🚨🚨AN ANALYSIS OF THE "PROPOSAL"🚨🚨

⚠️⚠️⚠️⚠️A PHOENIX RISES⚠️⚠️⚠️⚠️

#Proton #XPR #Metallicus

10B Circulating Supply ✖️

14B Circulating Supply ✖️

28B Circulating Supply ✅

🔴MANIPULATION⁉️

🔴100% A SECURITY⁉️

🔴TAKING YOUR MONEY⁉️

🔴ARE YOU BEING SCAMMED⁉️

🧵

⚠️⚠️⚠️⚠️A PHOENIX RISES⚠️⚠️⚠️⚠️

#Proton #XPR #Metallicus

10B Circulating Supply ✖️

14B Circulating Supply ✖️

28B Circulating Supply ✅

🔴MANIPULATION⁉️

🔴100% A SECURITY⁉️

🔴TAKING YOUR MONEY⁉️

🔴ARE YOU BEING SCAMMED⁉️

🧵

1) This is my opinion, not a declaration of future success of the project or an accusation of illegal activity. It's a non-technical evaluation of the proposal to double #XPR's circulating supply from 14B to 28B.

You decide what to trust.

drive.google.com/file/d/1huTxPe…

You decide what to trust.

drive.google.com/file/d/1huTxPe…

2) The first concept I'd like you to understand is the "Anchoring Effect." Anchoring involves presenting you with information upfront to influence your judgment of subsequent information. Its goal is to bias your thinking through the lens of the anchor.

en.wikipedia.org/wiki/Anchoring…

en.wikipedia.org/wiki/Anchoring…

3) In this thread, I will identify the initial "anchors" and how they are persistently used. It's important to recognize that this is a manipulative tactic aimed at biasing your thinking towards positive emotions that can distract you from any inconsistencies in their argument.

4) The second concept to understand is the "Appeal to Emotion." It manipulatively stirs emotional responses rather than relying on logic to support an argument, thereby distorting judgment of subsequent information.

logicallyfallacious.com/cgi-bin/uy/web…

logicallyfallacious.com/cgi-bin/uy/web…

5) In this thread I will point out the multiple emotional appeals and how they manipulate our perception of the information presented.

Now on to the multiple red flags...🚩🚩🚩

Now on to the multiple red flags...🚩🚩🚩

🚩1) The "Phoenix" narrative. The Phoenix narrative has long been used to the highest degree for XRP. To me, this is a sign of manipulation to capture the attention of #XRPCommunity members with a common frame of reference. We've seen the Proton promote this Dog Whistle before.

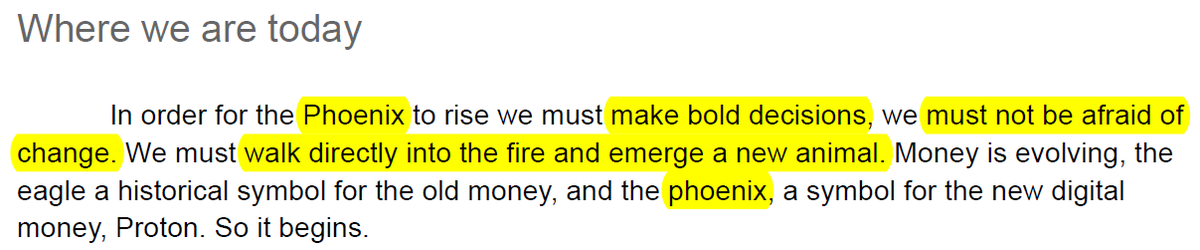

🚩2) The first paragraph mentions the Phoenix and relies on emotional appeals. It suggests that being brave and making bold decisions is necessary, but these terms are used to evoke emotion instead of logic, clouding our judgment for the information ahead.

🚩3) The second paragraph starts out with Anchoring to good claims about the project, irrelevant to the doubling of supply. It then appeals to ones sense of community and tribalism. Then reinforcing the need for "Change"...

🚩4) This statement is highly manipulative, implying that Proton's lack of success is due to the need for the proposed changes, unfairly placing the responsibility for success or failure on the reader instead of @MarshallHayner & the team. Support this proposal or Proton fails.

🚩5) In the third paragraph, more anchoring claims about the project. There's also a subtle appeal to the fear of not being among the "losers in years to come." Once again, your support of this proposal will determine whether you will be perceived as a winner or loser over time.

🚩6) It's suggested that supporting this proposal will lead to success comparable to Coinbase or Binance. An expectation of profit? Then additional anchoring. These points are irrelevant to determining whether doubling the supply is beneficial or detrimental to the investor.

🚩7) The autonomous organism: Here attempting to assuage your concerns about increasing the supply by pointing out what Dogecoin has done. Implying that there's no need for worry. Does it sound like a reasonable argument to justify doubling the supply of XPR based on a shitcoin?

🚩8) Here, we observe another emotional appeal - an appeal to the fear of not taking a risk.

Additionally, it is worth noting the usage of the word "risk" and how there is no discussion in the entire document about what that risk actually entails.

Additionally, it is worth noting the usage of the word "risk" and how there is no discussion in the entire document about what that risk actually entails.

🚩9) XPR's initial supply was 10 billion, with 98% allocated to the team and "development." Did they miscalculate their initial assessment of the necessary resources to support their developers? Why is it now the responsibility of holders to make the sacrifice?

🚩10) Disregard past mismanagement or growth projection failures. Take a chance on yourself and embrace the doubling of supply. Ignore your fears and become a winner!

The manipulation is quite obvious if you know what to look for. Trying to convince you to part with YOUR MONEY!

The manipulation is quite obvious if you know what to look for. Trying to convince you to part with YOUR MONEY!

🚩11) It appears that their protocol and future vision did not consider the possibility of a market downturn. The HOLDERS are now expected to pay to "keep the network online" when it should have been designed to withstand the volatility to begin with.

🚩12) The project failed to address this issue from the outset. 1% block reward was insufficient to maintain network during downturns.

What leads you to believe that with such failings - apparently addressed by doubling the supply - will not be necessary again in the future?

What leads you to believe that with such failings - apparently addressed by doubling the supply - will not be necessary again in the future?

🚩13) The success or failure of the project depends on the community, not the protocol, the tokenomics, the team or the CEO.

Refusing to support the proposal is equivalent to denying support to the community.

Can you identify the Appeal to Guilt?

Refusing to support the proposal is equivalent to denying support to the community.

Can you identify the Appeal to Guilt?

🚩14) Also support marketing! We forgot to allocate funds for it after taking 98% of the initial supply. The proposal will take 50% of holders' coins for marketing. If it is not approved, we can't proceed with this essential aspect of all business that we failed to plan for.

🚩15) Don't wait! The window of opportunity to be noticed will pass us by! If we don't pay for marketing, we will "ultimately fail".

HOORAYYY FOR COMMUNITY! HOORAYY FOR THE POWER OF PROTON!!!

HOORAYYY FOR COMMUNITY! HOORAYY FOR THE POWER OF PROTON!!!

🚩16) In the most blatant cash grab of the entire document, 10,000,000,000 of the newly created supply will go to Metallicus. Remember, Metallicus is its own project that already possesses over 50% of the token....

🚩17) 71% of the proposed supply increase will go to Metallicus, with no requirement for DAO approval. Metallicus will have complete control over how this money is spent. For all we know, it could potentially include a CEO or staff bonus. They've done it before.

🚩18) Is it necessary for me to point out the utter absurdity of arguing for a reduction in supply being a good thing on a proposal meant to double it? The logic is baffling, and it seems as if the creators of this proposal have a low opinion of our intelligence.

🚩18) Do I need to point out the hypocrisy of those who vehemently opposed Ripple's use of market makers to enhance the liquidity of XRP are now backing a project that aims to do just the same for Proton/XPR?

🚩19 )This proposal is specifically targeted at the holders and block producers of the network. It's not about the requirement for more physical XPR coins, but it's completely about taking away your value. The value you possess is being consumed to cover their operating expenses.

🚩20) This is not about your bravery, fears, community loyalty, or guilt. A significant part of this document was intended to appeal to your emotions and influence you positively, rather than to critically assess the justification for doubling the supply of XPR.

🚩21) The document could single-handedly be used as evidence to support the claim that XPRs a security. They're asking for investors' money to support Metallicus, developers, and the marketing team to promote Proton and increase its network value. How could it not be a security?

🚩22) There was a time when I was interested in this project, but this proposal was all I needed to see in order to run for the hills. No matter how good the project sounds, if they need to be manipulative towards investors, I want nothing to do with them. It's your choice though

• • •

Missing some Tweet in this thread? You can try to

force a refresh