Yesterday a large put trade in ES traded. My clients had questions. This was my answer. Let's call it "Icahn 101" I answer these client questions all day long. This is my value add if I have any. Waitlist sign up at dampedspring.com

#SPX $ES $SPy

#SPX $ES $SPy

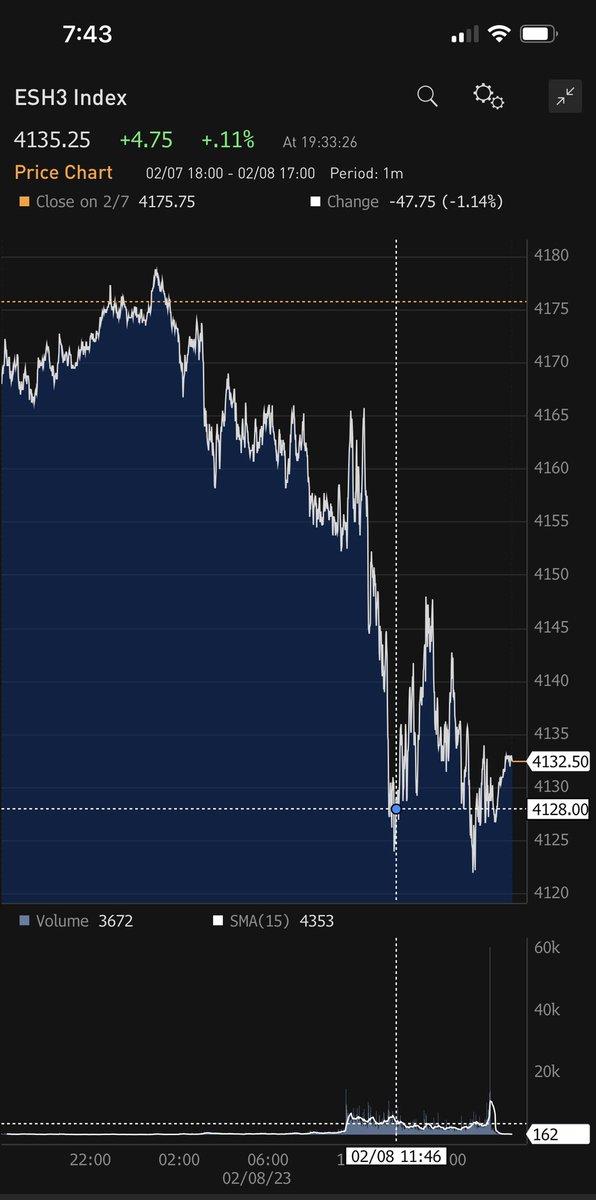

Mid day today 24000 2/17 expiry 4050 strike options on ES were purchased from market makers. People have speculated it was Carl Icahn as his trading desk is well know to make agressive short term bets (usually selling options). The trade cost 30MN in premium on 4.8BN notional

The immediate implications of this trade when it printed was the need for Market makers who sold the put to short roughly 7200 futures contract worth roughly 1.5BN dollars. That caused the local low

Now the games begin. The buyer is not likely to hedge. The market making sellers are short volatility and their hedging activity will exacerbate any moves up or down but particularly down moves. However as the option decays the delta will decrease in size which is called charm

The total charm buying between now and expiration if the market stands still is 1.5BN. However as the market prices change the gamma will have a major impact on charm. Charm won't be a dominant flow until Wednesday. Of course the CPI is on Tuesday.

At any time of course the buyer could look to exit. If he did right this second that would have a one time impact similar to the impact when he entered. Perhaps 10-20 handles. However that will depend on the delta at the time of selling. If for instance the market falls to 4000

By Wednesday the delta will be much larger and the unwind delta impact could be very significant. But let's be clear. Only the MM will have a chance to get this delta. As soon as the buyer calls the desk at the big broker dealer to ask for a bid the information will leak

Literally everyone salesperson on the desk as well as the trading desk have the clients phone number on their personal turret. When it rings the actual covering salesperson will pick it up. BUT the trading desk will already be buying futures and every other sales person will

Be calling their best client to give them the tip that the trade is about to unwind. YOU will get the information very late. When it prints the hedging was already done. So for you what is important is that a large negative gamma exists

Which until the trade is unwound will create instability at 4050. But when we blow through that the buyer will highly likely want to take profits. That's why the dealer desk will all be watching that light on the torrent. Because it will cause a sharp reversal. I've spent

10 years sitting next to the SPX options trader at Salomon and I can guarantee that's how it will go down. One more tweet about how it was below

Typical phone turrets in my time had about 4x the number of dedicated client lights that Bud Fox had. He was a piker

• • •

Missing some Tweet in this thread? You can try to

force a refresh