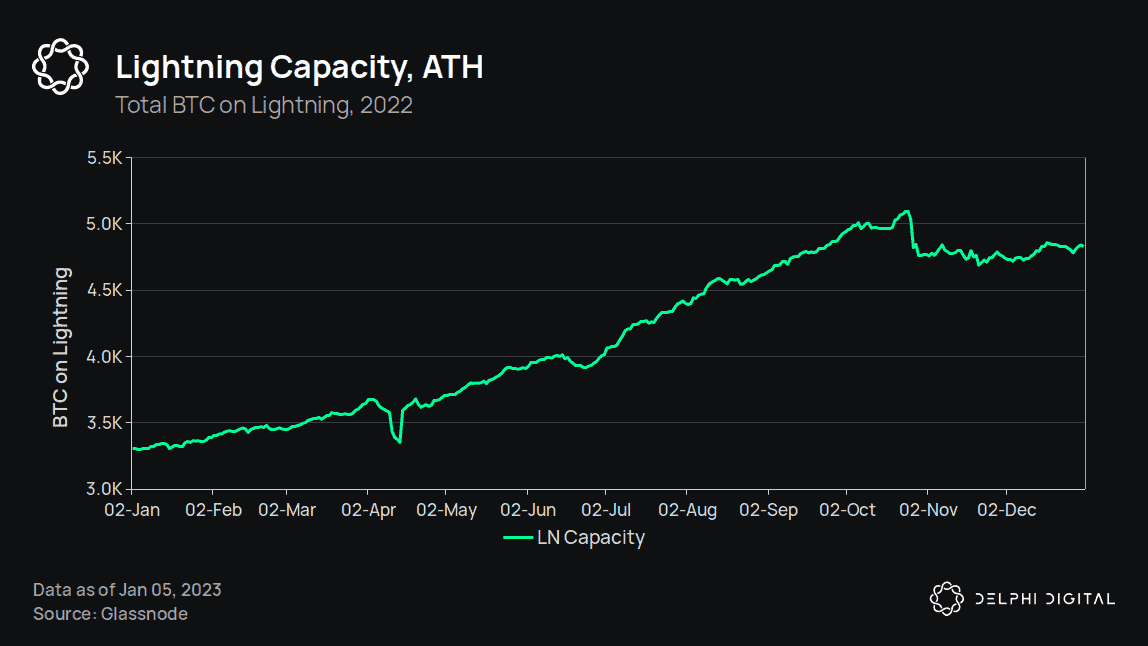

2. Lightning Adoption

On the capacity front, Lightning had a good year.

Bitcoin on Lightning hit an all-time high of slightly more than 5k BTC ($82.5M) in Q4.

It declined shortly after, but held stable at around 4.8k BTC ($79.2M).

On the capacity front, Lightning had a good year.

Bitcoin on Lightning hit an all-time high of slightly more than 5k BTC ($82.5M) in Q4.

It declined shortly after, but held stable at around 4.8k BTC ($79.2M).

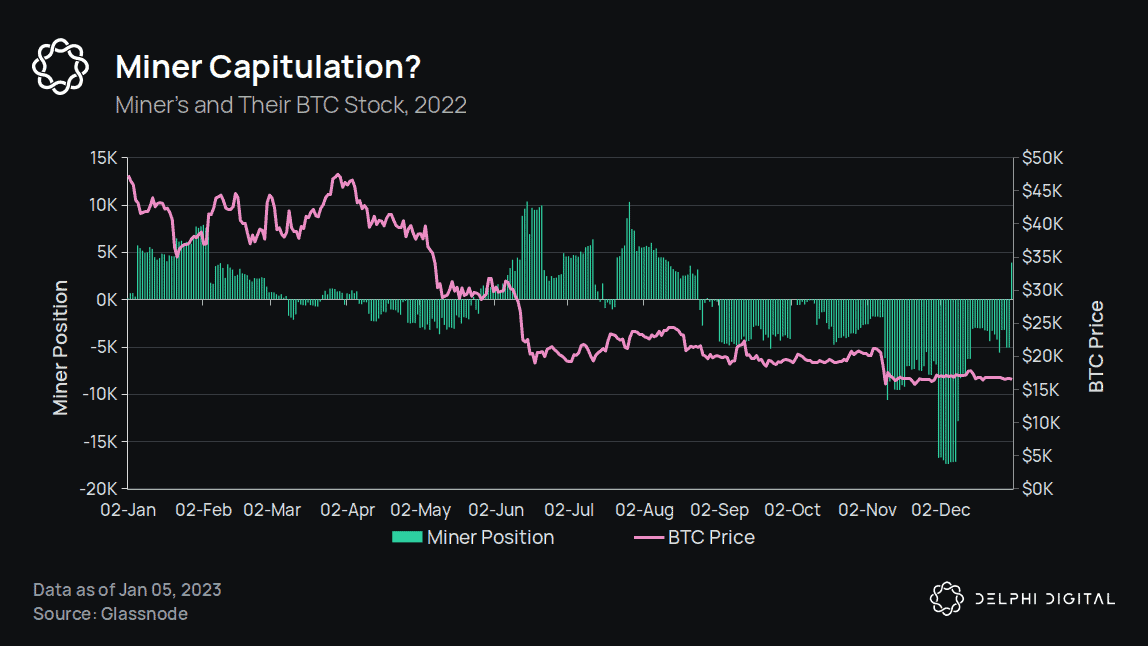

3. Miners

Recently, miners seem to be selling everything to keep their firms afloat.

Given that macro conditions have mostly remained the same, there’s no material reason to think this will change.

Recently, miners seem to be selling everything to keep their firms afloat.

Given that macro conditions have mostly remained the same, there’s no material reason to think this will change.

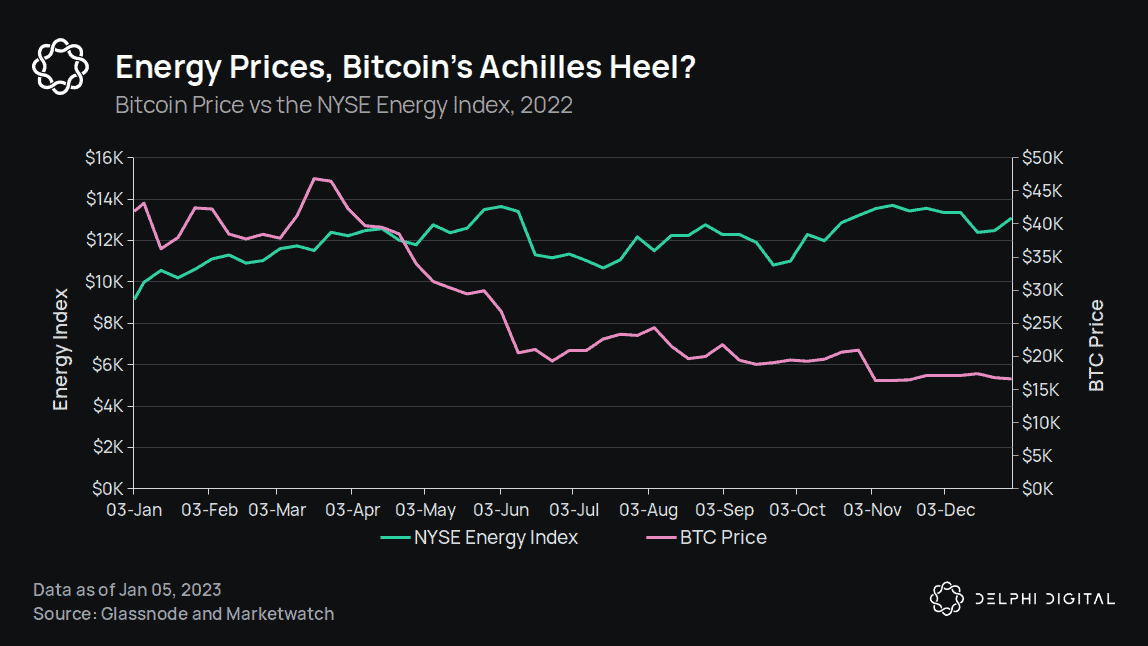

4. Energy Prices

Energy prices have skyrocket in 2022.

The increase in energy prices was horrible news for miners, as PoW is energy-intensive. This undoubtedly hurts the bottom line for mining companies.

Energy prices have skyrocket in 2022.

The increase in energy prices was horrible news for miners, as PoW is energy-intensive. This undoubtedly hurts the bottom line for mining companies.

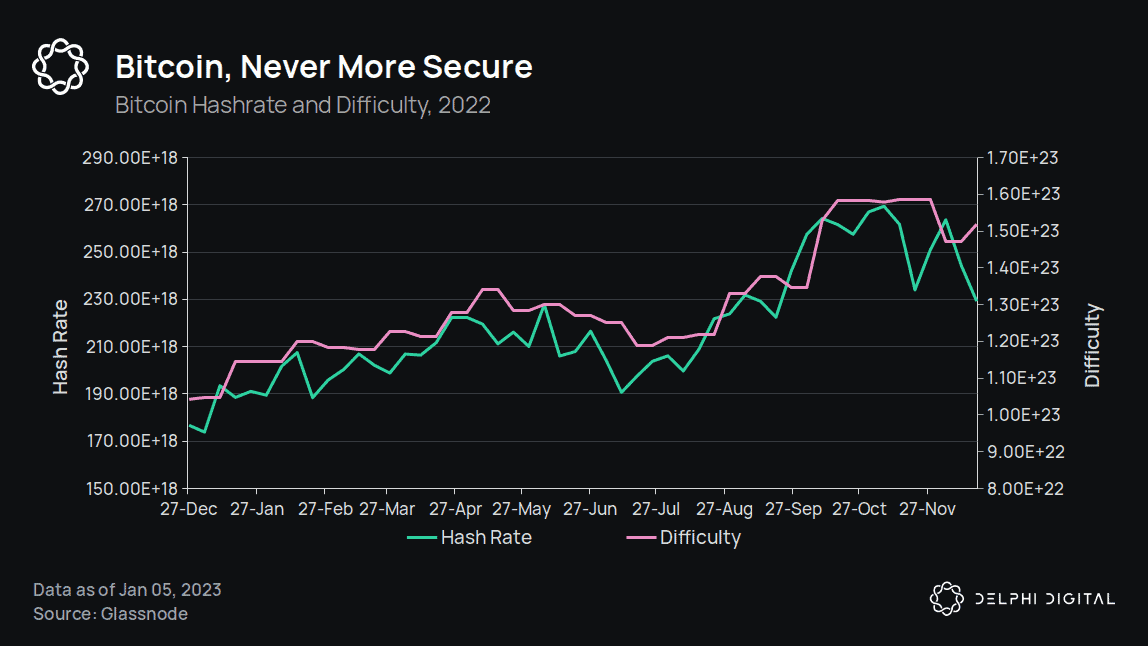

5. HashRate/Difficulty

The HashRate/Difficulty of the Bitcoin network reached ATHs in 2022.

One can speculate that maybe Ethereum PoW miners shifted rack space to BTC mining, or maybe existing miners picked up heavily discounted ASICs from failed miners. Overall tough to tell.

The HashRate/Difficulty of the Bitcoin network reached ATHs in 2022.

One can speculate that maybe Ethereum PoW miners shifted rack space to BTC mining, or maybe existing miners picked up heavily discounted ASICs from failed miners. Overall tough to tell.

There are interesting narratives to watch for bitcoin moving forward including:

- Taproot

- Taro, Lightning

- The African market

- zk-rollups on Bitcoin

Overall, the future does indeed seems bright...

- Taproot

- Taro, Lightning

- The African market

- zk-rollups on Bitcoin

Overall, the future does indeed seems bright...

But, our main concern is Bitcoin miners.

A decimated mining sector could potentially devastate Bitcoin’s security.

To learn more about Bitcoin's mining situation, follow us @Delphi_Digital and join the Telegram for an extra chart! We'll see you there 🤝

t.me/DelphiDigitalA…

A decimated mining sector could potentially devastate Bitcoin’s security.

To learn more about Bitcoin's mining situation, follow us @Delphi_Digital and join the Telegram for an extra chart! We'll see you there 🤝

t.me/DelphiDigitalA…

• • •

Missing some Tweet in this thread? You can try to

force a refresh