1/

From the latest #Celsius Coin Report:

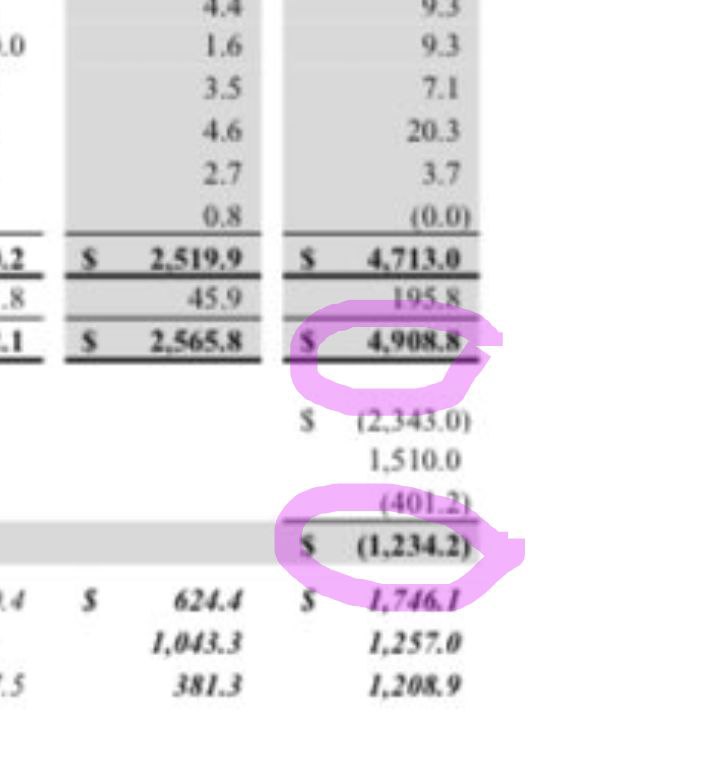

Total Coin Liabilities: $4.7b

Equity: ($1.2b)

Taking the ratio of the two numbers we get:

Size of Hole: 25%

That is the value missing, and the remaining 75% is still in the estate.

From the latest #Celsius Coin Report:

Total Coin Liabilities: $4.7b

Equity: ($1.2b)

Taking the ratio of the two numbers we get:

Size of Hole: 25%

That is the value missing, and the remaining 75% is still in the estate.

2/

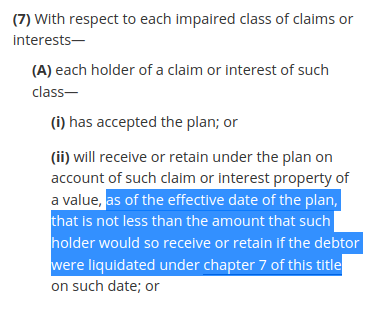

Bankruptcy Law is clear.

Any plan, whether by TradFi or not, must return at least 75% back to creditors in order to meet the threshold defined in the clause below.

Anything short of that will not be approved by the judge.

Bankruptcy Law is clear.

Any plan, whether by TradFi or not, must return at least 75% back to creditors in order to meet the threshold defined in the clause below.

Anything short of that will not be approved by the judge.

3/

So if 75% of the value is still there (not including the intangible value of the business, tech stack, and community), then any plan should provide at least 75% back.

Those creditors that are selling their claims today for the measly 15-17% are literally being scammed.

So if 75% of the value is still there (not including the intangible value of the business, tech stack, and community), then any plan should provide at least 75% back.

Those creditors that are selling their claims today for the measly 15-17% are literally being scammed.

Small typo.

Total coin liabilities should read $4.9b, which means the size of the hole is even less at 24%.

Total coin liabilities should read $4.9b, which means the size of the hole is even less at 24%.

Also note that this does not include clawbacks. If any value was returned to the bankruptcy estates, assets and liabilities would increase by the same amount, and the percentage size of the hole would be reduced even further.

• • •

Missing some Tweet in this thread? You can try to

force a refresh