Since the IRA become law, we’ve been tracking how the US #EV supply chain has responded.

My students and I have inventoried publicly announced projects, capital investment, target production and employment levels, and more.

Here is what we’ve learned so far in 8 charts. 1/8

My students and I have inventoried publicly announced projects, capital investment, target production and employment levels, and more.

Here is what we’ve learned so far in 8 charts. 1/8

Not surprisingly, the IRA has accelerated investments in the domestic EV supply chain. More than 25 major new projects add up to a potential $32 billion in capital investment and 20,000 new jobs. 2/8

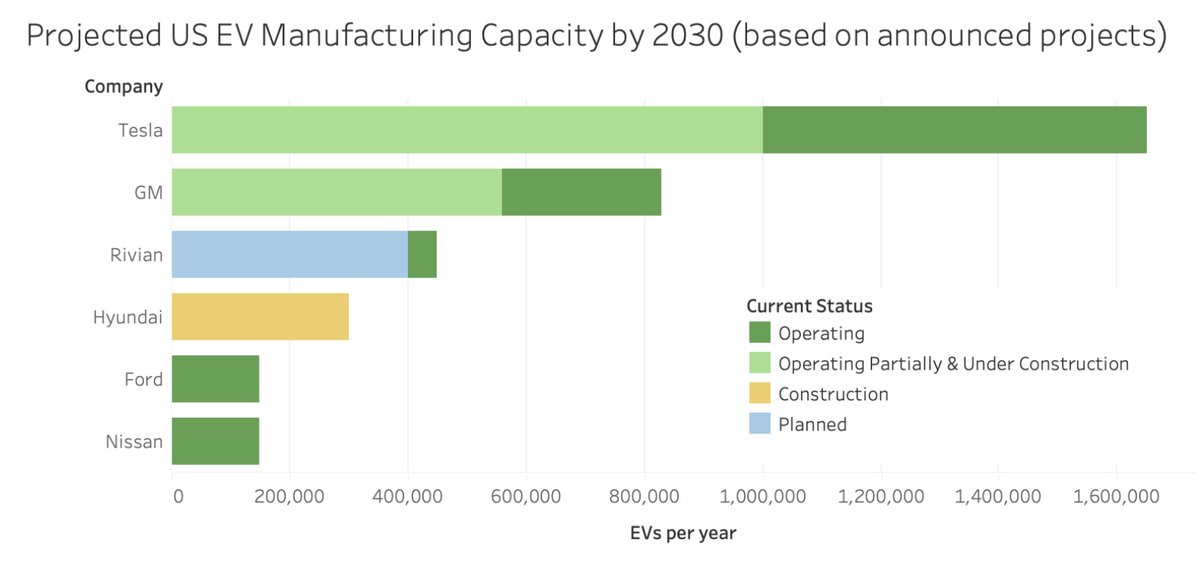

US EV manufacturing is now on track to reach 4.5 million vehicles a year, with more projects in the pipeline. Once preliminary plans announced by Ford, Honda, Volvo, and BMW are finalized, production levels could meet the Biden administration’s goal of 50% EV sales by 2030. 3/8

The boom in domestic battery manufacturing now outpaces plans for EV mfg. Battery mfg capacity is targeting 950 GWh by 2030, including 250 GWh in newly announced capacity since IRA. If each EV has 75 kWh battery pack, that is enough to support 12 million cars per year. 4/8

Mining and materials processing projects are lagging. Manufacturers will have to rely on free-trade partners to meet IRA critical minerals sourcing requirements. 5/8

Post-IRA investments have been concentrated in Republican-led states. Whether measured by capital investment, target employment, or the amount of federal support awarded to date, states led by Republican governors have claimed an outsized share of new EV projects. 6/8

We posted a longer version of this six-month update on CleanTechnica.

cleantechnica.com/2023/02/21/tra…

7/8

cleantechnica.com/2023/02/21/tra…

7/8

Explore the EV supply chain with this dashboard - it is a window into the developing U.S. EV supply chain. Let us know what you think and what we are missing. 8/8

charged-the-book.com/na-ev-supply-c…

charged-the-book.com/na-ev-supply-c…

• • •

Missing some Tweet in this thread? You can try to

force a refresh