Taking a moment to reflect on the financial secrecy problems that football continues to refuse to deal with...🧵

There's a lot of great work around at the moment, digging into the questionable finances of their clubs, and those who would acquire them - from @uglygame on crypto sponsors, @SSTInvesting on Morecambe, to @sportingintel @PhilippeAuclair @JosimarFotball on the whole ball game

And just sometimes, there's a win for fans: a dubious would-be owner is sent on their way, a club refuses the filthy lucre of a crypto scam, or - even - a league stands up for meaningful financial fair play.

But you only need a small step back to see that, across the board, fans - and society - are still losing, hand over fist.

There are more fightback wins, yes, but that's because the problems are everywhere.

There are more fightback wins, yes, but that's because the problems are everywhere.

And these aren't new problems that have suddenly appeared. We can't pretend there's just a natural delay before policies will be in place to fix this.

It's 13 (THIRTEEN) years since the first #taxjustice report on this, published by @christianaid: Blowing the Whistle

It's 13 (THIRTEEN) years since the first #taxjustice report on this, published by @christianaid: Blowing the Whistle

Blowing the Whistle highlights the threat of financial secrecy in (UK) football, and how that mirrors the threat of tax abuse globally. Two key fan groups wrote an open letter in the report, calling for urgent action.

Link to the report: financialtransparency.org/wp-content/upl…

Link to the report: financialtransparency.org/wp-content/upl…

The key message is that fans suffer - and society suffers - from the failure to regulate against financial secrecy and its exploitation.

And on that, nothing has changed - except perhaps the scale of the abuse.

And on that, nothing has changed - except perhaps the scale of the abuse.

The only Scottish team in the top 20 of the 2010 secrecy league table was Rangers, ranked 6th. Within two years, that hundred-year-old institution of the game was no more - bust after pursuing an offshore tax scheme for a decade, finally uncovered by HMRC.

Then @TaxJusticeNet created @theoffshoregame (currently dormant) to highlight the issues. In 2015, we published the Football Financial Secrecy League table, showing the most vulnerable clubs across the UK taxjustice.net/reports/the-of…

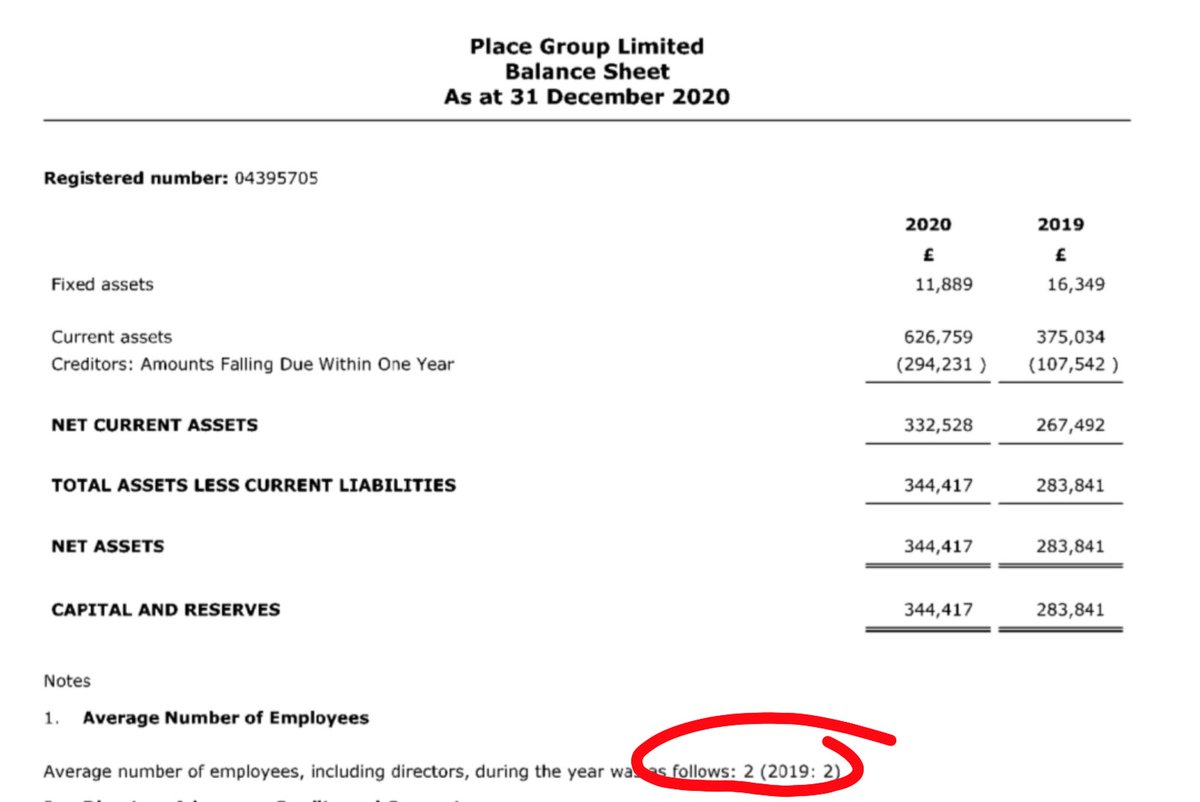

The top two in the Football Financial Secrecy League of 2015, for what it's worth, were Man City (nuff said) and Bolton (since bankrupt). I'm not saying we told you so,* but let no one be in any doubt: financial secrecy is a serious risk factor.

*ok, I am

*ok, I am

Next @theoffshoregame published a report into the Scottish Football Association's shocking failures, in allowing Rangers to go bust, 'Doing SFA for Fair Play'.

theoffshoregame.net/475-2/

theoffshoregame.net/475-2/

That report highlighted two issues. First, the long-serving Rangers official who was a central figure in the establishment of one of their tax avoidance schemes, gave misleading evidence to the subsequent inquiry *while he was President of the SFA*(!).

Reader, the inquiry did not strip Rangers of the titles that had been won during the many years of proven tax abuse.

Second, the report showed how the SFA allowed Rangers entry to lucrative European competition when this should clearly have been barred by the outstanding tax issues - thereby robbing another member club of the right to compete.

The Rangers case shows how football authorities' failure to regulate can lead to enormous damage- both to Rangers fans, who lost their club and had to restart from scratch; and to all other fans, who saw the fundamental breach of integrity in their teams' domestic competition.

And still UK football fails to protect fans against dubious practices - from dodgy money and dodgy owners coming in, and from dodgy tax practices and FFP abuses. To say nothing of the likely seriousness of any efforts to defeat match-fixing.

The UK is increasingly perceived as corrupt, and continues to undergo a period of government that is characterised, perhaps above anything substantive or ideological, by a sense of impunity. opendemocracy.net/en/nadhim-zaha…

What hope can fans have for the integrity of even such a simple thing as the game of football?

Politicians - and regulators and clubs - don't see the light, they feel the heat (as the saying has it). Fans need to make sure their voices are clearly heard, to turn the heat up.

Politicians - and regulators and clubs - don't see the light, they feel the heat (as the saying has it). Fans need to make sure their voices are clearly heard, to turn the heat up.

• • •

Missing some Tweet in this thread? You can try to

force a refresh