A mega-trend is on the horizon for crypto

Tokenized real-world assets (RWAs) are now being issued on public blockchains by a growing number of Web3 projects and instituions alike

How and why?

This blog is my thesis on RWAs 🧵

blog.chain.link/tokenized-real…

Tokenized real-world assets (RWAs) are now being issued on public blockchains by a growing number of Web3 projects and instituions alike

How and why?

This blog is my thesis on RWAs 🧵

blog.chain.link/tokenized-real…

Firstly, why do people care about crypto and DeFi in the first place?

Because of the properties enabled by public blockchains:

- Atomic settlement

- Transparency

- User control

- Reduced costs

- Composability

Tens of billions of dollars have been absorbed into DeFi

Because of the properties enabled by public blockchains:

- Atomic settlement

- Transparency

- User control

- Reduced costs

- Composability

Tens of billions of dollars have been absorbed into DeFi

When faced with extreme market volatility, rapid deleveraging events, and the collapse of centralized crypto institutions, DeFi remained resilient

And yet...

DeFi remains a circular economy, disconnected from the global economy and largely fueled by capital rotation games

And yet...

DeFi remains a circular economy, disconnected from the global economy and largely fueled by capital rotation games

There is one major exception: Stablecoins

By tokenizing USD on-chain, we have created a superior version of the dollar, one that is natively digital, programmable, composable, and atomically settled

This is why there is now $132B of stablecoins circulating on-chain

By tokenizing USD on-chain, we have created a superior version of the dollar, one that is natively digital, programmable, composable, and atomically settled

This is why there is now $132B of stablecoins circulating on-chain

Over time, stablecoins have been deeply integrated into DeFi, primarily as a method to generate yield

While the yield mostly comes from leverage traders and inflationary rewards, stablecoins connect DeFi back to traditional finance and are useful for the average consumer

While the yield mostly comes from leverage traders and inflationary rewards, stablecoins connect DeFi back to traditional finance and are useful for the average consumer

The adoption of stablecoins in DeFi has proven that there is real market demand for tokenized RWAs

RWAs are simply the evolution of finance, where public blockchains serve as the golden source of truth, rather than taking place across siloed ledgers that require reconciliation

RWAs are simply the evolution of finance, where public blockchains serve as the golden source of truth, rather than taking place across siloed ledgers that require reconciliation

Tokenizing currencies, commodities, and securities brings many benefits:

- Delayed T+2 settlement is no more

- Reduce the need for costly intermediaries

- Audits can happen in real-time

- Liquidity is brought to private markets

- Entirely new financial products can be created

- Delayed T+2 settlement is no more

- Reduce the need for costly intermediaries

- Audits can happen in real-time

- Liquidity is brought to private markets

- Entirely new financial products can be created

Oracles like @chainlink will also play a crucial role, providing not only the Data Feeds required to use RWAs in DeFi

But also the infrastructure for connecting institutions to the multi-chain world (CCIP) and the ability for dApps to monitor off-chain reserves (PoR)

But also the infrastructure for connecting institutions to the multi-chain world (CCIP) and the ability for dApps to monitor off-chain reserves (PoR)

While there is no doubt a number of challenges that must be overcome to realize the full potential of tokenized RWAs

There has already been significant traction from both traditional institutions and DeFi projects alike

RWAs are no longer theoretical, they're here and now

There has already been significant traction from both traditional institutions and DeFi projects alike

RWAs are no longer theoretical, they're here and now

A notable example is Singapore central bank's Project Guardian

JP Morgan, DBS Bank, and SBI conducted live trades with tokenized government bonds & currencies using forked versions of @AaveAave and @Uniswap on @0xPolygon mainnet

oliverwymanforum.com/future-of-mone…

JP Morgan, DBS Bank, and SBI conducted live trades with tokenized government bonds & currencies using forked versions of @AaveAave and @Uniswap on @0xPolygon mainnet

oliverwymanforum.com/future-of-mone…

https://twitter.com/TyLobban/status/1587679344792829954

Just this week, @Siemens issued a €60M digital bond on the @0xPolygon mainnet, purchased by DekaBank, DZ Bank, & Union Investment

The need for paper-based certificates and central clearing was removed, allowing the bond to be sold without intermediaries

press.siemens.com/global/en/pres…

The need for paper-based certificates and central clearing was removed, allowing the bond to be sold without intermediaries

press.siemens.com/global/en/pres…

A number of DeFi apps are also rapidly incorporating tokenized RWAs as well

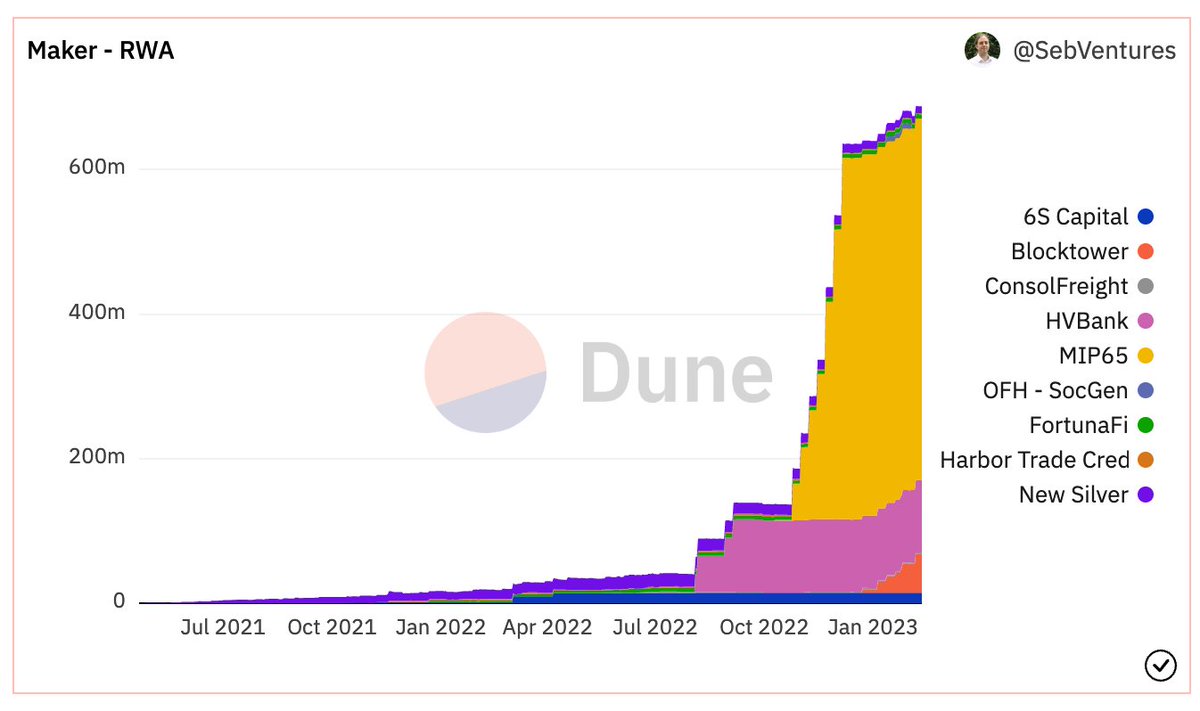

@MakerDAO has $680M+ worth of RWAs in collateral backing DAI today

This includes $500M of US treasury bonds and $100M of loans from a US-regulated bank (HVB)

A major boost in protocol revenue

@MakerDAO has $680M+ worth of RWAs in collateral backing DAI today

This includes $500M of US treasury bonds and $100M of loans from a US-regulated bank (HVB)

A major boost in protocol revenue

This is just the tip of the iceberg, with @OndoFinance, @BackedFi, @maplefinance, @goldfinch_fi, @centrifuge and many more DeFi projects jumping headfirst into tokenizing RWAs

Projects like @AaveAave, @avalancheavax, and many more also provide infra to facilitate RWA markets

Projects like @AaveAave, @avalancheavax, and many more also provide infra to facilitate RWA markets

And yes, the trust properties of tokenized RWAs will likely never be the same as a DeFi ecosystem relying entirely on crypto-native assets

But the power of public blockchains is that they can support *both* types of markets, allowing the consumer to choose their path

But the power of public blockchains is that they can support *both* types of markets, allowing the consumer to choose their path

Tokenized real-world assets are a multi-trillion-dollar opportunity for the crypto economy and someone will capture it

This thread is just a brief summary of the some of the main points I laid out in my recent blog

I implore you to take a full read 👇

blog.chain.link/tokenized-real…

This thread is just a brief summary of the some of the main points I laid out in my recent blog

I implore you to take a full read 👇

blog.chain.link/tokenized-real…

• • •

Missing some Tweet in this thread? You can try to

force a refresh