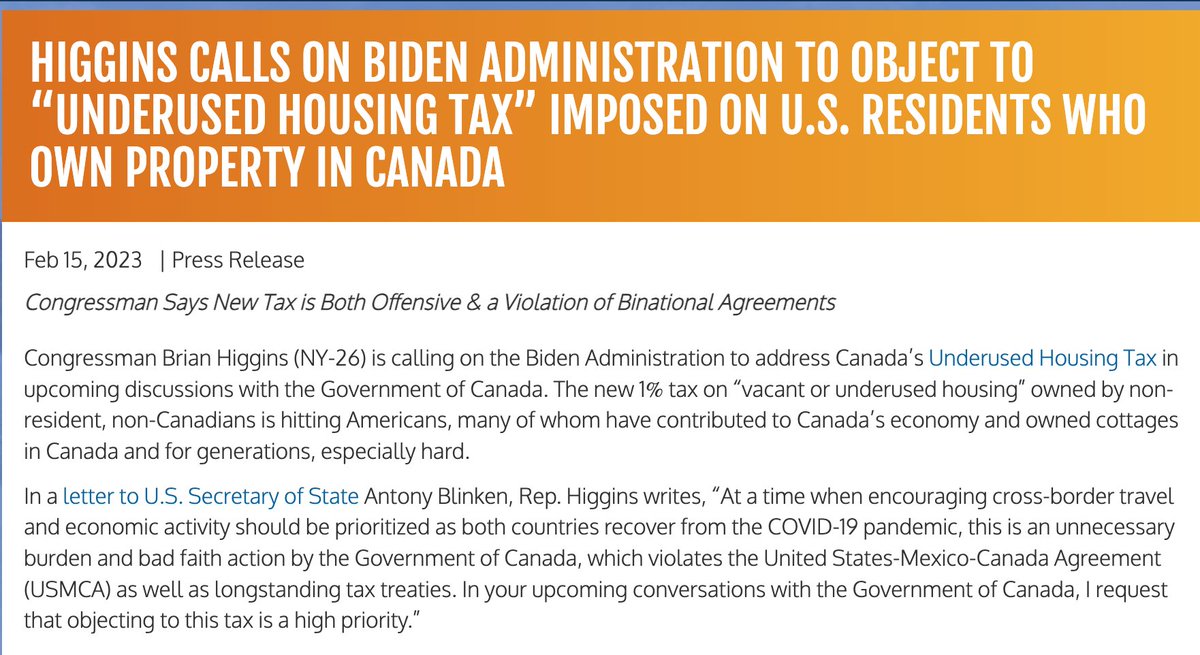

@RepBrianHiggins launches campaign seeking "carve out" from Canada's @VacantHomeTax for US citizens. He argues that this CDN tax (based on citizenship) violates US/CAN tax treaty and #USMCA. What about US @citizenship tax and #FATCA imposed on CDNs? higgins.house.gov/media-center/p…

Although @RepBrianHiggins is reinforcing the image of "The Ugly American" by his bullying tactics and viewing the world ONLY through his interests, this may be an opportunity to bring a discussion of US @citizenshiptax and #FATCA as applied to CDN residents into public domain.

As this thread indicates, @RepBrianHiggins is demanding that Secretary Blinken raise this issue when he visits Canada next month. Notice also the google from used to solicit complaints from his constituents.

https://twitter.com/RepBrianHiggins/status/1625952168309100585

Both @RepBrianHiggins and @USAccidental are using "Google Forms" in their respective fights against applications of @citizenshiptax. Is this an opportunity for "joint advocacy" to oppose ALL "forms" (pun intended) of citizenship-based taxes (#FATCA too)?

https://twitter.com/USAccidental/status/1626365678163836928

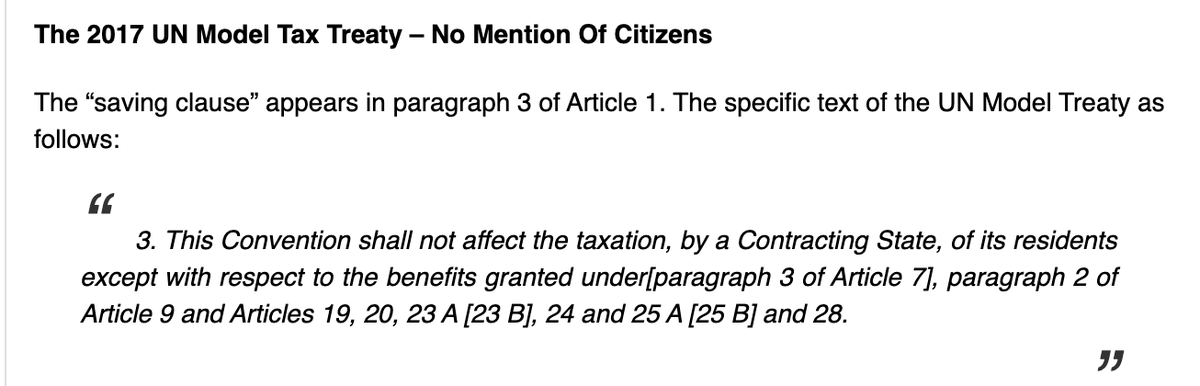

BTW, for those who don't understand Canada's Underused Property tax (yes it's a stupid tax), why it's based on citizenship and/or immigration status and why @RepBrianHiggins and US residents are (justifiably) upset, see this description and explanation citizenshipsolutions.ca/2023/02/08/us-…

It does strike me as rather ignorant (most probably explanation) and hypocritical for @RepBrianHIggins to opposed the CDN citizenship tax but (presumably) support US @citizenshiptax applied to CDNs and enforced by #FATCA. But probably he just doesn't know ...

It seems likely (given his propensity for fairness, justice and dislike of @citizenshiptax) that @RepBrianHiggins would want to advocate for the recognition that all citizenship taxes, imposed by either Canada or the US violate, "long standing tax treaties" and the USMCA.

And since @RepBrianHiggins references the USMCA, he really should also be complaining that Mexico's "citizenship based" restrictions on owning certain Mexican property should be called into question. Surely this discriminates against US citizens? See here mexlaw.com/desired-proper…

And surely @RepBrianHiggins would want to support CDN Snowbirds but are required to pay higher prop taxes than Americans. Could it be that he only objects to discrimination against US citizens who are not CDN residents? See this: snowbirds.org/bird-talks/flo…

In furtherance of fair taxation and the abolition of ALL forms of @citizenshiptax I would like to invite @RepBrianHiggins to join hands with @USAccidental in a joint statement opposing ALL forms of taxation based solely on citizenship or immigration status!

Where @RepBrianHiggins sees division, I see a clear opportunity for unity and collaboration toward fair taxation. What unites Mr. Higgins, the Gov of Canada and individual citizens - ending @citizenshiptax - is far greater than what divides them... Yes!

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh