Can the XRPL represent the value of everything, all at once? Can $XRP be backed by gold? Both questions seem related to misunderstanding what $XRP is & how it functions, a boorish, simple🧵/14.

(Note: just condensing XRPL.org. All misunderstandings are mine.)

(Note: just condensing XRPL.org. All misunderstandings are mine.)

2. First, according to XRPL.org there are 2 types of assets on the XRPL.

1. XRP

2. Tokens.

That's it.

Two categories with different properties. Honestly could end the thread here. But I'm avoiding work, so here goes...

xrpl.org/currency-forma…

1. XRP

2. Tokens.

That's it.

Two categories with different properties. Honestly could end the thread here. But I'm avoiding work, so here goes...

xrpl.org/currency-forma…

3. $XRP is the ledger's native token. It can be sent anywhere, from anyone & receipt is settlement. Don't have to wait for anything more. It secures the network as payment of a very small (but traffic scaled) tx cost & a required reserve for an account.

4. "Some advanced features of the XRP Ledger, such as Escrow and Payment Channels, only work with $XRP."

(Payment channels are wild, & that will have to wait but they allow asynchronous payments, for now just remember a paychannel is not a trustline)

xrpl.org/xrp.html#xrp

(Payment channels are wild, & that will have to wait but they allow asynchronous payments, for now just remember a paychannel is not a trustline)

xrpl.org/xrp.html#xrp

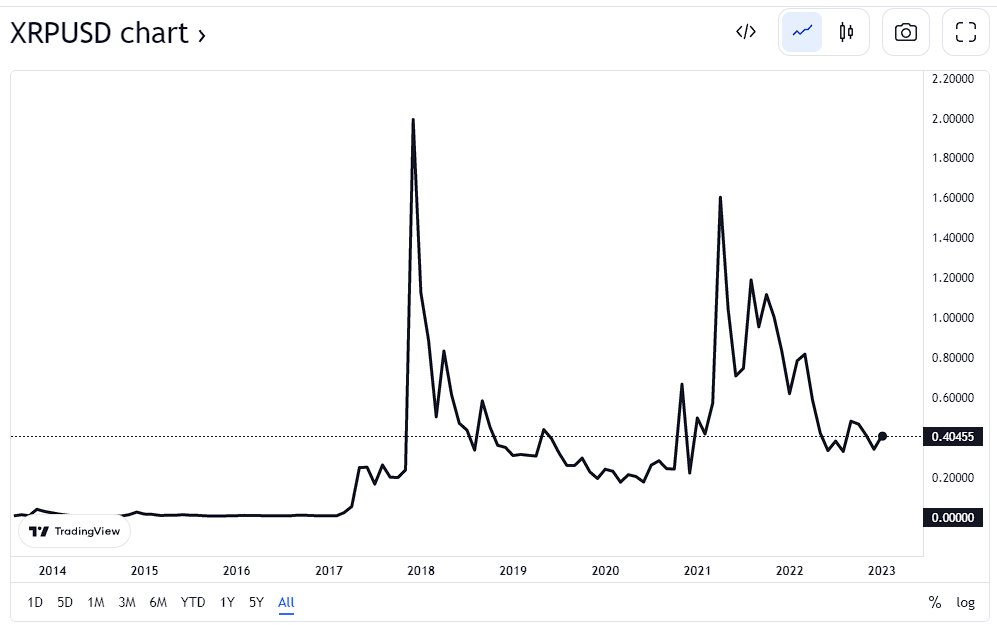

5. 100b $XRP were created. None can be created, only destroyed, by TX fees or by sending it to an address for which no one holds a key, "blackholing" it. The price of XRP is determined by market value: how much do people want to pay to hold #XRP or use it to move money?

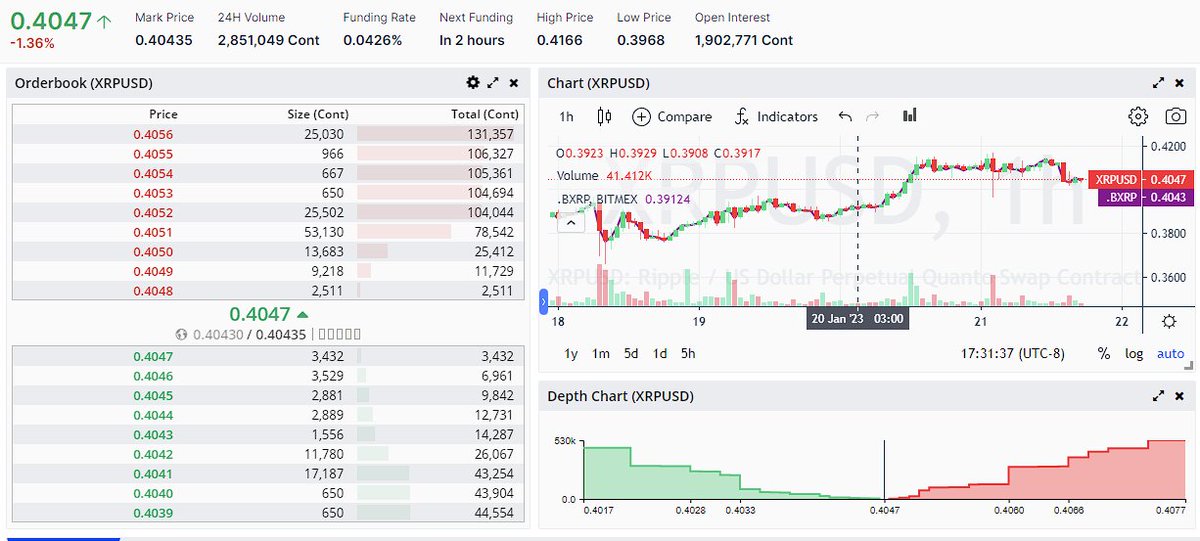

6. If the value of $XRP existing on the orderbooks is not enough to move value as desired, it will be bid up to handle it. There are lots of debates about what amount of value will XRP be used to move, and what it will do to price. There are 100b XRP afterall, settling quickly.

7. Important! Note $XRP is not "backed" by anything. It can't be; it does not represent external value, only the price someone is willing to pay for it on an orderbook. It's not "guaranteed" Its price is a metric of intrinsic value, the value of the network fxn to the market.

8. $XRP doesn't tokenize. It’s this lack of backing that makes it a useful trustless in-between settling currency. XRP can't be backed by gold. It makes no sense to even try (buy it all & guarantee it.)

Tokenizing requires the 2nd kind of asset; "tokens"-

Tokenizing requires the 2nd kind of asset; "tokens"-

https://twitter.com/WKahneman/status/1579991325876723712

9. Tokens have different qualities than $XRP. Originally called IOUs, then "issued currencies" & now just “tokens” to reflect the growing diversity of NFTs , Stablecoins, and other tokenized value, they represent assets outside of the XRPL on the ledger.

xrpl.org/tokens.html#to…

xrpl.org/tokens.html#to…

10. This representation of assets requires trust. You can tokenize almost anything, but something outside of the XRPL is guaranteeing the value. The XRPL can only represent someone else's promises in a token, it cannot guarantee it.

11. Tokens require “trustlines,” a relationship between two XRPL accounts.

- Stablecoins, NFTs, Community Credit, all require trustline, but not $XRP.

- Unlike $XRP, tokens can be frozen. Fees can be charged.

xrpl.org/currency-forma…

- Stablecoins, NFTs, Community Credit, all require trustline, but not $XRP.

- Unlike $XRP, tokens can be frozen. Fees can be charged.

xrpl.org/currency-forma…

12. Tokenizing things on the XRPL does not directly increase $XRP value. In fact, they function almost independently. Sure, there is a tx fee, reserve fee, required in XRP, but the value tokenized is quite divorced from the value of XRP. (ignoring pathfinding, atm)

13. So here's the point:

The hope is that the usefulness of the XRPL to tokenize things makes XRP valuable because the ledger works, but XRP is not the tokenization.

/end

The hope is that the usefulness of the XRPL to tokenize things makes XRP valuable because the ledger works, but XRP is not the tokenization.

/end

14. Of course there's more to it😅One issue is pathfinding for tokens, which, for simplicity’s sake (mine) I’ve left out. The role of smart contracts/amm com into play, but I don’t think it changes the basic paradigm: Tokens require external trust.

end/

sorry, long and dry but the way people talk about assets on the XRPL and XRP gets muddled on this app and it seemed lame to just tell everyone to read the docs. 😆

sorry, long and dry but the way people talk about assets on the XRPL and XRP gets muddled on this app and it seemed lame to just tell everyone to read the docs. 😆

read the docs.

😇

😇

• • •

Missing some Tweet in this thread? You can try to

force a refresh