The term "hostile takeover" begets images of "raiders" dawning two-toned collared shirt & suspender combos, screaming into phones in a cigar-smoke-clouded mahogany rooms filled with dot matrix printer tear-sheets...

But, $EMR showed that companies too can also "go hostile"🧵

But, $EMR showed that companies too can also "go hostile"🧵

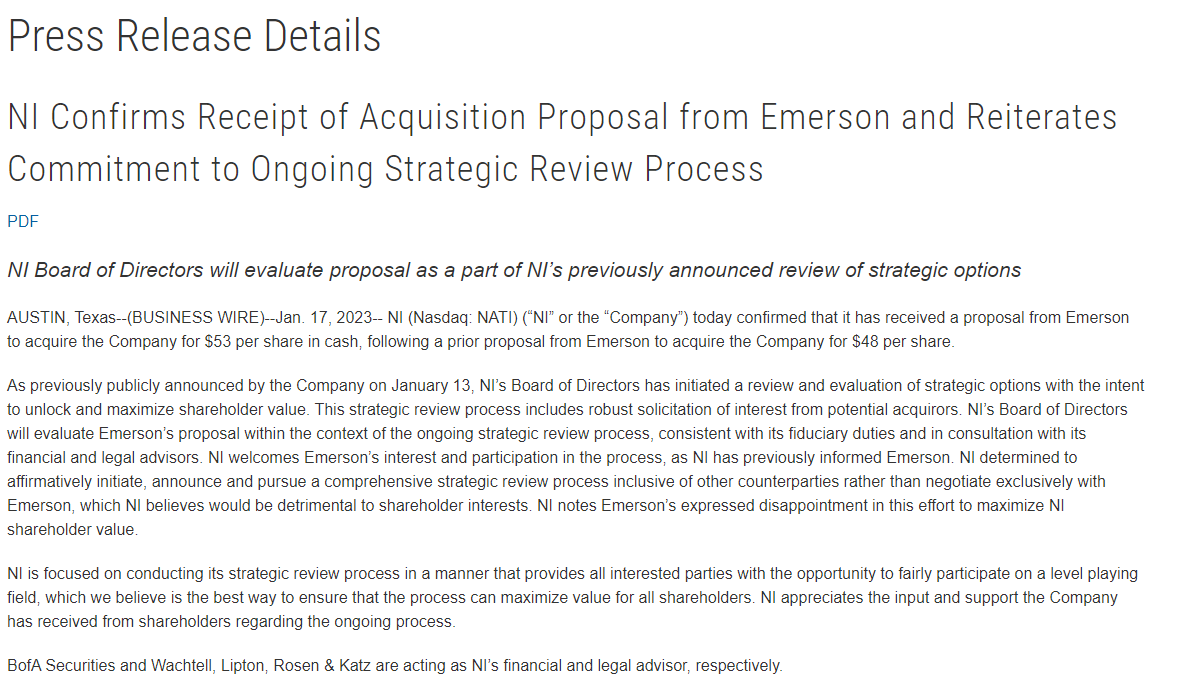

So yesterday, $EMR announced *a proposal* to acquire $NATI for $53.00 a share (~$7.6bn and 32% premium to last close)

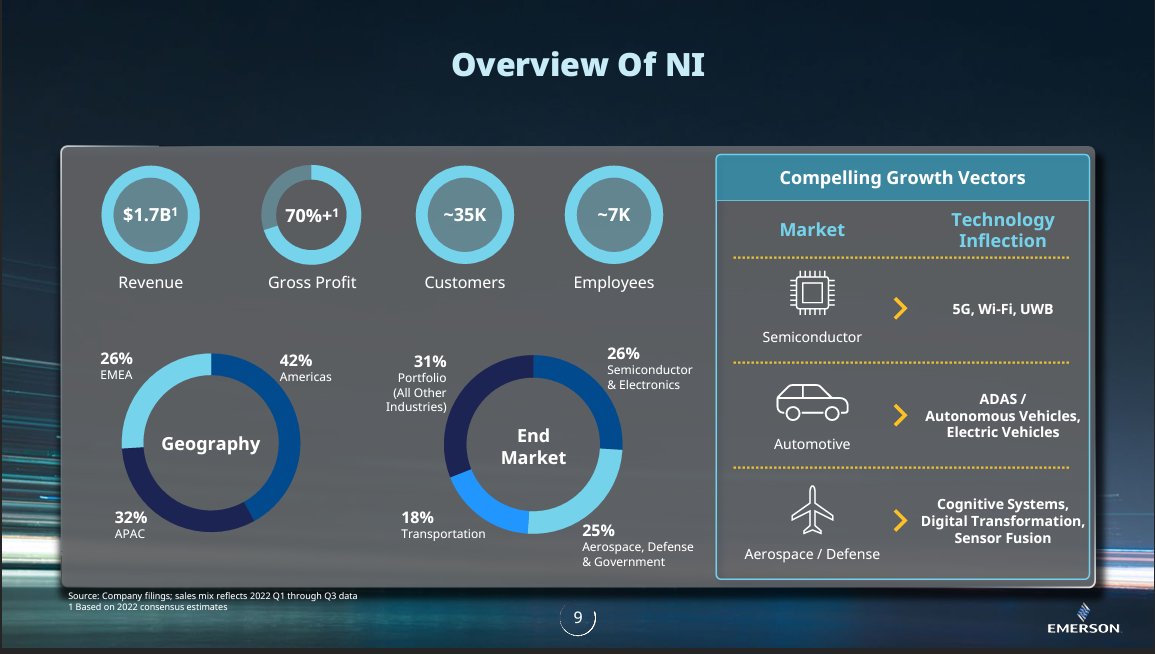

$NATI is a $1.7bn electronic T&M business with 70% GMS, 35K customers across diverse end markets

Deal would advance $EMR's global automation focus & strategy

$NATI is a $1.7bn electronic T&M business with 70% GMS, 35K customers across diverse end markets

Deal would advance $EMR's global automation focus & strategy

Why go "hostile"?

Well, in short, if as a buyer you're getting stonewalled by management & their Board, you can put the target "in play" by going directly to shareholders

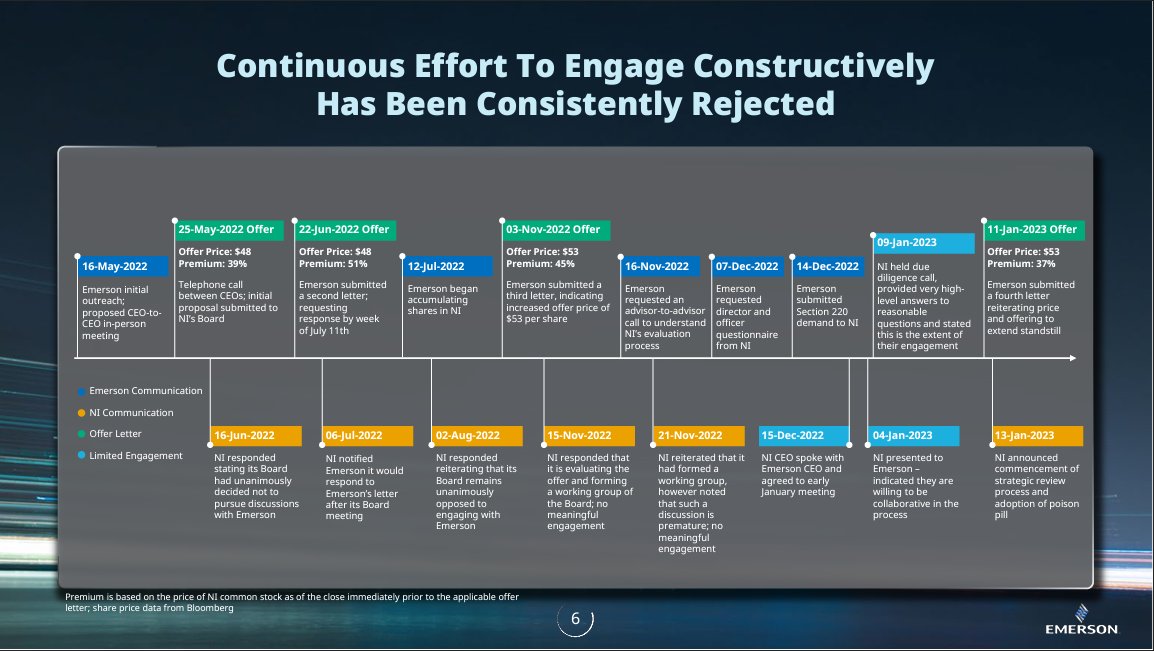

$EMR made many attempts to engage with $NATI in private dating to 5/22 with no constructive engagement

Well, in short, if as a buyer you're getting stonewalled by management & their Board, you can put the target "in play" by going directly to shareholders

$EMR made many attempts to engage with $NATI in private dating to 5/22 with no constructive engagement

$EMR does a good job cataloging their history of interactions with $NATI

"Hostile" actions are always carefully planned

With 2023 "proxy season" looming, my sense is that "going hostile" was in the cards in the event of no substantive path to a deal following the 11/3 offer

"Hostile" actions are always carefully planned

With 2023 "proxy season" looming, my sense is that "going hostile" was in the cards in the event of no substantive path to a deal following the 11/3 offer

$EMR's PR playbook is textbook, unveiling:

1⃣ Website "maximizingvalueatni.com"

2⃣ PR (w/ email correspondence)

3⃣ Investor presentation & call

All painting a narrative of delay tactics by $NATI voiding shareholders the opportunity to participate in the deal's value creation

1⃣ Website "maximizingvalueatni.com"

2⃣ PR (w/ email correspondence)

3⃣ Investor presentation & call

All painting a narrative of delay tactics by $NATI voiding shareholders the opportunity to participate in the deal's value creation

Several tactics a buyer can utilize in order to effect a "hostile takeover" include:

1⃣ Proxy contest

(i.e. shareholders "vote by proxy")

2⃣ Tender offer

(i.e. shareholders "vote with their wallets")

3⃣ Open market purchases

$EMR is going with Door #1: Proxy context

1⃣ Proxy contest

(i.e. shareholders "vote by proxy")

2⃣ Tender offer

(i.e. shareholders "vote with their wallets")

3⃣ Open market purchases

$EMR is going with Door #1: Proxy context

How do targets play "defense"? There are 2 buckets:

"Generate More Votes"

1⃣ Dual-class structure (i.e. high & low votes)

2⃣ ESOP plan

"Become Less Attractive"

3⃣ Divest a "crown jewel"

4⃣ Shareholder rights plan (i.e. "poison pill")

5⃣ Golden parachutes

On 1/13 $NATI did #4

"Generate More Votes"

1⃣ Dual-class structure (i.e. high & low votes)

2⃣ ESOP plan

"Become Less Attractive"

3⃣ Divest a "crown jewel"

4⃣ Shareholder rights plan (i.e. "poison pill")

5⃣ Golden parachutes

On 1/13 $NATI did #4

TLDR on $NATI's "flip-in" "poison💊"

"If anyone (e.g. a hostile buyer) acquires 10%+ of $NATI's stock, other shareholders can purchase newly issued $NATI stock at a 50% discount"

Intent (via dilution) is to make an accumulation of a control stake economically "self-defeating"

"If anyone (e.g. a hostile buyer) acquires 10%+ of $NATI's stock, other shareholders can purchase newly issued $NATI stock at a 50% discount"

Intent (via dilution) is to make an accumulation of a control stake economically "self-defeating"

My thoughts...

Not $EMR's 1st rodeo (hostile on $ROK in '17) & they can sign a deal by $NATI's earnings (1/31)

$NATI's "reactive guide pump" (below) & poison💊denote standalone path conviction but the strategic review signals appetite to get to *a* deal beyond fiduciary CYA

Not $EMR's 1st rodeo (hostile on $ROK in '17) & they can sign a deal by $NATI's earnings (1/31)

$NATI's "reactive guide pump" (below) & poison💊denote standalone path conviction but the strategic review signals appetite to get to *a* deal beyond fiduciary CYA

Thanks to @NonGaap for the topic suggestion

Follow me at @GlogauGordon & you enjoy some steam of consciousness on #mergersandacquisitions, #SaaS and other topics (perhaps even a Substack someday)

RT, like, spread the word🙏

Follow me at @GlogauGordon & you enjoy some steam of consciousness on #mergersandacquisitions, #SaaS and other topics (perhaps even a Substack someday)

RT, like, spread the word🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh