2/ Consolidation for nearly 6 months with one fakeout pump and dump and now in Jan again broke out of that range.

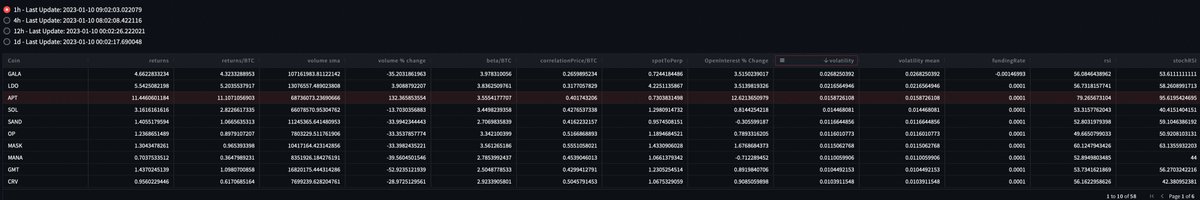

3/ DYDX funding rate %, fluctuations show some minor insight into proceeding price action. Negative funding rates together with a dump most often seem to coincide with scalp buy opportunities.

4/ As far as active addresses on Matic are concerned, they are in sync with the price of the token. Almost work as a proxy to price.

5/ When 30d price volatility goes up on Matic, it does not typically end well for the price action in short term. Right now, we see both price and volatility metric up on the 30d frame.

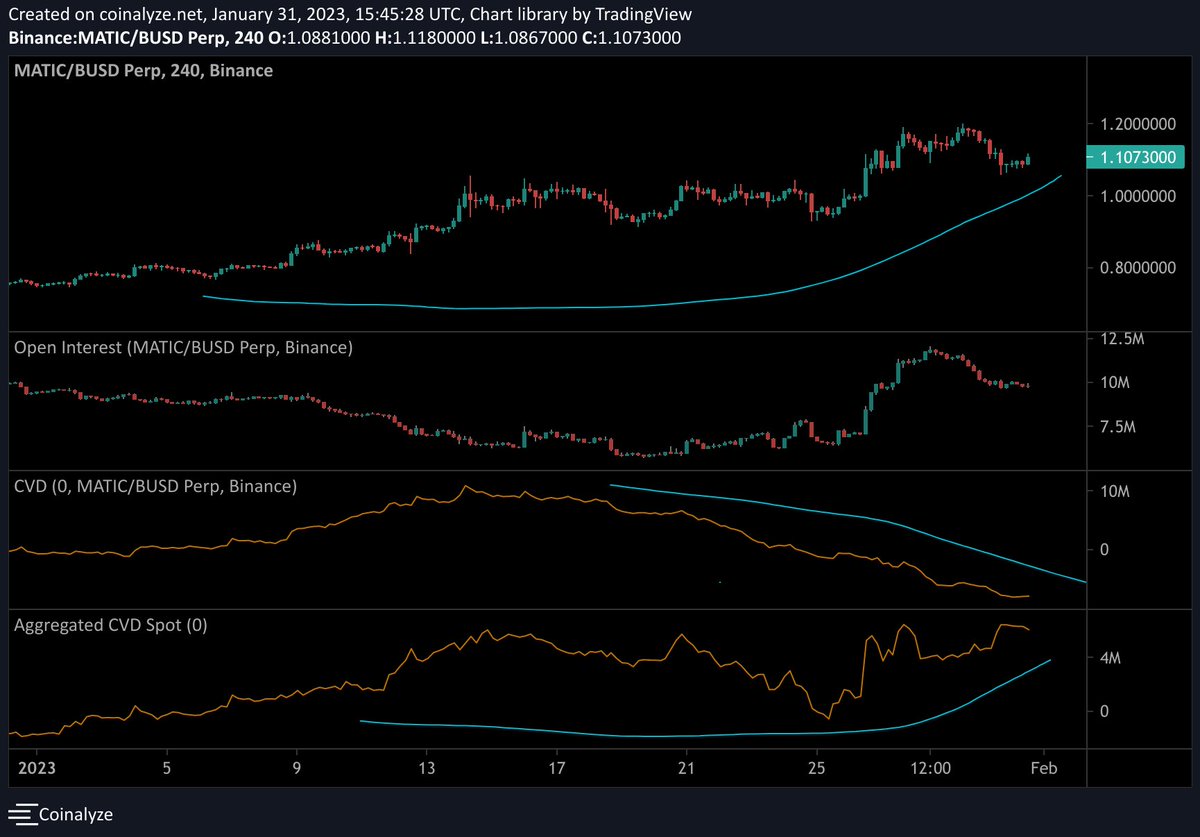

6/ Binance open interest sees spikes on every price pump during this consolidation and then dissipates as soon as momentum slows down. Funding rate regimes on Binance have also switched to neutral.

7/ While on USDT paired CVD has been neutral, we see that in the BUSD pairing Matic has seen spot bidding while perps cvd has been relatively dim.

8/ Breakout of such a long consolidation range should not be taken lightly although there are warning signs of a pullback as well. With ZK2023 Mainnet announcement and release coming up,Matic might surprise us.

• • •

Missing some Tweet in this thread? You can try to

force a refresh