2023 is the year of ZK-rollups.

ZK is the future of scaling Ethereum, and with the upcoming token launches of @zksync, @Starknet and @0xPolygon's zkEVM - the narrative is starting to heat up.

🧵: Here are the best released (and unreleased) ZK projects to keep your eye on. 👀👇

ZK is the future of scaling Ethereum, and with the upcoming token launches of @zksync, @Starknet and @0xPolygon's zkEVM - the narrative is starting to heat up.

🧵: Here are the best released (and unreleased) ZK projects to keep your eye on. 👀👇

In this thread, I'll cover:

• What are ZK-rollups

• The ZK narrative (and why it's heating up)

• The best released ZK projects

• The best unreleased ZK projects (including airdrop opportunities)

Let's dive in! 👇

• What are ZK-rollups

• The ZK narrative (and why it's heating up)

• The best released ZK projects

• The best unreleased ZK projects (including airdrop opportunities)

Let's dive in! 👇

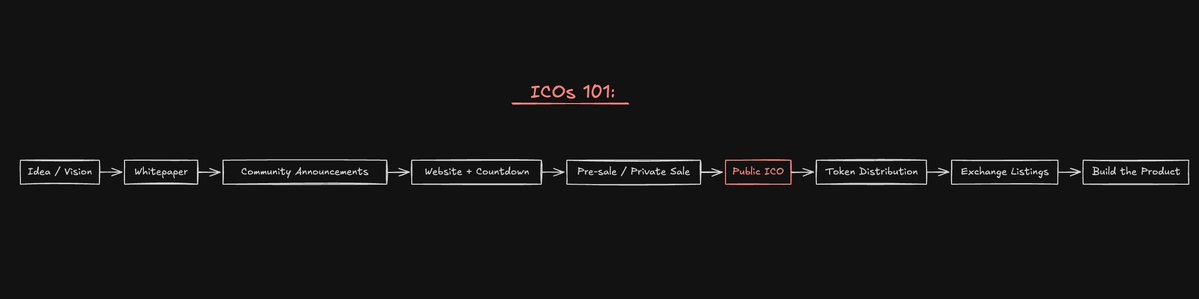

What are ZK-rollups?

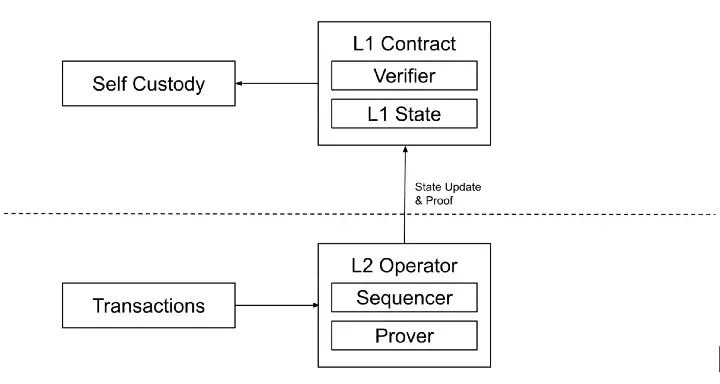

ZK-rollups are Layer-2 blockchain protocols that process transactions, perform computations, and store data off-chain while holding assets in an on-chain smart contract.

ZK-rollups are Layer-2 blockchain protocols that process transactions, perform computations, and store data off-chain while holding assets in an on-chain smart contract.

Ethereum has inherent scalability problems due to its design.

And although there is a roadmap to eventually solve these issues, this process will take a long time.

ZK-rollups help alleviate congestion by 'rolling up' transactions into batches that are executed off-chain.

And although there is a roadmap to eventually solve these issues, this process will take a long time.

ZK-rollups help alleviate congestion by 'rolling up' transactions into batches that are executed off-chain.

Zk-rollups store all addresses and respective balances in a merkle tree. The root of this “balance tree” is stored in an on-chain smart contract.

They have 3 main tasks: Handling deposits, transfers, and withdrawals.

This image represents a (simplified) ZK-architecture.

They have 3 main tasks: Handling deposits, transfers, and withdrawals.

This image represents a (simplified) ZK-architecture.

If you'd like a more non-technical explanation, @benjaminsimon97 wrote a great analogy to help explain how rollups work.

To summarise, ZK-rollups are "hybrid scaling solutions" (off-chain protocols) that operate independently but derive security from the Ethereum network.

The ZK narrative is gaining momentum. Why?

There are a few major catalysts this year which are giving the sector a spike in interest.

• Upcoming token launch of @zksync

• Upcoming token launch of @Starknet by @StarkWareLtd

• Upcoming launch @0xPolygon's zkEVM

There are a few major catalysts this year which are giving the sector a spike in interest.

• Upcoming token launch of @zksync

• Upcoming token launch of @Starknet by @StarkWareLtd

• Upcoming launch @0xPolygon's zkEVM

This has resulted in ZK-related protocols such as $MINA, $LRC, $IMX and $DUSK outperforming.

https://twitter.com/apes_prologue/status/1620127562906337282?s=20&t=QLJj1NP85KD92wQBO8e7eA

@hosseeb, Managing Partner at @dragonfly_xyz, named ZK-rollups as the top narrative to look out for in 2023.

https://twitter.com/milesdeutscher/status/1615686396068659213?s=20&t=TINR0QhMgL-SvcO_ROnR3g

This recent run, however, is likely speculation-driven, as key on-chain metrics (active users, transactions, bridge deposits) haven't increased alongside price.

So, is this short-term rally unsustainable? Perhaps.

So, is this short-term rally unsustainable? Perhaps.

However, a sustained rally is more likely to occur closer to (and post) the launch of ZkSync, Polygon zkEVM and StarkNet.

This would be aided by an increase of new users and a fresh inflow of liquidity into the ecosystem.

This would be aided by an increase of new users and a fresh inflow of liquidity into the ecosystem.

So to prepare, I've broken down a list of released and unreleased ZK-related crypto projects (in no particular order).

---- RELEASED -----

$MINA

@MinaProtocol is "the world's lightest blockchain", which uses zk-SNARKs alongside a Proof-of-Stake (PoS) consensus mechanism.

@MinaProtocol is "the world's lightest blockchain", which uses zk-SNARKs alongside a Proof-of-Stake (PoS) consensus mechanism.

Mina dramatically reduces the amount of data each user needs to download, with ZK-Rollups allowing nodes to store smaller proofs, as opposed to the entire chain.

$IMX

@Immutable is a Layer-2 scaling solution, designed to offer near-instant confirmation and near-zero gas fees for NFT trading and minting.

IMX relies on @StarkWareLtd ZK-rollups to achieve scalability, and plans to support multiple L2/L3 ZK-rollups for different use cases.

@Immutable is a Layer-2 scaling solution, designed to offer near-instant confirmation and near-zero gas fees for NFT trading and minting.

IMX relies on @StarkWareLtd ZK-rollups to achieve scalability, and plans to support multiple L2/L3 ZK-rollups for different use cases.

They describe themselves as "the developer platform for web3 games", with popular web3 games such as @illuviumio, @GodsUnchained, @kongregate and many more all building on IMX.

I'm a fan of ImmutableX ecosystem.

I'm a fan of ImmutableX ecosystem.

$LRC

@loopringorg is a Layer-2 designed for scaling and building decentralised crypto exchanges.

They leverage ZK Proofs to allow anyone to build a high-throughput, non-custodial DEX.

@loopringorg is a Layer-2 designed for scaling and building decentralised crypto exchanges.

They leverage ZK Proofs to allow anyone to build a high-throughput, non-custodial DEX.

The combination of exposure to 2 strong narratives: ZK, and the DEX (trading) narrative, make Loopring an interesting project to watch in the future.

$SYS

@syscoin combines both #Bitcoin's POW architecture and $ETH's EVM into a single network.

Its dual-layer approach allows the creation of scalable smart contracts, whilst maintaining network security.

@syscoin combines both #Bitcoin's POW architecture and $ETH's EVM into a single network.

Its dual-layer approach allows the creation of scalable smart contracts, whilst maintaining network security.

Syscoin uses a modified version of the EVM, called NEVM, which uses ZK proofs to facilitate "up to 210,000 transactions per second (TPS)."

The visual below defines Syscoin's architecture.

The visual below defines Syscoin's architecture.

$DUSK

@DuskFoundation is a privacy-focused Layer-1 blockchain, built for trading programmable, confidential, and compliant securities.

Think of it as the privacy blockchain for financial applications.

@DuskFoundation is a privacy-focused Layer-1 blockchain, built for trading programmable, confidential, and compliant securities.

Think of it as the privacy blockchain for financial applications.

Dusk Network uses a ZK proof (ZKP) system called 'PlonKup' to protect data in an affordable manner.

Below is a visual explanation of the consensus mechanism.

Below is a visual explanation of the consensus mechanism.

$MUTE

@mute_io is a ZK-rollup based DEX, farming platform, and Bond platform built on Ethereum and @zksync.

Think of it as a comprehensive DeFi platform which leverages the benefits of ZK.

@mute_io is a ZK-rollup based DEX, farming platform, and Bond platform built on Ethereum and @zksync.

Think of it as a comprehensive DeFi platform which leverages the benefits of ZK.

@QuantMeta also wrote a helpful "cheat sheet" to further breakdown the ZK narrative.

It's important to note that much of this rally (like a lot of crypto narratives) is speculation-based.

Just because a project has implemented ZK-tech, doesn't automatically make it a winner.

Look for projects that are using the tech to innovate, or learn to trade the hype.

Just because a project has implemented ZK-tech, doesn't automatically make it a winner.

Look for projects that are using the tech to innovate, or learn to trade the hype.

When it comes to these projects, like most altcoins, price action is largely dependent on #Bitcoin.

However if your market outlook is bullish, the strongest narratives will undoubtably outperform (ZK could be one of them).

However if your market outlook is bullish, the strongest narratives will undoubtably outperform (ZK could be one of them).

How you approach trading these projects depends on your personal strategy, but consider a DCA-orientated approach and strictly define a) your time horizon, and b) financial objectives before investing.

And of course, DYOR.

And of course, DYOR.

----- UNRELEASED -----

So we've covered some of the currently released projects which leverage ZK.

But I'm much more excited by the upcoming unreleased protocols, which are some of the most strongly backed projects in crypto (and also have airdrop potential).

Let's explore some of my favourites. 👇

But I'm much more excited by the upcoming unreleased protocols, which are some of the most strongly backed projects in crypto (and also have airdrop potential).

Let's explore some of my favourites. 👇

@zksync

zkSync is a ZK rollup that represents the "end-game" for scaling Ethereum.

It's one of the most backed projects in crypto, raising over $450m from the likes of a16z, Dragonfly, Lightspeed and more.

zkSync is a ZK rollup that represents the "end-game" for scaling Ethereum.

It's one of the most backed projects in crypto, raising over $450m from the likes of a16z, Dragonfly, Lightspeed and more.

Their full Mainnet hasn't even launched yet, but the ecosystem is already vast.

It's going to be a behemoth in the ZK space.

It's going to be a behemoth in the ZK space.

The next stage of zkSync is the "Fair Onboarding Alpha" stage, where protocols can start deploying on zkSync 2.0 in a closed environment.

@StarkWareLtd

StarkWare is an L2 scaling solution which utilises STARK proofs to reduce the amount of information sent to the Ethereum blockchain and alleviate blockchain congestion.

SnarkNet, like zkSync, utilises ZK-Rollup technology to achieve this.

StarkWare is an L2 scaling solution which utilises STARK proofs to reduce the amount of information sent to the Ethereum blockchain and alleviate blockchain congestion.

SnarkNet, like zkSync, utilises ZK-Rollup technology to achieve this.

Starkware is also heavily backed, raising $285m+ from the likes of Paradigm, Pantera, Sequoia, the Ethereum Foundation and more.

Their ecosystem is also impressive.

Their ecosystem is also impressive.

@Scroll_ZKP

Scroll is a zkEVM-based zkRollup, that enables native compatibility for existing Ethereum applications and tools.

Scroll has the 4th highest pre-market valuation out of the upcoming L2s.

Scroll is a zkEVM-based zkRollup, that enables native compatibility for existing Ethereum applications and tools.

Scroll has the 4th highest pre-market valuation out of the upcoming L2s.

https://twitter.com/LenoCrypto11/status/1617464288083595265?s=20&t=HUejr9MEmFZcn3PqT93TRA

And with a token launch on the horizon, there may be an airdrop opportunity here.

They recently hinted at an airdrop, stating that they're "creating an incentive mechanism to encourage participation."

Here's how you can prepare:

They recently hinted at an airdrop, stating that they're "creating an incentive mechanism to encourage participation."

Here's how you can prepare:

https://twitter.com/TKatugwa/status/1598785423588749312?s=20&t=I84_n-QuSGEctVA-wUslPw

@aztecnetwork

Aztec is a privacy-first ZK-rollup on Ethereum bringing confidentiality and cost savings to the Ethereum ecosystem.

They recently raised $100m, led by @a16z.

They may also have an airdrop in the future.

Aztec is a privacy-first ZK-rollup on Ethereum bringing confidentiality and cost savings to the Ethereum ecosystem.

They recently raised $100m, led by @a16z.

They may also have an airdrop in the future.

https://twitter.com/OlimpioCrypto/status/1609259055075463169?s=20&t=Ztdf-UVGdoC5uCj3FFmNwQ

@0xPolygon (zkEVM)

Recently, Polygon acquired Hermez Network (a ZK-rollup) in order to work on their own zkEVM offering.

zkEVM is a virtual machine that executes Ethereum transactions in a transparent way, including smart contracts with zero-knowledge-proof validations.

Recently, Polygon acquired Hermez Network (a ZK-rollup) in order to work on their own zkEVM offering.

zkEVM is a virtual machine that executes Ethereum transactions in a transparent way, including smart contracts with zero-knowledge-proof validations.

zkEVM adds to an already expansive ecosystem that is developing rapidly.

As Hermez has merged with Polygon, the $MATIC token will power the network.

I wrote a full deep-dive on $MATIC and its architecture last year.

As Hermez has merged with Polygon, the $MATIC token will power the network.

I wrote a full deep-dive on $MATIC and its architecture last year.

https://twitter.com/milesdeutscher/status/1549366133441998854?s=20&t=_020Fz8WqvG1yWCrG_hsbw

@axiom_xyz

Axiom is a ZK coprocessor for Ethereum.

Although not strictly a ZK-rollup, I wanted to include Axiom on this list as it gives us a great representation of how the technology can be utilised in a practical sense.

Axiom is a ZK coprocessor for Ethereum.

Although not strictly a ZK-rollup, I wanted to include Axiom on this list as it gives us a great representation of how the technology can be utilised in a practical sense.

It allows developers to query on-chain data, and get a trustless response via ZK - allowing developers to enhance their apps with ZK in an efficient manner.

https://twitter.com/axiom_xyz/status/1620104714322051073?s=46&t=nahLsNUpwUc_Y91A-Q2txg

Whether it be via an airdrop, investment upon release, or investing in the individual ecosystems - there are many strategies for positioning yourself in these upcoming projects.

If you're interested in learning more crypto airdrops specifically, I wrote a full thread outlining 20 upcoming airdrops that I've got on my radar.

https://twitter.com/milesdeutscher/status/1619701531544268801?s=20&t=TNCzrvekVGsIi3R8nBQz2g

Tomorrow I'll be doing a YouTube video on ZK-rollups, where I break down this list even further, and give you my personal strategy for approaching this narrative.

Subscribe to my channel if haven't already so you don't miss it!

youtube.com/channel/UCVVX-…

Subscribe to my channel if haven't already so you don't miss it!

youtube.com/channel/UCVVX-…

If you enjoyed this thread, follow me @milesdeutscher for more content like this.

Also, Like/Retweet the first tweet below if you can. 💙

Also, Like/Retweet the first tweet below if you can. 💙

https://twitter.com/milesdeutscher/status/1620799259976007681

• • •

Missing some Tweet in this thread? You can try to

force a refresh